Nitrile Gloves Market Overview:

The global nitrile gloves market was valued at $9.4 billion in 2021, and is projected to reach $16.9 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031. Rise in demand for nitrile gloves in the healthcare and medical sectors is largely driven by rise in need for high-quality protective gear to ensure hygiene and safety. Nitrile gloves offer superior protection against a wide range of chemicals, viruses, and bacteria, making them the preferred choice in medical environments. In addition, advancements in nitrile glove technology, such as improvements in durability, flexibility, and comfort, have further boosted their adoption. Enhanced manufacturing techniques have also allowed for better quality control, reducing defects and ensuring consistent performance, thus driving the growth of the nitrile gloves market.

Key Market Insights

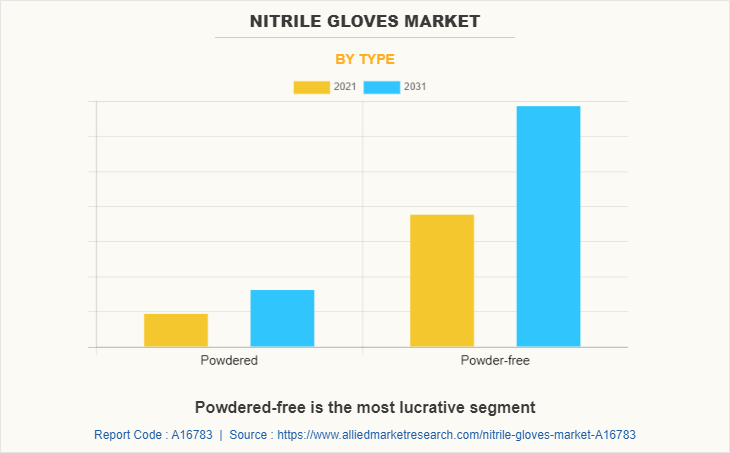

By Type: Powder-free gloves dominated in 2021, holding over 80% of the market revenue.

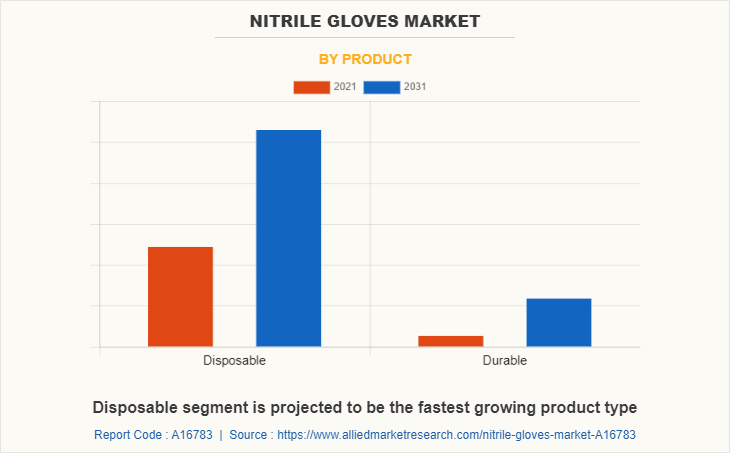

By Product: Disposable gloves led in revenue in 2021 and are expected to grow at a CAGR of 6.3%.

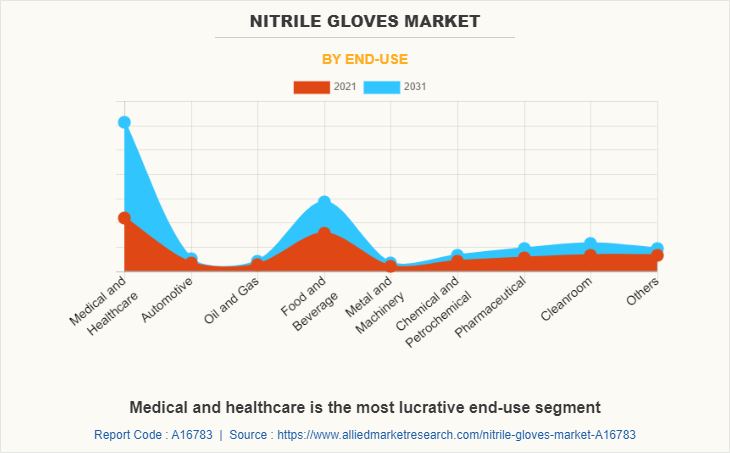

By End-Use Industry: Medical and healthcare accounted for over 76% of market revenue in 2021.

By Region: Asia-Pacific is projected to grow at the highest CAGR of 6.6%.Market Size & Forecast

2031 Projected Market Size: USD 16.9 Billion

2022 Market Size: USD 9.4 Billion

Compound Annual Growth Rate (CAGR) (2022-2031): 6.1%

How to Describe Nitrile Gloves

Nitrile gloves are a type of synthetic rubber gloves made from acrylonitrile and butadiene, offering a high level of protection against chemicals, oils, and punctures. Known for their durability, flexibility, and resistance to tears and abrasions, nitrile gloves are commonly used in medical, laboratory, industrial, and food processing environments. Unlike latex gloves, nitrile gloves are hypoallergenic, making them a preferred choice for individuals with latex allergies. They provide a reliable barrier for various tasks, ensuring safety while maintaining comfort and dexterity.

Market Dynamics

Powder-free and powdered nitrile gloves are two major types of gloves available in the market. Powdered nitrile gloves consist of cornstarch powder that acts as donning agent. The powder content in nitrile gloves depend upon its intended application. For instance, nitrile gloves used in hospitals and healthcare centers uses high amount of powder content.

Nitrile gloves are anti-static in nature. They offer improved solvent resistance, are odor free, making them viable to be used across food and dairy applications. Nitrile gloves are capable of withstanding ISO Propyl Alcohol thus making them commonly used in food industry. Moreover, latex free origin and production technology make these gloves ideal for surgeons or doctors that tend to have latex allergy. Disposable nitrile gloves are synthetic gloves that are mainly used in dental application. Nitrile gloves are capable of withstanding or offering resistance with solvents and chemicals, making them viable and most widely used gloves by dental specialists and surgeons. In addition, these gloves are manufactured and tested through series of abrasion resistance tests and are approved by Food and Drug Administration for medical use. All these factors drive the growth of the global market.

However, less tactile sensitivity than latex gloves is anticipated to hamper the market growth. Conversely, surge in demand for durable nitrile gloves is anticipated to offer new growth opportunities in the global nitrile gloves market. Durable nitrile gloves offer high durability and improved safety in comparison to disposable nitrile gloves. Durable nitrile gloves offer high protection level against rips, snags, and wear & tear. In addition, this type of nitrile gloves offer advanced protection owing to low acceptable quality level (AQL). Durable nitrile gloves are recommended and widely used by healthcare professionals engaged in cancer treatment. Chemotherapy, a type of cancer treatment, includes use of several cytotoxic drugs and some medical devices that tend to emit harmful rays causing skin associated risk to healthcare professionals. Hence, use of durable nitrile gloves minimizes occupational illness.

Nitrile Gloves Market Segment Review:

The nitrile gloves market is segmented into Type, Product and End-use, and region. On the basis of type, the market is bifurcated into powdered and powder-free. By product, the market is divided into disposable and durable. By end-user, the market is categorized into medical & healthcare, automotive, oil & gas, food & beverage, metal & machinery, chemical & petrochemical, pharmaceutical, cleanroom, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Nitrile Gloves Market By Region

The Asia-Pacific nitrile gloves market size is projected to grow at the highest CAGR of 6.6% during the forecast period and accounted for 28.6% of the nitrile gloves market share in 2021. Nitrile gloves are gaining importance in medical and healthcare industry owing to their health associated benefits is the key market trend. Health professional tend to wear gloves and are prone to increased risk of hand dermatitis. In addition, keeping hand clean and healthy hand skin condition is challenging for clinicians. In order to follow all the cleaning regulatory guidelines, health professional tend to use sanitizers and follow other convectional method for hand sanitizing. Thus, in order to prevent frequent hand sanitizing and cleaning, health professional tend to use hand gloves. Healthcare industry in Asia-Pacific is growing rapidly owing to change in demographics, technological developments, and support from governmental bodies. This factor is further anticipated to offer new growth opportunities in the nitrile gloves industry.

Nitrile Gloves Market By Type

In 2021, the powder-free segment dominated the global market in terms of revenue in 2021, with over 80% of the total share. Powder-free nitrile gloves are anti-static in nature, offers improved solvent resistance, odor free, making them viable to be used across food and dairy applications. These nitrile gloves are capable of withstanding ISO Propyl Alcohol thus making them commonly used nitrile gloves in food industry. Moreover, latex free origin and production technology makes them ideal to be used for surgeons or doctors that tend have latex allergy.

Nitrile Gloves Market By Product

By product, the disposable product dominated the global market in terms of revenue in 2021 and is anticipated to grow at highest CAGR of 6.3% in the forecast period. Disposable nitrile gloves offer high level of protection, improved puncture resistance, and minimal abrasion for easier donning & doffing. Disposable nitrile gloves are synthetic gloves that are mainly used in dental application. Disposables gloves are capable of withstanding or offering resistance with solvents and chemicals making them viable and most widely used gloves by dental specialists and surgeons. In addition, disposable gloves are manufactured and tested through series of abrasion resistance tests and are approves by Food and Drug Administration for medical use.

Nitrile Gloves Market By End Use Industry

By end use industry, medical & healthcare industry dominated the global market in terms of revenue in 2021, with over 76% of the total share. Nitrile gloves that are used in medical and healthcare industry are formulated differently. Medical and healthcare nitrile gloves are proven to offers resistance with bodily fluids, microorganisms, and chemicals. In addition, owing to latex-free formulation, nitrile gloves are suitable to be used with health professional that are prone to Type I allergies. Majorly, powder-free nitrile gloves are used in medical and healthcare industry as these offers flexibility, tactility, tear and chemical resistance. Moreover, nitrile gloves can be formulated using special Nitrile formulation that makes them ideal to be used by healthcare professionals. Nitrile gloves used in medical & healthcare industry are ultra soft, latex and BPA free, stronger, and are tested & approved by ASTM D6319.

Which are the Leading Companies in Nitrile Gloves

The major companies profiled in this report include Adventa Berhad, ANSELL LTD, Carolina Glove & Safety Company, Dynarex Corporation, Kossan Rubber Industries Bhd, MCR Safety, Medline Industries, LP, Rubberex Corporation (M) Berhad, Superior Glove, Top Glove Corporation Bhd, Unigloves (Uk), and Hartalega Holdings Berhad.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the nitrile gloves market analysis from 2021 to 2031 to identify the prevailing nitrile gloves market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nitrile gloves market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the nitrile gloves market players.

- The report includes the analysis of the regional as well as global nitrile gloves market trends, key players, market segments, application areas, and nitrile gloves market growth strategies.

Nitrile gloves Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Product |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Top Glove, Cardinal Health Inc., Ansell, MCR Safety, Medline, unigloves (uk) ltd., Rubberex, Carolina, Top Glove Corporation Berhad, Hartalega Holdings Berhad, kossan rubber industries berhad, Adenna LLC, Superior Gloves, Dynarex, DYNAREX, Adventa Berhad, Ammex Corporation |

Analyst Review

According to CXOs of leading companies, the global nitrile gloves market is expected to exhibit high growth owing to its use in oil & gas and automotive end-use industry. Nitrile gloves in automotive industry are used as personal protective equipment as they tend to offer protection from bases, acids, oils, solvents, gasoline, esters, greases, alcohols, and caustics. In addition, nitrile gloves have become the automotive industry standard. Surge in number of automotive technicians and mechanics is anticipated to drive the demand of the global nitrile gloves. Automotive technicians and mechanics are prone to injuries as they tend to handle different lubricants and automotive fluids that contain bases, acids, oils, solvents, gasoline, esters, greases, alcohols, and caustics. Thus, they need to protect their hands using appropriate gloves. Nitrile gloves are widely preferred by automotive technicians and mechanics owing to their comfort level with high protection level offered against different operating fluids. All these factors have escalated the demand for nitrile gloves in automotive end-use industry.

Workers in oil and gas industry are prone to extreme working conditions associated during drilling, transportation, construction, and refining. These processes involve serious risks of injury associated with impact, pinching, cut, and puncture hazards. Thus, oil and gas industry require specially developed gloves for protection. Combined impact, cut and thermal protection offered by nitrile gloves makes them suitable to be used by oil and gas industry workers. Oil and gas industry workers are vulnerable to heat and arc flash hazards, thus, requiring the need for primary protective equipment such as gloves primarily.. Nitrile gloves have gained immense popularity in oil and gas industry over latex based gloves owing to benefits offered by nitrile gloves. In addition, oil and gas industry workers are vulnerable to contamination caused by oil and other hazardous chemicals. Thus, worker tend to use nitrile gloves as these are proven to offers resistance with hazardous chemicals and other corrosive liquids. These factors have escalated the demand and use of nitrile gloves in oil & gas industry thereby driving the growth of the global market.

North America is the largest regional market in the global nitrile gloves market owing to the continuously growing demand across different end-use industries, predominantly in the healthcare and medical sector.

The major application of nitrile gloves is found in the medical and healthcare sectors. In addition, owing to latex-free formulation, nitrile gloves are suitable to be used with health professionals that are prone to Type I allergies.

The global nitrile gloves market is projected to reach $16.9 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031.

Keeping hand clean and healthy hand skin condition is challenging for clinicians. Health professionals tend to wear gloves and are prone to an increased risk of hand dermatitis. This is the key market trend in the nitrile gloves market.

The major companies profiled in this report include Adventa Berhad, ANSELL LTD, Carolina Glove & Safety Company, Dynarex Corporation, Kossan Rubber Industries Bhd, MCR Safety, Medline Industries, LP, Rubberex Corporation (M) Berhad, Superior Glove, Top Glove Corporation Bhd, Unigloves (Uk), and Hartalega Holdings Berhad.

Loading Table Of Content...