Neurodegenerative Drugs Market Research, 2031

The global neurodegenerative drugs market size was valued at $36,277.20 million in 2021 and is estimated to reach $74,809.38 million by 2031, growing at a CAGR of 7.5% from 2022 to 2031. Neurodegenerative drugs are the medications used to treat neurodegenerative diseases, which are conditions that result in progressive damage and degeneration of neurons in the brain and nervous system. These diseases include Alzheimer's disease, Parkinson's disease, Huntington's disease, and multiple sclerosis (MS), and others. It is a group of conditions that are characterized by the progressive loss of neurons, leading to a decline in brain function and neurological symptoms. Neurodegeneration involves various aspects of neuronal structure and function, including the loss of axons, dendrites, synapses, and cell bodies, as well as the accumulation of abnormal proteins and other substances within neurons. Examples of neurodegenerative drugs include cholinesterase inhibitors (used to treat Alzheimer's disease), levodopa (used to treat Parkinson's disease), and interferon beta (used to treat multiple sclerosis).

“The neurodegenerative drugs market was decreased during the lockdown period owing to decline in sales of drugs which can be used in treatment of Parkinson’s disease, and Alzheimer’s disease. In addition, many clinical trials for neurodegenerative drugs had delayed or postponed. This has resulted in a slowdown in the development of new drugs, which ultimately negatively impacted the growth of the market.”

Market Dynamics

Increase in prevalence of neurodegenerative diseases such as Parkinson’s, multiple sclerosis and Alzheimer's disease which is expected to fuel the demand for drugs to treat these conditions. The growth of the neurodegenerative drugs market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, and rise in prevalence of chronic diseases. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, and significant investments by government to improve healthcare infrastructure.

In addition, governments, pharmaceutical companies, and non-profit organizations are investing more in R&D for neurodegenerative drugs, leading to the development of new treatments and therapies which further supports the neurodegenerative drugs market growth.

Moreover, rise in awareness about the neurological disorders and the need for early diagnosis and treatment leading to a greater demand for drugs that can slow down or halt the progression of these diseases which is expected to contribute towards the growth of the market. E-commerce (electronic commerce) has become a vital tool for small and large businesses globally, due to rise in preference of consumers for online shopping over traditional purchasing methods. This is attributed to further supports growth of the neurodegenerative drugs market size.

Developing new drugs for neurodegenerative diseases is a complex and expensive process that requires significant investment in R&D. Thus, high costs of drug development limit the number of companies willing to invest in this area and limit the number of new drugs that come to market which hamper the growth of the neurodegenerative drugs market share. In addition, regulatory approval process for new drugs can be lengthy and expensive, which can limit the number of drugs that come to market and delay patient access to new treatments. Thus, high cost and complications associated with the neurodegenerative drugs hamper the growth of neurodegenerative drugs market share.

The COVID-19 had disrupted the workflows in the health care sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global neurodegenerative drugs market experienced a decline in 2020 due to global economic recession led by COVID-19. For instance, Biogen company which manufactured the neurodegenerative drugs had experienced the direct and indirect impact of the COVID-19 pandemic on business and operations, including sales, expense, supply chain, manufacturing, R&D costs, and clinical trials. Thus, the pandemic had a negative impact on the market growth.

However, pandemic has led to increased demand for treatments for neurological and psychiatric disorders, as many patients had experienced mental health issues as a result of the pandemic. This increased demand had led to a boost in sales for some neurodegenerative drugs which moderately drive the market growth.

Segmental Overview

The neurodegenerative drugs market is segmented into drug class, indication, distribution channel and region. By drug class, the market is categorized into dopamine agonists, decarboxylase inhibitors, cholinesterase inhibitors, immunomodulators and others. On the basis of indication, the market is segregated into Parkinson’s disease, Alzheimer's disease, multiple sclerosis, and others. By distribution channel, the market is classified into hospital pharmacies, drug store & retail pharmacies, and online providers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

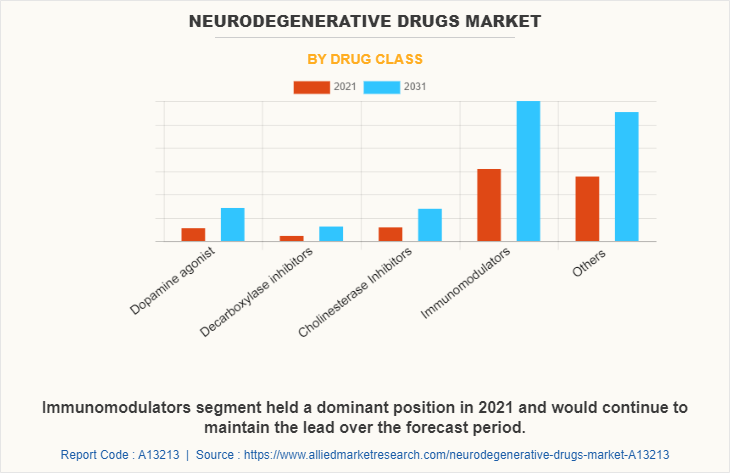

By Drug Class

The neurodegenerative drugs market is segmented into dopamine agonists, decarboxylase inhibitors, cholinesterase inhibitors, immunomodulators, and others. The others segment dominated the global market in 2021, owing to increase in prevalence of neurological conditions such as Parkinson's disease and the growing aging population as they are more prone to the neurological diseases. However, decarboxylase inhibitors segment is expected to register highest CAGR during the neurodegenerative drugs market forecast period. This is attributed to decarboxylase inhibitors help to reduce the side effects of dopamine replacement therapy by reducing the need for high doses of dopamine agonists.

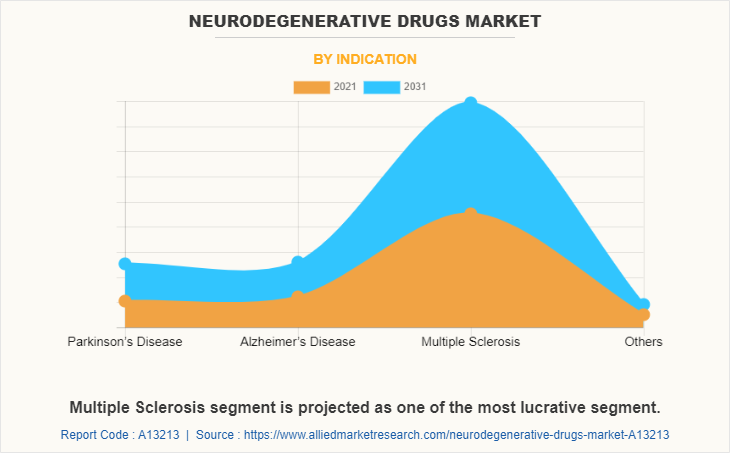

By Indication

The neurodegenerative drugs market is segregated into Parkinson’s disease, Alzheimer's disease, multiple sclerosis, and others. The multiple sclerosis segment dominated the global market in 2021. This was attributed to an increase in the number of people affected by multiple sclerosis. However, Parkinson's disease segment is expected to register highest CAGR during the forecast period. This is attributed to rise in prevalence of Parkinson’s disease. For instance, according to the Parkinson’s Foundation, 90,000 people in the U.S. diagnosed with Parkinson's every year. Thus, rise in prevalence of Parkinson’s disease is expected to drive the growth of the market.

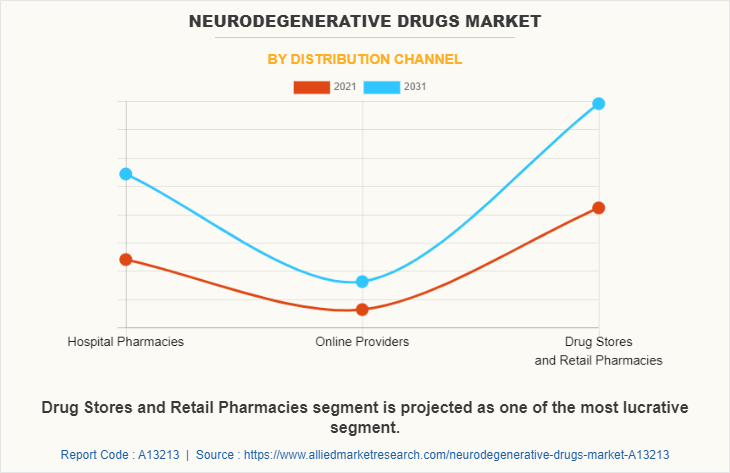

By Distribution Channel

The neurodegenerative drugs market is classified into hospital pharmacies, online providers, and drug store & retail pharmacies. The drug store & retail pharmacies held the largest market share in 2021 and is expected to remain dominant throughout the forecast period. This is attributed to the increase in number of patient suffering from neurological disorders including Parkinson’s and Alzheimer's which increases the demand for drugs in drug stores & retail pharmacies. However, online providers segment is expected to register the highest CAGR during the forecast period. This is attributed to convenient to use, lower prices, easy accessibility, and technological advancements.

By Region

The neurodegenerative drugs market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the neurodegenerative drugs market in 2021 and is expected to maintain its dominance during the forecast period.

Presence of several major players, such as AbbVie Inc., F. Hoffmann-La Roche Ltd., Novartis AG, Teva Pharmaceutical Industries Ltd., and Viatris Inc manufactured the neurodegenerative drugs. However, governments and private organizations are investing heavily in R&D to develop new and effective neurodegenerative drugs led to the development of new therapies which supports the market growth. Furthermore, high purchasing power, and rise in adoption rate of neurodegenerative drugs are expected to drive the market growth. Moreover, product approvals, collaborations, and acquisitions adopted by the key players in this region boost the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. In addition, rise in personalized medicine expenditure and adoption of neurodegenerative drugs to treat the diseases, drive the growth of the market. Furthermore, the Asia-Pacific region exhibits the largest medicine supply and the largest pharmaceuticals industry with availability of raw material in abundance, which can be easily accessed by manufacturers of neurodegenerative drugs. This, in turn, drives the growth of the neurodegenerative drugs industry.

Asia-Pacific offers profitable opportunities for key players operating in the neurodegenerative drugs industry, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rise in disposable incomes, as well as well-established presence of domestic companies in the region. In addition, the rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the neurodegenerative drugs, such as AbbVie Inc., Biogen, F. Hoffmann-La Roche Ltd., Novartis AG, Orion Corporation, Sanofi, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Viatris Inc., and UCB S.A. are provided in this report. There are some other important players in the market such as SQUARE GROUP, Dr. Reddy's Laboratories Ltd., and others. Major players have adopted product approvals, acquisition and collaboration as key developmental strategies to improve the product portfolio of the neurodegenerative drugs market.

Recent Product Approvals in The Neurodegenerative Drugs Market

- In June 2021, Biogen announced that the U.S. Food and Drug Administration (FDA) has granted accelerated approval for ADUHELM (aducanumab-avwa) as the first and only Alzheimer’s disease treatment.

- In October 2020, Novartis announced the U.S. Food and Drug Administration (FDA) has approved the fast-track designation for branaplam (LMI070) for the treatment of Huntington’s disease (HD).

- In January 2020, Novartis announced the European Commission (EC) has approved Mayzent (siponimod) for the treatment of adult patients with secondary progressive multiple sclerosis (SPMS) with active disease evidenced by relapses or imaging features of inflammatory activity.

- In May 2020, Teva Pharmaceutical Industries Ltd. announced the China National Medical Products Administration (NMPA) has approved AUSTEDO (Deutetrabenazine Tablets) for the treatment of chorea associated with Huntington's disease (HD) and Tardive Dyskinesia (TD) in adults.

Acquisition In The Neurodegenerative Drugs Market

- In March 2022, AbbVie Inc. announced that it has completed the acquisition of Syndesi Therapeutics SA, which will help to expand AbbVie's neuroscience portfolio. This acquisition gives AbbVie access to Syndesi's portfolio of novel modulators of the synaptic vesicle protein 2A (SV2A).

Collaboration In The Neurodegenerative Drugs Market

- In October 2021, Teva Pharmaceutical Industries Ltd. and MODAG GmbH announced a strategic collaboration for the development of MODAG's lead compound anle138b and a related compound, sery433. Teva received an exclusive global license to develop, manufacture and commercialize anle138b and sery433. The companies will jointly develop the compounds for the multiple system atrophy (MSA) and Parkinson’s disease (PD) indications based on early-stage clinical studies and consider exploring additional indications based on clinical outcomes.

Agreements In The Neurodegenerative Drugs Market

- UCB S.A. announced that it has entered into a global co-development and co-commercialization agreement with Novartis covering UCB0599, a potential first in class, small molecule, alpha-synuclein misfolding inhibitor currently in Phase 2 clinical development, and upon completion of the ongoing Phase 1 program of UCB7853 for Parkinson’s Disease (PD).

- UCB S.A. announced an agreement to enter into a world-wide, exclusive license agreement with Roche and Genentech, a member of the Roche Group, for the global development and commercialization of UCB0107 in Alzheimer’s Disease (AD).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the neurodegenerative drugs market analysis from 2021 to 2031 to identify the prevailing neurodegenerative drugs market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the neurodegenerative drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global neurodegenerative drugs market trends, key players, market segments, application areas, and market growth strategies.

Neurodegenerative Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 74.8 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Drug Class |

|

| By Indication |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Sanofi, Orion Corporation, Viatris Inc., Teva Pharmaceutical Industries Ltd., Biogen, Sun Pharmaceutical Industries Ltd., Novartis AG, F. Hoffmann-La Roche Ltd., AbbVie Inc., UCB S.A. |

Analyst Review

This section provides various opinions of top-level CXOs in the global neurodegenerative drugs market. According to the insights of CXOs, the global neurodegenerative drugs market is expected to exhibit high growth potential attributable to high demand for neurodegenerative drugs and rise in pipeline products. However, availability of alternative treatment for neurodegenerative diseases and side effects of therapeutics hamper the market growth.?

CXOs further added that rise in number of product approvals for neurodegenerative drugs drive the market growth. Moreover, rise in awareness about Parkinson’s disease, Alzheimer's disease, increase in number of generic drug manufactures, and surge in ageing population are some factors which further boost the market growth. In addition, the presence of skilled neurologists and various diagnostic facilities for neurological disease patients are major factors which foster the growth of the market.??

Furthermore, North America is expected to witness the highest growth, in terms of revenue, owing to the increase in prevalence of neurodegenerative diseases along with rise in geriatric population and presence of key players in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in prevalence of neurological diseases and rise in R&D pipeline products for neurology field.

Increase in prevalence of neurodegenerative diseases such as Alzheimer’s disease, multiple sclerosis, & Parkinson’s disease and rise in clinical trials for treatment of neurodegenerative diseases are the factors responsible for the market growth.

Parkinson’s disease is the leading application of Neurodegenerative Drugs Market.

North America is the largest regional market for Neurodegenerative Drugs.

The total market value of neurodegenerative drugs market is $36,277.2 million in 2021.

Top companies such as Novartis AG, F. Hoffmann-La Roche Ltd., AbbVie Inc., and Biogen held high market share in 2021.

Neurodegenerative drugs are used to treat neurodegenerative diseases that are designed to slow down the progression of the disease and/or relieve symptoms.

Asia-Pacific is expected to experience the growth rate of 9.2% during the forecast period, owing to surge in prevalence of disease such as Alzheimer’s disease, multiple sclerosis, & Parkinson’s disease, and rise in government initiatives for the management of neurodegenerative disease.

Loading Table Of Content...

Loading Research Methodology...