Network Equipment Market Insight: 2032

The global network equipment market was valued at $29.9 billion in 2022, and is projected to reach $69.7 billion by 2032, growing at a CAGR of 9.2% from 2023 to 2032.

Network equipment consists of hardware devices and components that used to build and manage computer networks. These devices are responsible for facilitating the communication and transmission of data between different devices, such as computers, servers, routers, switches, modems, firewalls, and wireless access points. Furthermore, network equipment plays a key role as industries grow as it supports scalability. It integrates any number of components depending on the enterprise’s needs. Network equipment helps establish an effective mode of communication, thereby improving business standards. It promotes multiprocessing and enables sharing of resources, information, and software with ease.

Factors such as rise in digitalization and increase in adoption of advanced technologies such as IoT across the globe positively impact the growth of the market. In addition, the increase in adoption of network equipment across businesses to enhance operation & productivity is anticipated to propel the growth of the network equipment market trends in future. Furthermore, an increase in investments by top players and a rise in government initiatives are expected to provide lucrative growth opportunities for market expansion during the forecast period.

Furthermore, the increase in adoption of emerging technologies such as 5G & edge computing and a rise in demand for SD-WAN technology are anticipated to provide lucrative growth opportunities for the network equipment market forecast. For instance, in March 2022, Nokia Corporation launched of its cloud-native solution, Adaptive Cloud Networking, to transform service provider cloud networks to be consumable, agile and automated. The comprehensive solution is designed to respond to the unpredictable demands of the 5G era by supercharging a service provider's data center fabric and seamlessly extending its operations to the edge clouds.

In addition, the increase in deployment of virtualized software among enterprises including data center and service provider drive the network equipment market growth. On the contrary, overutilization of capacity, physical connectivity challenges issue and malfunctioning hardware devices limit the growth of the network equipment market.

Segment Review

The network equipment market is segmented into type, enterprise size, application, and region. By type, it is categorized into switches, routers, gateway, fiber optic equipment, and others. By enterprise size, the market is segregated into small & medium-sized enterprises and large enterprises. By application, the market is classified into IT & telecom, BFSI, retail and e-commerce, government & defense, manufacturing, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

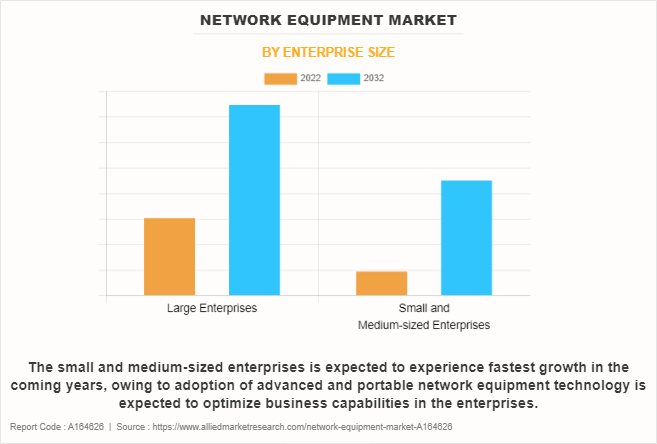

By enterprise size, the global network equipment market share was dominated by the large enterprises segment in 2022 and is expected to maintain its dominance in the upcoming years, owing to demand for network equipment technology in enterprises. However, the small & medium-sized enterprises segment is expected to witness the highest growth in the upcoming years. The adoption of advanced and portable network equipment technology is expected to optimize the business capabilities of small & medium-sized enterprises.

By region, North America dominated the market share in 2022 for the network equipment market. The increase in investment in advanced technologies such as SD-WAN and network equipment devices to improve businesses and the customer experience are anticipated to propel the growth of the market in this region. For instance, in August 2023, Nokia Corporation announced the expansion of its ‘network-in-a-box’ program to provide essential network infrastructure products in a single bundle that operators and broadband equity, access and deployment (BEAD) participants need to quickly build or scale broadband networks.

The pre-packaged solutions from Nokia are configurable to each individual network build and are available to ship directly through Nokia or its network of channel partners. BEAD participants focused on bridging the digital divide and leveraging Nokia’s network-in-a-box program. The program provides all the recently announced U.S. manufactured fiber-optic broadband network electronics products and optical modules in a single solution. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of portable hardware devices.

COVID-19 Impact Analysis

The COVID-19 pandemic has presented both challenges and opportunities for the network equipment industry. While the initial disruptions to global supply chains and workforce availability posed hurdles, the increased reliance on remote work, telehealth, e-learning, and digital collaboration tools has generated substantial opportunities for the industry. With the surge in demand for robust, high-speed, and reliable internet connectivity, network equipment manufacturers and service providers have witnessed a heightened need for upgrades and expansions. The growing emphasis on remote access and digital transformation has accelerated investments in 5G infrastructure, cloud computing, and edge computing solutions.

Furthermore, the heightened awareness of cybersecurity threats in the wake of the pandemic has driven greater interest in network security solutions. Overall, the COVID-19 crisis has underscored the essential role of network equipment in supporting modern work and lifestyle trends, driving innovation and investment in industry.

Top Impacting Factors

Rapid Advancement and Acceleration of Digitalization in Businesses:

Increase in digitalization means that IT infrastructure and network connections are needed in places where demand is rapidly growing, such as with edge computing where volumes of data are created and processed, buoyed by an onslaught of IoT devices collecting data and application needs for real time analytics. Moreover, as a result of the COVID-19 outbreak, the more remote workforce has emerged, which requires network access to be spun up quickly at the edge, outside of corporate and branch offices.

Owing to this, enterprises deploy online services such as telemedicine, unified communications, and collaboration (UCC), and digital payments, requiring greater network bandwidth capacity and distributed network access points. Furthermore, IT organizations are increasingly turning to SD-WAN, virtual private network (VPNs), firewall, and cloud routing virtual devices that quickly interconnect with employees, customers, and partner ecosystems over high-speed, low-latency network connections. Such rapid advancement drives the growth of the market and enhances digitalization toward operations.

Competition Analysis

The market players operating in the network equipment market are Cisco Systems, Inc., Juniper Networks, Inc., Huawei Technologies Co., Ltd., AT&T, Inc., Verizon Communication, Hewlett Packard Enterprise Development LP., Telefonaktiebolaget LM Ericsson, Arista Networks Inc., ZTE Corporation, and Nokia Corporation. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the network equipment market globally.

Recent Product Launch in the Market

In October 2023, Telefonaktiebolaget LM Ericsson launched a new software toolkit to strengthen 5G Standalone network capabilities and enable premium services with differentiated connectivity. The portfolio enhancement comes as the growth of new use cases and rising mobile user expectations on the quality of 5G experience are putting greater demands on network capacity and performance.

In June 2023, ZTE Corporation, a global leading provider of information and communication technology solutions has unveiled a series of new products for 5G industrial field networks, including the 5G UniEngine V1100A, SmartEdge 6100, and MSE N100.

In April 2023, Arista Networks, a leading provider of cloud networking solutions, launched the AI-driven network identity service for enterprise security and IT operations. Based on Arista's flagship CloudVision platform, Arista Guardian for Network Identity (CV AGNI.) CV AGNI helps to secure IT operations with simplified deployment and cloud scale for all enterprise network users, their associated endpoints, and Internet of Things (IoT) devices.

Recent Partnership in the Market

In June 2023, Nokia Corporation partnered with DXC Technology, a leading Fortune 500 global technology services firm, for launching DXC Signal Private LTE and 5G, a managed secure private wireless network and digitalization platform solution that helps industrial enterprises digitally transform their operations.

Key Benefits for Stakeholders

- The study provides an in-depth network equipment market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the network equipment market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the network equipment industry.

- The quantitative analysis of the global network equipment market for the period 2022–2032 is provided to determine the network equipment market potential.

Network Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 69.7 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 269 |

| By Type |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hewlett Packard Enterprise Development LP, Verizon Communications Inc., Juniper Networks, Inc., AT&T, Inc., Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., Arista Networks, Inc., ZTE Corporation |

Analyst Review

Over time, businesses have seen various changes in the business processes, operations, and industrial automation. As more businesses become reliant on internet connectivity for business-critical and cloud applications, network equipment technology has become a necessity. As customers add more connections to their enterprises, and as applications move toward a multi-cloud environment, network security is expected to be a top priority. Customers need to protect against the evolving cyber threat landscape as they want their business assets to always be available and secure. Businesses in the equipment industry have expanded investments in all aspects of network security to create effective cybersecurity architectures.

Furthermore, service providers AT&T, Verizon Communication, and other key players are beginning to offer more devices that support 5G coverage. As these products roll out, networking equipment competitors are investing in or acquiring companies that produce optics capable of supporting the bandwidth requirements and the economics of next-generation networks. For instance, in June 2023, Huawei announced to launch a complete set of commercial 5.5G network equipment in 2024 at the 5G Advanced Forum. This concept of a "5.5G Era", is based on an end-to-end solution that integrates comprehensive evolved technologies including 5.5G, F5.5G, and Net5.5G. This solution is anticipated to protect operators' previous investment in 5G, while also improving network performance by 10 times. This 5.5G Era would feature 10 gigabit peak downlink speeds and gigabit peak uplink speeds to meet increasingly diverse service requirements. It would also refresh the industry vision by using new technologies such as passive IoT to unlock a market of 100 billion IoT connections. Such enhanced factors are expected to provide lucrative opportunities for network equipment market growth during the forecast period.

Moreover, prominent market players explore new technologies and portable devices to meet the increase in customer demands. Product launches, collaborations, and acquisitions are expected to enable them to expand their product portfolios and penetrate different regions. Emerging economies provide lucrative opportunities to market players for growth or expansion. For instance, in June 2023, the U.S.-based telecom gear maker, Cisco System, Inc. launched the “Networking Cloud Platform” to simplify the management of networking gear through a single, common interface. This platform has been rolled out alongside enhancements to several of Cisco’s products, including ThousandEyes infrastructure monitoring service, and Catalyst portfolio.

North America is the largest regional market for the Network Equipment.

Factors such as rise in digitalization and increase in adoption of advanced technologies such as IoT across the globe positively impact the growth of the market.

The key growth strategies for Network Equipment Market include product portfolio expansion, acquisition, partnership, merger, and others

Network Equipment Market is expected to reach $69,712.13 Million, by 2032.

The key players operating in the network equipment market are Cisco Systems, Inc., Juniper Networks, Inc., Huawei Technologies Co., Ltd., AT&T, Inc., Verizon Communication, Hewlett Packard Enterprise Development LP., Telefonaktiebolaget LM Ericsson, Arista Networks Inc., ZTE Corporation, and Nokia Corporation

Loading Table Of Content...

Loading Research Methodology...