Network Security Testing Market Research, 2031

The global network security testing market size was valued at $1.8 billion in 2021, and is projected to reach $10.8 billion by 2031, growing at a CAGR of 19.6% from 2022 to 2031.

The rise in demand for work from home and remote working policies during the period of the COVID-19 pandemic aided in propelling the demand for global network and enterprise security solutions, hence empowering the growth of the network security testing industry. However, higher installation costs and maintenance challenges of network security testing platforms can hamper the network security testing market forecast. On the contrary, the integration of advanced tools such as machine learning and data analytics with network security testing solutions suites are expected to offer remunerative opportunities

Network security testing is a method of evaluating the current state of security of the overall enterprise network including internal, external security assessment, and device-level security policies throughout a network to detect and illustrate flaws and assess hazards.

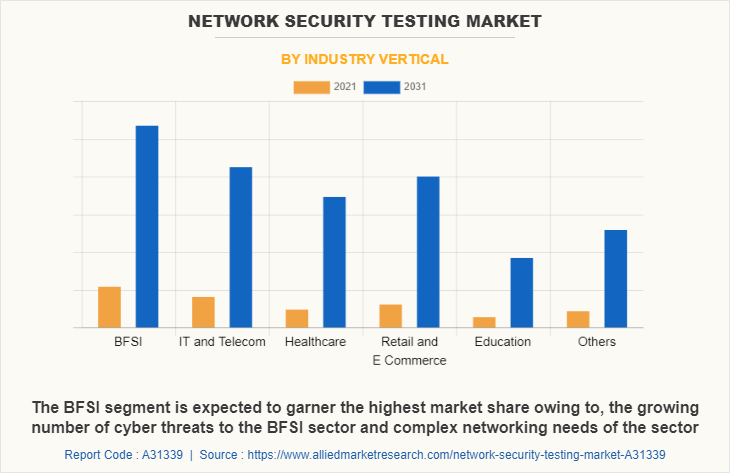

The network security testing market is segmented on the basis of type, deployment model, enterprise size, industry vertical, and region. On the basis of type, the industry is divided into VPN testing, firewall testing, and others. Depending on deployment mode, the market is classified into on premise and cloud. Based on enterprise size, the market is bifurcated into large enterprises and SMEs. The industry vertical covered in the study include BFSI, IT and telecom, healthcare, retail and e-commerce, education, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the network security testing market analysis are AT&T, Checkmarx Ltd., Cigniti, Core Security, Data Theorem, Inc., IBM, ImpactQA, Kryptowire, LogRhthym, Inc., McAfee, LLC, Micro Focus, NowSecure, Parasoft, PortSwigger Ltd., Rapid7, ScienceSoft USA Corporation, SecureWorks, Inc., Synopsys, Inc., and Veracode. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Depending on industry vertical, the BFSI segment dominated the network security testing market share in 2021, and is expected to continue this trend during the forecast period owing to the growing digital participation of BFSI sector companies, incentivizing major businesses of the sector to invest in effective network security testing solutions for their organization. However, the healthcare segment is expected to witness the highest growth in the upcoming years, owing to the rising security standards and government regulatory policies being implemented in the sector.

Region wise, the network security testing market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of data visualization solutions vendors such as AT&T, IBM Corporation, and McAfee, LLC, which is expected to drive the market for network security testing technology within the region during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rapid economic and technological developments in the region, which is expected to fuel the growth of network security testing industry in the region in the coming few years.

The report focuses on growth prospects, restraints, and analysis of the global network security testing market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global network security testing market share

Top Impacting Factors

Surge in web and mobile-based business-critical applications requiring higher secure endpoint protection

In the wake of the COVID-19 pandemic, enterprises are allowing employees to work from home with their own devices, such as laptops and smartphones to access company data as well as also provide company-specific web and mobile-based applications for usage. These external devices work on (often) relatively unsecured personal network of the employees, making them susceptible to various cyberattacks due to insufficient security; thus, companies are adopting network security testing solutions to provide enhanced security and to reduce various types of cyberattacks, which propels the growth of the market.

In addition, growing cyberattacks, in-house data thefts, and other theft issues among the organizations drives the growth of the market. Furthermore, an increase in the adoption of network security testing in large and medium size enterprises for providing higher secure endpoint protection for various mobile and other devices across the enterprises drives the growth of the market.

Increase in number of cyber-attacks and fraud cases

The outbreak of COVID-19 prompted a considerable proportion of routine activities and businesses to shift their operations online. In addition to this, the growing adoption of digital media and communication networks across the organization and the growing need to reduce cyber-attacks and fraudulent cases across the globe drive the growth of the market.

Furthermore, reducing cybercrimes is the key goal for many organizations, according to a study published in Cybercrime Magazine, in February 2022, total damages and ransoms collected by hackers and cybercriminals around the globe amounted to more than $6 trillion in 2021. The study also claims that these costs could grow every year and reach up to $10.5 trillion in the coming 5 years, growing at the rate of 15% each year. In July 2021, a major game publisher, Electronic Arts Inc. was hacked with more than 780 GB of their data stolen and held at ransom. This stolen data included source code for their upcoming game titles including FIFA 21 and others. Such factors are influencing the global network security testing market growth.

COVID-19 Impact Analysis

The global network security testing market has witnessed stable growth during the COVID-19 pandemic, owing to the dramatically increased digital penetration during the period of COVID-19-induced lockdowns and stringent social distancing policies, which further fueled the demand for remote operational tools such as network security testing tools. Moreover, the lack of skilled IT professionals and highly skilled hackers has led to a surge in cyber-crimes and security breaches in organizations.

In addition, different enterprises adopted security testing solutions due to the rise in the number of data breaches and lack of security within the organization to prevent unauthorized access to enterprise information using the loopholes in the security systems. As a result, the rise in the number of data and security breaches during the COVID-19 pandemic in enterprises drives market growth.

Furthermore, the increasing number of COVID-19 cases, caused many organizations to adopt remote working tools. According to an article published by TechTarget, in December 2020, more than 67% of organizations that adopted work-from-home policies post the outbreak of COVID-19, plan to keep their remote working options available for their employees even after the period of the pandemic. Such factors propelled the growth of the global network security testing solutions market during the period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the network security testing market analysis from 2021 to 2031 to identify the prevailing network security testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the network security testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global network security testing market trends, key players, market segments, application areas, and market growth strategies.

Network Security Testing Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | MICRO FOCUS, ImpactQA, Checkmarx, SecureWorks, Core Security Technologies, data theorem, PortSwigger, ParaSoft, McAfee, Cigniti Technologies Ltd, Veracode, AT&T, WhiteHat Security, Rapid7, .IBM CORPORATION, Kryptowire, ScienceSoft, Synopsys, LogRhythm |

Analyst Review

Demand for network security testing has been on a rise for the past few years and the market is expected to continue this trend in the coming years as well, owing to growth in complexity of enterprise communication networks and increase in digital dependence on modern businesses, increasing the need for network security testing solutions. In addition, rise in internet penetration in many regions of the world is promising new opportunities for the growth of the network security testing markets.

Key providers of the network security testing market such as IBM Corporation, McAfee, LLC, and Micro Focus account for a significant share of the market. With larger requirements for network security testing and services, various companies are establishing partnerships to increase their network security capabilities. For instance, in November 2021, Cigniti announced a strategic partnership with innovative5G. With this partnership, Cigniti plans to expand its portfolio of digital assurance and experience solutions for next generation 5G technologies, since there is a rapid increase in the demand for new services and shift toward 5G.

In addition, with surge in demand for network security testing, various companies have expanded their current product portfolio with increasing diversification among customers. For instance, in April 2022, McAfee, LLC announced the launch of their Personal Data Cleanup solution in the U.S. Personal Data Cleanup is a feature of the updated McAfee Total Protection. This new update offers the users with visibility and removal guidance along with continuous monitoring to remove their personal data from some of the riskiest data broker sites and protect themselves from identity thieves, hackers, and spammers.

Moreover, market players have expanding their business operations and customers by increasing their acquisitions. For instance, in June 2022, Synopsys, Inc. announced the acquisition of WhiteHat Security. WhiteHat Security provides application security Software-as-a-Service. This is a strategic acquisition for Synopsys as with the strengths of WhiteHat Security and its own SaaS capabilities and market-segment-leading dynamic application security testing technology, it can help Synopsys create the industry's broadest application security testing portfolios.

The rise in demand for work from home and remote working policies during the period of the COVID-19 pandemic aided in propelling the demand for global network and enterprise security solutions, hence empowering the growth of the network security testing industry.

Region wise, the network security testing market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of data visualization solutions vendors such as AT&T, IBM Corporation, and McAfee, LLC, which is expected to drive the market for network security testing technology within the region during the forecast period.

The global network security testing market size was valued at $1.82 billion in 2021, and is projected to reach $10.75 billion by 2031, growing at a CAGR of 19.6% from 2022 to 2031.

The key players profiled in the network security testing market analysis are AT&T, Checkmarx Ltd., Cigniti, Core Security, Data Theorem, Inc., IBM, ImpactQA, Kryptowire, LogRhthym, Inc., McAfee, LLC, Micro Focus, NowSecure, Parasoft, PortSwigger Ltd., Rapid7, ScienceSoft USA Corporation, SecureWorks, Inc., Synopsys, Inc., and Veracode. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...