New, Pre-Owned, And Rental Construction Equipment Market Research, 2032

The Global New, Pre-Owned, and Rental Construction Equipment Market size was valued at $445.3 billion in 2020, and is projected to reach $871.4 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

New, pre-owned, and rental construction equipment is the service to rent out construction equipment to end users for a certain period by signing contracts with terms and conditions about their usage. Construction equipment is majorly used at construction mining sites to facilitate heavy operations. Customers can also opt for used or new equipment as per budget constraints.

Market Dynamics

In developing countries in Asia, Africa, and Latin America, malls and office buildings are currently undergoing construction. For instance, Brazil experienced the construction of more than 13 shopping mall in 2021. These shopping centers are multistory and built on several acres of land, which increases the need for large construction tools. Furthermore, the construction of brand-new, opulent office buildings in several nations and significant cities is a result of the rising industrialization of developing nations. For instance, in 2021, over 17 significant IT parks are currently being constructed in India's major cities of Mumbai, Delhi, Pune, Bangalore, and Hyderabad.

In addition, construction equipment tends to become damaged or undergo destruction regularly given the demanding tasks performed at construction sites. Construction equipment, like any other vehicle, needs to be timely maintained by going through routine servicing and maintenance to keep it operating properly. In addition, there are labor costs and operational costs, which cover things such as the cost of hiring skilled, experienced drivers and fuel costs for running the equipment.

However, equipment rental businesses employ and train their own staff of equipment operators. Furthermore, some businesses offer to pay the cost of the diesel, which is deducted from the customer's payment. These factors make it easy for customers to hire heavy and expensive equipment with well-trained operators only when needed. This helps to minimize the expense in the form of wages of operators as well as expenses incurred due to their maintenance. Hence such an advantage of construction rental equipment propels the growth of the market.

Moreover, several housing developments are also being built throughout Africa. For instance, in February 2022, six new mega social housing projects were planned for South Africa in the coming few years. In addition, in 2021, Africa's largest 3D-printed affordable housing project started in Kenya. To operate, such infrastructure projects require heavy construction machinery. This equipment is rented and used at these sites, which drives the growth of the global new, pre-owned, and rental construction equipment market.

However, in developed countries in North America and Europe, there is a saturation of new construction activity due to the already constructed infrastructure, the recent industrial slump, and the high cost of development. As a result, substantial investments in brand-new building projects have declined, which is anticipated to eventually constrain the expansion of the market for renting construction equipment in developed countries.

Moreover, at new construction sites, large cranes are inexpensive to rent instead of buying, simple to disassemble, and easy to move. In addition, rental firms can now easily follow the locations and operations of their equipment thanks to modern technology like IoT embedded in construction equipment. IoT assists in addressing a lack of experienced labor, increasing task accuracy, guaranteeing on-time delivery within budget, and addressing equipment safety concerns. Thus, it is anticipated that throughout the projection period, the introduction of new internet-connected equipment will promote new, pre-owned, and rental construction equipment market growth.

Segmental Overview

The new, pre-owned, and rental construction equipment market is segmented into sales type, application category, and region. By sales type, the market is classified into new, preowned, and rental. By application category, the market is divided into heavy and compact.

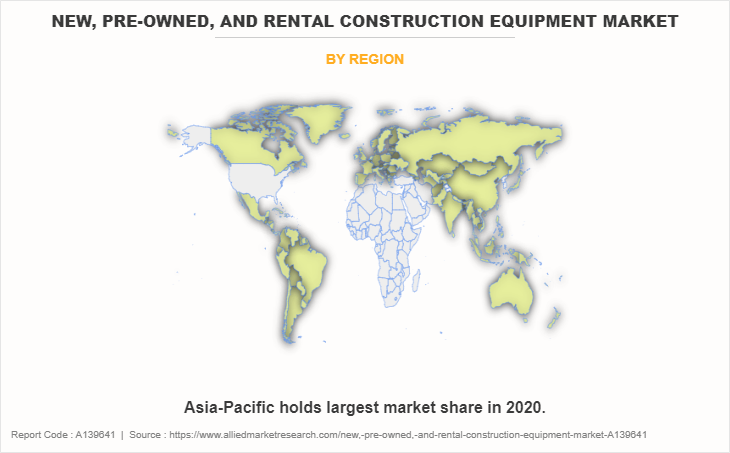

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

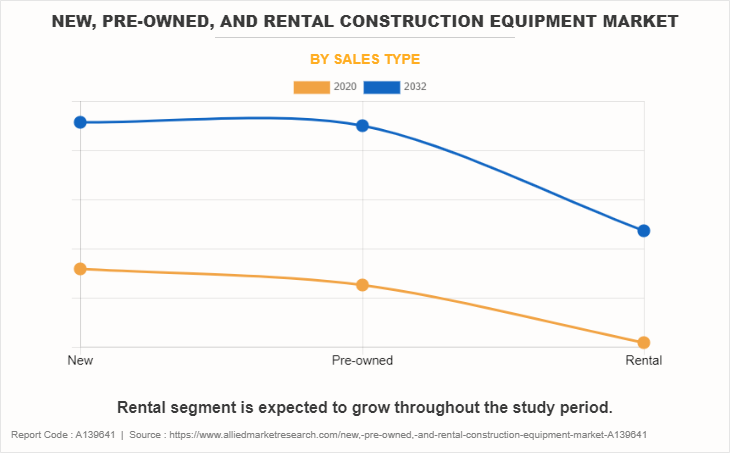

By Sales Type:

The new, pre-owned, and rental construction equipment market is divided into new, preowned, and rental. Equipment for construction that is brand-new, has never been used before and is bought straight from the manufacturer or an authorized retailer. It often comes with warranties, and the most recent features, and is in brand-new, unused condition. Pre-owned construction equipment that has been owned or utilized in the past by another person. It may have undergone upgrades or repairs, and it is frequently offered for sale at a lower cost than brand-new machinery.

The condition can change, and it might or may not come with the newest features or warranties. Construction machinery that is rented or leased for a set amount of time. Users can utilize the equipment on a temporary basis without having to buy it completely. Rental equipment is typically maintained by the rental company and can be a cost-effective solution for short-term projects or when equipment is needed on a temporary basis. The new segment is expected to exhibit the largest revenue contributor during the forecast period. Preowned is expected to exhibit the highest CAGR share in the sales type segment in the new, pre-owned, and rental construction equipment market during the forecast period.

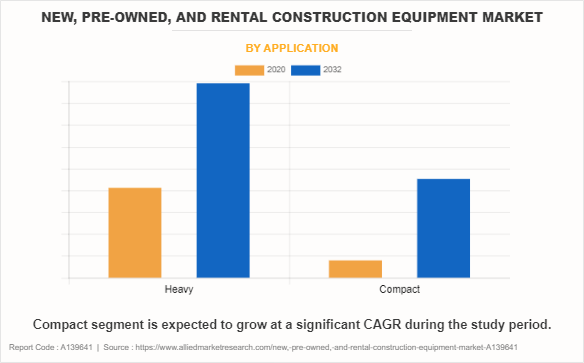

By Application:

The new, pre-owned, and rental construction equipment market is divided into heavy, and compact. Heavy construction equipment’s with more than 40 hp output are considered in this segment. Compact construction equipment’s with up to 40 hp output are considered in this segment. The heavy segment is expected to be the largest revenue contributor during the forecast period, and the compact segment is expected to exhibit the highest CAGR share in the equipment type segment in the new, pre-owned, and rental construction equipment market during the forecast period.

By Region:

The new, pre-owned, and rental construction equipment market forecast is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2020, Asia-Pacific held the highest revenue in new, pre-owned, and rental construction equipment market share. And LAMEA is expected to exhibit the highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the new, pre-owned, and rental construction equipment market include AB Volvo, Boels Rentals, H&E Equipment Services Inc., Haulotte Group, Herc Rentals Inc., Hitachi Ltd., Loxam (Ramirent), Maxim Crane Works, L.P., Sumitomo Corporation (Sunstate Equipment Company), and United Rentals, Inc.

Major companies in the market have adopted acquisition, product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the New, pre-owned, and rental construction equipment market.

Some Examples of Expansion and Acquisition on the Market

In April 2023- Boels Rental acquired Norwegian company BAS Maskinutleie making Nordic subsidiary Cramo. By means of this acquisition, it expands its rental services throughout the Nordic region.

In June 2023, - H&E Equipment Services Inc. (H&E) expanded its new branch in Houston South branch, its 22nd rental location in the state of Texas. By means of this expansion it is handling a variety of construction and general industrial equipment.

In March 2022, - Herc Holdings acquired Cloverdale Equipment Company to provide general and specialty equipment rental solutions and related services.

In October 2022- H&E Equipment Services Inc. acquired One Source Equipment Rentals Inc. By this acquisition, it offers its rental services to Midwest and further penetration into the southern U.S. positions H&E for increased participation in the non-residential construction and industrial end-markets.

In February 2023, United Rentals, Inc. acquired Able Equipment Rental, which is a New York based company that provides construction equipment for rent such as aerial equipment, earthmoving, and compaction.

In December 2022, United Rentals, Inc. acquired Ahern Rentals which is a leading provider of rental construction equipment in the U.S. and this acquisition will strengthen its position with the newly added 60,000 rental assets.

In May 2022, United Rentals, Inc. announced a new agreement with Ford Pro to buy electric vehicles for its North American fleets, both for business and rentals.

In June 2023, Boels Rental invested more than $500 million in construction equipment that incorporates new battery, electric, and hybrid technologies.

In May 2023, Boels Rental acquired two rental businesses to increase the size of its specialized rental divisions in Sweden and the UK. The first company is KraftX AB, a leader in backup power and power renting for industrial, construction, and infrastructure projects. Illumin8, a renowned light tower rental expert in the UK, is the second firm.

Some Examples of Collaboration on the Market

In May 2022, - United Rentals, Inc. collaborated with Ford Pro to purchase all-electric vehicles for its North American rental and company fleets. Through this collaboration, 500 F-150 Lightning pickups and 30 E-Transit vans are being ordered, with 120 trucks and all 30 vans scheduled to be delivered in 2022. Customers of United Rentals, as well as the staff members who handle sales, servicing, and deliveries for the company, will use the trucks on industrial and construction job sites.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the new, pre-owned, and rental construction equipment market analysis from 2020 to 2032 to identify the prevailing new, pre-owned, and rental construction equipment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the new, pre-owned, and rental construction equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global new, pre-owned, and rental construction equipment market trends, key players, market segments, application areas, and market growth strategies.

New, Pre-Owned, And Rental Construction Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 871.4 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2020 - 2032 |

| Report Pages | 220 |

| By Sales Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Haulotte Group S.A., Herc Holdings Inc., Loxam SAS (Ramirent), AB Volvo, Maxim Crane Works, L.P., Sumitomo Corporation (Sunstate Equipment Co., LLC), United Rentals, Inc., Hitachi Ltd., H&E Equipment Services Inc., Boels Rental |

Analyst Review

The rise in construction & mining activities in developing countries propels the growth of the new, pre-owned, and rental construction equipment market. Moreover, the decline in expenses such as the maintenance cost of the equipment, and high labor costs such as wages for skilled laborers and operational costs at the time of actual working on the site has led end users to opt for rental equipment. Furthermore, the ownership of this heavy equipment can incur a high initial investment, which is not affordable for all end users. In addition, it is inconvenient to hire a full-time skilled operator of this equipment as the wages might be higher.

However, the construction market has saturated in several developed nations and has affected the new, pre-owned, and rental construction equipment market. On the contrary, integration of IOT in the equipment prevents accidents in the workplace and aids in downtime reduction, thereby boosting the growth of the new, pre-owned, and rental construction equipment market during the forecast period.

Furthermore, rapid urbanization and industrialization of emerging countries and the use of construction equipment are anticipated to provide lucrative opportunities for the growth of the new, pre-owned, and rental construction equipment market.

The global new, pre-owned, and rental construction equipment market was valued at $445,292.4 million in 2020, and is projected to reach $871,401.5 million by 2032, registering a CAGR of 5.7% from 2023 to 2032.

The forecast period considered for the global new, pre-owned, and rental construction equipment market is 2020 to 2032, wherein, 2020-2021 are historic years, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global new, pre-owned, and rental construction equipment market report can be obtained on demand from the website.

The base year considered in the global new, pre-owned, and rental construction equipment market report is 2022.

The major players profiled in the new, pre-owned, and rental construction equipment market include AB Volvo, Boels Rentals, H&E Equipment Services Inc., Haulotte Group, Herc Rentals Inc., Hitachi Ltd., Loxam (Ramirent), Maxim Crane Works, L.P., Sumitomo Corporation (Sunstate Equipment Company), and United Rentals, Inc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on application the heavy segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...