Network And Location Analytics Market Overview

The global network and location analytics market was valued at $19 billion in 2021, and is projected to reach $89.7 billion by 2031, growing at a CAGR of 17% from 2022 to 2031.

The growth of the global network and location analytics market size is mainly driven by the proliferation of smartphones and the upsurge in the usage of GPS-enabled devices. In addition to this, factors such as growing usage of spatial data and analytical tools, increasing adoption of networks, and further, the COVID-19 pandemic increased the use of location-based services, which fueled the market expansion. However, consent and privacy concerns may hamper the market growth to some extent. On the other hand, the emergence of advanced technologies in the field of GIS, and the integration of AI with location analytics is expected to provide lucrative opportunities for market growth during the forecast period.

Network analytics is adopted by organizations with specific networks such as complex networks, overtaxed networks, or high-level security requirements. As a result, large enterprises are using network analytics broadly due to the facilities such as easier to use, more standardized, less expensive, or embedded in more managed services. Companies with smaller networks will find it more approachable to use analytics however, big-sized companies consume network analytics as a built-in feature of cloud-managed network services, such as a network-as-a-service offering, managed software-defined WAN, or managed wireless LAN service.The network and location analytics market is segmented into Component, Deployment Model, Enterprise Size, Application and Industry Vertical.

Segment Review

The network and location analytics market is segmented on the basis of component, deployment mode, enterprise size, application, industry vertical, and region. On the basis of component, it is categorized into solutions and services. As per the deployment Model, it is classified On-premise and cloud. On the basis of enterprise size, it is classified into large enterprises and SMEs.

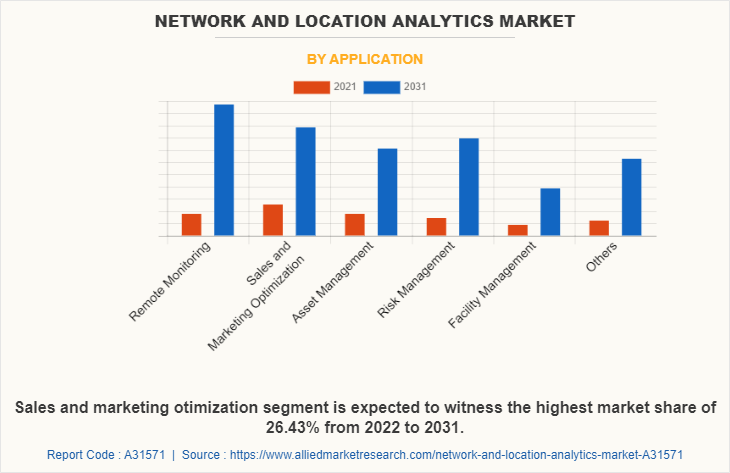

Depending on the application, it is divided into remote monitoring, sales & marketing optimization, asset management, risk management, facility management, and others. On the basis of industry vertical it is categorized into BFSI, retail & consumer goods, healthcare, hospitality, transport & logistic, government, IT & telecom, media and entertainment, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of application, the sales and marketing optimization segment holds the largest network and location analytics market share, owing to the rise in demand to evaluate current sales efforts, and the ongoing efforts by companies to streamline processes. However, the remote monitoring segment is expected to grow at the highest rate during the forecast period, owing to the upsurge in usage of advanced geospatial data analytics solutions to track and monitor COVID-19 progression to help curb the disease propelling the network and location analytics market growth. For instance, technology platforms such as NoBroker.com remotely monitor demand and supply patterns happening across micro localities.

Region-wise, the network and location analytics market is dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to a rise in awareness among SMEs and large businesses toward network and location analytics services. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the rise in awareness and additional savings by individuals to purchase their own real-estate properties.

The company profiles of network and location analytics market analysis included in this report are Google LLC., Microsoft Corporation, IBM, Cisco Systems, Inc., Oracle, SAP SE, Hexagon, ALTERYX, INC., ESRI, SAS Institute Inc.

Top Impacting Factors

Proliferation of smartphones and upsurge in usage of GPS-enabled devices

Proliferation of smartphones and tablets with embedded GPS, creates the perfect opportunity for actionable, location-aware analysis. This factor significantly drives the network & location analytics market growth as the mobile location data offers relevant and real-time proximity-based information on target consumers. For instance, location-based marketing platforms such as HYP3R, Reveal Mobile, bluedot, NinthDecimal, Swirl Network, and Verve enable businesses to target mobile users with the right promotional message when they are in the proximity of a store. Such real-time data analytics has become essential for businesses to gain behavioral insights about consumers’ dietary patterns, purchasing habits, and others.

Surge in usage of spatial data and analytical tools

The usage of spatial data and analytical tools is increasing across organizations. Spatial data usage has grown significantly in the retail industry along with the extensive range of applications for insurance companies and real estate agencies to understand where their business will and won't expand. Spatial data and analytics tools enable organizations to manage facilities & networks, discover growth insights, and provide location information to the customer. Without consideration of spatial components as well as their impact on business, the risks and possibility of poor results will increase in the organization. Therefore, majority of the organizations are using spatial data and analytics tools. This is one of the major factors fueling the growth in network and location analytics industry.

COVID-19 Impact Analysis

The COVID-19 outbreak has low impact on the growth of the network and location analytics industry, as the adoption of location intelligence or analytics is increased to understand the impact of COVID-19 on consumer behavior and the economy. On the other hand, healthcare systems are experiencing an unprecedented level of demand for location data, with numerous countries having to inspect medical facilities, including primary care clinics, hospitals, and retirement homes to analyze care capacity and vulnerability. For instance, in March 2020, to help public health agencies as well as other organizations to initiate their response, Esri launched ArcGIS Hub Coronavirus Response template with a complimentary six-month ArcGIS Online subscription for ArcGIS Hub. ArcGIS Hub is a framework used for building websites to analyze and visualize crises in the context of the population and assets of a community or organization.

Furthermore, businesses across the globe are planning to come back stronger; hence, network and location analytics industry software adoption would help them to map COVID-19 density zones to plan their business operations accordingly. For instance, in May 2020, Transerve Technologies, a provider of network and location solutions launched a solution to map COVID-19 density zones using remote sensing and network and location technologies.

KEY BENEFITS FOR STAKEHOLDERS

The study provides an in-depth analysis of the global network and location analytics market forecast along with current & future trends to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on global network and location analytics market trends is provided in the report.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Network and Location Analytics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 89.7 billion |

| Growth Rate | CAGR of 17% |

| Forecast period | 2021 - 2031 |

| Report Pages | 338 |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | SAP SE Inc., .Alteryx, Inc., Microsoft Corporation, SAS Institute, Inc., Oracle Corporation, SAP SE, Cisco System Inc, HEXAGON AB, IBM CORPORATION, ESRI |

Analyst Review

According to the CXOs of leading companies, the network and location analytics market is going through enormous transformation and growth. Also, the market is undergoing a paradigm shift in adoption of innovative technologies. As the competition across all the business sectors is intensifying over the years, it has become necessary for companies to maintain consistent and stable relationships with their customers as well as ensure customer loyalty.

The network and location analytics solutions are widely being adopted by numerous organizations across the globe to improve customer satisfaction levels as well as to enhance their product or service according to the consumer needs. Location analytics combines business data with location data to disclose the relationship of location to people, transactions, events, facilities, and assets. Therefore, many organizations are using location data and spatial analytics in their business intelligence (BI) and analytical workflows. Location analytics has enabled businesses to make more informed decisions to improve both efficiency and effectiveness of their services and growth strategies.

Moreover, the demand for more accurate location data is increasing rapidly. Thus, organizations are becoming increasingly dependent on data as well as becoming more data-driven. This is one of the key trends which is expected to significantly fuel the market growth in upcoming years. For instance, nearly 93% of organizations in Singapore, use data analytics for critical and automated decision-making. On the other hand, the enhancement in location data quality is leading to the improved quality of AI and machine learning, which is further opportunistic for market growth during forecast period. Furthermore, the emergence of autonomous mobility is anticipated to provide lucrative opportunities for market growth.

The network and location analytics market is competitive and comprises a number of regional and global vendors competing based on factors such as cost of solutions & services, reliability, efficiency of the product, and support services.

The market is concentrated with major players consuming 40–50% of the share. The degree of concentration will remain the same during the forecast period. Owing to the competition, vendors operating in the market are offering advanced location analytics solutions to improve the marketing strategies of enterprises. For instance, in march 2022, Alteryx, Inc., the Analytics Automation company, introduced the launch of Alteryx Analytics Cloud, its first unified end-to-end analytics automation platform that helps businesses empower all users across the enterprise to make more informed decisions with the data.

On the other hand, the rise in investment trend in companies across the location-based industry is projected to boost the market growth. For instance, in January 2020, Placer.ai, a startup company that analyzes location and foot traffic analytics for retailers as well as other businesses raised $12 million in funding, which used on R&D for product development and to expand the business portfolio associated with networking solutions. Such significant investments in R&D activities to develop effective location analytics software and services offerings, which is opportunistic for the market.

The network and location analytics market is estimated to grow at a CAGR of 17.0% from 2022 to 2031

The network and location analytics market is projected to reach $ 89,646.27 million by 2031.

Proliferation of smartphones and upsurge in usage of GPS-enabled devices, growing usage of spatial data and analytical tools, and increase in the adoption of location-based services during the COVID-19 pandemic contribute toward the growth of the market.

The key players profiled in the report include Google LLC., Microsoft Corporation, IBM, Cisco Systems, Inc., Oracle, SAP SE, Hexagon, ALTERYX, INC., ESRI, SAS Institute Inc.

The key growth strategies of network and location analytics market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...