Next-Gen Cybersecurity For 5G Networks Market Research, 2032

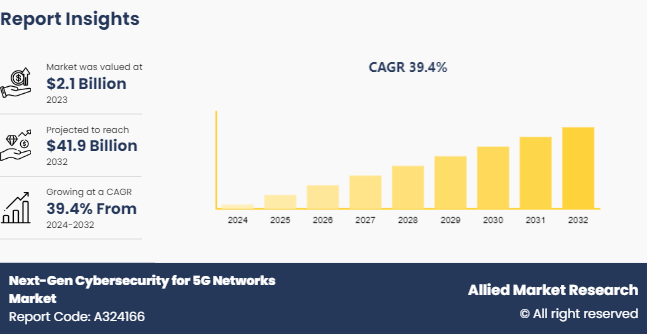

The global next-gen cybersecurity for 5G networks market size was valued at $2.1 billion in 2023, and is projected to reach $44.3 billion by 2032, growing at a CAGR of 40.4% from 2024 to 2032. 5G Network Security is critical for securing the new, super-fast internet, which allows for higher connectivity of devices such as phones, automobiles, and household appliances. With the rapid speed and wider connection that 5G delivers, the potential of hacker attacks increases due to the increasing number of linked devices.

Key Takeaways

The next-gen cybersecurity for 5G networks market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major next-gen cybersecurity for 5G networks industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The global next-gen cybersecurity for 5G networks market growth is significantly growing due to several factors such as technological advancements and the expansion of networks beyond 5G radio access networks (RAN) are some of the main factors anticipated to propel the growth of the market. However, high initial costs act as restraints for next-gen cybersecurity for 5G networks market. In addition, the high penetration of 5G and IoT technology will provide ample opportunities for the market's development during the forecast period.

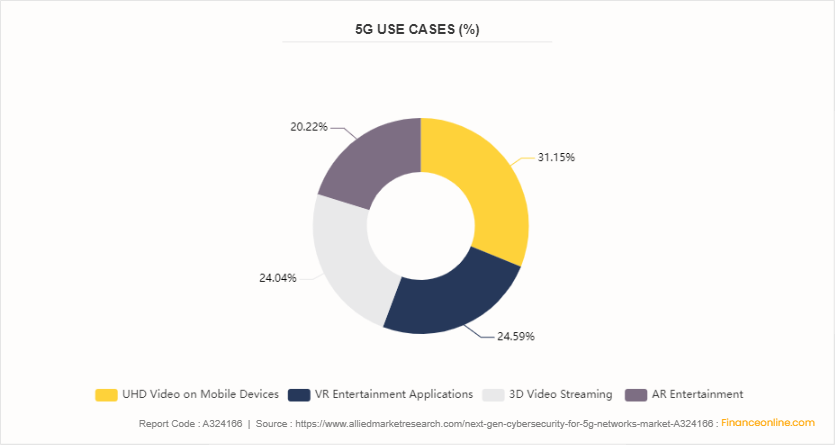

5G Use Cases

The increasing number of cybercrime incidents globally is attributed to several factors such as the proliferation of digital technologies, and rising internet accessibility. The widespread adoption of smartphones, tablets, and 5G devices has expanded the potential attack chances for cyber criminals. More devices mean more potential entry points for malicious activities. This is further expected to propel market growth. According to the FBI’s Internet Crime Complaint Center (IC3) , the 2021 Internet Crime Report shares data relating to cybercrimes reported by the American public. These reported losses were based on 847, 376 reported complaints, which equates to an average loss of more than $8, 140 per complaint. The 2021 reported total losses are an increase of 7% over the complaints reported in 2020.

FIGURE 1: 5G Use Cases (%)

According to Financaonline.com, UHD stands for ultra high definition videos, which are 4K and 8K resolutions. With high speeds of 5G, users can expect 8K videos to stream smoothly over the internet. Moreover, virtual reality is an advanced computer application where users can visit a computer-generated virtual world and interact with other users. VRs require a massive amount of data transmission at the fastest possible speeds. 3D videos require additional information to communicate extra depth. Therefore, for smooth streaming of 3D movies and videos, users need ultra-fast internet speeds that 5G aims to provide.

Market Segmentation

The next-gen cybersecurity for 5G networks market share is segmented into component, deployment, end user, industry vertical, and region. On the basis of component, the market is divided into solutions and services. By deployment, the market is segregated into cloud and on-premise. On the basis of end user, the market is bifurcated into other industries and telecom operators. On the basis of industry vertical, the market is classified into manufacturing, healthcare, retail, automotive & transportation, public safety, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The global next-gen cybersecurity for 5G networks market is experiencing substantial growth, with North America playing a pivotal role in this expansion. North America leads the market, propelled by robust technological infrastructure, significant investments in next-generation technologies, and stringent safety regulations that encourage the integration of advanced safety solutions. In Europe, countries like Germany and the UK are at the forefront, leveraging 5G networks in sectors such as manufacturing and transportation. In the Asia-Pacific region, rapid industrialization and increasing awareness of network safety are driving the adoption of the global market, particularly in China and Japan, where government initiatives support technological advancements.

In January 2024, the U.S. Department of Energy (DOE) launched an initiative to ensure cybersecurity is integrated into the development of clean energy solutions. These investments, made possible by the President’s Bipartisan Infrastructure Law, is expected to be provided through a $30 million funding opportunity to support the research, development, and demonstration (RD&D) of next-generation tools to protect clean energy delivery infrastructure from cyber-attacks.

In October 2022, the Government of Canada invested in innovative solutions that is projected to advance Canada’s digital infrastructure. The investment of $15.9 million to support a $77 million project with EXFO to create a 5G center of excellence in Montréal and create 50 high-skills job opportunities.

Industry Trends

In July 2023, CISA and the National Security Agency published 5G Network Guidelines, which consists of Security Considerations for Design, Deployment, and Maintenance. Developed by the Enduring Security Framework (ESF) , a cross-sector, public-private working group, the guidance focuses on addressing some identified threats to 5G standalone network slicing, and provides industry-recognized practices for the design, deployment, operation, and maintenance of a hardened 5G standalone network slice (s) .

In October 2021, the National Security Agency (NSA) and the Cybersecurity and Infrastructure Security Agency (CISA) published cybersecurity guidance to securely build and configure cloud infrastructures in support of 5G. Security Guidance for 5G Cloud Infrastructures: prevent and detect lateral movement and provides cybersecurity guidance that addresses high-priority cyber-based threats to the nation’s critical infrastructure.

Competitive Landscape

The major players operating in the next-gen cybersecurity for 5G networks market size include ERICSSON, Palo Alto Networks, Thales, A10 Networks, Inc., Allot, AT&T, F5, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., and Spirent Communications.

Recent Key Strategies and Developments

In February 2024, Palo Alto Networks launched private 5G security solutions and services in collaboration with leading Private 5G partners. Bringing together Palo Alto Networks enterprise-grade 5G Security and Private 5G partner integrations and services allows organizations to easily deploy, manage, and secure networks throughout their entire 5G journey.

In February 2023, Atos launched its new ‘5Guard’ security offering for organizations looking to deploy private 5G networks and for telecom operators looking to enable integrated, automated, and orchestrated security to protect and defend their assets and customers.

In December 2022, SecurityGen launched its new 5G Cyber-security Lab. This Lab is an innovative solution designed to help MNO security teams study and understand 5G networks, thus enabling them to prepare and protect their networks against potential security threats.

Key Sources Referred

Cybersecurity & Infrastructure Security Agency

Center for Internet Security

National Institute of Standards and Technology

ResearchGate

Journal of Theoretical and Applied Information Technology

Key Benefits for Stakeholders

This report provides a quantitative analysis of the next-gen cybersecurity for 5G networks market forecast segments, current trends, estimations, and dynamics of the next-gen cybersecurity for 5G networks market analysis from 2023 to 2032 to identify the prevailing next-gen cybersecurity for 5G networks market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the next-gen cybersecurity for 5G networks industry segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global next-gen cybersecurity for 5G networks Market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional and global next-gen cybersecurity for 5G networks market trends, key players, market segments, application areas, and market growth strategies.

Next-Gen Cybersecurity for 5G Networks Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 41.9 Billion |

| Growth Rate | CAGR of 39.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Component |

|

| By Deployment |

|

| By End User |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Thales Group, Palo Alto Networks, AT&T, ERICSSON, A10 Networks, Inc., Spirent Communication, Check Point Software Technologies Ltd., Allot, Fortinet, Inc., F5, Inc. |

The proliferation of IoT devices connected via 5G networks increases the attack surface for cyber threats. Next-gen cybersecurity solutions are focusing on integrating IoT security measures.

Telecom operators is the leading end user of Next-Gen Cybersecurity for 5G Networks Market.

North America is the largest regional market for Next-Gen Cybersecurity for 5G Networks in 2023.

$41.9 billion is the estimated industry size of Next-Gen Cybersecurity for 5G Networks in 2032.

ERICSSON, Palo Alto Networks, Thales, A10 Networks, Inc., Allot, AT&T, F5, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., and Spirent Communications are the top companies to hold the market share in Next-Gen Cybersecurity for 5G Networks.

Loading Table Of Content...