North America and Europe Medical Display Market Outlook:

The North America and Europe medical display market size was valued at $1,010.5 million in 2018 and is expected to reach $1,515.8 million by 2026 with a CAGR of 5.2% during the forecast period. Diagnosing patients accurately using Picture Archive Communication System (PACS) viewer that displays medical images on LCD monitors is important for detecting various diseases. Thus, medical display devices are significant tools for medical professionals to see images better than the physical films or CRT monitors. Streamlining the overall hospital operations and improving patient care in the healthcare system is important for proper diagnosis. Medical professionals such as surgeons, radiologists, and information technology specialists need medical grade monitors for consistent and accurate performance of medical display systems. Thus, adequacy of medical display monitors is a vital element in the modern hospitals.

Increase in number of medical establishments and rise in healthcare expenditure fuel the demand for medical display devices in these regions. Furthermore, rise in geriatric population in the countries boosts the demand for medical-aid and medical display devices in North America and Europe. The growth in demand for multimodality displays for radiology and various medical applications to get a detailed view of ultrasound outputs and PET further drive the growth of the North America and Europe medical display market. Nonetheless, the higher costs associated with the devices restrict the growth of the market. The increase in demand for various diagnostic procedures such as ultrasound, medical resonance imaging, and X-ray are expected to provide newer opportunities for the market growth.

North America and Europe Medical Display Market Segmentation

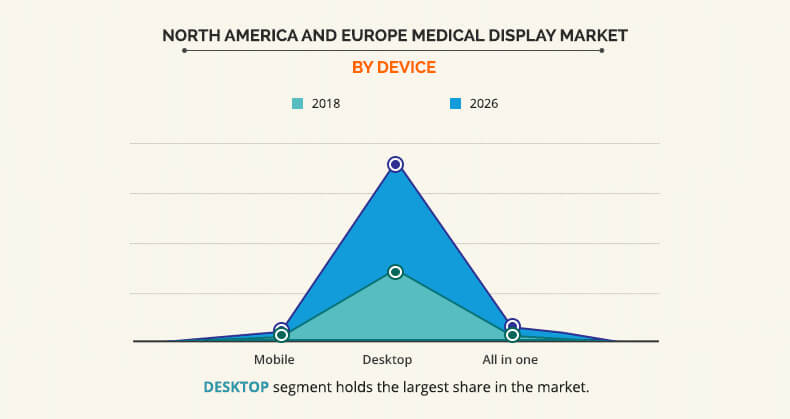

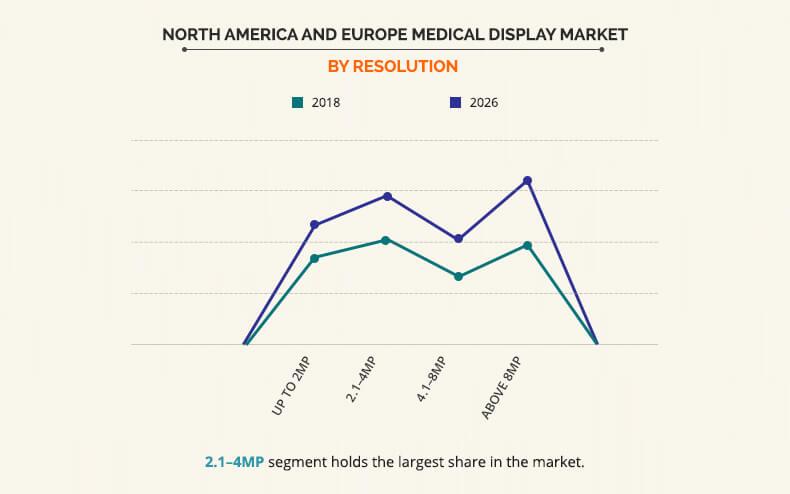

The North America and Europe medical display market is segmented into device, panel size, resolution, application, and region. Based on device, the market is categorized into mobile, desktop, and all-in-one product. Based on panel size, it is divided into under-22.9-inch panels, 23.0–26.9-inch panels, 27.0–41.9-inch panel, and above-42-inch panels. Based on resolution, it is studied across up to 2MP resolution displays, 2.1–4MP resolution displays, 4.1–8MP resolution displays, and above 8MP resolution displays. Based on application, it is classified into digital pathology, multi-modality, surgical, radiology, mammography, and others. Based on region, it is analyzed across North America and Europe.

Segment review

Based on device type, the North America and Europe medical display market is divided into the desktop, mobile, and all-in-one product. The desktop segment is largest among the device type with its wide usage in major applications owing to high image quality, ease of image analysis, and others. Desktop medical displays are the most commonly used medical displays and are often connected with various medical devices such as endoscopic cameras, imaging and radiology equipment to visualize medical procedures.

Based on panel size, the North America and Europe medical display market is divided into the under-22.9-inch panels, 23.0 to 26.9-inch panels, 27.0–41.9-inch panel, and above-42-inch panels. The 27.0–41.9-inch panel segment is largest among the panel size owing to its suitability for wide range of applications including surgical as well as diagnostics.

Based on resolution, the North America and Europe medical display market is divided into up to 2MP, 2.1–4MP, 4.1–8MP, and above 8MP. The 2.1–4MP segment is largest among the device type owing to its decent configuration that is suitable for multiple applications. Based on application, the North America and Europe medical display market is divided into the digital pathology, multi-modality, surgical, radiology, mammography, and others. The radiology segment is further classified into X-ray, CT, and MRI. The surgical segment is largest among the application owing to wide usage of medical displays for surgeries with its critical impact on the quality of procedures.

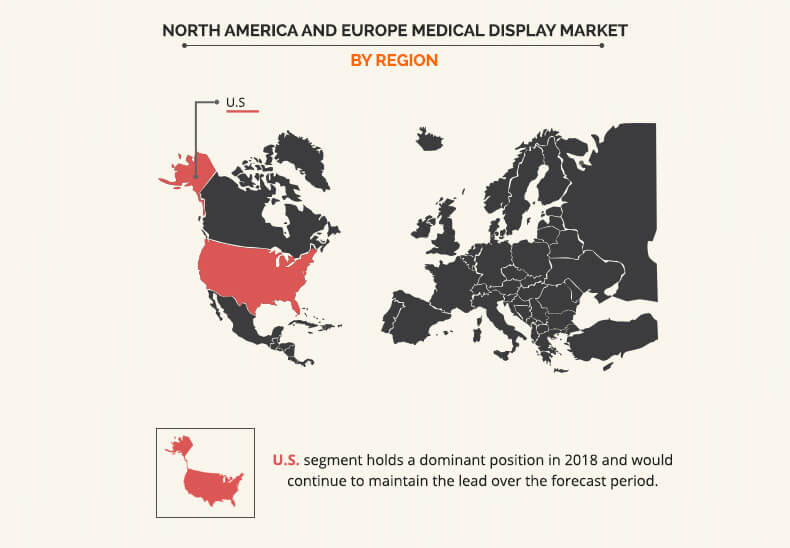

U.S. held the largest share of the North America and Europe medical display market in 2018 owing to increase in adoption of hybrid operating rooms along with the short duration of replacement cycle supports the medical display market growth in North America. Moreover, the lesser budget constraints on the U.S. hospitals results in the increase in purchases of equipment including medical display, followed by Germany. On the other hand, Germany is also anticipated to be the fastest-growing regional segment during the analysis period due to rise in expenditure in healthcare and increase the demand for medical devices in Germany.

The North America and Europe medical display market is highly competitive and the prominent players in the market have adopted various strategies for increasing their market share. These include expansion of their geographical presence through collaborations, product launch, development, and acquisition. Major players operating in the medical display market include Alpha Display, ASUSTeK Computer Inc., Axiomtek Co., Ltd., Barco NV, BenQ Medical Technology, Coje CO., LTD., Dell Technologies Inc., Double Black Imaging Corporation, FSN Medical Technologies, Hisense Medical, HP INC., JVC Kenwood Holdings Inc., Nanjing Jusha Commercial & Trading Co, Ltd., Shenzhen Beacon Display Technology Co., Ltd., Steris PLC, EIZO Corporation (EIZO), Sony Corporation, LG Display Co., Ltd., Novanta Inc. (Novanta), and Advantech Co., Ltd. (Advantech).

Key Benefits for North America and Europe Medical Display Market:

- This report entails a detailed quantitative analysis along with the current North America and Europe medical display market trends from 2019 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The North America and Europe medical display market forecast is studied from 2019 to 2026

- The North America and Europe medical display market size and estimations are based on a comprehensive analysis of key developments in the industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market.

North America and Europe Medical Display Market Report Highlights

| Aspects | Details |

| By Device |

|

| By Panel Size |

|

| By Resolution |

|

| By Application |

|

| By Region |

|

| Key Market Players | Shenzhen Beacon Display Technology Co., Ltd., EIZO Corporation (EIZO), COJE CO., LTD., Steris PLC, Dell Technologies Inc., BenQ Medical Technology, Double Black Imaging Corporation, Advantech Co., Ltd. (Advantech), LG Display Co., Ltd., Sony Corporation, Barco NV, JVC Kenwood Holdings Inc., ALPHA DISPLAY, Axiomtek Co., Ltd., ASUSTeK Computer Inc., Hisense Medical, Nanjing Jusha Commercial & Trading Co, Ltd., Novanta Inc. (Novanta), FSN Medical Technologies, HP INC. |

Analyst Review

The adoption of medical displays in hybrid operating rooms in hospitals and specialty clinics is anticipated to witness significant growth due to the need for early diagnosis and use of medical imaging in various surgeries in the developed nations. Moreover, the medical display market has gained immense interest of the healthcare industry due to its major role in diagnosis of endovascular and vascular surgeries, spinal & neurological surgeries, orthopedic trauma procedures, and cardiac surgeries. Germany is projected to register highest growth rate in the North America and Europe medical display market due to rise in expenditure in healthcare and rise in geriatric population.

Shorter replacement cycles of medical displays, increase in preference for minimally invasive treatments, and rise in adoption of hybrid operating rooms are the major factors that drive the market growth. However, surge in adoption of refurbished medical displays and market saturation in developed countries refrain the overall market growth. Moreover, adoption of consumer-grade displays in hospitals and clinics across the region significantly limits the use of medical display devices. Such factors are expected to restrain the market growth.

Loading Table Of Content...