Network Engineering Services Market Overview

The global network engineering services market size was valued at USD 43.7 billion in 2021, and is projected to reach USD 111.7 billion by 2031, growing at a CAGR of 10.1% from 2022 to 2031.

The increasing number of connected devices, the increased requirement for new highly developed network infrastructure, and technological advancements in the field of Information and Communications Technology (ICT) are the major factors driving the market forwards. Such services are widely used in the ICT industry, which is expected to drive the market for network infrastructure among various businesses even further. With the growth of IoT across industries and the growth of communications technologies, there is a rising demand for advanced network infrastructure.

In addition, the dependence of growing data-based services on web hosting propels the growth of the market. However, the major restraint of the network engineering services market is the high price of the upgradation of software. Contrarily, the introduction of advanced networking solutions is expected to provide major growth opportunities for the growth of the market.

Network engineering is an important emerging engineering discipline that encompasses specific features of the digital network and services. The growth of the worldwide digital network and services has increased the demand and need for engineering graduates with core digital networking skills. Furthermore, network engineering services are utilized by various organizations to maintain the connectivity of networks in terms of data, calls, voice, videos, and wireless networks.

In addition, for the smooth operation of an organization, new technologies and applications are introduced on a regular basis. Maintaining and ensuring the effective execution of information and communication within and outside the organization requires computer network engineering.

Segment Review

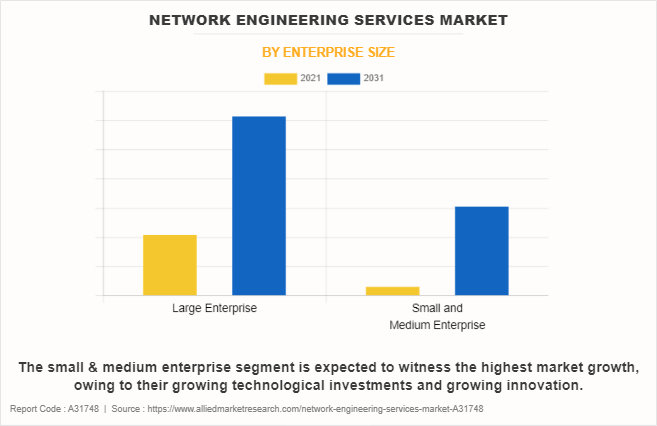

The network engineering services market is segmented on the basis of service type, connectivity, enterprise size, industry vertical, and region. By service type, it is segmented into network design, network deployment, and network assessment. By connectivity, the market is divided into wired, and wireless. By enterprise size, it is bifurcated into large enterprise, and small and medium enterprise. By industry vertical, it is segmented into BFSI, IT & telecom, healthcare, manufacturing, education, media & entertainment, and others. By region, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

On the basis of enterprise size, the large enterprise segment dominated the overall network engineering services market in 2021 and is expected to continue this trend during the forecast period. This is attributed to the complex communication demands of various large corporations needing custom networking solutions. However, the SMEs segment is expected to witness the highest growth owing to their growing technological investments and growing innovation, which is expected to further fuel the growth of the global network engineering services industry.

By Region

The network engineering services market was dominated by North America in 2021, owing to advancements in communications sector.

Region wise, the network engineering services market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its transforming technology and communications sector which is expected to drive the market for network engineering services within the region during the forecast period.

However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to its growing digital capabilities and a highly competitive market space, which is anticipated to fuel the network engineering services industry growth in the region in the coming few years.

Country Specific Statistics & Information

Developing countries such as India and U.S. are increasingly targeted by the key players to develop and launch the network engineering services features into the existing range of products. For instance, in June 2021, L&T Technology Services Limited, an India-based engineering services company, entered into a partnership with Mavenir, U.S. based telecommunications software company, to deliver end-to-end 5G automation services.

Furthermore, according to an article published in October 2022, The U.S. Air Force and U.S. Defense Information Systems have awarded SOS International (SOSi) two task orders to provide network services for international U.S. armed forces commands.

The global network engineering services industry has witnessed growth during the COVID-19 pandemic, owing to the dramatic increase in the demand for communication technology, which further fueled the demand for Wi-Fi coverage and network system. Moreover, the increasing work-from-home trends during COVID-19 generated a need for Wi-Fi networks that use multiple nodes and can communicate with each other to seamlessly share a wireless connection within a larger area. Such factors propelled the growth of the global network engineering services market during the period.

Key Developments/Strategies

In August 2022, SkyMax Network and Ericsson signed MoU for next-generation 5G network in Sub-Saharan Africa.

In June 2022, Technology solutions firm Cyient had signed a definitive agreement to acquire Celfinet, a Portugal based wireless engineering services firm for $41 million. The company provides end-to-end network planning and performance optimization services.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the network engineering services market analysis from 2021 to 2031 to identify the prevailing network engineering services market opportunities.

Information about key drivers, restrains, & opportunities and their impact analysis on the global network engineering services market trends are provided in the report.

Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the market.

An extensive analysis of the key segments of the industry helps to understand the global network engineering services market forecast.

The quantitative analysis of the global network engineering services market growth from 2021 to 2030 is provided to determine the market potential.

Network Engineering Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 111.7 billion |

| Growth Rate | CAGR of 10.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 275 |

| By Service Type |

|

| By Connectivity |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Sincera Consulting LLC, Cyient, Mphasis, Integration International, Inc., PCS Technologies Inc., Datavision, Inc., Imagit Inc, Infosys Limited, Softnautics, TATA Communications |

Analyst Review

The increase in network traffic and the need to support the technology demand are creating opportunities for network assistance. The much-need help to businesses for optimizing the network functionality and availability to achieve business goals by identifying the network’s capabilities, security vulnerabilities, and helping existing infrastructure to support new technologies, an increasing need to deploy networks tailored to meet current and future traffic demands are continuously creating demand for advanced network design adoption. Furthermore, the evolution in hybrid connectivity technology, cloud inclusion, secure remote access, and the need for effective network design drive the demand for network design engineering services. In addition, the increased adoption of broadband drives the market as it attributes to high-speed internet connectivity that is always quicker than typical dial-up access. It enables high-quality and rapid access to information, teleconferencing, data transfer, and other functions in various settings, including healthcare, education, and technical development. Moreover, network engineering services create a balance between security and the rising need for computing that is fast, more effective, and more adaptable. For instance, in June 2021, L&T Technology Services Limited, an India-based engineering services company, entered into a partnership with Mavenir to deliver end-to-end 5G automation services. Mavenir is a U.S.-based telecommunications software company creating the future network with cloud-native software that operates on any cloud. Additionally, in October 2021, Accenture, an Ireland-based information technology company with leading digital, cloud, and security capabilities, acquired Umlaut. Through this acquisition, Accenture scales its network engineering skills to assist firms in using digital technologies such as cloud, artificial intelligence, and 5G to alter how they design, create, and produce their products while embedding sustainability.

The global network engineering services market was valued at $43.73 billion in 2021, and is projected to reach $111.68 billion by 2031

The network engineering services market is projected to grow at a compound annual growth rate of 10.1% from 2022 to 2031.

Cyient, Datavision, Inc., Imagit Inc, Infosys Limited, Integration International, Inc., Mphasis, PCS Technologies Inc., Sincera Consulting LLC, Softnautics, and TATA Communications.

North America is the largest regional market for network engineering services market.

Dependence of growing data-based services on web hosting and rising demands for network services across the world are the major growth factor for the network engineering services market.

Loading Table Of Content...

Loading Research Methodology...