Natural Fiber Reinforcement Materials Market Overview, 2030

The global natural fiber reinforcement materials market was valued at $360.97 million in 2020, and is projected to reach $694.64 million by 2030, growing at a CAGR of 6.81% from 2021 to 2030.

The natural fiber reinforcement materials market is segmented into End Use Industry and Type.

Natural fibers are fibers that are not synthetic or manmade. The use of natural fiber from both resources, renewable and non-renewable, such as oil palm, sisal, flax, and jute to produce reinforced materials, increase in environmental awareness and community interest, new environmental regulations, and consumption of unsustainable fossil fuels lead to the development and utilization of environmentally friendly materials. This is expected to lead to the overall market demand for natural fiber reinforcement materials during the forecast period.

Surge in demand for natural fiber reinforcement materials, primarily comes from the automotive and construction industries. Furthermore, several advantages of being bio-based as compared to other synthetic fibers, such as easy to dispose, non-toxic, light weight, and others drive the market growth. The increase in investment of governments in developing countries towards infrastructure projects, especially India, and China has created lucrative opportunities for the development of the natural fiber reinforcement materials market. India has planned to complete the smart city project by 2050 in major economic cities. China also launched various policies to reduce poverty all over the nation by providing infrastructure assistance in rural areas. The abovementioned policies and initiatives are expected to provide a solid platform for the overall development of the natural fiber reinforcement materials market during the forecast period.

Fluctuations in price, availability in the raw materials, and low strength as compared to synthetic fibers are expected to hamper the market growth. In addition, increase in demand for e-commerce across the globe during the pandemic period has led to rise in demand for packing from the packaging industry, which create several lucrative opportunities for the growth of the natural fiber reinforcement materials market.

The natural fiber reinforcement materials market is segmented on type, end-use industry, and region.

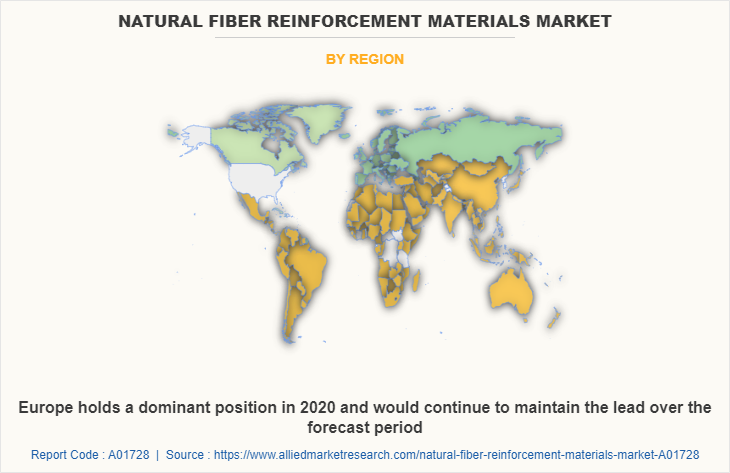

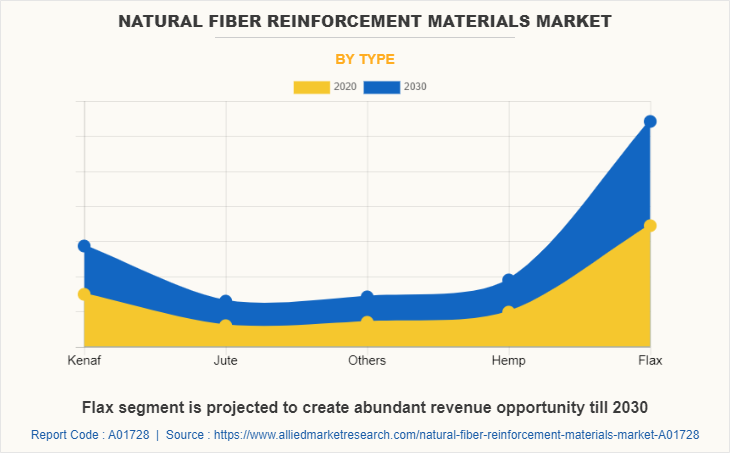

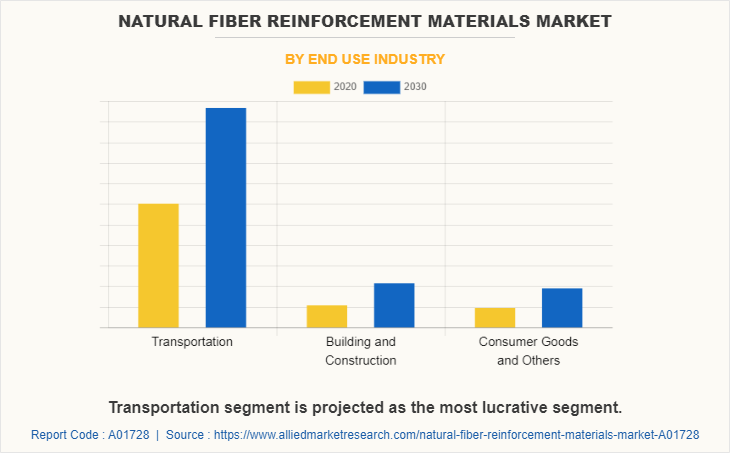

On the basis of type, the market is divided into hemp, flax, kenaf, jute, and others (coir, abaca, sisal). On the basis of end-use industry, it is segmented into transportation, building & construction and consumer goods & others. By geography, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Europe region accounted for the largest market share of total revenue in 2020, followed by North America and Asia-pacific. The high adoption of natural fiber products in the region is expected to continue to bolster the natural fiber reinforcement materials market size, due to the presence of huge population base, increase in investment in the construction & transportation projects, and presence of many developing countries in this region.

The key players operating in the global natural fiber reinforcement materials market are AgroFiber SAS, Bast Fiber LLC., Greene Natural Fibers LLC., Procotex Corporation, Hempflax BV, Saneco S.A., Hempline Inc., Schweitzer-Mauduit International, Inc., Kenaf Industries of South Texas, and NFC Fibers GmbH. Other major natural fiber reinforcement materials players in the natural fibers market (not included in the report) such as EUCHORA S.R.L., Badische Naturfaseraufbereitung GmbH, Tenbro, Wilhem G. Clasen, FlaxStalk Natural Fiber Solutions, Fiberon LLC., Tecnaro, FlexForm Technologies, Greencore Composites, and Greengran B.V. are competing for the share of the market through product launch, joint venture, partnership, and expanding the production capabilities to meet the future demand for the natural fiber reinforcement materials market in the forecast period.

Europe dominates the natural fiber reinforcement materials market. According to the European Commission, Europe is one among the biggest producers of automobile, accounting for 4% of its GDP. The burgeoning automobile production is the major factor responsible for the growth of natural fiber reinforcement material market in European countries. In 2015, the European Union legislation had set mandatory emission reduction targets. The fleet average set by the European Union legislation for new automobile was 130 g of CO2 per kg in 2015, and 95 g/kg by 2021. This compelled the automobile manufacturers to focus on innovative lightweight material such as natural fiber reinforcement material to meet European Union legislation emission targets. Thus, CO2 emission reduction has emerged as a driver empowering the growth of natural fiber reinforcement materials market in automotive and transportation industries in Europe.

The flax segment dominates the global natural fiber reinforcement materials market. Flax fiber is a cellulose polymer having crystalline structure, making it stronger, crisper, and stiffer. It ranges in length up to 90 cm and 12–16 microns in diameter. It has the highest tensile strength among the other natural fibers, and thus is widely used for architectural applications for both structural and nonstructural assemblies. It has always been used as the basis for fabric, not only for clothing but also for sails and tents.

The transportation segment dominates the global natural fiber reinforcement materials market. Natural fiber reinforcement material in automobiles offer better thermal and acoustic insulation than synthetic fibers, and reduce irritation of the skin and respiratory system. The high strength to weight ratio of natural fibers reduces vehicle weight, which further minimizes fuel consumption and CO2 emission. Lightweight and high strength of natural fiber make it ideal for load floors located in the rear of the vehicle. In addition, it is used for floor protection in cars. Various global car manufacturers have employed natural fiber composites with thermoplastic and thermoset matrices for door panels, seat backs, headliners, package trays, dashboards, and interior parts.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the natural fiber reinforcement materials market analysis from 2020 to 2030 to identify the prevailing natural fiber reinforcement materials market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the natural fiber reinforcement materials market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global natural fiber reinforcement materials market trends, key players, market segments, application areas, and market growth strategies.

Natural Fiber Reinforcement Materials Market Report Highlights

| Aspects | Details |

| By End Use Industry |

|

| By Type |

|

| By Region |

|

| Key Market Players | SCHWEITZER-MAUDUIT INTERNATIONAL, INC., PROCOTEX CORPORATION, NFC FIBERS GMBH, HEMPLINE INC., KENAF INDUSTRIES OF SOUTH TEXAS, BAST FIBER LLC, GREENE NATURAL FIBERS LLC, HEMPFLAX BV, AGROFIBER SAS, SANECO S.A. |

Analyst Review

Natural fibers are fibers derived from plants, animals, or minerals. Bio-based natural fibers have several advantages, including environmentally friendly, easy to dispose, non-toxic, lightweight, and many others over other synthetic fibers.

The market for natural fiber reinforced materials recorded the highest growth in Asia-Pacific in 2020. This is due to the large presence of automakers using developed technologies, such as natural fiber composites. Applications of natural fibers in the automotive industry include, headliners, interior panels, seat covers, and acoustic panels. Properties such as lightweight, low cost, ease of processing, low carbon emissions, and high strength make natural fiber composites attractive for non-structural parts of vehicles.

In Europe, Germany accounts for more than one-third of total demand for natural fiber and is a leader in the European natural fiber market. The use of natural fibers in the packaging industry has received considerable attention in recent years. Traditional packaging materials, such as plastic, glass, and metal are non-biodegradable, dangerous, and have a significant impact on the environment. Therefore, replacement is necessary to avoid the adverse effects of using plastic and reduce carbon dioxide emissions.

Natural fibers are increasingly adopted in the packaging industry because they are the best packaging materials. Natural fiber-based packaging can reduce carbon dioxide emissions and packaging waste that causes land and water pollution. R & D focused on the development of natural fiber-based packages, especially sisal and jute, are expected to bring further benefits to the market. Therefore, the introduction of natural fibers as packaging materials is expected to create multiple growth opportunities in the global natural fiber reinforced material market during the forecast period.

Growth in demand from the automotive industry and biodegradability, recyclability & environment-friendly nature of natural fibers are the key factors boosting the natural fiber reinforcement materials Market growth

The market value of natural fiber reinforcement materials in 2030 is expected to be US$ $694.64 million

AgroFiber SAS, Bast Fiber LLC., Greene Natural Fibers LLC., Procotex Corporation, Hempflax BV, Saneco S.A., Hempline Inc., Schweitzer-Mauduit International, Inc., Kenaf Industries of South Texas, and NFC Fibers GmbH.

Transportation industry is projected to increase the demand for natural fiber reinforcement materials Market

The natural fiber reinforcement materials market is segmented on type, end-use industry, and region. On the basis of type, the market is divided into hemp, flax, kenaf, jute, and others. On the basis of end-use industry, it is segmented into transportation, building & construction and consumer goods & others. By geography, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Consumer awareness & stringent regulations towards using environment friendly products is the Main Driver of natural fiber reinforcement materials Market

Transportation and Building & Construction end-use industries are expected to drive the adoption of natural fiber reinforcement materials

COVID-19 has severely impacted the global economy with devastating effects on global trade, which has simultaneously affected households, business, financial institution, industrial establishments, and infrastructure companies. The restrictions on international trade and lockdown regulations on the operations of the variety of industries, are projected to work at low limit due to decline in the demand for products in the market.

Loading Table Of Content...