Neuropathic Pain Market Research, 2032

The global neuropathic pain market size was valued at $7.7 billion in 2022, and is projected to reach $13.3 billion by 2032, growing at a CAGR of 5.6% from 2022 to 2032. The growth of the neuropathic pain market is driven by the rise in demand for drugs meant for neuropathic pain, increase in initiatives taken by various government associations to raise awareness about management of neuropathic pain, and rise in clinical trials of drug for treatment of neuropathic pain. For instance, in May 2023, Algiax Pharmaceuticals provided an update on its ongoing Phase 2a study (NCT04429919) with lead candidate AP-325 in patients with chronic neuropathic pain. As part of a planned mid-enrollment interim analysis, the independent Data Monitoring Committee (DMC) recommended the continuation of the study and confirmed the absence of safety issues among the study participants.

Key Takeaways:

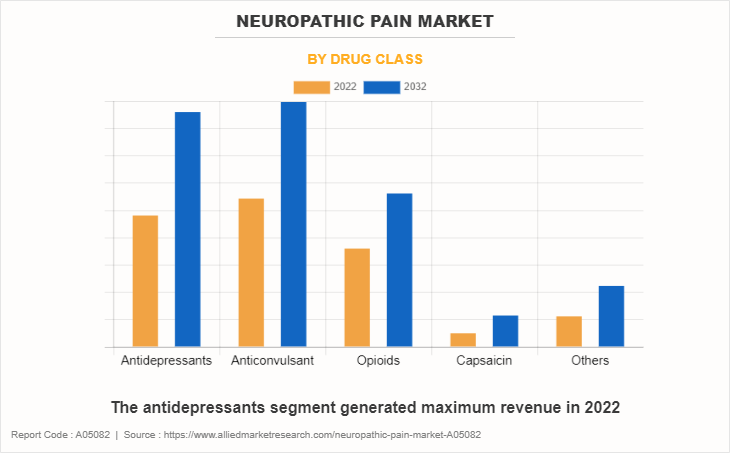

- On the basis of drug class, the anticonvulsant segment held the largest share in the neuropathic pain market in 2022.

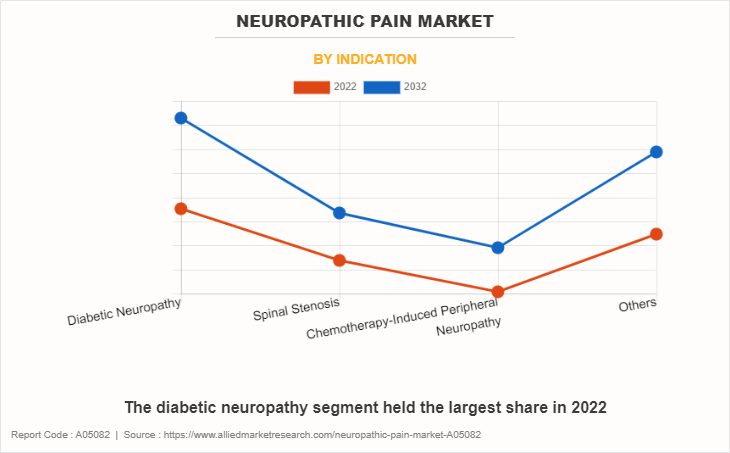

- On the basis of indication, the diabetic neuropathy segment held the largest share in the neuropathic pain market in 2022.

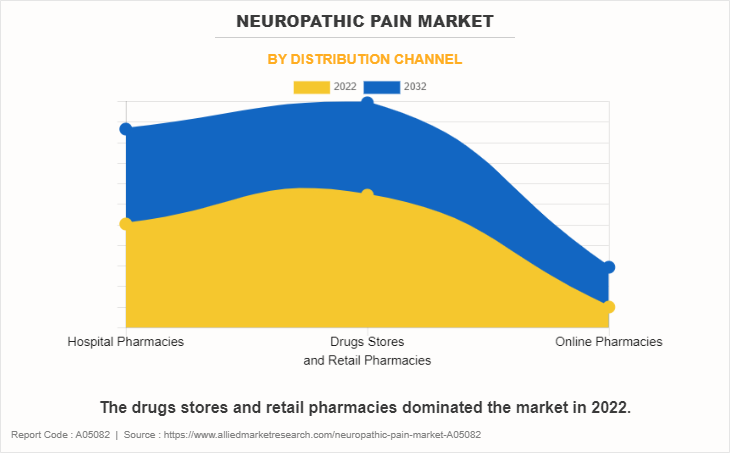

- On the basis of distribution channel, the drugs stores and retail pharmacies dominated the market in 2022.

- On the basis of region, North America was the major shareholder in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Neuropathic pain is usually caused due to damage or disease that has affected the somatosensory nervous system. This type of pain may either be related to abnormal sensations called dysesthesia or pain or due to continuous and paroxysmal components. Many common symptoms include feelings of burning or coldness, pins and needles, numbness, and itching. Opioids, capsaicin, anticonvulsants, and antidepressants are some of the common kinds of medications used for neuropathic pain control.

Market Dynamics

The rise in cases of spinal stenosis and diabetic neuropathy which cause neuropathic pain are expected to drive the growth of neuropathic pain market size. In addition, the chemotherapy drugs of cancer causes peripheral neuropathy, leading to neuropathic pain. Thus, the increase in number of cases of cancer which requires chemotherapy is the key factor that drives the growth of the market. For instance, according to American Cancer Society, estimated new cancer cases of female breast (281,550), uterine cervix (14,480), colon & rectum (149,500), uterine corpus (66,570), lung & bronchus (235,760), melanoma of the skin (106,110), non-hodgkin lymphoma (81,560), prostate (248,530), urinary bladder (83,730) were diagnosed in 2021 in the U.S.

Furthermore, the rise in the prevalence of chronic diseases is a significant driver for the growth of the neuropathic pain market share. Many chronic diseases are associated with nerve damage or dysfunction, leading to the development of neuropathic pain. The increase in global burden of patients with HIV, postherpetic neuralgia, trigeminal neuralgia, and fibromyalgia which further lead to neuropathic pain increases the demand for neuropathic pain medicine and drives the growth of neuropathic pain market share. Neuropathic pain is a common complication of HIV (human immunodeficiency virus) infection and is often associated with peripheral neuropathy. HIV itself causes damage to nerves, leading to neuropathic pain and drives growth of neuropathic pain market. For instance, according to the Joint United Nations Program on HIV and AIDS (UNAIDS), 39 million people globally were living with HIV in 2022. As per the same source, 1.3 million people became newly infected with HIV in 2022. And 630,000 people died from AIDS-related illnesses in 2022.

Moreover, aging is a risk factor for various health conditions, including diabetes, shingles, and other nerve-related disorders, which lead to neuropathic pain. The higher prevalence of these conditions in the geriatric population contributes to a greater incidence of neuropathic pain. Thus, rise in geriatric population associated with neuropathic pain drives the growth of market. Hence, such factors drive the growth of the neuropathic pain market.

Recession 2023 Impact Analysis on Neuropathic Pain Market

The recession presents challenges for the neuropathic pain market, particularly for pharmaceutical companies engaged in R&D efforts. During economic downturns, funding constraints and reduced return on investment in pharma R&D impede the progress of introducing innovative drugs of neuropathic pain to the market. For instance, Deloitte's report in January 2023 showed that the projected return on investment in pharma R&D fell to 1.2%, the lowest in 13 years. In addition, the average cost of developing a new drug increased significantly, reaching $2.3 billion in 2022. This financial pressure is expected to lead to slower development timelines and reduced focus on researching new drug for neuropathic pain.

Despite these challenges, the overall demand for therapeutic drugs, including drugs of neuropathic pain, remains relatively stable during economic downturns due to their essential role in treating health conditions. Moreover, the prevalence of neuropathic pain contributes to sustained demand for therapeutic drugs, in the face of a recession and is expected to drive the growth of the market.

Neuropathic Pain Market Segmental Overview

The neuropathic pain market is segmented on the basis of drug class, indication, distribution channel, and region. On the basis of drug class, the market is divided into antidepressants, anticonvulsant, opioids, capsaicin, and others. The antidepressants segment is further categorized into tricyclic antidepressants and serotonin–noradrenaline reuptake inhibitors (SNRI). On the basis of indication, the market is classified into diabetic neuropathy, spinal stenosis, chemotherapy-induced peripheral neuropathy, and others. On the basis of distribution channel, it is segregated into hospital pharmacies, drugs stores & retail pharmacies, and online pharmacies. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Drug Class

The anticonvulsant segment generated maximum revenue in 2022, owing to high adoption of anticonvulsant drugs for the treatment of neuropathic pain and the effectiveness of anticonvulsant drugs against neuropathic pain. The capsaicin segment is expected to witness the highest CAGR during the forecast period, owing to a rise in demand of capsaicin, particularly in the U.S., where the product is indicated for treating postherpetic neuralgia and pain related to diabetic neuropathy of the feet. In addition, the increase in clinical trials of capsaicin for the treatment of post-surgical neuropathic pain (PSNP).

By Indication

The diabetic neuropathy segment generated maximum revenue in 2022, owing to high adoption of drugs for the treatment of diabetic neuropathy and the high prevalence of diabetic neuropathy. The chemotherapy-induced peripheral neuropathy segment is expected to witness the highest CAGR during the forecast period, owing to a rise in cancer patients who taken chemotherapy drugs and cause peripheral neuropathy and availability of products in pipeline for the treatment of chemotherapy-induced peripheral neuropathy.

By Distribution Channel

The drugs stores and retail pharmacies segment dominated the market in 2022, owing to high sales of drugs from drugs stores and retail pharmacies and high number of drugs stores and retail pharmacies. The online pharmacies segment is expected to witness the highest CAGR during the forecast period, owing to convenience in shopping, increase in e-commerce sales, improvements in logistics services, and ease in payment options. In addition, the easy accessibility and heavy discounts & offer provided by these online platforms drives the growth of online pharmacies during forecast period.

By Region

North America accounted for a major share of the Neuropathic pain market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Abbott Laboratories (U.S.), Collegium Pharmaceutical, Inc. (U.S.), Eli Lilly and Company (U.S.), Pfizer Inc. (U.S.) and others; rise in number of clinical trials of drugs for neuropathic pain; availability of advanced healthcare facilities; and high healthcare expenditure from the government organizations in the region drive the neuropathic pain market growth.

Furthermore, the existence of a sophisticated reimbursement structure that aims to reduce expenditure levels fosters the growth of the market. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the neuropathic pain market throughout the forecast period. The presence of key players, high purchasing power, high prevalence of diabetic neuropathy, and significant increase in capital income in developed countries.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributable to a rise in cases of neuropathic pain as well as increase in purchasing power of populated countries, such as China and India. A rise in population along with longer life expectancy is thus expected to drive the growth of the market in Asia-Pacific during the neuropathic pain market forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the neuropathic pain market, such as Abbott Laboratories, Collegium Pharmaceutical, Inc., Eli Lilly and Company, Glenmark Pharmaceuticals Limited, Grünenthal, Mallinckrodt Pharmaceuticals, Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd are provided. These players have adopted agreement, acquisition, clinical trial, and product approval as their key developmental strategies to improve their product portfolio.

Recent Acquisition in the Neuropathic Pain Market

In February 2020, Collegium Pharmaceutical, Inc., a specialty pharmaceutical company announced that it has entered into a definitive agreement to acquire the U.S. rights to the Nucynta Franchise from Assertio Therapeutics, Inc. (“Assertio”) for $375.0 million in cash. The Nucynta Franchise, which includes both an extended-release and an immediate release formulation of tapentadol, is supported by patents with expiries in mid-June 2025, with the potential for a six-month pediatric extension. The acquisition of the full U.S. rights to the Nucynta Franchise is financially transformative for Collegium.

In January 2021, Eli Lilly and Company and Asahi Kasei Pharma Corporation announced a license agreement whereby Lilly will acquire the exclusive rights for AK1780 from Asahi Kasei Pharma. AK1780 is an orally bioavailable P2X7 receptor antagonist that recently completed Phase 1 single and multiple ascending dose and clinical pharmacology studies. P2X7 receptors have been consistently implicated in neuroinflammation, a driving force in chronic pain conditions. Under the terms of the agreement, Lilly is expected to be responsible for future global development and regulatory activities for AK1780. Asahi Kasei Pharma will retain the right to promote AK1780 in Japan and China (including Hong Kong and Macau).

Recent Agreement in the Neuropathic Pain Industry

In March 2023, Confo Therapeutics, a company in the discovery of medicines targeting G-protein coupled receptors (GPCRs), announced a worldwide licensing agreement with Eli Lilly and Company for Confo’s clinical stage CFTX-1554 and back-up compounds. CFTX-1554, a novel inhibitor of the angiotensin II type 2 receptor (AT2R) currently in Phase 1 clinical development, represents a non-opioid approach to treating neuropathic pain, a devastating condition caused by damage to the nerves outside of the brain and spinal cord, and potentially additional peripheral pain indications. Current treatment methods are often insufficiently effective and can lead to serious side effects including addiction. Patients suffering from peripheral pain are therefore in urgent need of effective analgesics that are well-tolerated and do not impact quality of life.

In October 2020, Eli Lilly and Company announced a definitive agreement to acquire Disarm Therapeutics, a privately held biotechnology company creating a new class of disease-modifying therapeutics for patients with axonal degeneration. Disarm has discovered novel, potent SARM1 inhibitors and is advancing them in preclinical development, with the goal of delivering breakthrough treatments to patients with peripheral neuropathy and other neurological diseases such as amyotrophic lateral sclerosis (ALS) and multiple sclerosis. SARM1 protein is a central driver of axonal degeneration. Disarm's SARM1 inhibitors are designed to directly prevent the loss of axons.

Recent Clinical Trial in the Neuropathic Pain Industry

In October 2021, Grünenthal announced that its U.S. subsidiary, Averitas Pharma Inc., enrolled the first patient in the randomised, double-blind trial AV001. The Phase III study investigates the efficacy, safety, and tolerability of QUTENZA (capsaicin) 8% topical system in post-surgical neuropathic pain (PSNP) to support an extension of the U.S. label.

In December 2020, Grünenthal announced that the first participants have been enrolled in a Phase I trial of a peripherally restricted Nociceptin/orphanin peptide receptor (NOP) agonist, an oral investigational medicine with a unique mechanism of action for the treatment of chronic peripheral neuropathic pain. The phase I trial will include 76 healthy participants. The trial aims to demonstrate a favorable safety and tolerability profile and to confirm the pharmacokinetic characteristics of the compound following single and multiple-ascending doses.

Recent Product Approval in the Neuropathic Pain Market

In July 2020, Grünenthal announced that its U.S. subsidiary Averitas Pharma, Inc. received U.S. Food and Drug Administration (FDA) approval for QUTENZA (capsaicin) 8% patch for the treatment of neuropathic pain associated with diabetic peripheral neuropathy (DPN) of the feet in adults. QUTENZA is a topical, non-systemic, non-opioid pain treatment delivered in the form of a patch and is the first and only treatment of its kind to deliver prescription strength capsaicin directly into the skin.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the neuropathic pain market analysis from 2022 to 2032 to identify the prevailing neuropathic pain market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the neuropathic pain market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global neuropathic pain market trends, key players, market segments, application areas, and market growth strategies.

Neuropathic Pain Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.3 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 279 |

| By Drug class |

|

| By Indication |

|

| By Distribution channel |

|

| By Region |

|

| Key Market Players | Mallinckrodt Pharmaceuticals, Pfizer Inc., Eli Lilly and Company., Teva Pharmaceuticals, Novartis AG, Abbott Laboratories, Glenmark Pharmaceuticals Limited, Collegium Pharmaceutical Inc, Sun Pharmaceutical Industries Ltd., Grunenthal GmbH. |

Analyst Review

This section provides opinions of top level CXOs in the neuropathic pain market. According to the insights of the CXOs, the neuropathic pain market is poised to grow at a notable pace due to rise in cases of diabetic neuropathy, cancer, and shingles.

As per the perspectives of CXOs, advancements in neuropathic pain medications, increase in awareness regarding neuropathic pain in developing countries, and surge in spinal injury cases which cause neuropathic pain drive the growth of neuropathic pain market. In addition, the aging population is more susceptible to conditions such as diabetes and neurological disorders, which are associated with neuropathic pain. Thus, the rise in aging population is expected to drive the growth of the market. The CXOs further added that the demand for new neuropathic pain options is on continuous rise due to R&D of neuropathic pain, increase in healthcare expenditure, and rise in patient advocacy & support. Moreover, emerging markets gain importance for the majority of the neuropathic pain manufacturers and distributors, as they focus on unmet demand for treating diseases. Hence, many companies have started introducing advanced products to cater to the needs of a growth in population, especially in developing economies.

North America garnered the highest market share in 2022 and is expected to maintain its lead during the forecast period, in terms of revenue, owing to availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth owing to increase in use of drugs of neuropathic pain, high unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.

The estimated industry size of Neuropathic Pain is $7.7 billion in 2022.

The forecast period for neuropathic pain market is 2023 to 2032.

The estimated industry size of Neuropathic Pain would be $13.3 billion in 2032.

An alarming rise in the cases of diabetic neuropathy, as well as an increase in the number of research related to medicine of neuropathic pain, increase in number of patients suffering from neuropathic pain are the upcoming trends of Neuropathic Pain Market in the world.

The diabetic neuropathy is the leading indication of Neuropathic Pain Market.

North America is the largest regional market for Neuropathic Pain.

The Collegium Pharmaceutical, Inc, Eli Lilly and Company Grünenthal, and Pfizer Inc are the top companies to hold the market share in Neuropathic Pain.

Yes, competitive analysis included in Neuropathic Pain Market report.

Loading Table Of Content...

Loading Research Methodology...