Near Infrared Imaging Market Outlook - 2026

The near infrared imaging market accounted for $271 million in 2018, and is expected to reach $375 million by 2026, registering a CAGR of 4.1% from 2019 to 2026.

Near infrared imaging uses light between 650 to 950 nm to detect any changes induced, injury, or disease. It is a powerful diagnostic tool for minimally invasive and nonionizing method for tissue imaging. NIR are not absorbed well by the blood or water, which are the main components of tissues, thus increases the changes of illumination for internal structures. It is advantageous over other techniques since it provides better resolution and is less harmless to patients.

Rise in number of surgical procedures worldwide for cancer surgery, gastrointestinal surgery, and cardiovascular surgery, plastic/reconstructive surgeries coupled with surge in prevalence of target diseases such as lung cancer, breast cancer, colon cancer, and prostate cancer; and increasing prevalence of chronic diseases and neurological disorders, are the factors that drive the growth of the near infrared imaging market. In addition, surge in adoption of NIR imaging across the globe, rise in geriatric population, and health awareness in the emerging economies are the prime factors that boost the growth of the global near infrared imaging market. However, high availability of other alternative imaging techniques and high price of infrared detectors restrict the market growth.

Near Infrared Imaging Market Segmentation

The near infrared imaging market is segmented based on product, application, indication, end user, and region to provide a detailed assessment of the market. Based on product, the market is divided into near infrared fluorescence imaging systems and near infrared fluorescence & bioluminescence imaging systems. Based on application, the market is classified into pre-clinical imaging, medical imaging and clinical imaging. Based on indication, the market is segmented into cancer surgeries, cardiovascular surgeries, gastrointestinal surgeries, plastic/reconstructive surgeries, and others. Based on end user, the market is divided into hospitals & clinics, research laboratories, and others. Based on region, the near infrared imaging market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

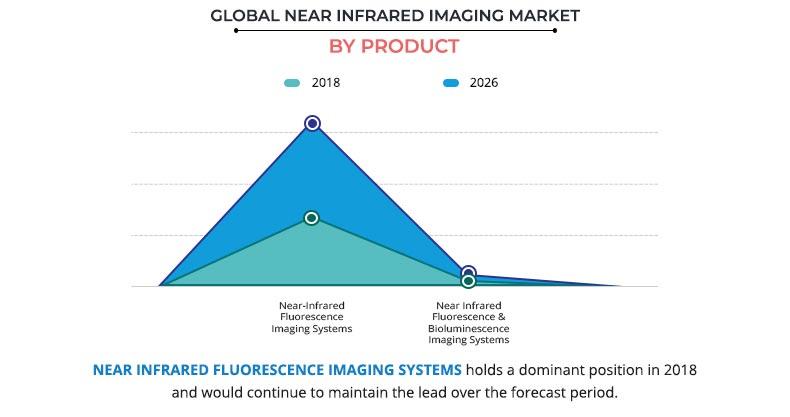

The near infrared imaging market is segmented based on product, application, indication, end user, and region to provide a detailed assessment of the market. Based on product, the market is divided into near infrared fluorescence imaging systems and near infrared fluorescence & bioluminescence imaging systems. Near Infrared Fluorescence Imaging Systems acquired the major near infrared imaging market share owing to their application during surgeries such as cancer surgery, plastic surgery, and other surgeries. Furthermore, the surge in number of surgeries performed for cancer is another factor that boosts the growth of the market. These systems are also employed in diagnosis of cancers such as breast cancer. Therefore, these factors contribute to the near infrared imaging market growth.

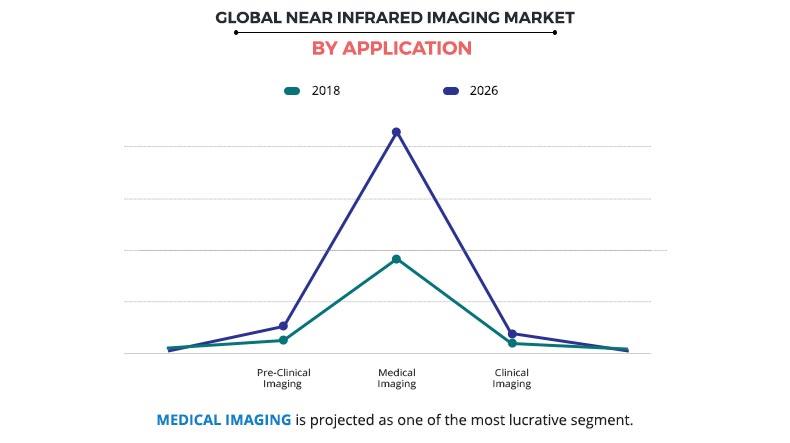

Based on application, the near infrared imaging market is classified into preclinical imaging, medical imaging, and clinical imaging. Medical imaging acquired the major share of the near infrared imaging market as NIR imaging systems are used in surgeries. There is a rise in number of surgeries performed across the globe. Moreover, surgical procedures such as plastic surgery are gaining popularity across different parts of globe, which boosts the growth of this segment. Surge in use of NIR for diagnosis of diseases such as Alzheimer’s fuels the growth of the market. The clinical imaging segment is projected to grow with highest CAGR during the forecast period owing to increase in research related to new cancer drugs.

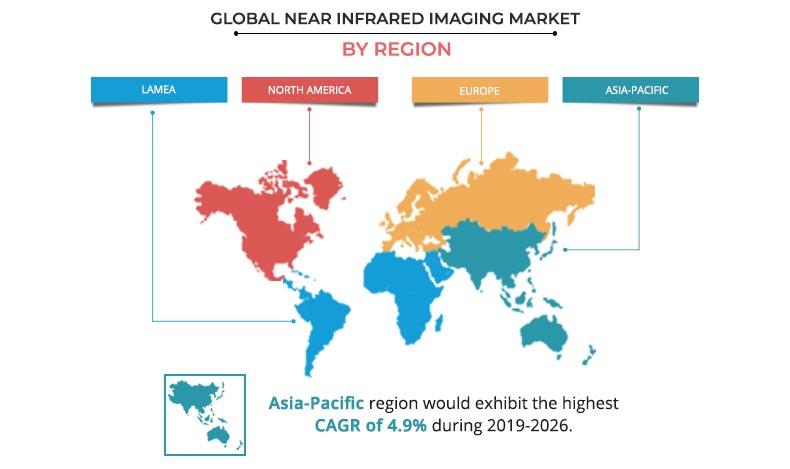

In 2018, North America accounted for the major share of near infrared imaging market size and is expected to continue this trend owing to rise in number of surgical procedures performed in the region. Moreover, other factors such as easy availability of NIR imaging systems, presence of key players, and surge in adoption of NIR imaging systems boost the market growth in this region. Asia-Pacific is expected to exhibit fastest growth rate owing to surge in awareness related to early screening of cancer. The other factors that boost the growth of the market include huge patient base and rise in healthcare expenditure in the region. The developing economies offer lucrative opportunities for near infrared imaging providers to expand their business. The constantly evolving life science industry drives the growth of the market in the developing economies such as India, China, Malaysia, and others.

The global near infrared imaging market is highly competitive and the prominent players in the market have adopted various strategies for garnering maximum market share. These include collaboration, product launch, partnership, and acquisition. Major players operating in the market include Carl Zeiss AG, Danaher Corporation (Leica Microsystems), Hamamatsu Photonics K.K., Karl Storz SE & Co. KG, Li-Cor, Inc., Medtronic plc., PerkinElmer Inc., Quest Innovations B.V. (Quest Medical Imaging B.V.), Shimadzu Corporation, and Stryker Corporation.

Key Benefits for Near Infrared Imaging Market:

- This report entails a detailed quantitative analysis along with the current global near infrared imaging market trends from 2019 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The near infrared imaging market forecast is studied from 2019 to 2026.

- The market size and estimations are based on a comprehensive analysis of key developments in the near infrared imaging industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market

Near Infrared Imaging Market Segments:

By Product

- Near Infrared Fluorescence Imaging Systems

- Near Infrared Fluorescence & Bioluminescence Imaging Systems

By Application

- Pre-clinical Imaging

- Medical Imaging (Diagnostic and Surgeries)

- Clinical Imaging

By Indication

- Cancer Surgeries

- Cardiovascular Surgeries

- Gastrointestinal Surgeries

- Plastic/Reconstructive Surgeries

- Others

By End User

- Hospitals & Clinics

- Research Laboratories

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Near Infrared Imaging Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATION |

|

| By INDICATION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | QUEST INNOVATIONS B.V. (QUEST MEDICAL IMAGING B.V.), DANAHER CORPORATION (LEICA MICROSYSTEMS), HAMAMATSU PHOTONICS K.K., STRYKER CORPORATION, PERKINELMER INC., LI-COR, INC., CARL ZEISS AG (CARL ZEISS MEDITECH AG), KARL STORZ SE & CO. KG, MEDTRONIC PLC., SHIMADZU CORPORATION |

Analyst Review

NIR Imaging technique is non-invasive and uses non-ionizing rays for detecting and diagnosing disorders and injuries. It is advantageous over other techniques since it provides better resolution and is less harmless to patients. NIR Imaging can be helpful in diagnosing breast cancer, depression, Alzheimer’s disease, and others. Moreover, the technology is also employed in detecting boundaries of tumors in cancer surgeries. The light emitted by the system is not absorbed by blood or water that are the main components of a biological tissue thus, it can penetrate deep optically.

Factors responsible for driving the growth of the near infrared imaging market are rise in number of surgical procedures worldwide coupled with surge in prevalence of target diseases and increase in prevalence of chronic diseases and neurological disorders. In addition, rise in adoption of NIR imaging across the globe and is the prime growth factor for the growth of global near infrared imaging market. However, high availability of other alternative imaging techniques and high price of infrared detectors restrict the growth of the global near infrared imaging market.

North America garnered the largest share of this market due to rise in research activities related to drug development, easy availability of near infrared imaging products, and surge in adoption of personalized medicine in the region.

Loading Table Of Content...