Next Generation Sequencing Market Summary

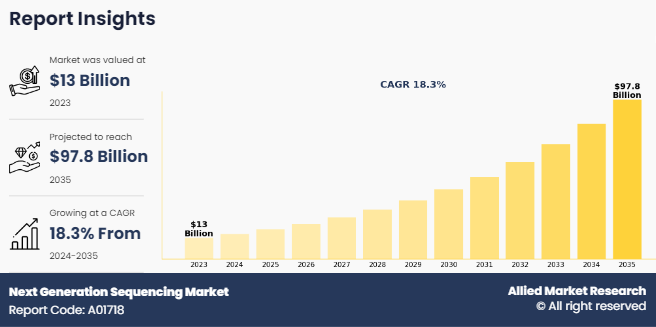

The global next generation sequencing market size was valued at $12,982.08 million in 2023, and is projected to reach $97,813.73 million by 2035, registering a CAGR of 18.3% from 2024 to 2035. Rising prevalence of genetic disorders and cancer, increasing demand for precision medicine, advancements in sequencing technologies, and declining sequencing costs and growing adoption in clinical diagnostics are the other factors that contribute to the growth of the market.

Market Dynamics & Insights

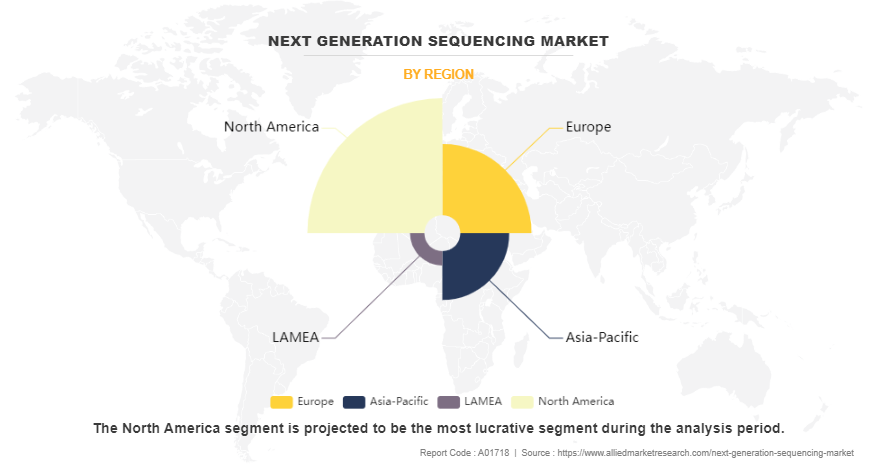

The next generation sequencing industry in North America held a significant share of over 46.5% in 2023.

The next generation sequencing industry in China is expected to grow significantly at a CAGR of 21.4% from 2024 to 2035.

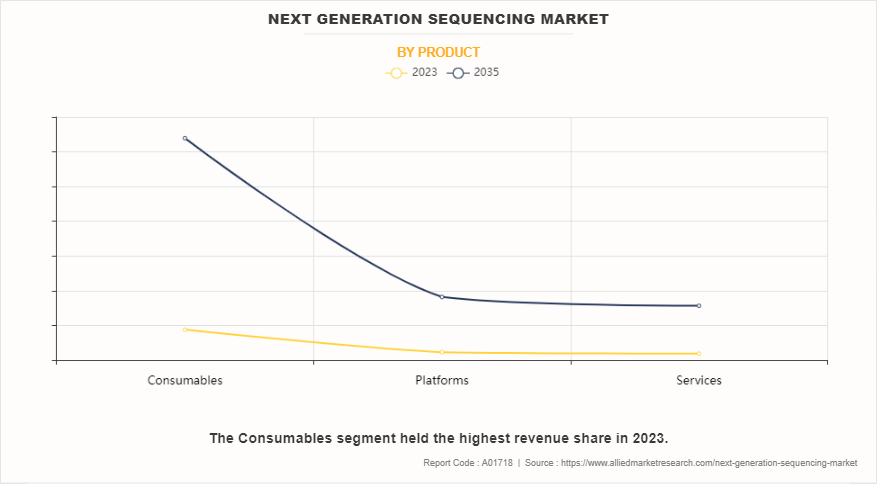

By product, consumables is one of the dominating segment in the market and accounted for the revenue share of over 67.8% in 2023.

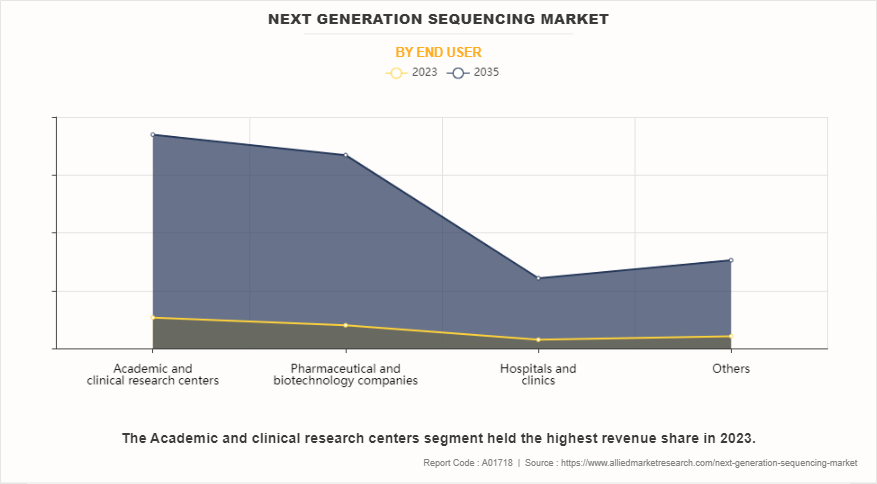

By end user, the academic and clinical research centers segment is the fastest growing segment in the market.

Market Size & Future Outlook

2023 Market Size: $12.98 Billion

2035 Projected Market Size: $97.8 Billion

CAGR (2024-2035): 18.3%

North America: Largest market in 2023

Asia Pacific: Fastest growing market

Increase in incidences of genetic disorders and cancer is the major factor driving the growth of the next generation sequencing market. The World Health Organization (WHO) estimated that approximately 400,000 children develop cancer every year worldwide, emphasizing the urgent need for advanced genomic technologies to better understand the genetic basis of cancer and develop targeted therapies Thus, high incidences of genetic disorders and cancer increases the demand for next generation sequencing around the globe and thus propels the growth of the market.

Next-generation sequencing (NGS) is a high-throughput methodology revolutionizing genetic analysis. It encompasses diverse techniques that enable rapid sequencing of DNA and RNA molecules. Unlike traditional Sanger sequencing, NGS facilitates parallel sequencing of millions of fragments simultaneously. This approach offers unparalleled speed, cost-effectiveness, and scalability, empowering various applications such as whole genome sequencing, transcriptomics, and metagenomics. NGS has significantly advanced diagnosis of genomics, enabling comprehensive insights into genetic variations, gene expression, and microbial diversity, thereby catalyzing breakthroughs in biomedical research and personalized medicine.

Key Takeaways

- On the basis of product, the consumables segment dominated the next generation sequencing market size in terms of revenue in 2023. However, the services segment is anticipated to register the fastest CAGR during the forecast period.

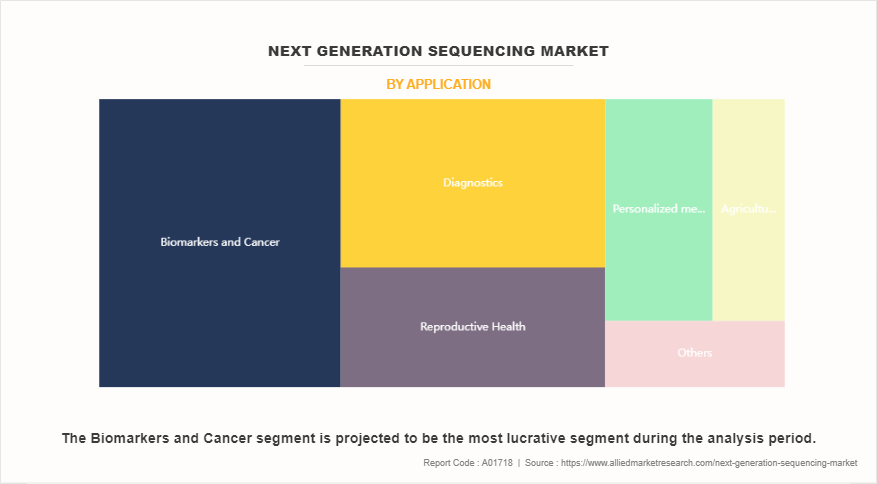

- By application, the biomarkers and cancer segment was the major revenue contributor in 2023. However, the agriculture and animal research segment is anticipated to register the fastest CAGR during the forecast period.

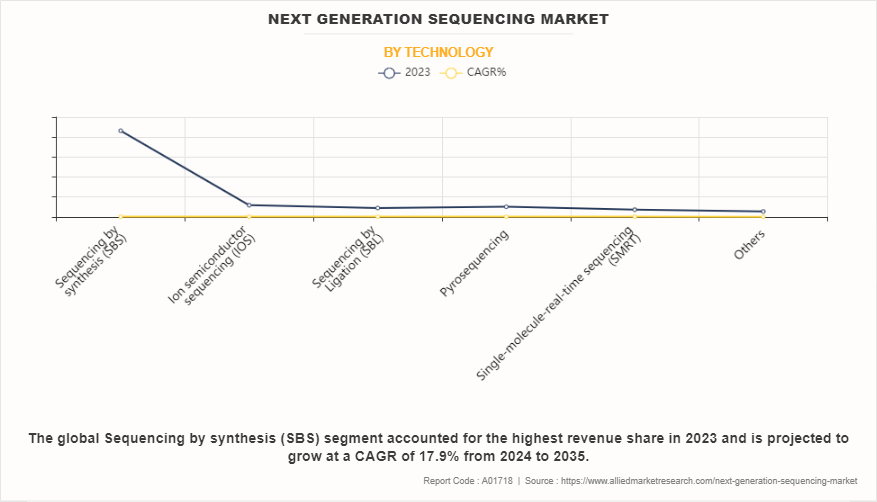

- Depending on technology, the sequencing by synthesis segment accounted for the highest revenue in 2023. However, the pyrosequencing segment is anticipated to register the fastest CAGR during the forecast period.

- On the basis of end user, the academic and clinical research centers segment accounted for the highest next generation sequencing market size in 2023. However, the pharmaceutical and biotechnology companies segment is anticipated to grow at the fastest CAGR during the forecast period.

- Region-wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

Next generation sequencing platforms have witnessed remarkable progress in recent years through technological developments. They are very useful and advantageous when compared with traditional microarrays due to different reasons, namely, less quantity (in nanograms) of input sample required, lack of experimental bias observed in microarrays, and others. The total number of produced sequence reads per run has drastically increased through the advent of massive parallelization of sequencing reactions. Complex mixtures of DNA and RNA can be thoroughly visualized and analyzed through the NGS technology. A practical platform that reduces the number of pre-sequencing steps, assures authentic sequences with long reads (MB to GB) produced per run, works on a DNA/RNA molecule without any pre-amplification, and possesses high read accuracy, is desired by researchers worldwide. Scientists are focusing on the development of advanced sequencing platforms.

For instance, Oxford Nanopore Technologies (ONT) is one of the companies that deals with building nano-pore sequencing platforms. Single molecule, amplification free, base detection without labels, long reads, scalable in data output, and low GC bias are some of the anticipated characteristics of this platform. This company is also involved in innovating the MinION system. MinION is the only real time, portable, device for RNA and DNA sequencing. In addition, in 2020, Pacific Biosciences, a leading provider of high-quality sequencing platform, launched Sequel lle system to accelerate the adoption of highly accurate HiFi sequencing. Thus, technological advancements are further contributing to the growth of the next generation sequencing market.

Furthermore, the rise in demand for precision medicine is a significant driver for the next generation sequencing market growth. Precision medicine, also known as personalized medicine, involves tailoring medical treatments to individual patients based on their genetic makeup, lifestyle, and environmental factors. Next generation sequencing technologies play a crucial role in precision medicine by providing comprehensive genomic insights, allowing researchers and clinicians to identify rare genetic variants, structural variations, and biomarkers associated with disease susceptibility and drug response.

By leveraging next generation sequencing, healthcare providers can offer more precise diagnoses, prognoses, and treatment strategies tailored to patient's unique genetic profile. This personalized approach enhances treatment efficacy, minimizes adverse reactions, and improves patient outcomes. As awareness of the benefits of precision medicine grows and genomic technologies become more accessible, there is an increasing demand for advanced sequencing platforms capable of generating detailed genomic data. Consequently, the market for next generation sequencing is propelled by the expanding adoption of precision medicine practices across various therapeutic areas, including oncology, rare diseases, and pharmacogenomics.

However, NGS as a technology demands a seasoned workforce with a rich experience in not only proficient wet-lab protocols but also skilled in interpretation, analysis, storage, management, and handling of complex genomic data. It is difficult to recruit a workforce that is completely trained in handling genomic data completely.

Training of technicians is essential, as the lack of training and NGS knowledge cannot serve the purpose of NGS technology used in experiments and research endeavors. As the NGS technologies are still nascent, technicians are not completely aware of their efficient usage. Even though lab technicians and researchers are expected to perform NGS with precision to generate optimum results, due to insufficient knowledge, many NGS consumables, materials, and time is wasted. Thus, significant investments by the companies generate low or no results. Therefore, unavailability of skilled professionals restricts market growth.

Segments Overview

The global next generation sequencing industry is segmented into product, application, technology, end user, and region. By product, the market is classified into consumables, platforms, and services. On the basis of application, the market is fragmented into biomarkers & cancer, diagnostics, reproductive health, personalized medicine, agriculture & animal research, and other applications. On the basis of technology, the market is segmented into sequencing by synthesis, ion semiconductor sequencing, sequencing by ligation, pyrosequencing, single molecule real time sequencing, and other technologies. By end user, the market is divided into academic & government research institutes, pharmaceutical companies, biotechnology companies, and hospitals & clinics. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, North Africa and rest of Middle East & Africa).

By Product

Depending on product, the market is segmented into consumables, platforms, and services. The consumables segment accounted for the largest next generation sequencing market share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period. This is attributed to recurring nature of consumable purchases, such as reagents, cartridges, and other materials necessary for sequencing experiments, ensures a steady revenue stream for sequencing companies. Additionally, the growing adoption of sequencing technologies across research, clinical, and industrial settings increase the demand for consumables.

However, the services segment is expected to exhibit the fastest CAGR during the forecast period owing to several factors. As the adoption of next-generation sequencing (NGS) technologies increases, there is a parallel rise in demand for associated services such as sequencing data analysis, interpretation, and consulting. Additionally, outsourcing sequencing tasks to specialized service providers offers cost-efficiency and expertise, further driving the growth of this segment. Moreover, the complexity of NGS data analysis necessitates specialized skills, prompting organizations to seek professional services for efficient and accurate interpretation of genomic information.

By Application

Depending on application, the market is divided into biomarkers & cancer, diagnostics, reproductive health, personalized medicine, agriculture & animal research, and other applications. The biomarkers & cancer segment accounted for the largest next generation sequencing market share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period. Next-generation sequencing (NGS) plays a pivotal role in identifying genetic biomarkers for cancer diagnosis, prognosis, and treatment selection. With advancements in NGS technology, the segment continues to thrive, offering tailored approaches to cancer management, driving its sustained leadership in revenue within the forecast period.

However, the agriculture and animal research segment is expected to exhibit the fastest CAGR during the next generation sequencing forecast period. Next-generation sequencing (NGS) empowers comprehensive genomic analysis, facilitating advancements in crop improvement, livestock breeding, and disease resistance research. The segment's growth is propelled by the increasing application of NGS in enhancing agricultural productivity, ensuring food security, and addressing challenges in animal health, thereby driving its rapid expansion during the forecast timeframe.

By Technology

By technology, the market is segregated into sequencing by synthesis, ion semiconductor sequencing, sequencing by ligation, pyrosequencing, single molecule real time sequencing, and other technologies. The sequencing by synthesis segment accounted for the largest share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period. This is attributed to its efficiency in generating high-quality sequencing data at scale, meeting the increasing demand for rapid and cost-effective genomic analysis in diverse applications.

However, the pyrosequencing segment is expected to exhibit the fastest CAGR during the next generation sequencing market forecast period. This is attributed to the increase in prevalence of chronic diseases and rise in demand for personalized medicine. This technology has various advantages such as faster detection technique and short reading time are further driving the segment growth.

By End user

Depending on the end user, the next generation sequencing market is segmented into academic & research centers, pharmaceutical and biotechnology companies, hospitals & clinics and others. The academic & research centers segment accounted for the largest share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period, owing to increase in prevalence of genetic diseases, increased application-based usage in these institutes and rise in oncology research.

However, the pharmaceutical and biotechnology companies segment is expected to exhibit the fastest CAGR during the forecast period, owing to the increasing demand for personalized medicine and targeted therapies, which rely heavily on genomics and molecular diagnostics. Pharmaceutical and biotechnology companies are investing heavily in genomic research to develop tailored treatments for various diseases, including cancer, rare genetic disorders, and infectious diseases.

By Region

Region-wise, the next generation sequencing market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America acquired the largest share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period owing substantial investment in genomics research and development, supported by government funding, private investments, and academic collaborations. Moreover, the presence of advanced healthcare infrastructure, favorable regulatory policies, and a strong focus on precision medicine initiatives further propel the adoption of next generation sequencing technologies in clinical and research settings across North America.

However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period. The region's increased investment in healthcare infrastructure, research and development, and biotechnology sectors, fostering a conducive environment for the adoption of advanced genomic technologies, thereby driving the market growth in the region.

Competitive Analysis

The major players such as Illumina Inc. and Qiagen N.V. have adopted product launch, collaboration, partnership, product development, and product approval as key developmental strategies to strengthen their foothold in the competitive market. For instance, in January 2023, Qiagen N.V., announced an exclusive strategic partnership with California-based population genomics leader Helix to advance companion diagnostics for hereditary diseases.

Recent Developments in Next Generation Sequencing Industry

In March 2023, Qiagen N.V., announced the launch of the new QIAseq Platform Partnership program and the first partnership with medical data-analysis provider SOPHiA GENETICSTM that will bring together its QIAseq reagent technology for next-generation sequencing (NGS) with the SOPHiA DDMTM digital analytics platform.

In March 2022, Thermo Fisher Scientific announced the launch of CE-IVD marked Ion Torrent Genexus Dx Integrated Sequencer, an automated, next-generation sequencing (NGS) platform that delivers results in as little as a single day. Designed for use in clinical laboratories, the fully validated system enables users to perform both diagnostic testing and clinical research on a single instrument.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the next generation sequencing market analysis from 2023 to 2035 to identify the prevailing next generation sequencing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the next generation sequencing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global next generation sequencing market trends, key players, market segments, application areas, and market growth strategies.

Next Generation Sequencing Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 275 |

| By TECHNOLOGY |

|

| By END USER |

|

| By PRODUCT |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | ILLUMINA INC., PerkinElmer, Inc, PRECIGEN INC, Pacific Biosciences of California, Thermo Fisher Scientific Inc. , Qiagen N.V, abgi group, Agilent Technologies, Inc., F. HOFFMANN-LA ROCHE AG |

Analyst Review

Next-generation sequencing (NGS) is expected to witness high adoption rate due to increase in distinct applications and interventions such as diagnostics, biomarker discovery, personalized medicine, and others. As a technology, NGS is better and more advanced than its predecessors, especially microarray, owing to increased affordability of comprehensive sequence-based genomic analysis.

In addition, the NGS market has gained momentum in the research, innovation, and development sectors, owing to surge in the number of genome mapping projects across the globe, significant technological advancements in NGS, and surge in collaborations & partnerships among NGS product manufacturing companies and other organizations.

Furthermore, North America is expected to remain dominant during the forecast period, due to surge in the use of next generation sequencing. This is attributed to a well-established healthcare infrastructure and high healthcare expenditure. Furthermore, the presence of major market players fosters innovation and product development. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to key players, due to surge in awareness toward preventative healthcare, high population base, and upsurge in healthcare expenditure.

The total market value of next generation sequencing market market is $13 billion in 2023.

The forecast period for next generation sequencing market market is 2024 to 2035

The market value of next generation sequencing market market in 2035 is $97.8 billion

The base year is 2023 in next generation sequencing market market .

Top companies such as Agilent Technologies, Inc., BGI Group, F. Hoffmann-La Roche AG, Illumina Inc, Precigen Inc., held a high market position in 202

3. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The consumables segment is the most influencing segment in next generation sequencing market market . This is attributed to recurring nature of consumable purchases, such as reagents, cartridges, and other materials necessary for sequencing experiments, ensures a steady revenue stream for sequencing companies.

The major factor that fuels the growth of the next generation sequencing market are growing applications in various fields such as genomics, oncology, agriculture, and infectious disease research, technological advancements and increasing demand for personalized medicine .

Next generation sequencing (NGS) is a novel procedure for sequencing genomes at low costs and high speed with improved efficiency. NGS, also known as deep sequencing and parallel sequencing, is a technology that has revolutionized molecular biology and genomics research.

Loading Table Of Content...

Loading Research Methodology...