North America Aseptic Packaging Market Research 2031

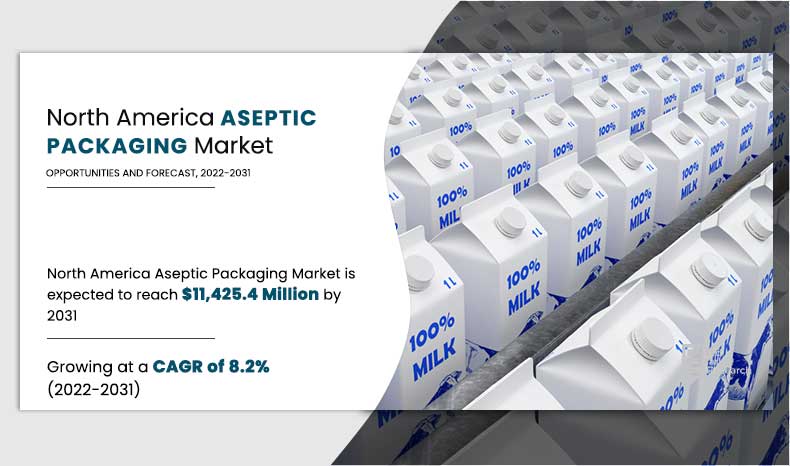

The North America Aseptic Packaging Market Size was $5,115.7 million in 2021, and is expected to reach $11,425.4 million by 2031, with a CAGR of 8.2% from 2022 to 2031.

Aseptic packaging is the process of packaging beverages or foods at ultra-high temperature (UHT), sterilizing or disinfecting the packaging individually, and then fused and sealed under sterile atmosphere conditions to avoid contamination by viruses and bacteria. Cans, containers, cartons, and other sterile packaging are made of materials, such as plastic, glass, paperboard and metal. Aseptic packaging extends the shelf life of packaged products. Moreover, it is eco-friendly.

Increase in emphasis of government entities globally, on developing their own domestic healthcare infrastructure for R&D purposes, has boosted the demand for aseptic packaging systems. Furthermore, rise in number of pharmaceutical companies, diagnostic laboratories, clinics, and hospitals has boosted the demand for the aseptic packaging systems. Moreover, the demand for generic drugs has increased in recent times, owing to the rise in awareness among people for their health. This factor is anticipated to boost the demand for aseptic packaging systems.

However, the high cost of these machines and fluctuating prices of raw materials used by packaging companies, such as polymer, board, paper, glass, aluminum, and steel are restraining factors that hinder the growth of aseptic packaging systems market.

Furthermore, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. Construction and transportation activities, along with their supply chains, were hampered on a global level. This led to decline in manufacturing of aseptic packaging as well as their demand in the market, thereby restraining the growth of the aseptic packaging market. Conversely, industries are gradually resuming their regular manufacturing and services. This is expected to lead to re-initiation of aseptic packaging companies at their full-scale capacities, which is likely to help the aseptic packaging market to recover by end of 2021.

Contrarily, technological developments in aseptic packaging systems products, such as adoption of remote operation and improvements in HEPA filters and automation, can boost the efficiency of the equipment and result in lower number of human errors caused due to mishandling of aseptic packaging systems. This is anticipated to create lucrative opportunities for the aseptic packaging systems market growth during the forecast period.

Segment Overview

The aseptic packaging market is segmented on the basis of packaging type, material, application, end-user industry, and region. On the basis of packaging type, the market is divided into carton, bags & pouches, and bottles & cans. Depending on material, it is classified into glass, metal, plastic, and paper & paperboard. On the basis of application, the market is divided into beverage and food. On the basis of end-user industry, the market is divided into retail and food service. By region, it is analyzed across North America (the U.S., Canada, and Mexico).

On the basis of packaging type, in 2021, the cartons segment dominated the aseptic packaging market in terms of revenue, whereas the bags & pouches segment is expected to witness growth at the highest CAGR during the forecast period. As per material, the paper & paperboard segment led the aseptic packaging market in 2021, and is expected to exhibit highest CAGR in the near future. By application, the beverage segment led the market in 2021, in terms of revenue; however, the food segment is anticipated to register highest CAGR during the forecast period. By end-user industry, the retail segment led the market in 2021, in terms of revenue; however, the food service segment is anticipated to register highest CAGR during the forecast period. Country wise, the U.S. garnered the highest revenue in 2021; however, Mexico is anticipated to register highest CAGR during the forecast period.

By Packaging Type

Carton segment holds the largest share in the market

Competition Analysis

The major players profiled in the aseptic packaging market include, Amcor plc, DS Smith plc, Mondi PLC, Greatview Aseptic Packaging Company Ltd., SIG, Sonoco, Smurfit Kappa Group plc, Stora Enso Oyj, Tetra Laval International, and UFlex Limited.

Major companies in the market have adopted product launch, business expansion and acquisition as their key developmental strategies to offer better products and services to customers in the aseptic packaging market.

By Application

Beverage segment holds dominant position in 2021

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current trends and future estimations.

- Extensive analysis of aseptic packaging market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global aseptic packaging market forecast analysis from 2021 to 2030 is included in the report.

- The key market players within the global aseptic packaging market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the global market.

North America Aseptic Packaging Market Report Highlights

| Aspects | Details |

| By Packaging type |

|

| By Material |

|

| By Application |

|

| By End-user Industry |

|

| By Region | |

| By North America |

|

| By Key Market Players |

|

Analyst Review

The aseptic packaging is widely utilized in beverages or foods in medical and food products at ultra-high temperatures (UHT), sterilizing or disinfecting the packaging individually, and then fused and sealed under sterile atmosphere conditions to avoid contamination by viruses and bacteria. Aseptic packaging is commonly utilized for packing in the e-commerce industry. Aseptic packaging systems are in higher demand due to the expansion of domestic healthcare infrastructure for R&D objectives. The high cost of these equipment, as well as variable raw material costs employed by packaging firms, are restricting factors in the aseptic packaging systems market's growth. Technological advancements in aseptic packaging systems goods, such as remote operation, HEPA filter enhancements, and automation, can improve the equipment efficiency, which is expected to generate profitable prospects for the aseptic packaging systems market during the forecast period.

Major companies in the market have adopted product launch, business expansion and acquisition as their key developmental strategies to offer better products and services to customers in the North America aseptic packaging market.

The North America aseptic packaging market size was valued at $5,115.7 billion in 2020, and is expected to reach $11,425.4 billion by 2030, with a CAGR of 8.2% from 2021 to 2030.

The forecast period considered for the North America aseptic packaging market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 20310 is the forecast year.

To get latest version of North America aseptic packaging market report can be obtained on demand from the website.

The base year considered in the North America aseptic packaging market report is 2021.

The top companies holding the market share in the North America aseptic packaging market report include Amcor plc, DS Smith plc, Mondi PLC, Greatview Aseptic Packaging Company Ltd., SIG, Sonoco, Smurfit Kappa Group plc, Stora Enso Oyj, Tetra Laval International, and UFlex Limited.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

By material, the paper & paperboard segment dominated the North America aseptic packaging market, in terms of revenue and is expected to maintain this trend during the forecast period.

By packaging type, the carton segment is the highest share holder of North America aseptic packaging market.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The market value of the North America aseptic packaging market is $5,601.7 billion in 2022.

Loading Table Of Content...