NFC Payments Market Research, 2032

The global nfc payments market size was valued at $25.8 billion in 2022, and is projected to reach $507.1 billion by 2032, growing at a CAGR of 35.9% from 2023 to 2032. NFC, or Near Field Communication, represents a cutting-edge technology that has revolutionized payment systems. NFC payments offer users a seamless and secure way to conduct transactions by simply bringing their NFC-enabled mobile device in close proximity to an NFC reader at a point of sale. This innovative payment system establishes a wireless connection over a short distance, typically around 4 centimeters, using NFC technology. Its primary objective is to ensure the safe and secure transmission of users' payment information, making NFC payments a convenient and trusted method for modern financial transactions.

NFC payments, a technology utilizing near-field communication, has revolutionized the way payments are made. With NFC, data is wirelessly transferred between devices, such as smartphones, laptops, and tablets, making contactless payments possible through platforms like Apple Pay, Samsung Pay, Google Pay, and contactless cards. The adoption of NFC technology offers numerous benefits to both businesses and consumers. One of the major advantages is the speed of transactions; contactless payments can be as much as 10 times faster than traditional methods. This, in turn, enhances the overall customer experience as people increasingly seek convenient payment options. Moreover, NFC payments provide improved security compared to conventional card swiping, resulting in a significant reduction in in-person credit card fraud.

NFC payments are a streamlined method of financial transactions, allowing consumers to effortlessly complete purchases by tapping or waving their NFC-enabled cards, NFC wallet, smartphones, or wearable devices near contactless payment machine. This innovative approach to payments has significantly simplified the process for retailers while promoting financial inclusion and driving commercial and economic growth. With the increasing prevalence of smartphones and rapid advancements in mobile payment technologies, NFC payments market have become accessible to a broader spectrum of retailers. Leading payment apps like Apple Pay and Google Pay have integrated NFC capabilities, offering customers a familiar and user-friendly platform. The ease of using mobile phones and dedicated applications tailored for NFC payments serves as a primary driver for the retailers' increasing adoption of this technology, marking a key shift in the way payments are conducted in today's digital landscape.These are the major factors anticipated to boost the market during the forecast period.

However, mobile contactless payments also come with certain technical limitations. To utilize the tap-to-pay system, individuals must possess NFC-compliant smartphone, which can pose a barrier for those who do not have access to such devices. This requirement restricts the widespread adoption of mobile contactless payments, particularly among users with older or non-compatible smartphones. These are the major factors anticipated to hamper the market during the forecast period.

The NFC payments market has been significantly transformed by the introduction of NFC-enabled cards. These cards incorporate a tiny chip and antenna that establish seamless communication with NFC-enabled devices, such as digital payment terminals or smartphones. This innovation has revolutionized the way transactions are conducted, offering a contactless and efficient payment experience that comes with a host of advantages. The hallmark feature of NFC-enabled cards is their ability to provide a seamless tap-and-go payment experience. This simplicity enhances convenience, security, and efficiency, making daily transactions a breeze. As contactless payment trends continue to surge, NFC-enabled cards have gained widespread adoption.

An increasing number of merchants, ranging from local businesses to global retailers, now accept NFC payments. In a grocery store, restaurant, or even in front of a vending machine, card can be tapped for swift and secure payments. The accessibility of NFC-enabled cards from various issuers further enhances their convenience and usability. This has established the NFC Payments Market Opportunity as a fundamental component of modern payment technology.

The NFC payments market forecast key players profiled in this report include Google Pay, Apple Pay, Mastercard Paypass, Visa Paywave, Samsung Pay, PayPal, Venmo, Square Wallet, Pomelo Pay, and WePay. The market players are continuously striving to achieve a dominant position in this competitive market using strategies such as collaborations and acquisitions. For instance, in August 2023, J.P. Morgan Payments announced the availability of Tap to Pay on iPhone for its merchant clients in the U.S. The technology enables merchants to take contactless payments on their iPhones without the requirement for a dedicated payment card reader or other infrastructure.

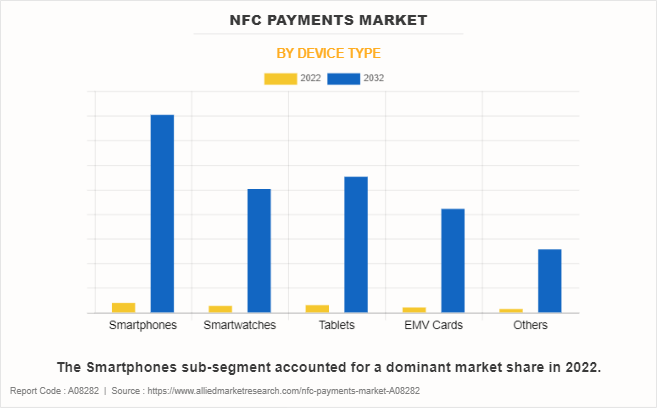

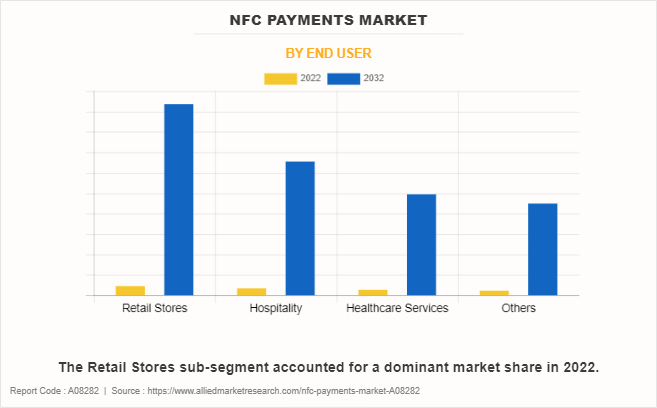

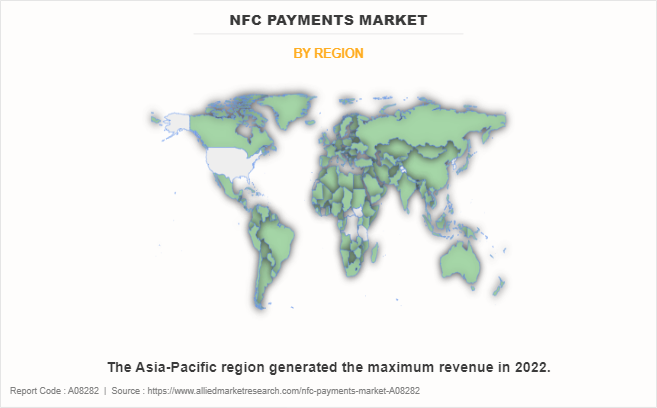

The NFC payments market share is segmented on the basis of device type, end user, and region. By device type, the NFC payments market is divided into smartphones, smartwatches, tablets, EMV cards, and others. By end user, the NFC payments market is classified into retail stores, hospitality, healthcare services, and others. By region, the NFC payments market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

The nfc payments market is segmented into Device Type and End User.

By device type, the smartphones sub-segment dominated the NFC payments market in 2022. The NFC payments market, particularly in the realm of smartphones, is experiencing robust growth driven by rising consumer demand. A significant number of individuals are now embracing the use of smartphones as their preferred payment method, whether for online purchases or in-store transactions. This surge in smartphone-based payments is highlighted by the remarkable convenience, speed, and security offered by the simple act of tapping or scanning one's device. Smartphone payments are a great way for a variety of enterprises, such as stores, restaurants, and professional service providers to accept payments. Smartphones have emerged as powerful tools in meeting these expectations, serving as a gateway to the future of contactless and NFC payments market.

The retail stores sub-segment accounted for a dominant NFC payments market share in 2022. Contactless payments have played a pivotal role in streamlining transactions, enabling retailers to offer faster and more efficient checkouts. This, in turn, translates to shorter lines and expedited payment procedures, greatly enhancing the overall shopping experience for consumers. Beyond the obvious benefits for shoppers, it also allows retailers to allocate their staff's time more effectively. With the checkout process made smoother and swifter, staff can redirect their attention to other critical tasks, ultimately contributing to improved customer service and operational efficiency within retail establishments. These factors are anticipated to boost NFC payments growth.

By region, Asia-Pacific dominated the global NFC payments market in 2022. The adoption of contactless payments in Asia-Pacific has been further accelerated by the increase in issuance of contactless cards by banks and a substantial 29% year-on-year growth in mobile wallet usage in 2020. The industry is poised for continued growth, driven by collaborative efforts within the sector and favorable regulatory conditions that support the widespread adoption of contactless payment methods. This increasing trend of NFC payments indicates a positive growth for the Asia-Pacific NFC payments market. All these are major factors projected to drive the NFC payments market outlook in the upcoming years.

Impact of COVID-19 on the Global NFC Payments Industry

- The pandemic led to an increase in awareness regarding hygiene and safety, leading to a surge in contactless payments as consumers sought to minimize physical contact with cash and payment terminals. NFC technology, which enables secure and convenient contactless transactions, experienced an increase in adoption, particularly for small to medium-sized purchases.

- Fear of virus transmission via physical cash encouraged consumers to embrace digital payment methods, including NFC payments. This shift away from cash payments towards contactless options was particularly evident in regions with advanced NFC infrastructure.

- The lockdowns and restrictions on in-person shopping led to a surge in online shopping and e-commerce transactions. NFC payments played a crucial role in facilitating secure online transactions, contributing to the growth of the digital payment environment.

- With the increase in use of NFC payments, there was a growing emphasis on security measures to protect users' financial information. Industry players invested in enhancing security protocols to safeguard against fraud and cyber threats.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the nfc payments market analysis from 2022 to 2032 to identify the prevailing nfc payments market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nfc payments market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global nfc payments market trends, key players, market segments, application areas, and NFC payments market growth strategies.

NFC Payments Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 507.1 billion |

| Growth Rate | CAGR of 35.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 180 |

| By Device Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Venmo, Apple Pay, One97 Communications, Mastercard Incorporated., Visa Inc., AMERICAN EXPRESS COMPANY, Samsung Pay, PayPal, Block, Inc., Alphabet Inc. (Google LLC) |

NFC payments provide consumers with a significantly faster and more convenient payment option than traditional methods such as cash or card swiping. This can result in shorter queues and faster transactions, making the shopping experience more enjoyable for customers. These are the major factors projected to drive the market growth in the upcoming years.

The major growth strategies adopted by the NFC payments market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global NFC payments market in the future.

Google Pay, Apple Pay, Mastercard Paypass, Visa Paywave, Samsung Pay, PayPal, Venmo, Square Wallet, Pomelo Pay, and WePay are the major players in the NFC payments market.

The smartphones sub-segment of the device type acquired the maximum share of the global NFC payments market in 2022.

Retailers, restaurants, healthcare services, and others are the major customers in the global NFC payments market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global NFC payments market from 2022 to 2032 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...