North America Aluminum Market Overview:

The North America aluminum market accounted for $12,076.0 million in 2015 and is anticipated to reach $17,995.6 million by 2023, registering a CAGR of 5.1% from 2015 to 2023.

Aluminum is a lightweight, nonmagnetic, soft, and ductile metal. It is the third most abundant element found in the earths crust but is seldom found uncombined in nature. It is usually extracted from minerals such as cryolite and bauxite. It forms a reflective coating when evaporated in vacuum, which is utilized to manufacture telescope mirrors, packaging, and toys. It is used in the production of variety of products such as foils, window frames, kitchen utensils, airplane parts, beer kegs, and others.

The North America aluminum market is witnessing healthy growth over the past few years and it is expected to grow significantly during the forecast period. This is due to the development of the transport industry and technological advancements in product manufacturing technologies, processing equipment, and alloy development over decades. In addition, increase in applications across various end-user industries due to its specific properties over other metals such as dampness and corrosion resistance. However, increase in competition from substitutes such as composites is expected to hamper the market growth. On the contrary, increase in use of recycled aluminum products is anticipated to offer lucrative growth opportunities to the market players.

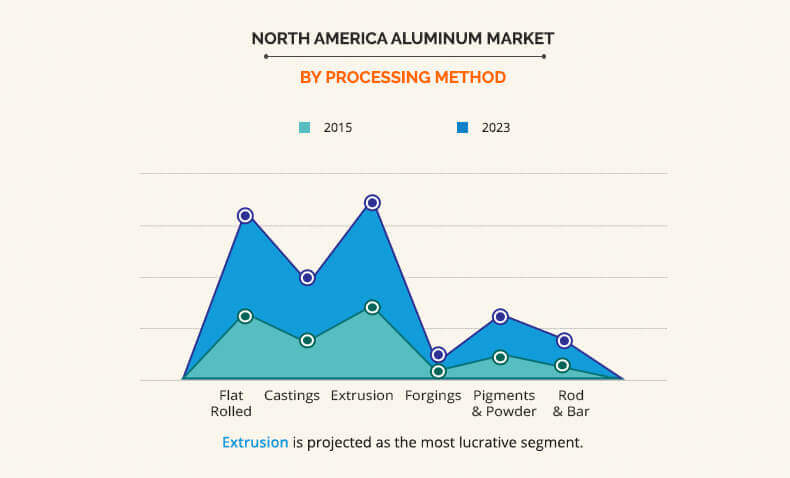

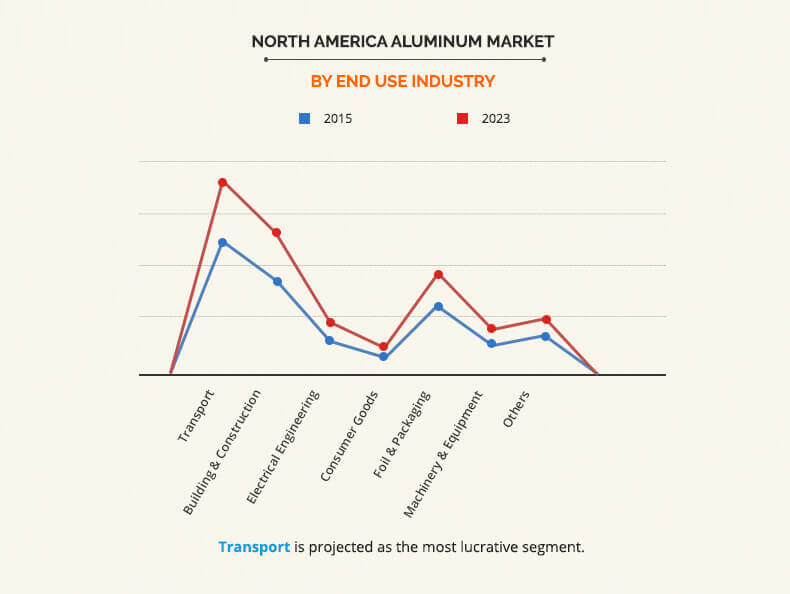

The North America aluminum market is segmented based on processing method, end-user industry, and country. Based on processing method, the market is classified into flat rolled, castings, castings, extrusions, forgings, pigments & powder, and rod & bars. Based on end-user industry, it is divided into transport, building & construction, electrical engineering, consumer goods, foil & packaging, machinery & equipment and others. Based on country, it is analyzed across U.S. and Mexico.

The major key players operating in the North America aluminum market include Alcoa, Norsk Hydro, Rio Tinto Alcan, Arconic, Century Aluminum, Novelis, Access Industries, United Company RUSAL, Kaisar Aluminum, and JW Aluminum, and others. The other player includes United Aluminum, GYFORDPRODUCTIONS, LLC, ALUMINERIE ALOUETTE INC., Extrudex Aluminum, and Almag Aluminum.

Based on region, the U.S. accounts for major share in the aluminum market due to presence of established end-use industries such as transportation and building & construction. Moreover, the U.S. is expected to remain dominant during the forecast period. This is due to growth in investment by key players in the aluminum production expansion to cater to the rise in demand.

Based on processing method, the extrusion segment dominated the market in 2015. Extrusion aluminum products have high demand in commercial application specifically in construction, machinery and equipment application, and consumer goods. Hence, rise in commercialization leads to the high demand for extrusion aluminum products in North America.

Based on end-use industry, the transportation segment emerged as a regional leader in 2015. Average amount of aluminum used in the vehicle production has reached 100 kg, which significantly drives the consumption rate for aluminum. The transportation industry dominated the North America region with the growth in production and sales of vehicle.

Key Benefits for North America Aluminum Market:

- Porters five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building

- It outlines the current trends and future scenario of the market from 2015 to 2023 to understand the prevailing opportunities and potential investment pockets

- Major countries in each region have been mapped according to their individual revenue contribution to the regional market

- The key drivers, restraints, and opportunities and their detailed impact analyses are elucidated in the study

- The profiles of key players along with their key strategic developments are enlisted in the report

North America Aluminum Market Report Highlights

| Aspects | Details |

| By Processing Method |

|

| By End Use Industry |

|

| By Country |

|

| Key Market Players | KAISER ALUMINUM, ACCESS INDUSTRIES, ARCONIC INC., NORSK HYDRO ASA, ALCOA CORPORATION, RIO TINTO ALCAN INC., JW ALUMINUM INC., CENTURY ALUMINUM COMPANY, UNITED COMPANY RUSAL, NOVELIS INC. |

Analyst Review

The development of the transportation industry and increase in expenditure for construction in the advanced & developing economies drive the growth of the aluminum market in North America. Rapid growth of cities and potential uses of aluminum as copper substitute in power industry further fuel the market growth. Rapid development and urbanization fuel the growth of the aluminum market in the emerging economies such as India and China. Stringent regulations toward carbon emissions and strong focus on environment stewardship in most of the developed countries boosts the adoption of aluminum in the transportation sector in developed economies, as its use in vehicles reduces fuel consumption and assists to reduce hazardous emissions. On an average, lightweight vehicles present in the European Union (EU) member countries and the U.S. contain 148 kg of aluminum.

Loading Table Of Content...