Next Generation Diabetes Therapy And Drug Delivery Market Research, 2030

The global Next Generation Diabetes Therapy and Drug Delivery Market size was valued at $7.1 billion in 2020, and is projected to reach $28.0 billion by 2030, growing at a CAGR of 14.28% from 2021 to 2030. Next generation diabetes therapy and drug delivery devices are used to check the blood glucose levels and deliver insulin into the body. Next Generation Diabetes Therapy and Drug Delivery Market opportunity in oral and inhalable insulin, help introduce insulin into the patient’s body without causing pain and reduce the risk of skin irritation, owing to frequent use of needles. Advancements in diabetes therapy systems, such as insulin patch, continuous glucose monitoring (CGM) system, and artificial pancreas, are frequently used to detect the glucose levels and adjust the insulin levels to manage the change in glucose levels.

Increase in prevalence of diabetes, especially type-2 diabetes, due to increase in urbanization, unhealthy diet, and reduced physical activity drive the growth of the next generation diabetes therapy and drug delivery market. In addition, benefits of using these advanced devices over conventional products, rise in the healthcare expenditure, and increase in the disposable income among the diabetic patients are some factors that further boost the growth of the market. However, lack of awareness, cost restrains in the developing regions, and less variability in products are expected to hinder the growth of the market. On the other hand, development of affordable products with fewer side effects and presence of undiagnosed diabetic patients globally are expected to offer profitable opportunities for the growth of the market during the forecast period.

The Next Generation Diabetes Therapy and Drug Delivery Market growth was slowed by the outbreak of COVID-19 resulted in disrupted workflows in the healthcare sector globally. The COVID-19 pandemic negatively impacted the global next generation diabetes therapy and drug delivery industry market initially in 2020 due to global economic recession led by COVID-19. The implementation of lockdown compromised clinical care of diabetic patients due to service disruption; thereby, having a minimal negative impact on the market.

The global COVID-19 pandemic has and may continue to have an adverse impact on manufacturing and distribution capabilities of drug delivery devices. In addition, the COVID-19 pandemic and associated shelter-in-place orders restricted ability to initiate, conduct or continue our clinical trials. Delays and disruption in clinical trials could results in delays for expanded FDA clearance or approval of new products. For instance, Dexom Inc. has experienced some delays in certain pivotal clinical trials for their next-generation CGM product. This has significantly contributed to decline of the global next generation diabetes therapy and drug delivery market. However, the market is anticipated to witness recovery in 2021, and show stable growth for next generation diabetes therapy and drug delivery market in the coming future. For instance, in April 2020, Dexom inc. provided CGM devices and support to users to enable real-time remote patient monitoring in hospitals and other healthcare facilities, to support COVID-19 healthcare related efforts.

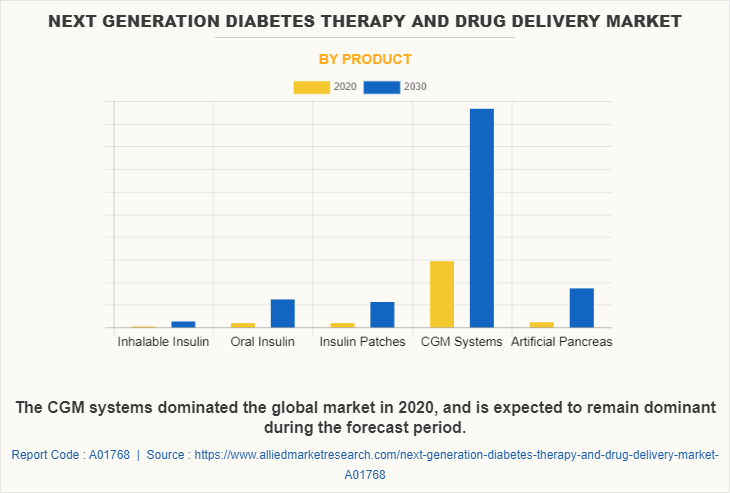

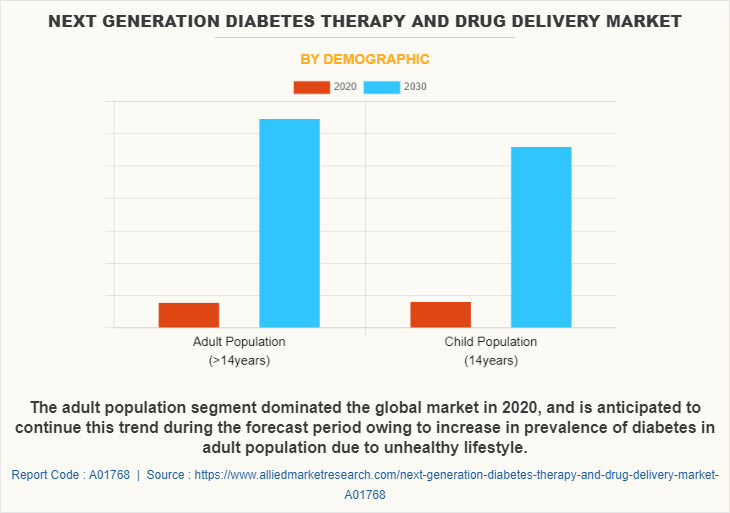

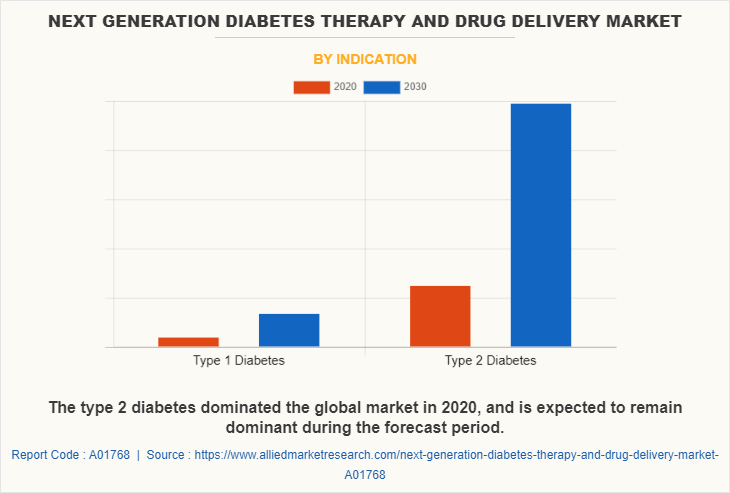

Next Generation Diabetes Therapy market and drug delivery market is segmented on the basis of product, demographic, indication, end user, and region. On the basis of product, it is classified into inhalable insulin, oral insulin, insulin patches, CGM systems, and artificial pancreas. On the basis of demographic, it is categorized into adult population (>14 years) and child population (≤14 years). On the basis of indication, it is divided into type 1 diabetes and type 2 diabetes. By end user, the Next Generation Diabetes Therapy and Drug Delivery Market opportunity is classified into diagnostics/clinics, ICUs, and home healthcare. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Product Review

By product, the market is segmented into inhalable insulin, oral insulin, insulin patches, CGM systems, and artificial pancreas. The CGM systems dominated the global market in 2020, and is expected to remain dominant for Next Generation Diabetes Therapy and Drug Delivery Market forecast. This is attributed to advantages of these systems as compared to conventional diabetic products such as ease of usage and efficient & early detection of change in blood glucose levels.

Demographic Review

By demographic, the market is segregated into adult population (>14 years) and child population (≤14 years). The adult population segment dominated the global market in 2020, and is anticipated to continue this trend during the forecast period owing to increase in prevalence of diabetes in adult population due to unhealthy lifestyle.

Indication Review

By indication, the market is segmented into type 1 diabetes and type 2 diabetes. The type 2 diabetes dominated the global market in 2020, and is expected to remain dominant during the forecast period. This is attributed to increase in cases of type-2 diabetic due to increase in urbanization, unhealthy diet, and reduced physical activity.

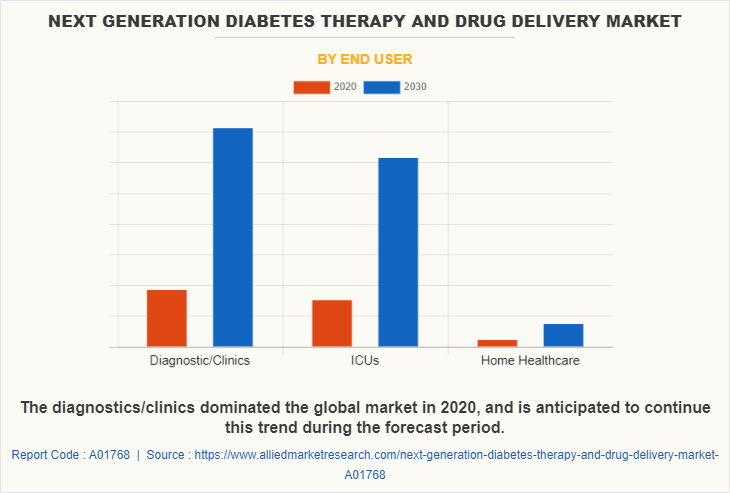

End User Review

By end user, the market is classified into diagnostics/clinics, ICUs, and home healthcare. The diagnostics/clinics dominated the global market in 2020, and is anticipated to continue this trend during the forecast period, owing to increase in procurement of the products from diagnostics and clinics by diabetic patients.

Region Review

The next generation diabetes therapy and drug delivery market in Asia-Pacific is witnessing significant growth, owing to rise in number of diagnostic centers for diabetes, and presence of a large diabetic patient population base in developing countries, such as India and China. In addition, rise in the healthcare expenditure for diabetes and increase in awareness about the benefits of using next generation diabetic products, such as better management of blood glucose level are projected to fuel the market growth in Asia-Pacific.

The Next Generation Diabetes Therapy and Drug Delivery Market share of key market players are profiled in the report include, Abbott Laboratories, Medtronic, Inc., Sanofi S.A., Novo Nordisk, MannKind Corporation, Eli Lilly and Company, Dexcom, Inc., Senseonics Holding, Inc., Glysens Incorporated, and Johnson & Johnson.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the next generation diabetes therapy and drug delivery market analysis from 2020 to 2030 to identify the prevailing next generation diabetes therapy and drug delivery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the next generation diabetes therapy and drug delivery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global next generation diabetes therapy and drug delivery market trends, key players, market segments, application areas, and market growth strategies.

Next Generation Diabetes Therapy and Drug Delivery Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Demographic |

|

| By Indication |

|

| By End User |

|

| By Region |

|

| Key Market Players | Abbott laboratories, Senseonics Holdings, Inc., Dexcom, Inc, Glysens Incorporated, MannKind Corporation, Eli Lilly and Company, Johnson & Johnson, Novo Nordisk A/S, Medtronic plc, Sanofi S.A. |

Analyst Review

The utilization of next generation diabetes therapy and drug delivery devices is expected to increase due to surge in the global incidence rate of diabetes. There have been remarkable technological advancements related to next generation diabetes therapy and drug delivery devices to provide advanced treatment options for patients suffering from diabetes. In addition, North America accounted for a majority of the global next generation diabetes therapy and drug delivery market share in 2020, and is anticipated to remain dominant during the forecast period. This is attributed to rise in the number of diabetic patients, high adoption rate of next generation diabetic products, emergence of more advanced products, presence of major key players, and development in technology for healthcare in the region. Asia-Pacific is anticipated to witness lucrative growth, owing to rise in R&D for the advancement of diabetic products in the countries of Asia-Pacific, growth in healthcare expenditures, and increase in awareness about the benefits of using next generation diabetic products such as better management of blood glucose level.

Moreover, increase in disposable income among the diabetic patients and technological advancement of next generation diabetic products are some of the driving factors of the market. However, lack of awareness, less variability in products, and cost restrains in the developing regions are expected to hamper the market growth. Presently, the demand for oral & inhalable insulin has increased as these are painless mode of insulin delivery and reduce the risk of skin irritation caused due to needles. They are expected to replace injectable insulin, owing to their ease of using with improved efficiency. Moreover, majority of the next generation diabetes therapy and drug delivery devices manufacturers and distributors have focused on expanding their presence in the emerging economies, such Asia-Pacific and LAMEA.

The total market value of next generation diabetes therapy and drug delivery market is $7,080.6 million in 2020.

The forcast period for next generation diabetes therapy and drug delivery market is 2021 to 2030

The market value of next generation diabetes therapy and drug delivery market in 2030 is $28044.23 million.

The base year is 2020 in next generation diabetes therapy and drug delivery market

Top companies such as Abbott Laboratories, Medtronic, Inc., Sanofi S.A., Novo Nordisk, MannKind Corporation, Eli Lilly and Company, Dexcom, Inc., Senseonics Holding, Inc., Glysens Incorporated, and Johnson & Johnson. held a high market position in 2020.

The CGM system segment is the most influencing segment owing to advantages of these systems as compared to conventional diabetic products such as ease of usage and efficient & early detection of change in blood glucose levels.

Increase in prevalence of diabetes, especially type-2 diabetes, due to increase in urbanization, unhealthy diet, and reduced physical activity drive the growth of the next generation diabetes therapy and drug delivery market. In addition, benefits of using these advanced devices over conventional products, rise in the healthcare expenditure, and increase in the disposable income among the diabetic patients are some factors that further boost the growth of the market.

Asia-Pacific is expected to experience the growth rate of 16.29 % during the forecast period, owing to rise in number of diagnostic centers for diabetes, and presence of a large diabetic patient population base in developing countries, such as India and China.

The next generation diabetes therapy and the drug delivery devices are the advanced form of diabetic products that improve the quality of life of diabetic patients.

Next generation diabetes therapy and drug delivery devices are used to check the blood glucose levels and deliver insulin into the body.

Loading Table Of Content...