Nitrogen Generators Market Research, 2032

The Global Nitrogen Generators Market Size was valued at $8.1 billion in 2020, and is projected to reach $14.6 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032. A nitrogen generator is a device that produces nitrogen gas from the surrounding air. It operates based on various technologies, with the common goal of separating nitrogen molecules from other gases present in the air, such as oxygen, water vapor, and carbon dioxide. The primary purpose of nitrogen generators is to provide a reliable and on-site source of high-purity nitrogen for various industrial applications.

Market Dynamics

Growth in the industrial sector is a major driver for the nitrogen generators market. A strong industrial sector contributes significantly to the GDP of the country; thus, the government of their respective countries offers policy and financial support for the growth of the industrial sector in their countries. In addition, the rate of increase in industrialization in many economies is rising rapidly. Nitrogen is widely used in industries such as pharmaceuticals, food & beverages, medical laboratories, oil & gas refineries, and others. Thus, policies in many countries that have driven industrialization have positively affected the demand for nitrogen and thus leading to nitrogen generator market growth due to various industrialization.

Traditionally industries source nitrogen gas via tankers, and cylinders for various applications at their plants. This method of nitrogen delivery involves various logistical challenges as well as safety challenges owing to heavy vessels containing gas under high pressure. In addition, delivery of these gas solutions is expensive. Furthermore, connecting the newly arrived tanks and cylinders to the plat machinery leads to downtime and added labor cost eventually decreasing the productivity of the company. These challenges can easily be countered by generating nitrogen on the plant using nitrogen generators. Having an onsite nitrogen generation facility that is primarily controlled by the plant itself leads to higher quality controls to achieve high purity gas. On-site nitrogen generation is known to save nearly 80% on the cost of nitrogen compared to rental nitrogen services. Other major benefit is reduction of wastage that generally occurs due to gas leakage during transit has also achieved using on-site nitrogen generation.

However, the cost of nitrogen generators is high compared to other alternatives that are present at a much lower cost. For example, a cylinder filled with nitrogen gas cost only $350, price of cylinder includes. On the other hand, the cost of a small-flow nitrogen generator ranges between $3000 to $20,000, which is still lower than a high flow nitrogen generator which may cost more than $20,000 and can reach up to a $100,000. This price difference between both the alternatives discourages many small businesses having limited capital from opting for on-site generators, In addition, an on-site nitrogen generator also requires a skilled operator, and periodic maintenance which further adds to the cost. Such factors have a negative impact on market growth.

Moreover, growth in the semiconductor industry is a nitrogen generators market opportunity for the key players. The electronics industry has evolved rapidly as public and private entities have increased investments in developing new and improved electronic components. In semiconductor manufacturing, nitrogen is used in various applications. It is employed in the production of integrated circuits (ICs) and other semiconductor devices to create inert atmospheres in critical process steps, such as annealing and sintering. Typically, flow rate required for electronics and electrical industry applications ranges from 300 NM3/hr to 4000 NM3/hr. In addition, for very large applications, 55,000 NM3/hr is also used. Both of these types are offered in cryogenic technology by Air Products and Chemicals Inc. company.

The nitrogen generators market has witnessed various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for nitrogen generators from the industrial sectors. However, COVID-19 has subsided, and the major manufacturers in 2023 have been performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry.

The flow rate required is different for different industries. For example, The medical & pharmaceuticals sector utilizes nitrogen generators in laboratories for testing and sampling application, and also for sterilizing medical equipment, and processing and packaging of drugs and medicines. Peak Gas Generation, which is a major provider of nitrogen generators for laboratories offer nitrogen generators with flow rate from 0.6 M3/hr to 3.0 M3/hr. Most of its products are below 5 M3/hr, indicating that low-flow nitrogen generators are required for laboratory applications.

However, for pharmaceutical manufacturing and packaging low to high flow nitrogen generators are required. Summits Hygronics (P) Ltd., offers nitrogen generators for pharmaceutical industries ranging from 1 to 500 NM3/hr. Similarly, Nitrogen is used for sparging, blanketing, and purging in a chemical manufacturing company which also includes petrochemical processing facilities. Typically, medium- to high-flow nitrogen generators are used for a large share of activities in a chemicals manufacturing and processing company. South-Tek Systems, a manufacturer of nitrogen generators, offer a generator with flow rates up to 84 M3/hr, 670 M3/hr, and 8400+ M3/hr.

Segmental Overview

The nitrogen generators market is segmented based on type, end user, and region. In terms of type, it is categorized into PSA nitrogen generator, membrane nitrogen generator, and cryogenic nitrogen generator. The market is further divided by end user, encompassing food & beverage, transportation, medical & pharmaceuticals, electrical & electronics, chemicals, and other sectors. Region-wise, the market analysis covers North America, Europe, Asia-Pacific, and LAMEA which includes Latin America, Middle East, and Africa).

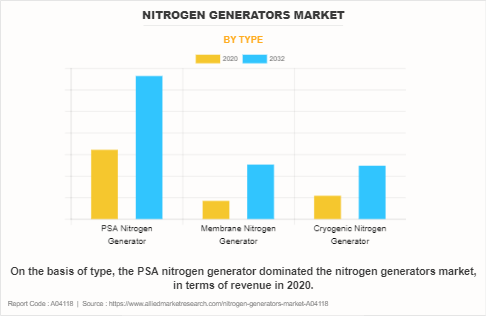

By Type:

The nitrogen generators market is divided into PSA nitrogen generator, membrane nitrogen generator, as well as cryogenic nitrogen generators. In industries,these three types of nitrogen generators are utilized widely; however, the PSA nitrogen generator segment was responsible for the generation of the highest revenue in 2020. Moreover, the membrane nitrogen generator segment is expected to dominate nitrogen generators market forecast by growing with a higher CAGR during the forecast period. Companies develop innovative PSA nitrogen generators to beat the competition.

For example, in March 2021, Peak Gas Generation show-cased its i-Flow PSA nitrogen generator at Foodtech Packtech, largest food manufacturing, packaging and processing technology exhibition of New Zealand. Thus, development of innovative generators and their advantages have driven the nitrogen generators market growth.

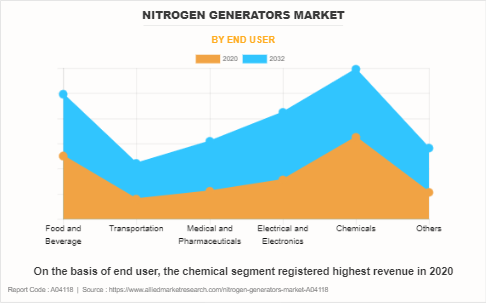

By End User:

The nitrogen generators market is categorized into food & beverage, transportation, medical & pharmaceuticals, electrical & electronics, chemicals, and others. In 2020, the chemicals segment dominated the nitrogen generators market share, in terms of revenue, and the electronics segment is expected to witness growth at a higher CAGR during the forecast period. The industrial sector comprises of many small and large-scale industries. Both industries have different needs. For example, large scale industries have high number of processes; thus, they require a large nitrogen generators.

However, the small-scale industries have less number of machineries and also they have less capital. Thus, small scale industries require low-powered nitrogen generators. Owing to such demand, nitrogen generators are available in a wide range of capacities and flow rate, making them suitable for use in both, small and large industrial facilities. Thereby positively influencing the growth of the market. Nitrogen is instrumental in purging pipelines and equipment, ensuring the integrity and purity of chemicals. Its use extends to cooling and freezing applications, providing controlled and low-temperature environments for specific chemical processes. Nitrogen is also used in solvent recovery, maintaining pressure and temperature conditions for efficient separation and recycling. The pressurization of reactors and vessels is another critical application, contributing to the safety and efficiency of chemical processes. The increase in focus of chemical industry is on safety, the global expansion of chemical manufacturing, and the adoption of environmentally sustainable practices drive the demand for nitrogen generators.

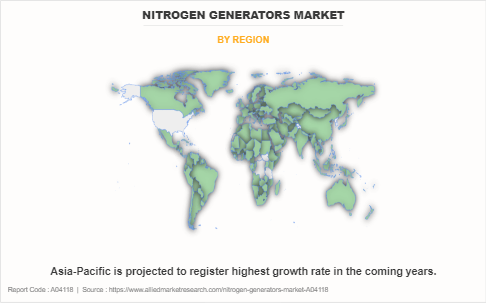

By Region:

North America accounted for the highest market share in 2020 and Asia-Pacific region is expected to grow with the highest CAGR during the forecast period. Asia-Pacific was responsible for generating the highest revenue share in 2020. There are many industrial facilities in Asia-Pacific region, countries such as China and India are the major industrialized countries. These countries have relatively easy statutory guidelines about industries which attracts many industries. In addition, labor laws are also relatively easy in Asia-Pacific, which further drives the industrialization in the region.

The demand for efficient nitrogen generation technologies becomes increasingly crucial as these industries undergo ongoing modernization and development, creating avenues for nitrogen generators manufacturers to deliver tailored solutions. The diverse industrial landscape in the Asia-Pacific region, together with continuing initiatives for energy diversification and industrial growth, positions nitrogen generators as indispensable components for various applications, fostering substantial market growth in the foreseeable future.

Competition Analysis

Competitive analysis and profiles of the major players in the nitrogen generators market are provided in the report. Major companies in the report include Air Liquide S.A., Air Products and Chemicals, Inc., Atlas Copco AB, Hitachi Industrial Equipment Systems Co., Ltd., Linde plc, NOVAIR SAS, On Site Gas Systems, Inc., Parker Hannifin Corporation, Peak Gas Generation, and PCI. Key players in the industry adopt competitive development strategies, including product launches, business expansion, acquisitions, partnerships, mergers, and technological integrations.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging nitrogen generators market trends.

- In-depth nitrogen generators market analysis is conducted by constructing market estimations for key market segments between 2020 and 2032.

- Extensive analysis of the nitrogen generators market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The nitrogen generators market revenue and volume forecast analysis from 2023 to 2032 are included in the report.

- The key players within the nitrogen generators market are profiled in this report and their strategies are analyzed thoroughly, which helps to understand the competitive outlook of the nitrogen generators industry.

Nitrogen Generators Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.6 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2020 - 2032 |

| Report Pages | 212 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | On Site Gas Systems, Inc., NOVAIR SAS, Parker-Hannifin Corporation, Peak Scientific Instruments, Atlas Copco AB, Air Liquide, PCI, Hitachi Ltd. (Hitachi Industrial Equipment Systems Co., Ltd.), Air Products and Chemicals, Inc., Linde plc |

Analyst Review

The nitrogen generators market has witnessed significant growth in past few years, owing to growth of manufacturing industry in developing countries and increase in productivity requirements in manufacturing sector.

Rise in demand for pharmaceutical products fueled by increase in global population and surge in number of lifestyle diseases has boosted the demand for nitrogen generators in the pharmaceutical industry. Furthermore, development of food & beverage and oil & gas processing industries has increased the use of nitrogen, thereby propelling the nitrogen generators market. Industries such as electronic manufacturing and chemical use nitrogen generators owing to the requirement of high purity nitrogen. In addition, integration of advanced technologies has enabled energy saving operations of the generators and helps in reducing CO2 footprint.

Moreover, supportive government initiatives and increase in number of free trade agreements across the globe have propelled the manufacturing industry providing lucrative opportunities for the growth of the nitrogen generators market

A rise in industrialization, benefits of nitrogen generators, and growth in popularity of sustainable development drive the growth of the global nitrogen generators market.

The latest version of the global nitrogen generators market report can be obtained on demand from the website.

The global nitrogen generators market size was valued at $8.1 billion in 2020.

The global nitrogen generators market size is estimated to reach $14.6 billion by 2032, exhibiting a CAGR of 4.8% from 2023 to 2032.

The forecast period considered for the global nitrogen generators market is 2023 to 2032, wherein, 2022 is the base year, 2023 to 2032 is the forecast duration. Historic data is also provided from 2020 to 2021.

North America is the largest regional market for nitrogen generators market.

Key companies profiled in the nitrogen generators market report include Air Liquide S.A., Air Products and Chemicals, Inc., Atlas Copco AB, Hitachi Industrial Equipment Systems Co., Ltd., Linde plc, NOVAIR SAS, On Site Gas Systems, Inc., Parker Hannifin Corporation, Peak Gas Generation, and PCI.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...