Natural Refrigerant Market Size & Insights:

The global natural refrigerant market was valued at $1.5 billion in 2022 and is projected to reach $2.7 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

A natural refrigerant is a substance derived from natural sources such as ammonia, water, or carbon dioxide that possesses favorable thermodynamic properties for heat transfer and is used in refrigeration and air conditioning systems. It is characterized by having low or zero ozone depletion potential (ODP) and low global warming potential (GWP), making it an environmentally friendly alternative to synthetic refrigerants. Natural refrigerants have minimal impact on climate change and thus serve as a sustainable and energy-efficient cooling solution.

Report key highlighters

- Quantitative information mentioned in the global natural refrigerant market includes the market numbers in terms of value (USD Million) and volume (Tons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided on the basis of the gas and application. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Danfoss, Linde Plc, A-Gas International Ltd., Daikin Industries Ltd., and Evonik Industries AG, hold a large proportion of the natural refrigerant market.

- This report makes it easier for existing market players and new entrants to the natural refrigerant business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Market Dynamics

Biological and chemical cycles in nature produce natural refrigerants without human intervention. Natural hydrocarbons, ammonia, carbon dioxide, water, and oxygen are substances with zero or close to zero global warming potential (GWP) and the potential to reduce energy, gas, and water consumption. Switching to natural refrigerants that are better for the sustainable development of the environment is one of the most effective methods to reduce greenhouse gas emissions.

Increased Awareness Regarding Environment-Friendly Refrigerants

In the past few years, the environmental impact of refrigerants has become a significant concern. With large gaps in the cooling system, these fluids are destroying the ozone layer, enhancing the greenhouse effect in the atmosphere, and contributing directly to global warming. Propane (R290), propylene (R1270), butane (R600), and isobutene (R600a) are the hydrocarbons that are currently the most popular refrigerants. Hydrocarbons can be used as long-term alternatives for residential air conditioning and heat transmission applications to increase productivity growth, as they provide good performance and reasonable energy savings without harming the environment. Thus, increased awareness of eco-friendly refrigerants is expected to drive market growth.

The increasing stringency of government regulations regarding refrigerants acts as a catalyst, propelling the adoption of natural refrigerants in various industries.

According to the U.S. Environmental Protection Agency (EPA), ozone-depleting substances (ODS) are classified as class I- or class II-controlled substances in the U.S. Class I substances such as chlorofluorocarbons (CFCs) and halons exhibit a higher ozone depletion potential and have been phased out in the U.S., with a few exceptions. As a result, class I substances cannot be produced or imported. Class II substances are all hydrochlorofluorocarbons (HCFCs), which serve as transitional replacements for a number of class I substances. As of 2020, the production and import of the majority of HCFCs were prohibited. Consequently, such regulations are anticipated to boost the demand for natural refrigerants.

In addition, natural refrigerants are inexpensive to produce, readily available over the long term, and permit the efficient operation of refrigeration and air conditioning systems. Although ammonia is a highly valuable refrigerant and could also be used for heat pumping (with some limitations due to its high discharge temperature), its use is complex, and it is only cost-effective for large-capacity units in the industrial refrigeration and district heating industries. Thus, all these factors collectively foster the expansion of the market for natural refrigerants.

Using combustible gas frequently involves risk. In many homes, propane or natural gas is used for cooking and heating. The goal of a heat pump that employs a flammable refrigerant is to contain the refrigerant within a hermetically sealed system. In contrast to refrigerators, which are governed by the International Electrotechnical Commission (IEC) standards that permit up to 150 grams of flammable refrigerant, heat pumps with flammable refrigerant charges exceeding 150 grams have no applicable standards. Certain authorities have determined that the risk associated with the use of flammable refrigerants is acceptable if certain precautions are taken. Depending on the extent of the room, the cost may be restricted. The heat pump installation chamber must have adequate ventilation. There may not be any components that can ignite in the event of a spill. Thus, the risks associated with flammable refrigerants can hamper the growth of the natural refrigerants market.

On the contrary, developing countries globally are witnessing high demand for cooling equipment owing to rapid industrialization and an increase in the inclination of industrialists towards efficient cooling systems. Moreover, as per capita disposable incomes are rising in developing countries such as China, India, and Indonesia, the use of air conditioning systems is anticipated to rise, leading to an unprecedented increase in the overall energy demand. Moreover, the surge in demand for quality maintenance and conservation of industrial equipment requiring cold surroundings among several manufacturing units in developing economies coupled with a rise in the demand for absorption chillers in oil & gas refineries offer lucrative opportunities for market growth. Furthermore, a rapid increase in the ownership of domestic air conditioning systems in developing countries is anticipated to open new avenues for the growth of the global natural refrigerant market during the forecast period.

Segment Overview:

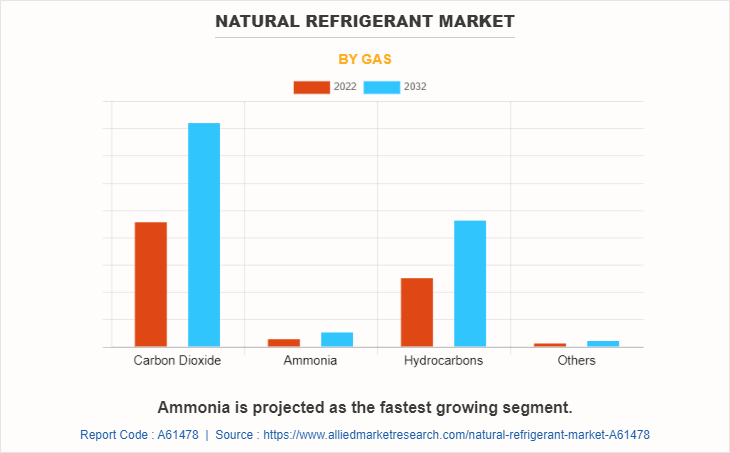

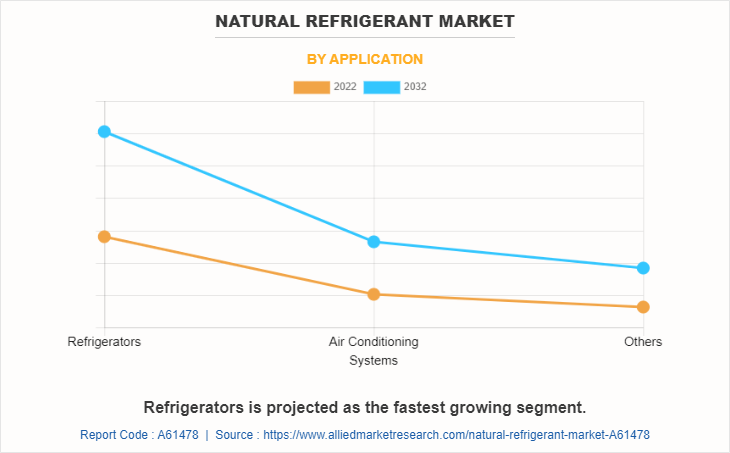

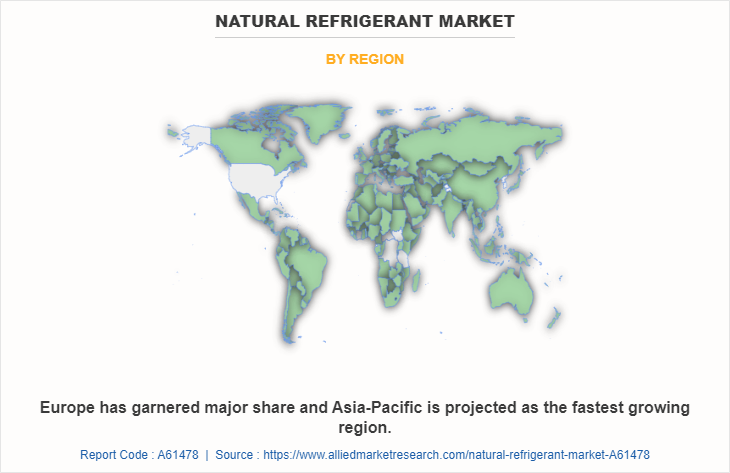

The global natural refrigerant market is segmented into gas, application, and region. By gas, the market is divided into carbon dioxide, ammonia, hydrocarbons, and others. On the basis of application, it is categorized as refrigerators, air conditioning systems, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global natural refrigerant market are Danfoss, Linde Plc, A-Gas International Ltd., Daikin Industries Ltd., Evonik Industries AG, AGC Inc., Air Liquide, HyChill Australia Pty Ltd., Johnson Controls, and Puyang Zhongwei Fine Chemical Co., Ltd.

The carbon dioxide segment accounted for more than three-fifths of the global natural refrigerant market revenue. Carbon dioxide (CO2) is a colorless, odorless, and heavier-than-air liquid under normal conditions. As an inflammable and non-toxic substance, it is categorized as a superior refrigerant. Co2-based refrigerants have no effect on the ozone layer, as their ODP (Ozone Depletion Potential) is 0. However, it can be argued that it does not contribute to climate change because it is a byproduct of industrial processes and would have been released into the atmosphere anyway. As an alternative to synthetic refrigerants, carbon dioxide is one of the most prevalent gases used for supermarket refrigeration. Other applications of this material include heat pump water heaters, commercial refrigerated vending machines, secondary expansion systems, industrial and transport refrigeration systems, and vehicle air-conditioning systems.

Ammonia is the fastest-growing segment with a CAGR of 6.8%. As a result of its excellent thermodynamic properties, zero ozone depletion potential, and low global warming potential, ammonia is acquiring popularity as a natural refrigerant. It is an ideal alternative to synthetic refrigerants for industrial and commercial refrigeration systems due to its high heat transfer coefficient and energy efficiency.

The refrigerators segment accounted for more than half of the global natural refrigerant market revenue and is the fastest-growing segment with a CAGR of 6.4%. There are numerous varieties, including industrial, domestic, and others. There is an immediate need to seek out pure, eco-friendly refrigerants for a better future. The search for refrigerants that do not contribute to the depletion of the ozone layer and global warming has increased the demand for natural refrigerants such as CO2, NH3, and hydrocarbons, which are widely used in refrigerators.

Europe garnered the largest share for around two-fifths of the global natural refrigerant market revenue Europe is attributable to strict environmental regulations that have limited the use of hydrofluorocarbon (HFC) refrigerants and increased the demand for natural refrigerants. Due to the region's high rate of natural refrigerant adoption by end consumers, Europe is also anticipated to be the fastest-growing region in the market. In addition, this region's market for refrigerants is anticipated to expand as a result of the region's population's higher standard of living. Natural refrigerants are more energy efficient, have a lower leakage rate, and are less expensive than fluorocarbons. According to the Air Conditioning and Refrigeration European Association (AREA), the European Association of Refrigeration, air conditioning, and heat pump (RACHP) contractors, the annual turnover in 2020 will approach $26.27 billion (€23 billion). The increasing volume of business reflects the expanding demand for natural refrigerants.

Key development strategies undertaken by key players

On August 14, 2019, Linde AG, a German industrial gases company, finalized the sale of its South India business to Japan's Air Water Inc. (AWI) as part of its global merger with US-based Praxair Inc.

On December 1, 2022, the new separators at A-Gas became operational in early 2023 and had more than twice the separation capacity of the existing plant, addressing a significant requirement identified by the NGO study.

On October 15, 2022, A-Gas International Ltd. announced that it had joined the Climate and Ozone Protection Alliance (COPA). The collaboration aimed to transition the cooling industry to more sustainable refrigerants and establish effective refrigerant lifecycle management. The approach was intended to propel the expansion of natural refrigerants and deliver efficient environmental solutions to the worldwide market.

On February 6, 2023, Linde entered into a long-term arrangement and committed around USD 1.8 billion to supply clean hydrogen and nitrogen to OCI's new world-scale blue ammonia facility in Beaumont, Texas. The Beaumont plant intends to expand and improve the world's top blue ammonia and clean fuels platform.

On March 1, 2023, Danfoss announced that it had acquired BOCK GmbH, a manufacturer of carbon dioxide and low-GWP compressors. BOCK GmbH had one of the most extensive portfolios of natural refrigerant compressors, including hydrocarbons, CO2 (R744), and other low-GWP refrigerants. The agreement accelerated energy efficiency and the global shift to natural and low-GWP refrigerants.

Impact Of Russia Ukraine War On Natural Refrigerants Market

The Russia–Ukraine war has had several potential impacts on the natural refrigerants market.

The conflict between Russia and Ukraine could disrupt the supply chain of natural refrigerants, as both countries are major producers and suppliers of refrigerants such as ammonia (NH3). Any disruptions in production or transportation routes could lead to supply shortages or increased prices.

If the conflict escalates and leads to trade restrictions or sanctions, it could result in changes to the trade dynamics of natural refrigerants. This may lead to shifts in sourcing and trading patterns, potentially affecting the availability and cost of natural refrigerants in certain regions.

War could prompt countries to prioritize energy security and reduce dependence on external sources for critical resources, including refrigerants. This may lead to increased exploration and development of domestic sources of natural refrigerants or a greater emphasis on energy-efficient technologies.

Geopolitical tensions can influence regulatory decisions. Governments may review their environmental policies, including regulations related to the use of refrigerants, and adjust to promote domestic industries or support climate goals. This could impact the adoption and promotion of natural refrigerants.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the natural refrigerant market analysis from 2022 to 2032 to identify the prevailing natural refrigerant market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the natural refrigerant market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global natural refrigerant market trends, key players, market segments, application areas, and market growth strategies.

Natural Refrigerant Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.7 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 516 |

| By Gas |

|

| By Application |

|

| By Region |

|

| Key Market Players | AGC Inc., Danfoss AS, A-Gas International Ltd, DAIKIN INDUSTRIES LTD., Air Liquide, Evonik Industries AG, HyChill Australia Pty Ltd, Linde Plc, Puyang Zhongwei Fine Chemical Co., Ltd, Johnson Controls International plc |

Analyst Review

According to the insights of the CXOs of leading companies, the growth of the natural refrigerant market is driven by various factors such as environmental regulations and policies aimed at reducing greenhouse gas emissions and phasing out synthetic refrigerants and stricter regulations. For instance, the Kigali Amendment to the Montreal Protocol is accelerating the adoption of natural refrigerants. In addition, the energy efficiency of natural refrigerants, such as ammonia and carbon dioxide, is superior to synthetic alternatives, leading to increased demand in line with energy conservation and sustainability goals, which drives the growth of the natural refrigerants market.

The CXOs further added that the potential for market growth is significant due to the increasing demand for environmentally friendly and energy-efficient cooling solutions. Moreover, natural refrigerants are finding new applications beyond traditional refrigeration and air conditioning systems.

The natural refrigerant market attained $1.5 billion in 2022 and is projected to reach $2.7 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

Region-wise the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Danfoss, Linde Plc, A-Gas International Ltd., Daikin Industries Ltd., Evonik Industries AG, AGC Inc., are the top companies to hold the market share in Natural Refrigerant.

Refrigerator is the leading application of Natural Refrigerant Market.

Europe is the largest regional market for Natural Refrigerant.

Increased Awareness Regarding Environment-Friendly Refrigerants and Rise in demand for frozen food and dairy productsa re the drivers of Natural Refrigerant Market.

Technological Developments in Green Cooling is the upcoming trend of Natural Refrigerant Market in the world.

Loading Table Of Content...

Loading Research Methodology...