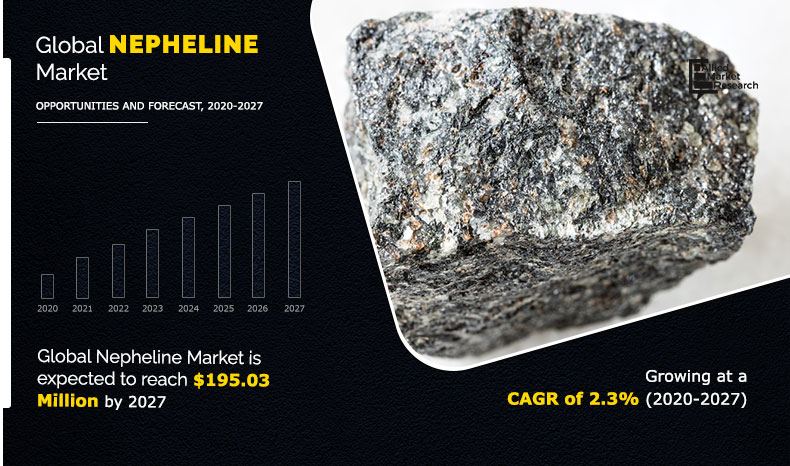

The global nepheline market size was valued at $171.70 million in 2019, and is projected to reach $195.03 million by 2027, growing at a CAGR of 2.3% from 2020 to 2027.

Nepheline, also known as nephelite or eleolite, is extracted from rock mineral that belongs to feldspathoid group. It exhibits similar structure to that of tridymite mineral consisting of two polymorph groups and aluminosilicate of sodium & potassium. It is used as a substitute for manufacturing of glass and ceramic. Nepheline syenite, nepheline monzonite, and nephelinites are types of nepheline that are available in the market. Nepheline syenite is a plutonic rock that is made up of feldspar and nepheline, and if the quantity of sodic plagioclase exceeds the quantity alkali feldspar in nepheline syenite it is known as nepheline monzonite. Nephelinite is fine grained aphanitic igneous rock that is made up of nepheline and pyroxene.

Nepheline syenite is widely used in paints & coatings, adhesives, plastics, and inks, owing to its ability to enhance performance. Brightness, tint retention, and weatherability are utmost important parameters in exterior paints that can be achieved by using nepheline syenite. In addition, use nepheline syenite helps to achieve color, sheen uniformity and chemical & stain resistance as well as prolong durability of interior paints. These factors are predicted to augment the growth of the global nepheline market. In addition, rise in use of nepheline syenite in industrial process such as ceramic tile, refractories, filler, and extraction of rare earth elements (REE) is anticipated to contribute toward the growth of the global market. However, high transportation cost involved in carrying nepheline from extraction sites to processing industries such as glass and ceramics hampers the nepheline market growth.

On the contrary, availability of nepheline reserve in countries such as India, China, Canada, Morocco, and Italy and the development of ceramic and electronic industries are predicted to offer lucrative opportunities for market expansion in the upcoming period. In addition, increase in import and export of nepheline syenite to meet the demand of construction and automotive sectors is likely to provide potential opportunities for the global market. For instance, according to the domestic survey by U.S. Geological Survey (USGS), a scientific agency that is formed by the U.S. Government, Canada exported 1 MT of nepheline syenite in 2018 that was majorly consumed by the construction and automotive sectors.

The global nepheline market analysis is done based on product type, application, and region. On the basis of product type, the market is categorized into nepheline syenite, nepheline monzonite, and nephelinites. The applications covered in the study include ceramic products, glass products, refractories, and others. Region wise, the global market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in this report include AGSCO Corporation, Unimin Corp. (COVIA), Phos Agro Group of Companies, Anglo Pacific Minerals Ltd., Anyang Country Mining Co Ltd., SCR Sibelco, RUSAL PLC, The 3M Company, Fineton Industrial Minerals Ltd., and North Cape Minerals AS.

Nepheline market, by region

Asia-Pacific is projected to grow at the fastest CAGR of 3.5%. China and India are the largest manufacturers of ceramic tiles in Asia-Pacific. Surge in production and consumption of ceramic tiles in Vietnam is the major factor that augments the growth of the nepheline market. However, North America accounted for the largest share in the global nepheline market in 2019. This is attributed to the presence of number of nepheline synite deposits and production sites in Canada and the U.S.

By Region

Asia-Pacific would exhibit highest CAGR of 3.50% during 2019-2027.

Global nepheline market, by product type

By product type, the nepheline syenite segment garnered the largest share in the global nepheline market in 2019, and is projected to exhibit a CAGR of 2.4% during the forecast period. This is attributed to the fact that nepheline syenite witnessing increased demand in applications such as glass, ceramic, coatings, plastic, and rubber.

By Product

Nepheline syenite segment is the most lucrative segment

Global nepheline market, by application

Depending on application, the glass product segment acquired the largest revenue share in the global nepheline market This is attributed to the fact that nepheline possesses properties such as high melting pressure, UV resistance, and chemical & thermal stability, which make it an ideal choice for glass manufacturing. This is the major factor that is escalating the use of nepheline for production of container glass. However, the refractories production segment grows at the highest CAGR of 2.6%, as nepheline possesses the ability to withstand high temperature range, making it a suitable chemical compound for production of refractories.

By Application

Refractories application is projected as the fastest growing segment

Key benefits for stakeholders

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current nepheline market trends and future estimations from 2019 to 2027 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact of COVID-19 on the global nepheline market

- The COVID-19 pandemic has negatively affected the global economy and is subsequent shrinking the GDP in global economies, thereby changing consumer spending patterns globally.

- Several challenges have been faced by the glass industry due to the outbreak of the pandemic such as temporary closure of manufacturing sites and travel restrictions, which, in turn, has created logistical supply issue and delay is shipment.

- Major ceramic and tile manufacturers across the world are facing problems despite of no construction ban. This is attributed to disruption in value chain and closure of other industries that are directly or indirectly linked with the ceramic sector.

- The real estate sector is directly dependent on the growth of the ceramic tile sector. Owing to unavailability of raw materials, slowdown in the construction sector, and restrictions laid by government to prevent the spread of virus, the demand for ceramic tile has declined considerably. Thus, consumption and production of nepheline have been hampered during the COVID-19 pandemic.

- In addition, other industries such as refractories and glass are hit due to the global health crisis, which, in turn, has negatively affected the global nepheline market.

Key Market Segments

By Product Type

- Nepheline Syenite

- Nepheline Monzonite

- Nephelinites

By Application

- Ceramic Product

- Glass Product

- Refractories

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- South Africa

- Rest of LAMEA

Key players in the global nepheline market are:

- AGSCO Corporation

- Unimin Corp. (COVIA)

- Phos Agro Group of Companies

- Anglo Pacific Minerals Ltd.

- Anyang Country Mining Co. Ltd.

- SCR Sibelco

- RUSAL PLC

- The 3M Company

- Fineton Industrial Minerals Ltd.

- North Cape Minerals AS

Nepheline Market Report Highlights

| Aspects | Details |

| By PRODUT TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | AGSCO Corporation, .RUSAL PLC, .SCR Sibelco, Unimin Corporation (COVIA), FINETON Industrial Minerals Limited, Anglo Pacific Minerals Ltd., Anyang Jiulong Mineral Industry Co., Ltd., Phos Agro Group of Companies, The 3M Company |

Analyst Review

The global nepheline market is expected to exhibit high growth potential due to its extensive use in ceramic products attributable to its properties such as UV resistance, high melting pressure, thermal & chemical stability, and nontoxicity. For instance, nepheline syenite that is extracted in parts of Sweden is rich in zirconium and rare earth elements (REE) such as eudialyte-group minerals (EGM). Glazed ceramic products are gaining importance owing to their distinctive color options, decorative appearance, and waterproof properties. Use of nepheline syenite for glazing of ceramic products is predicted to offer lucrative growth opportunities in the future. Moreover, nepheline syenite is an important raw material used during the production of ceramic bodies, owing to its use as a melting agent. Thus, all these factors are predicted to augment the growth of the global nepheline market.

However, impurities such as s iron, titanium, mica, and calcite minerals present in the nepheline syenite leads to quality problem in floor tile. Product development such as use of magnetic separation and flotation method during sintering process has enhanced the sintering properties and helps to improve quality of floor tile. This factor is not only gaining immense attention in the market but is also emerging as a key strategy in terms of gaining additional market demand.

Nepheline syenite is widely used in paints & coatings, adhesives, plastics, and inks, owing to its ability to enhance performance. Brightness, tint retention, and weatherability are utmost important parameters in exterior paints that can be achieved by using nepheline syenite, are the other major growth factors in the nepheline market

The nepheline market size is projected to reach $195.03 million by 2027.

AGSCO Corporation, Unimin Corp. (COVIA), Phos Agro Group of Companies, Anglo Pacific Minerals Ltd., Anyang Country Mining Co Ltd., SCR Sibelco, RUSAL PLC, The 3M Company, Fineton Industrial Minerals Ltd., and North Cape Minerals AS are the most established players in global nepheline market

glass industry is projected to increase the demand of nepheline market

The global nepheline market is segmented into product type, application, and region. On the basis of product type, the market is categorized into nepheline syenite, nepheline monzonite, and nephelinites. The applications covered in the study include ceramic products, glass products, refractories, and others. Region wise, the global market is studied across North America, Europe, Asia-Pacific, and LAMEA.

rise in use of nepheline syenite in industrial process such as ceramic tile, refractories, filler, and extraction of rare earth elements (REE). It is the major growth factor in the nepheline market.

Glass and refractories applications are expected to drive the adoption of nepheline.

COVID-19 has impacted negatively on the nepheline market. This is attributed due to • The COVID-19 pandemic has negatively affected the global economy and is subsequent shrinking the GDP in global economies, thereby changing consumer spending patterns globally. • Several challenges have been faced by the glass industry due to the outbreak of the pandemic such as temporary closure of manufacturing sites and travel restrictions, which, in turn, has created logistical supply issue and delay is shipment. • Major ceramic and tile manufacturers across the world are facing problems despite of no construction ban. This is attributed to disruption in value chain and closure of other industries that are directly or indirectly linked with the ceramic sector. • The real estate sector is directly dependent on the growth of the ceramic tile sector. Owing to unavailability of raw materials, slowdown in the construction sector, and restrictions laid by government to prevent the spread of virus, the demand for ceramic tile has declined considerably. Thus, consumption and production of nepheline have been hampered during the COVID-19 pandemic. • In addition, other industries such as refractories and glass are hit due to the global health crisis, which, in turn, has negatively affected the global nepheline market.

Loading Table Of Content...