Next-Generation Firewall Market Outlook - 2025

The global next-generation firewall market size was valued at $2,570.49 million in 2017, and is projected to reach $6,719.56 million by 2025, registering a CAGR of 12.9% from 2018 to 2025. The next-generation firewall (NGFW) refers to the third-generation of network firewall technology, which integrates additional capabilities such as in-line deep packet inspection (DPI), application-level traffic inspection, and intrusion prevention (IPS). Increase in IoT-based complex threat landscape, rise in number of data breach cases, and surge in demand for NGFW solutions supported by stringent government regulations for data safety & security boost the next-generation firewall market growth. However, certain factors such as shortage of cyber security skills and performance issues associated with cloud protection restrain the growth of the next-generation firewall industry.

The growth of the global next-generation firewall market size is driven by rise in demand for advanced cyber security solutions, development of IoT-based complex threat landscape, and enforcement of stringent government regulations for data security. Furthermore, performance issues associated with next-generation firewall solutions in cloud protection and lack of skilled professionals are expected to considerably impact the growth of the next-generation firewall market during the forecast period. Moreover, continuous increase in digital security spending and the emergence of firewall as a service are expected to be opportunistic for the global market during the forecast period.

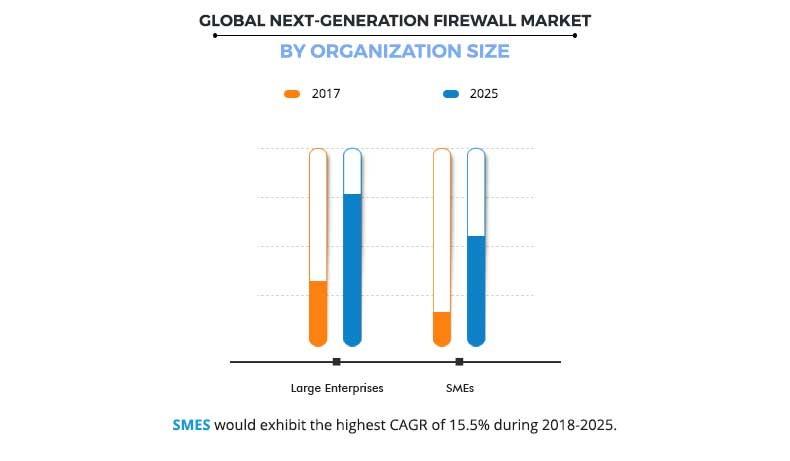

The large enterprises segment dominated the overall next-generation firewall market share in 2017, owing to significant adoption of advanced security solution among large-sized organizations. Digital security has become a complex process in large-sized organizations to manage and secure massive volume of data, which promotes the adoption of NGFW solutions among them. However, the SMEs are expected to exhibit the highest growth rate during the forecast period, owing to growth in the need to implement advanced firewall technology, which can perform multiple functions and rise in IT security spending among these organizations.

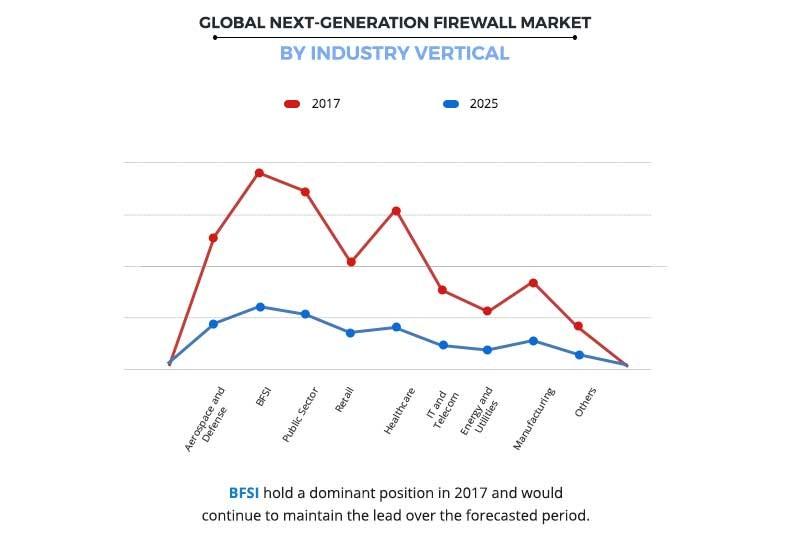

The BFSI segment dominated the global NGFW market in 2017, owing to rise in need to protect customer data with the increase in data volume and the large number of endpoints and mobile devices, which are vulnerable to brand-damaging threats. However, the healthcare segment is expected to grow at the highest rate, due to the ongoing trend of digitalization of healthcare industry and increase in security breaches related to medical records, medical devices, and its data in healthcare organizations, which fuel the demand for these firewall solutions, and drive the next-generation firewall market.

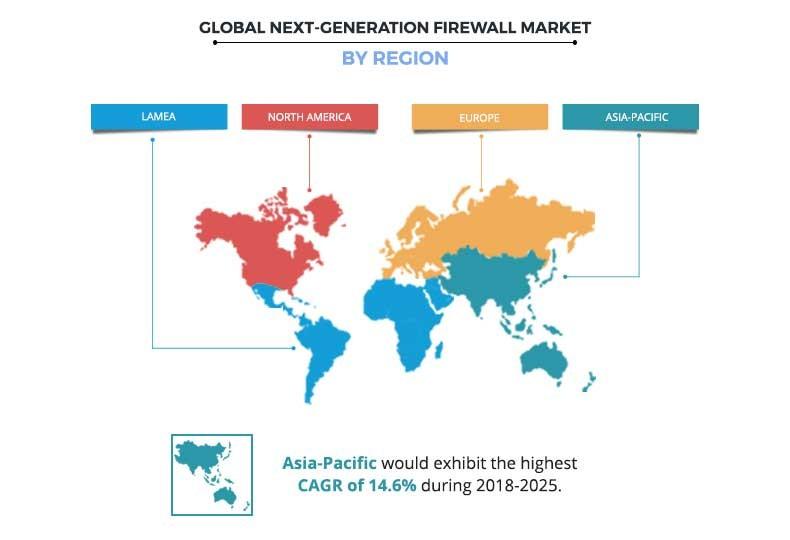

North America governed the overall next-generation firewall market share, in terms of revenue, in 2017, due to significant adoption of advanced cyber security solutions, supported by factors such as rise in cases of cyberattacks, significant adoption of BYOD and IoT-based devices in the region. However, Asia-Pacific is expected to witness the highest growth rate during the next-generation firewall market forecast period, owing to factors such as increase in IT modernization, surge in penetration of internet, and rise in need to protect corporate & personal information from cyberattacks. Moreover, upsurge in adoption of IoT-based devices in countries such as Taiwan & South Korea and development of smart cities are expected to provide remunerative opportunities for market expansion during the forecast period.

The report focuses on the growth prospects, restraints, and trends of the global next-generation firewall market analysis. Moreover, the study includes the Porter’s five forces analysis of the industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the growth of the market.

Segment review

The global next-generation firewall market is segmented based on component, type, organization size, industry vertical, and region. Based on component, it is bifurcated into solution and services. Depending on type, the market is divided into hardware, virtual, and cloud. On the basis of organization size, it is bifurcated into large enterprises and SMEs. By industry vertical, it is classified into aerospace & defense, BFSI, public sector, retail, healthcare, IT & telecom, energy & utilities, manufacturing, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global next-generation firewall market include Barracuda Networks, Check Point, Cisco, Forcepoint, Fortinet, Huawei, Juniper Networks, Palo Alto Networks, SonicWall, and Sophos.

Top impacting factors

Increase in sophisticated cyberattacks

Cyberattacks continue to increase, recording about 159,700 attacks in 2017, almost twice from 82,000 incidents of 2016. More than two-thirds of SMBs have reported rise in sophistication in cyberattacks. Presently, cyber criminals have access to a variety of plug-and-play options that are generally pieced together for complicated malware campaigns. More specifically, exploit builder kits such as GandCrab and ThreadKit are regularly updated on the latest attack strategies that make normal security tools incapable of protecting businesses and their data. Such sophisticated attacks are expected to continue, owing to increase in usage of bring-your-own-device (BYOD), smartphones, social media, and cloud services globally. Thus, rise in instances of advanced attacks are motivating companies to adopt advanced methods for data protection such as next-generation firewalls, thus playing a major role in NGFW market growth.

Enforcement of stringent government regulations for data safety and security

Governments across the world have taken several initiatives in the form of regulations regarding data security to overcome the issue of data breaches. These cyber security regulations aim to mandate the organizations to defend their systems and information from cyberattacks. Industry regulations such as Health Insurance Portability and Accountability Act (HIPAA), Gramm-Leach Biley Act, and Homeland Security Act promote the adoption of advanced cyber security solutions in critical industries such as BFSI, healthcare, and government. Similarly, the Financial Services Modernization Act, 1999 in the U.S. defines regulations related to data security for financial information of customers collected by financial institutions. These regulations in turn build pressure on organizations to set up enhanced security infrastructure and promote the adoption of advanced security solutions such as next-generation firewalls. Thus, these regulations significantly boost the growth of the global next-generation firewall market.

Rise in cyber security spending

There has been an increase in the cybersecurity budget across the globe in the recent years. Business and public organizations are investing more on securing their data, as they have been continuously trying to build comprehensive solutions to prevent hackers from attacking their networks. Rise in economic losses due to cyberattacks led to 23% increase in cyber security spending among in 2017. According to cyber security report from Vodafone, the awareness of rising cyber threats and more demanding customer requirements are driving an increase in cyber security budgets. About 87% of businesses are expected to increase spending on cyber security in the next three years, and almost 10% of companies are anticipated to double their cybersecurity budgets. Furthermore, developing countries such as India and China are continuously improving their cybersecurity spending for better safeguarding against advanced threats. This growth in cybersecurity spending is expected to create significant opportunities for the next-generation firewall market during the forecast period.

Impact of COVID-19 on Next-Generation Firewall Market:

- The growth of the next-generation firewall market is expected to increase during the Covid-19 pandemic outbreak. The incidence of cyber-attack in all industries has been increased during the lockdown. Therefore, the adoption of the next-generation firewall services and software has been increased in all industries.

- On the other hand, the benefits such as application-level security functions such as IDS and IPS, single console access, multi-layered protection, and optimal use of network speed are helpful during work from home facility Therefore, in consideration of safety and security of data in work from home facility, the demand for next-generation firewall services has been increased

Key Benefits for Next-Generation Firewall Market:

- This study includes the analytical depiction of the global next-generation firewall market trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities.

- The current next-generation firewall market is quantitatively analyzed from 2017 to 2025 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the global NGFW market.

Next-generation Firewall Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Type |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | FORCEPOINT LLC, HUAWEI TECHNOLOGIES CO., LTD., CHECK POINT SOFTWARE TECHNOLOGIES LTD., SOPHOS LTD., JUNIPER NETWORKS, INC., CISCO SYSTEMS, INC., FORTINET, INC., SONICWALL INC., PALO ALTO NETWORKS, INC., BARRACUDA NETWORKS, INC. |

Analyst Review

A next-generation firewall (NGFW) is the third-generation firewall technology, which offers a deep-packet inspection function by inspecting the data carried in network packets. The adoption of NGFW has increased in the recent years, owing to rise in need of handling data breaches and other cyber threats. According to the CXOs of the leading companies, the firewall technology is a crucial component of organizations’ cyber security ecosystem, and a series of developments are continuing in the industry. The growth of IoT-based complex threat landscape and stringent cyber security regulations fuel the demand for next-generation firewall technology for deep inspection and threat blocking. In addition, surge in adoption of firewall as a service and increase in cyber security spending are expected to have a significant impact on the market during the forecast period. However, lack of cyber security professionals and performance issues associated with these solutions in cloud protection are the factors that majorly hinder the growth of the market.

The NGFW market is consolidated with the presence of key vendors such as Palo Alto Networks, Juniper Networks, Checkpoint, and others that constitute large market share. North America and Europe are the prime consumers of NGFW solutions. However, Asia-Pacific is expected to experience significant growth in the near future, owing to increase in IoT landscape, development of smart cities, and rise in in cyber security spending in the developing countries such as China, South Korea, India, Japan, and more. Some of the key players profiled in the report include Barracuda Networks, Check Point, Cisco, Forcepoint, Fortinet, Huawei, Juniper Networks, Palo Alto Networks, SonicWall, and Sophos. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry. For instance, Fortinet launched new intent-based NGFWs in February 2019, which doesn’t rely on a single enforcement point and provide a robust security architecture. The new offerings result in granular access control, end-to-end visibility, continuous trust assessment, and automated threat protection, which helps organizations to secure their organizations through segmentation of its IT assets.

Loading Table Of Content...