New Zealand Medical Imaging Services Market Outlook - 2025

The New Zealand medical imaging services market was valued at $285 million in 2017, and is estimated to reach at $500 million by 2025, registering a CAGR of 7.3% from 2018 to 2025.

Medical imaging consists of different types of diagnostic devices, which are used to create visual representations of the interior body for the identification of various ailments. It also reveals the internal structures, which are hidden by skin and bones to identify abnormalities in a human body. It plays an important role in modern medicine and the modalities include X-ray, magnetic resonance imaging, computed tomography, ultrasound, and others. These find applications in various clinical fields for instance, in breast health, gynecology, neuro & spinal imaging, cardiovascular & thoracic imaging, and others. Medical imaging services are offered by clinics, hospitals, and other healthcare facilities and the expenses are borne by either the patients or the government or private payers.

The major factors that drive the market growth are the increase in chronic diseases coupled with the rise in technological advancements in medical imaging modalities. For instance, the introduction of fractional flow reserve-computed tomography (FFR-CT) from HeartFlow Inc. In 2014, revolutionized the healthcare industry as this device offers invasive catheter-based fractional flow reserve (FFR) measurements used in cardiac catheterization. Moreover, the increase in demand for combined use of medical imaging modalities is expected to create lucrative opportunities for key market players. For instance, the combined use of PET/CT scans for definitive diagnosis of cancer is on a constant rise in New Zealand.

In addition, surge in need for early diagnosis of various medical conditions such as breast cancer boosts the growth of the New Zealand medical imaging services market. However, high cost of sophisticated medical imaging modalities coupled with the shortage of helium will restrict the growth of the New Zealand medical imaging services market.

New Zealand Medical Imaging Services Market Segmentation

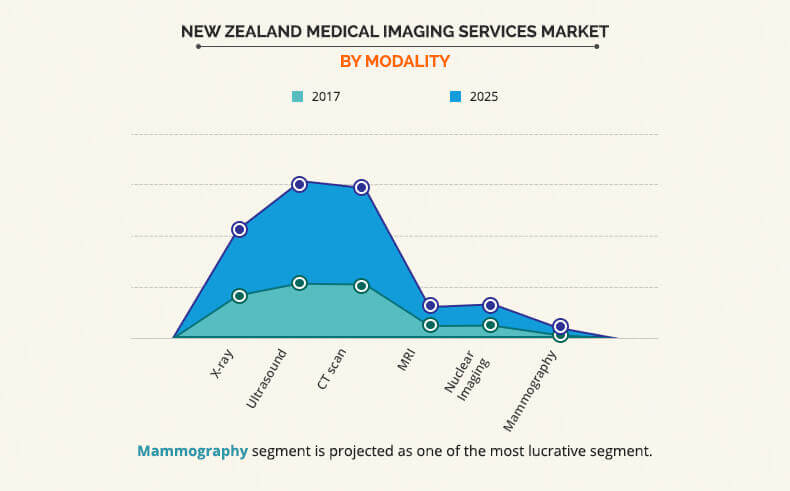

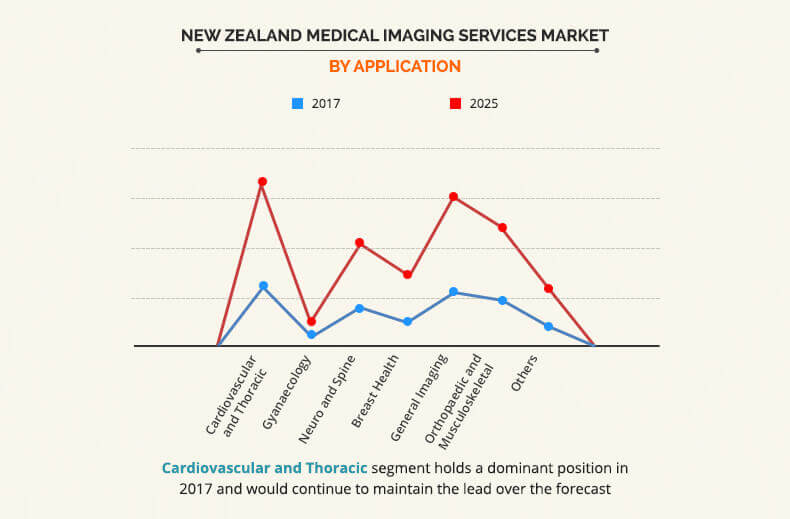

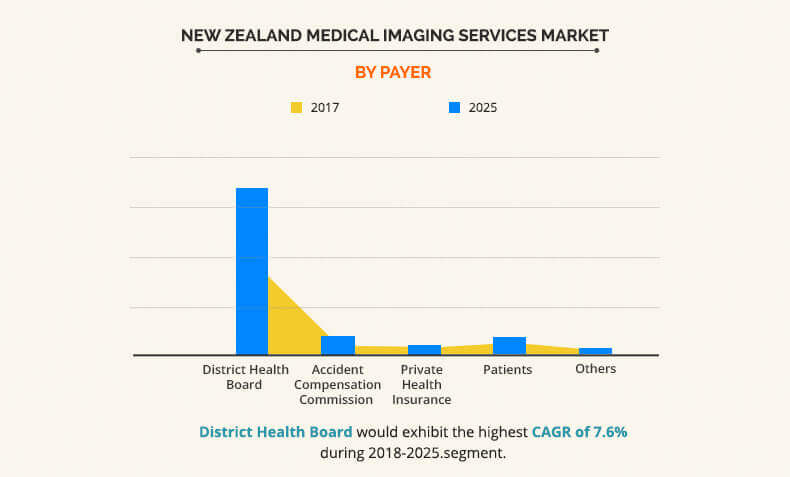

Based on modality, the New Zealand medical imaging services market is segmented into computed tomography (CT) scan, X-ray imaging, magnetic resonance imaging (MRI), ultrasound, nuclear imaging and mammography. Based on application, the market is divided into cardiovascular & thoracic, gynecology/obstetrics, neuro & spine, general imaging, breast health orthopedics & musculoskeletal, and others. By provider, it is categorized into public provider and private provider. According to payer, the market is classified into district health board, accident compensation commission, private health insurance, patients, and others. Based on city, the market is analyzed across Auckland, Wellington, Christchurch, Hamilton, Tauranga, and rest of New Zealand.

Segment review

According to modality, the ultrasound segment in terms of value segment accounted for the highest share in 2017 growing at a CAGR of 7.5% during the forecast period. The factors contributing toward the growth of this segment include the easy availability of the service at various hospitals. Computed tomography in terms of value is the fastest growing segment with a CAGR of 7.9% during the forecast period, owing to technological advancements such as scan organs and joints in a single rotation.

The cardiovascular and thoracic segment occupied the largest New Zealand medical imaging services market share in 2017 registering a CAGR of 7.3% during the forecast period. The growth was attributed to surge in prevalence of medical conditions related to heart such as heart stroke and others. Moreover, breast health was the fastest growing segment registering a CAGR of 8.6% from 2018-2025, owing to the rise in prevalence of breast cancer. In addition, increase in awareness related to need of early screening of in breast cancer majorly fuels the growth of the New Zealand medical imaging services market growth.

According to payer, the market is divided into district health board, accident compensation commission, private health insurance, patients, and others. The district health board segment occupied the largest New Zealand medical imaging services market share in 2017 registering a CAGR of 7.6% during the forecast period and is expected to maintain the lead during the forecast period. The growth was attributed to the large presence of government hospitals in the country. For instance, there are around 220 hospitals and 20 district health boards managing public healthcare in various regions of New Zealand. Moreover, public healthcare system of New Zealand offers high standards of care and provides significant amount of healthcare services in the country. In addition, 83% of the healthcare expenditures in New Zealand are paid by the district health board in the country.

Key Benefits for New Zealand Medical Imaging Services Market:

- This report entails a detailed quantitative analysis along with current New Zealand medical imaging services market trends of from 2017 to 2025 to identify the prevailing opportunities along with strategic assessment.

- The New Zealand medical imaging services market forecast is studied from 2018 to 2025.

- New Zealand medical imaging services market size and estimations are based on a comprehensive analysis of key developments in the New Zealand medical imaging services industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market.

New Zealand Medical Imaging Services Market Report Highlights

| Aspects | Details |

| By Modality |

|

| By Application |

|

| By City |

|

| By PROVIDER |

|

| By Payer |

|

| Key Market Players | Ascot Central, eastMED Radiology Auckland, Sonic Healthcare Limited, Horizon Radiology, TRG Imaging |

| KEY MANUFACTURERS | Canon Inc. (Canon Medical Systems Corporation), Esaote S.p.A., Fujifilm Holdings Corporation, General Electric Company (GE Healthcare), Hitachi Limited (Hitachi Medical Corporation), Hologic, Inc., Koninklijke Philips N.V. (Philips Healthcare), Samsung Electronics Co., Ltd. (Samsung Medison), Shimadzu Corporation, Siemens AG (Siemens Healthcare) |

Analyst Review

Medical imaging is a crucial part of health management in a patient. It helps monitor the patient’s body from the inside. Clinical advantages of these services are significant and affect critical decision making at every stage of patient management. These modalities have experienced a technological revolution in recent years in New Zealand. This propels the growth in demand for medical imaging services in the country. Auckland city has shown major contribution to the revenue generated by the New Zealand medical imaging services market in 2017. This is attributed to the rise in incidence of communicable cases in the city along with the presence of established service providers.

Key factors that contribute toward the market growth include technological advancements related to medical imaging modalities, increase in incidence of chronic diseases, and high focus on early diagnosis of diseases. However, shortage of helium hampers the adoption of MRI systems, and high cost of sophisticated medical imaging modalities is expected to restrain the market growth. Increase in demand for use of multiple medical imaging modalities together is set to offer lucrative opportunities for the market expansion in near future.

Loading Table Of Content...