North America Big Data Analytics in Healthcare Market Statistics, 2025

The North America big data analytics in healthcare market size was valued at $9.36 billion in 2017, and is projected to reach $34.16 billion by 2025, growing at a CAGR of 17.7% from 2018 to 2025. Big data analytics in healthcare is the complex process of examining big data to discover information including hidden patterns, market trends, unknown correlations, and customer preferences, which can help organizations to make informed clinical and business decisions. The field of healthcare analytics is enormous, spanning multiple diverse areas, particularly clinical analytics, operational efficiency, and personalized medicine. In addition, big data analytics optimizes process-oriented expenditures in the healthcare industry by improving the population health, integrating performance modeling with financial and predictive care monitoring, and others.

Initiatives by government, federal policies, and programs for healthcare sector in the North American countries are expected to drive the growth of the big data analytics in healthcare market in this region. For instance, Affordable Care Act (ACA), the crucial healthcare legislation in the U.S., has authorized the Department of Health and Human Services to release data that promotes transparency in the markets for healthcare and medical insurance. The government is providing incentive payments for healthcare providers to adopt Electronic Medical Records (EMRs) and has taken required actions to release data as a part of a program to promote data release and accessibility from agencies such as Centers for Medicare and Medicaid Services, and Centers for Disease Control. Thus, government healthcare policies drive the growth of the North America big data analytics in healthcare market.

Furthermore, increase in demand for data analytics solution for population health management, rise in expenditure on technologically advanced solutions by healthcare providers, and continuous growth in enormous amount of medical data generation in form of electronic health record (EHR), biometric data, sensors data fuel the growth of the North America big data analytics in healthcare market.

The report focuses on the growth prospects, restraints, and North America big data analytics in healthcare market trends. The study provides Porters five forces analysis of the big data analytics in healthcare industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the North America big data analytics in healthcare market growth. Report also provides North America Big Data Analytics in Healthcare Market Forecast for the period of 2018 to 2025.

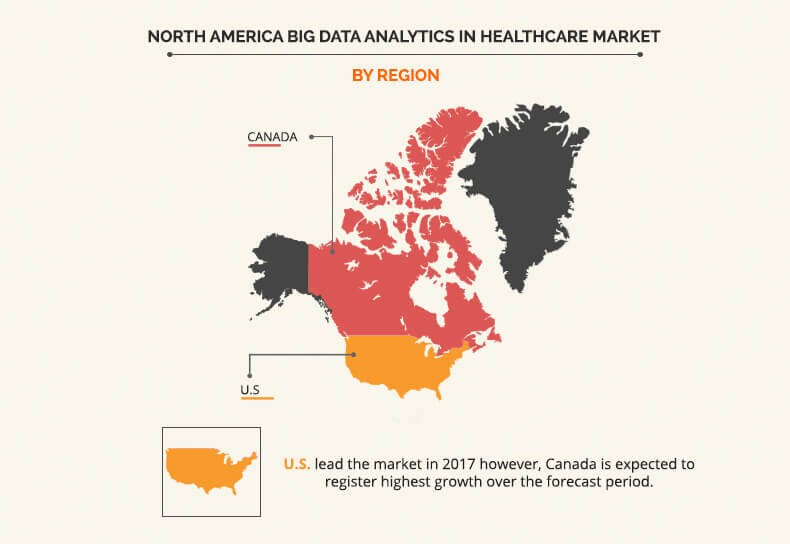

U.S. dominated the overall North America big data analytics in healthcare market share in 2017, due to major advancements in IoT and increase in the demand for analytical models on patient information for better service delivery, government policies, and regulatory provisions.

Segment Review

The North America big data analytics in healthcare market is segmented based on component, deployment, analytics type, application, end user, and country. In terms of component, the market is bifurcated into software and services. Based on deployment, it is fragmented into on-premise and cloud. Depending on analytics type, it is segregated into descriptive analytics, predictive analytics, prescriptive analytics, and diagnostic analytics. By application, it is classified into clinical analytics, financial analytics, and operational analytics. Further, clinical analytics is sub segmented into radiology, surgery and others. By end user segment, it is divided into hospitals & clinics, finance & insurance agencies, and research organizations. Based on country, it is analyzed across the U.S. and Canada.

The key players operating in the North America big data analytics in healthcare market analysis include All Scripts, Cerner, Dell EMC, Epic System Corporation, GE Healthcare, Hewlett Packard Enterprise (HPE), International Business Machines (IBM) Corporation, Microsoft, Optum, and Oracle Corporation.

Top Impacting Factors

Increase in the demand for analytics solutions for population health management and rise in need for business intelligence to optimize health administration and strategy are expected to drive the market growth. In addition, inclination toward cloud-based analytics solutions in the market is expected to provide North America big data analytics in healthcare market opportunity for the market expansion.

Increase in the demand for analytics solutions for population health management

Population health management demands for complete patient care with cost-effective medication processes, thereby requiring integration of clinical and claims data on the same platform for data analysis. Surge in the demand for improvement in care management, prediction of early illness factors, and hospitalization process is anticipated to fuel the growth of the North America big data analytics in healthcare market in the future. Moreover, citizen health is of prime importance for healthcare administration in the healthcare industry, which in turn requires predictive analysis of population health and is expected to augment the implementation of big data analytics during the forecast period.

Rise in need for business intelligence to optimize health administration and strategy

Various developed nations including the U.S. and Canada focus on big data implementation for healthcare analytics to provide best treatment procedures and clinical services. With an objective for better treatment with reduced costs, several government departments and healthcare agencies are focused on technological implementation for predictive modeling on healthcare and clinical data.

Growth in inclination toward cloud-based analytics solutions

In the recent past, organizations from healthcare sectors are realizing the benefits of cloud solutions and preferring using cloud analytics tools over conventional on-premise business intelligence (BI) solutions. Enhanced planning, insightful decision-making, and predictive analysis have become mainstream requirements among business leaders, owing to the growth in need for client and customer management. According to the Harvard Business Study on cloud business analytics, industry players are more focused on deploying cloud-based data discovery & visualization, predictive analytics, big data, and mobile analytics solutions. These factors are anticipated to create lucrative opportunities for the analytics providers during the forecast period.

Key Benefits for North America Big Data Analytics In Healthcare Market:

- This study presents the analytical depiction of the North America big data analytics in healthcare market along with the current trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and big data analytics in the healthcare market opportunities.

- The current market is quantitatively analyzed from 2017 to 2025 to highlight the financial competency of the North America big data analytics in healthcare industry.

- Porters five forces analysis illustrates the potency of buyers & suppliers in the North America big data analytics in healthcare market.

North America Big Data Analytics in Healthcare Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment |

|

| By Analytics Type |

|

| By Application |

|

| By End User |

|

| By Country |

|

| Key Market Players | OPTUM, INC., INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM), EPIC SYSTEMS CORPORATION, MICROSOFT CORPORATION, HEWLETT PACKARD ENTERPRISE (HPE), ALLSCRIPTS, CERNER CORPORATION, ORACLE CORPORATION, GE HEALTHCARE, DELL EMC |

Analyst Review

The North America big data analytics in healthcare market is projected to witness significant growth, especially in North America due to increase in adoption of big data analytics and increase in incidences of aging population, rise in need for business intelligence and implementation of data warehousing for healthcare data in this industry across the North American countries. The market is projected to grow at a CAGR of 17.7% from 2018 to 2025, owing to increase in regulatory compliance and rise in need for business intelligence to optimize health administration.

Big data analytics in healthcare market in the U.S. possesses the highest market share due to strong regulatory provisions, industry standards, and increase in cloud adoption among the end users.

Though vendors operating across the North America big data analytics in healthcare market are concentrating on bringing interoperability and better health information technology through big data analytics to hospitals and health systems, their customers are still focusing mostly on securing the sensitive health data, ensuring patient safety and improving operational efficiencies. Furthermore, growth in awareness about adopting population health management and clinical analytics boosts the growth of this market.

The key players profiled in the report include All Scripts, Cerner, Dell EMC, Epic System Corporation, GE Healthcare, Hewlett Packard Enterprise (HPE), International Business Machines (IBM) Corporation, Microsoft, Optum, and Oracle Corporation. These players have adopted various strategies such as merger & acquisition or strategic alliance with start-ups and well-established players to expand their market presence and enhance their product portfolio.

Loading Table Of Content...