Natural Gas Liquids Market Size & Insights:

The global natural gas liquids market was valued at USD 16.9 billion in 2020, and is projected to reach USD 28.5 billion by 2030, growing at a CAGR of 5.4% from 2021 to 2030.

Natural gas liquids (NGL) are components of natural gas that are separated from the gas state in the form of liquids. This separation occurs in a field facility or a gas processing plant through absorption, condensation, or other methods. In addition, Natural gas liquids are hydrocarbon, which are the family of molecules as natural gas and crude oil, composed exclusively of carbon and hydrogen. Moreover, there are several types of natural gas liquids and many different applications for NGL products. The products of natural gas liquid are Ethane, propane, butane, isobutane, and pentane. There are many uses for NGLs, spanning nearly all sectors of the economy.

NGLs are used as inputs for petrochemical plants, burned for space heat and cooking, and blended into vehicle fuel. Higher crude oil prices have contributed to increased NGL prices and, in turn, provided incentives to drill in liquids-rich resources with significant NGL content. The chemical composition of these hydrocarbons is similar, yet their applications vary widely. Ethane occupies the largest share of NGL field production. It is used almost exclusively to produce ethylene, which is then turned into plastics. Much of the propane, by contrast, is burned for heating, although a substantial amount is used as petrochemical feedstock. A blend of propane and butane, sometimes referred to as "autogas," is a popular fuel in some parts of Europe, Turkey, and Australia. Natural gasoline (pentanes plus) can be blended into various kinds of fuel for combustion engines, and is useful in energy recovery from wells and oil sands.

Segmentation Analysis

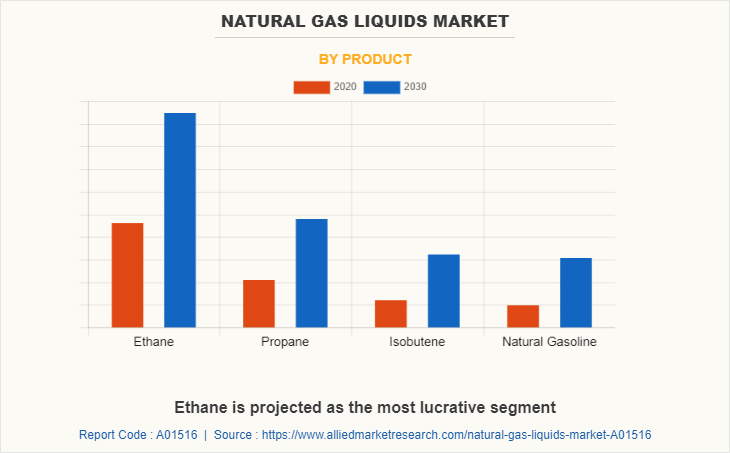

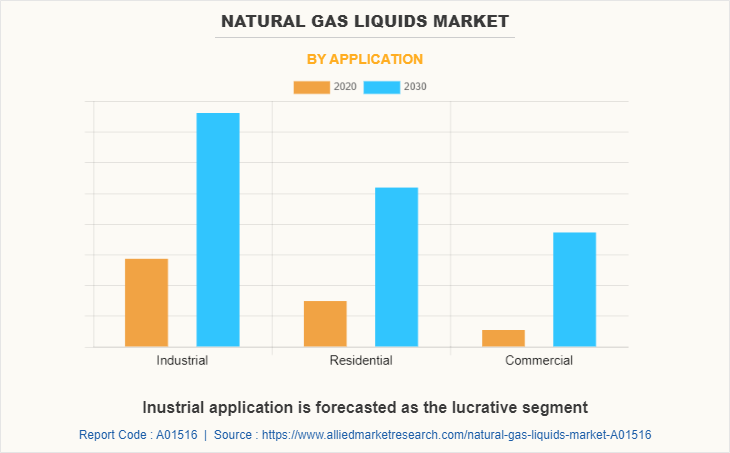

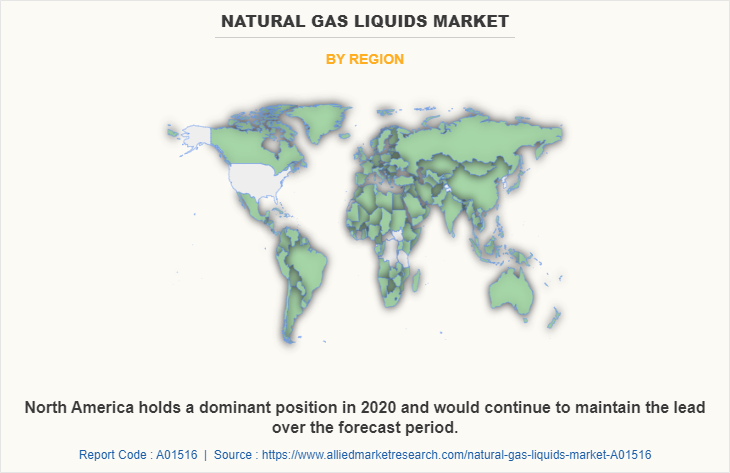

The natural gas liquids market forecast is segmented based on product and application. On the basis of product, it is classified as ethane, propane, isobutene and natural gasoline. By application, it is categorized as Industrial, residential and commercial. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product, the ethane segment dominated the global Natural gas liquids market share in 2020, and is projected to remain the fastest-growing segment during the forecast period.This is attributed due to rapid expansion of transportation infrastructure and increasing demand of ethane in heavy industries.

By Application, the industrial segment dominated the global Natural gas liquids market in 2020, and is projected to remain the fastest-growing segment during the forecast period. This is attributed due to rise in urbanization & industrialization. Moreover, emerging economies increase demand for energy in general and especially for transporting goods and materials from producers to consumers.

By region, North America dominated the global Natural gas liquids market in 2020, and is projected to remain the fastest-growing segment during the forecast period. This is attributed to the largest production of natural gas in the region due to large proved reserves and onshore area in the region.

Competitve Analysis

The key players profiled in the natural gas liquids industry report include BP P.L.C., Chevron Corporation, ConocoPhillips Company, Devon Energy Corporation, Exxon Mobil Corporation, Lukoil, Occidental Petroleum Corporation, Range Resources Corporation, Saudi Arabian Oil Co. and Shell Plc.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the natural gas liquids market analysis from 2020 to 2030 to identify the prevailing natural gas liquids market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the natural gas liquids market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global natural gas liquids market trends, key players, market segments, application areas, and market growth strategies.

Natural Gas Liquids Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Saudi Arabian Oil Co., BP P.L.C, Range Resources Corporation, Exxon Mobil Corporation, Occidental Petroleum Corporation, Devon Energy Corporation, Lukoil, Chevron Corporation, Shell Plc., ConocoPhillips Company |

Analyst Review

Natural gas liquids market holds a substantial scope for growth globally. Its contribution to the world market would increase significantly within the span of next ten years. Recent discoveries and innovations have created vast opportunities for numerous players to step in the natural gas liquids market.

According to the perspectives of CXOs of the leading companies, surge in demand for industrial and cry gases & relative products, especially from automotive, healthcare, power generation and steel production applications, boosts the growth of the market. Moreover, increase in demand from developing countries, such as China and India, due to rapid urbanization and surge in demand for electricity drive the market growth.

Furthermore, the CXOs are optimistic about the adoption of natural gas liquids in medical and healthcare facilities. As per the CXOs, Asia-Pacific occupies a large share of the global Natural gas liquids market; however, the Natural gas liquids market in Europe is expected to grow at a rapid rate in the near future.

Increasing demand of natura gas liquid in refineries & petrochemical plants, Usage of natural gas liquid in burned space heat and cooking are the major driving factor for the market. In addition, Transformation of NGL based vehicle may create lucrative opportunities for the market.

Oil & gas, chemical & petrochemicals, cosmetics products and many other such companies are the major customers of global natural gas liquid market.

Agreement, business expansion and product launch are the key growth strategy of global natural gas liquid market players.

BP P.L.C., Chevron Corporation, ConocoPhillips Company, Devon Energy Corporation, Exxon Mobil Corporation, Lukoil, Occidental Petroleum Corporation, Range Resources Corporation, Saudi Arabian Oil Co. and Shell Plc. are the leading market players active in the natural gas liquid market.

The global Natural gas liquid market was valued at $16.9 billion in 2020, and is projected to reach $28.5 billion by 2030, growing at a CAGR of 5.4% from 2020 to 2030.

Ethane segment holds the maximum share of the global natural gas liquid market

North America will provide more business opportunities for global natural gas liquid in future.

Rise in industrialization, increase in demand from refineries and petrochemical plants and continuous increase in dependency on natural gas products are expected to drive the adoption of natural gas liquid.

Technological evolution of natural gas liquid, increasing exploration and rapid expansion of favourable government policies with respect to drilling are the current trend expected to influence the global natural gas liquid market in the next few years.

Loading Table Of Content...