Next-Generation Battery Market Research, 2033

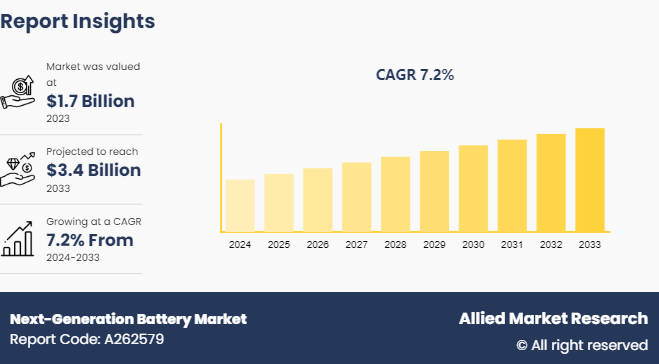

The global next-generation battery market was valued at $1.7 billion in 2023, and is projected to reach $3.4 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

Market Introduction and Definition

Next-generation batteries, such as solid-state batteries, lithium-sulfur batteries, and sodium-ion batteries, are designed to offer higher energy densities, allowing devices to operate longer without the requirement of frequent recharges. For example, solid-state batteries replace the liquid electrolyte with a solid electrolyte, significantly improving energy storage capacity and safety by eliminating the risk of leaks and fires associated with liquid electrolytes. Next generation batteries refer to a new and advanced class of energy storage devices that go beyond the capabilities and characteristics of traditional batteries. These batteries incorporate innovative materials, technologies, and design approaches to address the limitations of conventional energy storage systems and to meet the evolving demands of various applications, such as consumer electronics, electric vehicles, and renewable energy storage.

Key Takeaways

The next generation batteries market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major next generation batteries industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

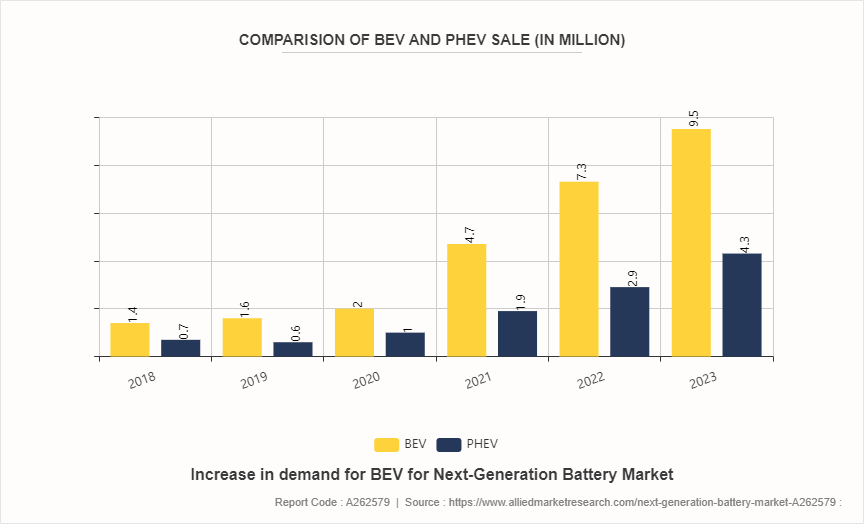

The growing demand for electric vehicles stands as a compelling and transformative driver for the next-generation batteries market. According to the International Energy Agency (IEA) , more than 10 million electric cars were sold worldwide in 2022, and sales are projected to grow by another 35% this year, reaching a total of 14 million. There has been a significant uptick in consumer interest and adoption of electric vehicles as the automotive industry undergoes a profound shift towards sustainability. This surge is primarily fueled by concerns over environmental impact, government incentives, and technological advancements in battery technologies. Next generation batteries play a central role in meeting the demands of the developing electric vehicle market by providing solutions that address key challenges associated with traditional internal combustion engines. All these factors drive the growth of the next generation batteries market during the forecast period.

The energy density and storage capacity limitations of next-generation batteries represent significant challenges that have the potential to hamper the growth of the next generation batteries market. Energy density is a critical parameter as it determines the amount of energy a battery can store per unit volume or weight. While next generation batteries often promise improvements over traditional technologies such as lithium-ion batteries, they still face constraints in achieving the desired levels of energy density. In addition, the challenges related to energy density and storage capacity can hinder the competitiveness of next-generation batteries in comparison to well-established technologies such as lithium-ion batteries. All these factors hamper the growth of the next generation batteries market.

The integration of smart and adaptive technologies is also a notable trend. Advanced battery management systems and smart algorithms enable better control over charging and discharging cycles, optimizing the overall efficiency and lifespan of batteries. This is essential for maximizing the economic and environmental benefits of energy storage systems. In addition, advancements are not limited to traditional applications but extend to emerging areas such as wearables, flexible electronics, and internet of things devices. Innovations in form factors and materials are paving the way for flexible and lightweight batteries, enabling the integration of energy storage into unconventional shapes and structures. All these factors are anticipated to offer new growth opportunities for the next generation batteries market during the forecast period.

Market Segmentation

The next generation batteries market is segmented into battery type, application, and region. By battery type, the market is classified into lithium-ion, sodium-ion, graphene battery, flow battery (vanadium and hybrid) , metal air battery, zinc-ion battery, and others. By application, the market is divided into electric vehicles, consumer electronics, renewable, uninterruptible power supply (UPS) , data centers and telecommunication, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Asia-Pacific region is a major hub for battery manufacturing, led by countries such as China, Japan, and South Korea. China dominates the next generation battery market, with extensive production capacities and substantial government support for EVs and renewable energy storage. The region benefits from a well-established supply chain and the presence of leading battery manufacturers. Innovations in lithium-ion batteries, as well as the development of alternative battery technologies such as sodium-ion and solid-state batteries, are prominent in this region. The rapid urbanization and growing demand for energy storage solutions in residential and commercial sectors further drives market growth.

Asia-Pacific is rapidly advancing in the adoption and development of next-generation batteries, driven by its dynamic technological landscape and pressing environmental goals. These advanced energy storage solutions, such as solid-state batteries, lithium-sulfur batteries, and sodium-ion batteries, are pivotal for the region's burgeoning electric vehicle (EV) market, renewable energy integration, and consumer electronics industry. According to the International Energy Agency (IEA) , India's installed renewable energy capacity will reach 174 GW in 2023, accounting for about 37% of the country's total energy supply. The report indicates that India has exceeded its target of installing 175 GW of renewable energy capacity by 2022, with a projected capacity of 280 GW by 2025.

Competitive Landscape

The major players operating in the next generation batteries market include BYD Company Ltd., SAMSUNG SDI CO., LTD., AESC GROUP LTD., Toshiba Corporation, Hitachi High-Tech India Private Limited, Solid Power Inc., SES AI Corporation., ESS Tech, Inc., 24M, PolyPlus. Other players in the next generation batteries market include GS Yuasa Corporation, Ilika., Pathion Holding Inc., LG Chem.

Recent Key Strategies and Developments

In March 2024, Samsung SDI announced its participation in Inter Battery 2024, which begins on March 6 and runs for three days in Seoul. At the event, the company plans to unveil a suite of 'super-gap' battery technologies, including fast-charging and ultra-long-life batteries. Additionally, Samsung SDI will present its roadmap for mass production of all solid-state batteries, a cutting-edge solution that surpasses traditional lithium-ion batteries.

In July 2022, Hitachi High-Tech Corporation announced the development of a remote diagnostic service for assessing the degradation status of on-board automotive lithium-ion batteries. Ensuring stable and efficient battery operation is crucial for the deployment of electric vehicles (EVs) . Hitachi High-Tech plans to offer this service to global customers through various networks, aiming to contribute to a circular society by addressing customer challenges.

Global Electric Car Sale (in million)

The surge in global electric car sales, rising from 2 million BEV in 2020 to 9.5 million in 2023, is significantly propelling the growth of the next-generation battery market. Next generation batteries, offering improved energy density, longer range, faster charging times, and enhanced durability, are crucial in meeting the rising demand for electric vehicles (EVs) .

Historical Trends of Next Generation Batteries

In the late nineteenth century, the groundwork for the next generation batteries market was laid as the early conceptualization of energy storage emerged. During this period, rudimentary experiments has conducted to harness the potential of batteries for industrial and residential applications. The focus was primarily on storing and releasing electrical energy efficiently.

Moving into the mid-twentieth century, advancements in battery technologies, particularly the development of rechargeable batteries, began to gain traction. Improved designs and materials laid the foundation for more efficient and durable batteries. However, widespread adoption was constrained by factors such as high costs and competition from traditional energy storage methods.

In the late twentieth century, the potential of next generation batteries garnered attention as a crucial component in the quest for sustainable and efficient energy storage solutions. Innovations, such as lithium-ion batteries, improved energy density and lowered costs, leading to increased utilization in various applications. Government incentives and renewable energy policies in certain regions played a pivotal role in fostering pilot projects and initial commercial deployments of advanced battery systems.

The early twenty-first century witnessed a significant surge in the development of next-generation battery technology. Growing concerns about climate change and the need for cleaner energy solutions fueled renewed interest in energy storage. Advances in materials science, including the exploration of alternative chemistries and nanotechnology, led to breakthroughs in improving the performance and safety of batteries.

By the mid-2010s, the global next-generation batteries market experienced substantial growth. Larger-scale battery installations has deployed in various regions to address the increasing demand for energy storage in grid applications, electric vehicles, and renewable energy integration. Improved efficiency, longer cycle life, and enhanced safety features further bolstered the attractiveness of next-generation batteries as a sustainable energy storage solution.

In the late 2010s and early 2020s, the next-generation batteries market continued its expansion, driven by a global focus on decarbonization and the transition towards renewable energy. Collaborative efforts between governments, industries, and research institutions led to breakthroughs in battery technologies, enhancing efficiency and reducing costs.

Industry Trends:

In 2022, according to the International Energy Agency (IEA) , China experienced a remarkable surge in battery demand for vehicles, with a growth rate of over 70%. Concurrently, electric car sales soared by 80% compared to the previous year, albeit slightly tempered by an uptick in the share of Plug-in Hybrid Electric Vehicles (PHEVs) . Meanwhile, in the U.S., battery demand for vehicles also witnessed a substantial increase of approximately 80%, outpacing the growth in electric car sales, which rose by around 55% during the same period.Nissan Motor Company unveiled plans in April 2022 to introduce laminated solid-state batteries to consumers by 2028. This initiative aligns with Nissan's Ambition 2030 strategy, which aims to drive innovation and sustainability in the automotive industry. As part of this strategy, Nissan also announced a significant investment of $17 billion towards the development of four new electric vehicle concepts.

India is on track to become the largest EV market by 2030, with a total investment opportunity of more than $200 billion over the next 8-10 years.

By 2030, the Indian government has committed that 30% of the new vehicle sales in India is projected to be electric.

Key Sources Referred

India Brand Equity Foundation

International Energy Agency

Green City Times

Invest India

Aerospace Industries Association (AIA)

International Renewable Energy Agency

American Chemical Society

Department of energy

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the next-generation battery market analysis from 2024 to 2033 to identify the prevailing next-generation battery market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the next-generation battery market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global next-generation battery market trends, key players, market segments, application areas, and market growth strategies.

Next-Generation Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.4 Billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Battery Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hitachi High-Tech India Private Limited, BYD Company Ltd., Toshiba Corporation, ESS Tech, Inc., 24M, SES AI Corporation., AESC GROUP LTD, Solid Power Inc, SAMSUNG SDI CO., LTD, PolyPlus |

Loading Table Of Content...