Nephrology And Urology Devices Market Research, 2032

The global nephrology and urology devices market size was valued at $31.3 billion in 2022 and is projected to reach $47.8 billion by 2032, growing at a CAGR of 4.3% from 2023 to 2032. The growth of the nephrology and urology devices market is driven by a rise in the prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD). For instance, according to the Centers for Disease Control and Prevention (CDC), chronic kidney disease is slightly more common in women (14%) than men (12%). Thus, the rise prevalence of chronic kidney disease and other urological conditions has propelled the demand for devices, thereby driving growth during nephrology and urology devices market forecast.

Key Takeaways

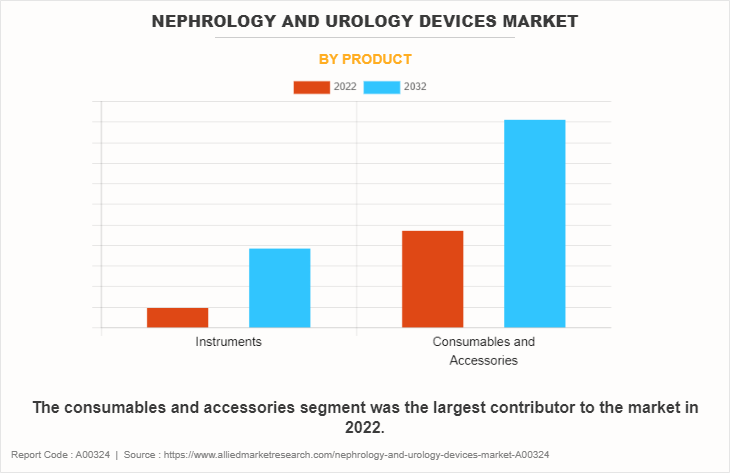

- The consumables & accessories segment dominated the global market in 2022.

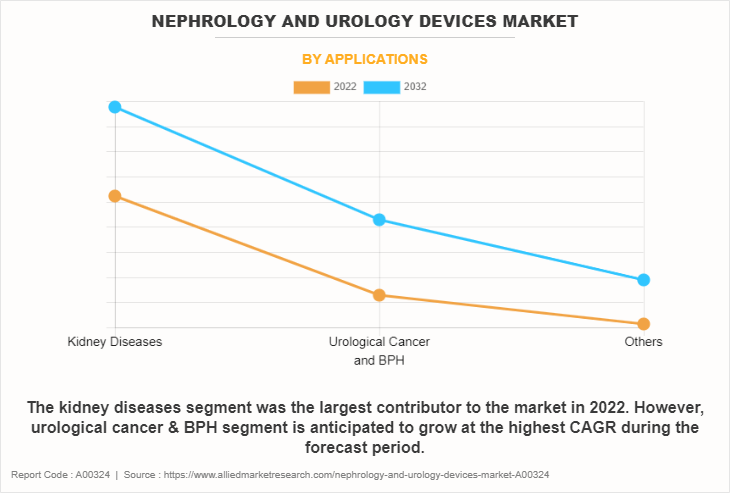

- The kidney diseases segment dominated the global market in 2022.

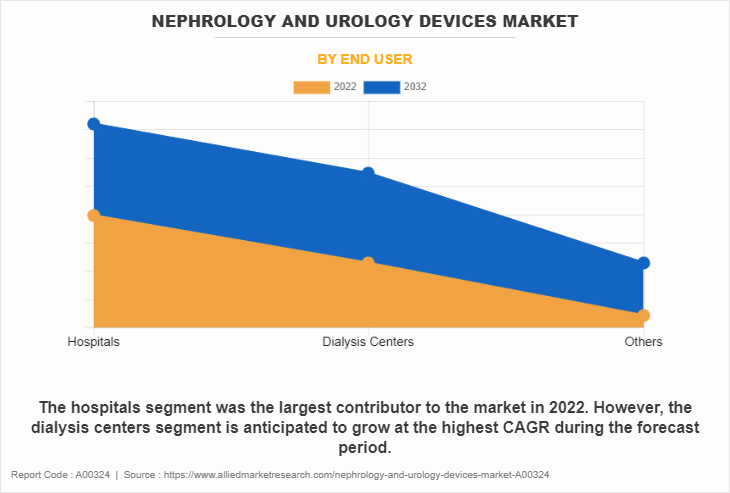

- The hospital segment dominated the global market in 2022.

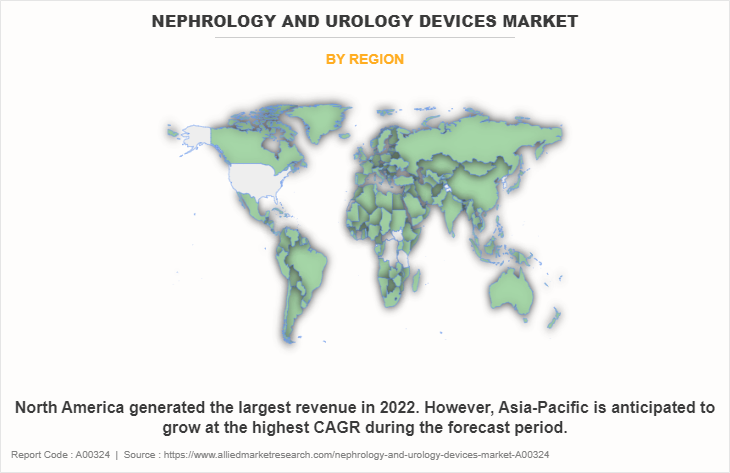

- The North America region dominated the market in terms of revenue in 2022. However, Asia-Pacific is expected to register the highest CAGR during the forecast period.

Urology and nephrology devices are medical tools and equipment used in the diagnosis & treatment of conditions affecting the urinary system and kidney. Urologists rely on a variety of devices to perform procedures, surgeries, and diagnostic tests. These devices are designed to aid in procedures such as dialysis, kidney stone removal, urine collection, and bladder management. They are essential in improving patient outcomes, enhancing the quality of life, and reducing the burden of renal and urological diseases. Some instances of nephrology and urology devices include ureteral catheters, catheters, urinary stents, stone baskets, urology guidewires, renal dilators, dialysis machines, hemodialysis machines, peritoneal dialysis machines, urine analyzers, cystoscopes, urodynamic systems, lithotripters, prostate stents, and urological lasers.

Market Dynamics

The rise in the incidence of conditions such as chronic kidney disease, kidney stones, urinary incontinence, and urological cancers has created a high demand for devices & treatments in nephrology and urology which propels the growth during nephrology and urology devices market analysis. In addition, ongoing innovations in medical devices, such as minimally invasive surgical instruments, robotic-assisted surgeries, and improved diagnostic tools, have enhanced patient outcomes and boosted the market growth. For instance, hemodialysis machines are essential for patients with end-stage renal disease. Fresenius Medical Care company offers the 6008 Series Hemodialysis Machines along with advanced features for precise dialysis treatment, including safety mechanisms, monitoring capabilities, and improved user interfaces, enhancing the overall dialysis experience for both patients and healthcare providers. Such advancements in devices have fueled the growth of the nephrology and urology devices market size.

Furthermore, an increase in awareness about the importance of early diagnosis & treatment of kidney and urology disorders has led to higher demand for screening & diagnostic devices which further drive the nephrology devices market growth. For instance, the American Kidney Fund supports policies that would expand the use of chronic kidney disease screening and coverage of genetic testing & counseling, as well as improve clinical research, provider training, diagnosis, prevention, and treatment of rare kidney diseases.

However, the high cost of urology devices is a major factor that negatively impacts market growth, particularly in price-sensitive regions such as Asia-Pacific. The high cost of urology endoscopes and endovision systems may hamper market growth. In addition, the lack of skilled professionals to operate & maintain urology devices is a significant factor that may restrain market growth. The shortage of trained professionals can limit the adoption of these devices, particularly in developing countries. On the other hand, the increase in demand for home-based dialysis solutions, and portable devices that may be easily operated by patients provides a lucrative opportunity to the nephrology and urology devices market growth.

The ongoing global economic recession influences several industries, including biotechnology & pharmaceuticals, which has an impact on the development & demand for antibiotics such as macrolides. During a recession, governments and healthcare providers may cut back on healthcare spending, which leads to reduced funding for R&D of new urology devices. A recession can lead to a decline in patient hospital visits and clinical services, as patients may postpone elective surgeries and other medical procedures to save money. This may result in a decrease in demand for urological and nephrological devices and restrain the growth of the nephrology devices market.

Despite these challenges, the nephrology and urology devices market continues to experience moderate revenue growth due to a rise in cases of urological conditions and ongoing technological advancements in devices.

Segmental Overview

The nephrology and urology devices market is segmented into product, application, end user, and region. By product, the market is segregated into instruments and consumables & accessories. The instruments segment was further categorized into dialysis devices, endoscopes, laser & lithotripsy devices, endovision & imaging systems, and others. Dialysis device segment is further bifurcated into hemodialysis devices and peritoneal dialysis devices. The endoscopes segment is classified into cystoscopes, ureteroscopes, and others. The consumables & accessories segment is further categorized into dialysis consumables, catheters & guidewires, stents, biopsy devices, and others. On the basis of application, the market is categorized into kidney diseases, urological cancer & BPH, and others. On the basis of end user, it is classified into hospitals, dialysis centers, and others.

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product

The consumables & accessories segment dominated the market in terms of revenue in 2022 and is expected to register the highest CAGR during the forecast period. This is attributed to the rise in demand for essential supplies such as catheters, dialysis filters, stents, and other disposable items used in nephrology and urology procedures.

By Application

The kidney disease segment dominated the nephrology and urology devices market share in terms of revenue in 2022, owing to a rise in incidences of chronic kidney disease, kidney stones, and kidney-related disorders. In addition, ongoing R&D efforts in nephrology, along with the introduction of innovative treatments and therapies for kidney-related conditions further support the segment growth.

However, the urological cancer & BPH segment is expected to register the highest CAGR during the forecast period. This is attributed to the increase in prevalence of urological cancers, and growing awareness of urological cancers, leading to an increase in screening and early diagnosis.

By End User

The hospital segment dominated the market in terms of revenue in 2022, owing to the availability of advanced medical infrastructure and specialized healthcare professionals in hospitals contributing to the widespread adoption of nephrology and urology devices.

However, the dialysis center segment is expected to register the highest CAGR during the forecast period. This is attributed to the convenience and accessibility of dialysis centers, which ensure consistent treatment & monitoring, the efficiency of renal replacement therapies, and the expertise of healthcare professionals. All these factors make dialysis centers a primary choice for managing chronic kidney diseases and driving segment growth.

By Region

The nephrology and urology devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the nephrology and urology devices market share in terms of revenue in 2022. Growth in this region is attributed to the advanced healthcare infrastructure, rise in prevalence of urological conditions, and growing aging population. In addition, the presence of several major players, such as Medtronic plc, B. Braun SE, and Olympus Corporation, contributes to the market growth in the region.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributed to a large & diverse population, growth in healthcare infrastructure, rise in government initiatives to spread awareness about urological diseases, surge in the aging population, and increase in technological advancements in urological and nephrological devices.

Asia-Pacific offers profitable opportunities for key players operating in the nephrology and urology devices industry, thereby registering the fastest growth rate during the forecast period, owing to a rise in awareness about urological health, early disease detection, and adoption of modern medical technologies.

Competition Analysis

Competitive analysis and profiles of the major players in the nephrology and urology devices industry, such as Medtronic plc, Boston Scientific Corporation, B. Braun SE, Baxter International Inc., Coloplast, Olympus Corporation, Stryker Corporation, Teleflex Incorporated, Becton, Dickinson and Company, and Karl Storz GmbH & Co. KG are provided in the report. Other key players in the market include STERIS, Advin Health Care, and Narang Medical Limited. Major players have adopted product launch, product approval, acquisition, agreement, and partnership as key developmental strategies to improve the product portfolio and gain a strong foothold in the nephrology and urology devices market.

Recent Expansions in the Nephrology and Urology Devices Market

- In October 2022, Medtronic plc, a global healthcare technology leader, has announced three significant global market entrance and indication expansion approvals for its Hugo robotic-assisted surgery (RAS) system.

- In April 2021, Medtronic plc and DaVita Inc. announced the launch of Mozarc Medical, an independent new company committed to reshaping kidney health and driving patient-centered technology solutions.

Recent Product Approvals in the Nephrology and Urology Devices Market

- In February 2023, Boston Scientific Corporation announced the U.S. Food and Drug Administration (FDA) 510(k) clearance of the LithoVue Elite Single-Use Digital Flexible Ureteroscope System, the first ureteroscope system with the ability to monitor intrarenal pressure in real-time during ureteroscopy procedures.

- In February 2022, Medtronic plc, a global leader in healthcare technology, announced that it has received approval from the U.S. Food and Drug Administration (FDA) for InterStim X, the next generation of the InterStim portfolio's recharge-free device and it is available immediately. InterStim systems are the standard of care in advanced therapy options, and the most personalized system, to deliver sacral neuromodulation (SNM) therapy.

Recent Agreements in the Nephrology and Urology Devices Market

- In July 2023, Teleflex Incorporated a leading global provider of medical technologies announced that it has entered into a definitive agreement to acquire privately held Palette Life Sciences AB for an upfront cash payment of $600 million at closing, and up to an additional $50 million upon the achievement of certain commercial milestones. This acquisition will expand the Teleflex Interventional Urology portfolio.

- In December 2022, Olympus Corporation (Olympus) announced it has signed a definitive agreement to acquire London-based Odin Vision, a cloud-AI endoscopy company with a strong portfolio of commercially available computer-aided detection/diagnostic (CAD) solutions and a deep innovation pipeline of cloud-enabled applications.

Recent Partnerships in the Nephrology and Urology Devices Market

- In June 2023, Teleflex Incorporated a leading global provider of medical technologies, announced a partnership with Shenzhen Insighters Medical Technology Co., Ltd. as the exclusive U.S. distributor of the Insighters Video Laryngoscope system, which is designed to inspect the upper glottic airway and facilitate endotracheal intubation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the nephrology and urology devices market analysis from 2022 to 2032 to identify the prevailing nephrology and urology devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nephrology and urology devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global nephrology and urology devices market trends, key players, market segments, application areas, and market growth strategies.

Nephrology and Urology Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 47.8 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 302 |

| By Product |

|

| By Applications |

|

| By End User |

|

| By Region |

|

| Key Market Players | Becton, Dickinson and Company, Medtronic plc, Baxter International Inc., Boston Scientific Corporation, Stryker Corporation., Coloplast, B. Braun SE, Olympus Corporation, Teleflex Incorporated, Karl Storz GmbH & Co. KG |

Analyst Review

The increase in demand for nephrology and urology devices, rise in the demand for minimally invasive surgical procedures, and surge in incidence of chronic kidney disease, kidney stone, & urinary tract infections are expected to offer profitable opportunities for the expansion of the market. However, the high cost of urology devices hinders market growth.

There are several advanced features in ureteroscopy devices such as camera miniaturization, improved optical systems, digital video capability, smaller ureteral stone baskets, and dual working channels which enables the continuous pressurized irrigation for enhanced visualization. In addition, increase in awareness regarding technologically advanced urology devices drive the market growth. For instance, presently flexible ureteroscopes are the most preferred in the market.

Furthermore, North America is expected to witness the largest growth, in terms of revenue, owing to rise in rise in awareness regarding urological disorders, strong presence of key players and easy availability of nephrology and urology devices. However, Asia-Pacific is expected to register the highest CAGR during the forecast period owing to growth in demand for minimally invasive surgical procedures and development of healthcare infrastructure.

The growth of the nephrology and urology devices market is primarily driven by increase in prevalence of urological and nephrological conditions, technological advancements in medical devices, and growing awareness about ealry diagnosis.

The consumables and accessories segment is the most influencing segment in nephrology and urology devices market owing to increasing prevalence of chronic kidney diseases, urological disorders and advancements in technology and materials used in consumables and accessories.

Nephrology and urology devices are the medical devices used for diagnosis, treatment, and management of conditions related to the kidneys (nephrology) and the urinary system (urology).

Medtronic plc, Becton, Dickinson and Company, Boston Scientific Corporation, B. Braun SE, and Baxter International Inc. held a high market position in 2022.

The forecast period for nephrology and urology devices market is 2023 to 2032.

The base year is 2022 in nephrology and urology devices market.

The market value of nephrology and urology devices market in 2032 is $47.8 billion.

The total market value of nephrology and urology devices market is $31.3 billion in 2022.

Loading Table Of Content...

Loading Research Methodology...