Neoprene Market Research - 2030

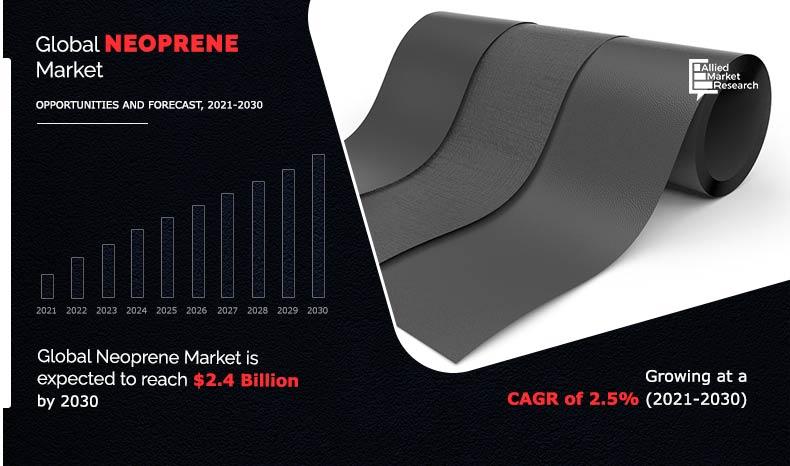

The global neoprene market size was valued at $1.9 billion in 2020, and is projected to reach $2.4 billion by 2030, growing at a CAGR of 2.5% from 2021 to 2030.

Neoprene is a type of a synthetic rubber that is formed by the polymerization of chloroprene and is resistant to aging and oil. It is extensively used in waterproof products such as wet suits and gloves. It exhibits the ability to maintain flexibility to a wide temperature range and has high chemical stability. It is extensively used in industries such as automotive, electrical & electronics, building & construction, and textiles.

The neoprene market is experiencing growth driven by rising demand in the automotive industry and increasing applications in construction and building sectors. In the automotive sector, neoprene's properties such as durability, resistance to heat and chemicals, and flexibility make it ideal for components such as seals, gaskets, and hoses, enhancing vehicle performance and longevity. According to the Invest India, in construction, neoprene is valued for its waterproofing and insulating properties, making it a popular choice for expansion joints, flooring, and roofing materials. As sustainability becomes more crucial, neoprene’s resistance to environmental factors positions it favorably for long-lasting applications. This dual demand from automotive and construction industries not only boosts market growth but also encourages innovation in neoprene formulations to meet specific industry requirements.

The availability of substitute materials poses a significant restraint to the growth of the neoprene market, as alternatives such as natural rubber, silicone, and thermoplastic elastomers offer comparable properties at competitive prices. These substitutes often provide similar durability, flexibility, and resistance to environmental factors, making them attractive options for various applications, including automotive, construction, and consumer goods. As industries increasingly seek cost-effective and sustainable solutions, the shift towards these alternative materials can limit the demand for neoprene. Additionally, advancements in the formulation and performance of substitutes further intensify competition, challenging neoprene's market position and growth potential.

The focus on sustainable and eco-friendly products presents a significant opportunity for growth in the neoprene market, as consumers and businesses increasingly prioritize environmentally responsible materials. Manufacturers are responding by developing neoprene alternatives that reduce environmental impact, such as bio-based neoprene and recycled materials. This shift aligns with global sustainability trends and regulatory pressures, enabling companies to attract eco-conscious customers. Additionally, promoting sustainable neoprene solutions can enhance brand reputation, open new market segments, and drive innovation in product development.

The neoprene market share is segmented into product, end user, and region. By product, the market is categorized into neoprene sponge/foam, neoprene sheet, and neoprene latex. Depending on end-user, it is categorized into automotive, electrical & electronics, building & construction, textiles, and others. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global neoprene market report include Sundow Polymers Co., Ltd, Covestro AG, Lanxess, TOSOH Corporation, Zenith Rubber, BGK GmbH Endlosband, Pidilite Industries, The 3M Company, Denka Company Limited, and TuHuang Chemical Co. Other players operating in this market include Shanxi Synthetic Rubber Group Co Ltd., Canada Rubber Group, and ACRO Industries.

Global Neoprene Market, By Product

By Product

Neoprene sheet is projected as the most lucrative segment.

The neoprene rubber sheet segment garnered a major share in the neoprene market in 2020, as neoprene rubber sheet exhibits properties such as low compression set, superior resilience, high abrasion resistance, and enhanced resistance to ultraviolet & ozone radiations. These properties make them ideal for their use in seals, gaskets, building insulations, and liners in the automotive, electrical and construction industries.Global Neoprene Market, By End-user

Global Neoprene Market, By End-user

By End-user

Automotive is projected as the most lucrative segment.

The automotive industry exhibited the highest market share in 2020. Neoprene is widely used in the automotive industry, owing to its thermal resistance, tensile strength, and prolonged durability. Neoprene rubber is highly employed in hose covers, constant velocity joint (CVJ) boots, power transmission belts, vibration mounts, shock absorber seals, and steering system components. To curb the carbon emission and reduce the dependency on fossil fuels, the demand for electric vehicles has escalated significantly across the globe, which has propelled the demand for neoprene, thereby contributing toward the growth of the global market.

Neoprene Market, By Region

By Region

LAMEA would exhibit an CAGR of 2.9% during 2021-2030

Asia-Pacific accounted for a major market share in 2020. Owing to rapid urbanization across the region, the demand for new homes has been escalated significantly, which, in turn, has propelled the growth of the construction industry. In addition, government-initiated housing projects, such as “Housing for All” for poor people living in urban and rural areas as well as the “Smart City Project” to provide smart homes with modern amenities, which is expected to create high demand for neoprene across the region. Furthermore, India has recorded a 13.0% growth in FDI investment during 2020 as compared to the previous year, despite the COVID-19 scenario, with large investments in the real estate and infrastructure sectors. This is likely to boost the construction and infrastructure development across the country, which is expected to further drive the growth of neoprene market across the region.

Key benefits for stakeholders

- The global neoprene market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis help analyze potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides in-depth analysis of the global neoprene market forecast for the period 2021–2030.

- The report outlines the current global neoprene market trends and future scenario of the global market from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- Key drivers, restraints, & opportunities and their detailed impact analysis are explained in the global neoprene market study.

Key market segments

By Product

- Neoprene Sponge/Foam

- Neoprene Sheet

- Neoprene Latex

By End-User

- Automotive

- Electrical & Electronics

- Building & Construction

- Textiles

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- Spain

- UK

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Neoprene Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By END-USER |

|

| By Region |

|

| Key Market Players | .ZENITH RUBBER, COVESTRO AG, SUNDOW POLYMERS CO., LTD., PIDILITE INDUSTRIES, BGK GmbH Endlosband, THE 3M COMPANY, LANXESS, TOSOH CORPORATION, TUHUANG CHEMICAL CO., DENKA COMPANY LIMITED |

Analyst Review

The global neoprene market is anticipated to witness growth during the forecast period driven by rise in demand from automotive and building & construction industries. Increase in demand for neoprene in the building & construction sector for applications such as window gaskets, cable coverings, and roof waterproofing membranes due to excellent durability, waterproofing, and resilience properties. The building & construction industry is growing globally at a rapid pace, and thus is one of the key drivers for the neoprene market. In addition, surge in automobile production, especially the electric vehicles has led to increase in demand for neoprene from the automotive industry for manufacturing of hose covers, constant velocity joint (CVJ) boots, power transmission belts, vibration mounts, shock absorber seals, and steering system components. These factors are projected to drive the growth of neoprene market during the forecast period.

However, volatility in crude oil prices and presence of substitutes are expected to hamper the growth of the neoprene market during the forecast period. Furthermore, increase in popularity of neoprene gloves is expected to provide growth opportunities for the neoprene market during the forecast period.

Growing adoption of neoprene rubber in the automobile Industry, rapidly expanding construction and electronic industry in the developing economies, and advancement of technologies are the driving factors and opportunities in the neoprene market.

Business expansion and acquisitions are the key growth strategies of neoprene market players.

LAMEA region will provide more business opportunities for neoprene in future.

Sundow Polymers Co., Ltd, Covestro AG, Lanxess, TOSOH Corporation, Zenith Rubber, BGK GmbH Endlosband, Pidilite Industries, The 3M Company, Denka Company Limited, and TuHuang Chemical Co. are the leading global players in the neoprene market.

Neoprene sheet and automotive segments holds the maximum share of the neoprene market.

Automobile, construction, electrical & electronics, and textile companies across the globe are the potential customers of neoprene industry.

The global neoprene market was valued at $1.9 billion in 2020, and is projected to reach $2.4 billion by 2030, growing at a CAGR of 2.5% from 2021 to 2030.

The global neoprene market analysis covers in-depth information of major industry participants, Porter’s five forces analysis help analyze potential of buyers & suppliers and the competitive scenario of the industry for strategy building, major countries have been mapped according to their individual revenue contribution to the regional market, the report provides in-depth analysis of the global neoprene market forecast for the period 2021–2030, the report outlines the current global neoprene market trends and future scenario of the global neoprene market from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets, and key drivers, restraints, & opportunities and their detailed impact analysis are explained in the global neoprene market study.

Loading Table Of Content...