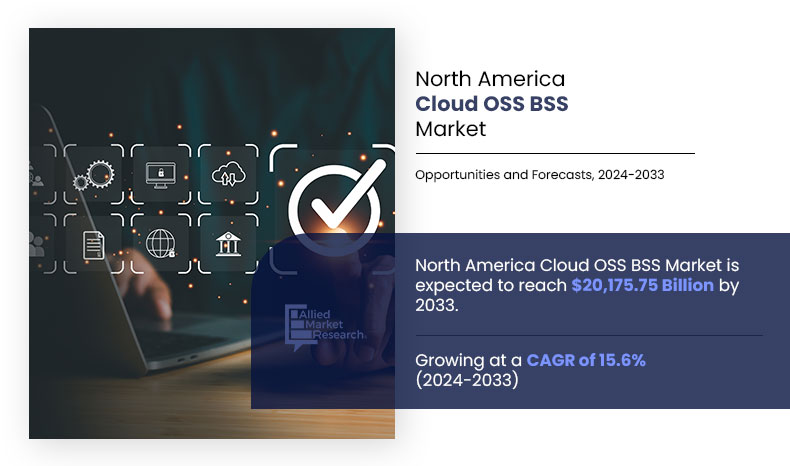

North America Cloud OSS and BSS Market Statistics: 2033

The North America cloud OSS and BSS market was valued for $4,692.28 million in 2023 and is estimated to reach $20,175.75 billion by 2033, exhibiting a CAGR of 15.6% from 2024 to 2033. The cloud OSS and BSS market includes adoption of cloud-based solutions for operations support systems (OSS) and business support systems (BSS) in the telecom industry. These systems enable telecom operators to manage network operations, billing, customer data, service delivery, and revenue management in a more efficient, scalable, and cost-effective manner.

Cloud-based OSS and BSS platforms offer enhanced flexibility, automation, and integration capabilities, allowing providers to support emerging technologies such as 5G, IoT, and digital transformation initiatives, improving overall operational performance and customer experience. For instance, in July 2024, Nokia expanded its Connected Partner Program (CPP) by adding two new cloud-based OSS/BSS suppliers, Sonar and Camvio. This initiative aims to improve the interoperability of Nokia’s solutions, thereby reducing the cost, time, and risk involved in deploying fiber broadband services. By integrating these cloud-based platforms, Nokia seeks to streamline operations and enhance the overall efficiency of broadband service delivery.

Furthermore, digital transformation across the telecom sector is another critical factor, with providers adopting AI, ML, and automation to streamline network operations and improve decision-making. These technologies enhance efficiency and customer satisfaction, further fueling market expansion. For instance, in September 2022, Nokia integrated its OSS, BSS, and security products into its AI and machine learning-focused Automation, Visualization, and Analytics (AVA) division. This move is part of Nokia’s strategy to promote the adoption of advanced technologies, enabling more intelligent, automated, and efficient network operations. By leveraging AI and machine learning, Nokia aims to enhance the capabilities of its OSS/BSS solutions, streamline processes, and improve overall network management, ultimately driving innovation in telecom services.

In addition, increasing trend of collaboration between telecom companies and technology providers supports innovation and drives the adoption of cutting-edge OSS and BSS solutions. For instance, in March 2022, Intraway, a global leader in OSS automated provisioning solutions, expanded its channel partner program to offer unique support and benefits to partners adopting its vendor-agnostic, industry standards-based business process, and orchestration solutions. To broaden its market reach, Intraway is promoting its flagship no-code, cloud-native OSS solution, Symphonica, in North America through the creation of this program, designed to strengthen its partner ecosystem with leading vendors and integrators in the OSS/BSS and network element sectors. These growth factors underline the robust potential of the North America cloud OSS and BSS market.

Segment Review

The North America cloud OSS and BSS market is segmented into component, solution type, organization size, industry vertical, type, and country. On the basis of component, the market is divided into solution and service. By solution type, the market is segmented into network planning and design, service delivery, service fulfillment, service assurance, customer and product management, billing and revenue management, network performance management, and others. On the basis of organization size, the market is divided into small and medium-sized enterprises, and large enterprises. By industry vertical, the market is segmented into telecom, and media and entertainment. On the basis of type, the market is divided into OSS and BSS. Country-wise, the North America cloud OSS and BSS market is analyzed across the U.S. and Canada.

Competition Analysis

The report analyzes the profiles of key players operating in the North America cloud OSS and BSS market such as Amdocs Limited, NEC Corporation (Netcracker), Nokia Corporation, TelcoDR Inc., Telefonaktiebolaget LM Ericsson, Oracle Corporation, Accenture, IBM Corporation, Comarch, CSG Systems International, Inc., Subex Limited, Ciena Corporation, Hewlett Packard Enterprise Development LP, Matrixx Software, Inc., Italtel, Infovista SAS, Salesforce, Inc., Deloitte, Cisco Systems Inc., and BillingPlatform. These players have adopted various strategies to increase their market penetration and strengthen their position in the North America cloud OSS and BSS market.

Recent developments in the North America Cloud OSS and BSS Market

In September 2023, MATRIXX Software, Inc., a leader in converged charging and monetization, launched a digital monetization solution that transforms traditional BSS architecture. By leveraging the TM Forum's Open Digital Architecture, it enables service providers to move away from outdated billing systems and processes. The solution supports new use cases that legacy systems cannot accommodate, operating effectively in multi-vendor environments.

In February 2023, Cisco launched cloud-managed networking by aligning with Cloud OSS and BSS by enabling CSPs to streamline IT and OT operations through unified dashboards and advanced management tools. These capabilities enhance OSS functions like network monitoring and service assurance while supporting BSS needs for monetizing IoT services. This integration drives agility and operational efficiency.

In March 2022, BillingPlatform launched a billing and revenue management platform that aligns seamlessly with Cloud OSS and BSS by providing advanced tools for automating billing processes, managing subscriptions, and streamlining revenue recognition. These innovations support service providers in integrating billing systems with operational support systems, enabling efficient monetization, improved customer experience, and scalable support for dynamic service models in cloud environments.

In March 2022, Infovista launched Infovista Ativa, a cloud-native suite of applications designed for automated assurance and operations of cloudified, fixed, IP, and wireless networks. Ativa provides CSPs with 360° visibility, predictive automation, and interoperability, replacing fragmented, domain-specific OSS and assurance systems. It supports various use cases, including customer experience analytics, network performance management, IoT assurance, smart CAPEX planning, and predictive SLA management, streamlining network and service management in a unified platform.

In September 2022, Hewlett Packard Enterprise (HPE) partnered with du is a digital innovation company, a subsidiary of Emirates Integrated Telecommunications Company (EITC), to deploy its end-to-end service orchestration software as part of du’s digital transformation. By migrating from a legacy system to a next-generation Operations Support System (OSS), this collaboration aims to enhance du's ability to support new services, improve customer experience, and accelerate time to market.

Top Impacting Factors

Increase in adoption of tailored cloud OSS and BSS solutions

Rise in adoption of tailored cloud OSS and BSS solutions is significantly driving the demand for the North America cloud OSS and BSS market. Telecom providers in the region are increasingly turning to cloud-based platforms to enhance operational efficiency, reduce costs, and scale their services to meet the growing demands of customers. Tailored cloud solutions offer flexibility and customization, allowing operators to address specific business needs while managing complex networks and customer data.

By Component

Small Loan segment is projected as one of the most lucrative segments.

The growing trend toward digital transformation, the deployment of 5G networks, and the need for improved customer experience are key factors propelling this demand. For instance, in February 2024, Ericsson and MTN Group renewed their partnership to continue delivering two key products from the Ericsson Business and Operations Support Systems portfolio, namely Ericsson Charging and Ericsson Mediation. These solutions are integrated with Ericsson Dynamic Activation (EDA) from the Ericsson Network Management portfolio.

By Solution Type

Mid-term Loan segment is projected as one of the most lucrative segments.

The renewed collaboration focuses on modernizing MTN Group’s Business Support Systems (BSS) ecosystem, enhancing it with advanced features and capabilities that support new monetization opportunities and business models, including those related to 5G and the Internet of Things (IoT). In addition, the integration of AI, automation, and data analytics into cloud OSS and BSS platforms helps telecom operators optimize network performance, streamline billing, and offer personalized services. As the market continues to evolve, cloud-native OSS and BSS solutions are becoming integral for telecom providers to stay competitive and drive innovation in service delivery. Therefore, increase in adoption of tailored cloud OSS and BSS solutions is driving the growth of the North America cloud OSS and BSS market.

By Organization Size

Family Travelers segment is projected as one of the most lucrative segments.

Concerns over data privacy

Concerns over data privacy are significantly hampering the growth for the North America cloud OSS and BSS market. As telecom operators increasingly adopt cloud-based solutions for operations and business support systems, they must navigate stringent data privacy regulations, such as GDPR and CCPA. Cloud platforms store vast amounts of sensitive customer data, raising concerns about the security and protection of personal information. Operators are cautious about transferring this data to the cloud due to potential risks such as data breaches, unauthorized access, and non-compliance with privacy laws. These challenges create hesitation in adopting cloud OSS/BSS solutions, as businesses prioritize protecting customer privacy and maintaining regulatory compliance. Therefore, concerns over data privacy are hampering the growth of the North America cloud OSS and BSS market.

By Industry Vertical

Family Travelers segment is projected as one of the most lucrative segments.

Adoption of cloud technologies transforming the telecom industry

Adoption of cloud technologies is transforming the telecom industry and presents a lucrative opportunity for the North America cloud OSS/BSS market. As telecom operators increasingly embrace digital transformation, cloud-based operations support systems (OSS), and business support systems (BSS) are becoming essential for enhancing operational efficiency, scalability, and customer experience. Cloud technologies enable telecom providers to modernize their infrastructure, reduce costs, and accelerate service delivery by leveraging automation, data analytics, and artificial intelligence.

By Type

Family Travelers segment is projected as one of the most lucrative segments.

These capabilities are critical for managing the complexity of modern networks, especially with the deployment of 5G, Internet of Things (IoT), and edge computing. Cloud OSS/BSS solutions provide telecom companies with the flexibility to integrate new services, optimize billing and customer management, and streamline network operations. In addition, the shift to cloud-native systems allows operators to deploy services faster and more efficiently while ensuring higher security and compliance with regulatory standards. As telecom providers continue to invest in cloud technologies to meet the evolving demands of their customers, the North America cloud OSS/BSS market stands to benefit from this transformation, driving growth and innovation in the market. Therefore, rise in adoption of cloud technologies transforming the telecom industry offers lucrative opportunity for the North America cloud OSS and BSS market.

By Country

Family Travelers segment is projected as one of the most lucrative segments.

Key Benefits for Stakeholders

- The study provides an in-depth North America cloud OSS and BSS market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the North America Cloud OSS and BSS market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the North America cloud OSS and BSS market industry.

- The quantitative analysis of the North America cloud OSS and BSS market for the period 2022–2032 is provided to determine the North America cloud OSS and BSS market potential.

North America Cloud OSS and BSS market, by Component Report Highlights

| Aspects | Details |

| By Component |

|

| By Service Type |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Type |

|

| By Country |

|

| By Key Market Players |

|

Analyst Review

The adoption of cloud-native technologies across industries is driving growth in the North America cloud OSS and BSS market. Telecom providers are increasingly utilizing cloud-based OSS and BSS solutions to improve operational efficiency, reduce costs, and scale services to accommodate growing customer demands. For instance, in July 2023, Prodapt, a leading and rapidly growing firm, partnered with Amazon Web Services (AWS) to support communications service providers (CSPs) in accelerating their digital transformation.

As an Advanced Consulting Partner of AWS, Prodapt brings strong expertise in AWS technologies, service delivery, and best practices. This enables Prodapt to leverage its deep capabilities in operations & business support systems (OSS/BSS) and extensive experience in the connectivity sector to enhance the operations and end-user experiences for its mutual customers. In addition, rise in emphasis on personalized and convergent services is driving the demand for integrated billing and operations platforms. As telecom providers aim to offer customized experiences across multiple channels, these platforms enable seamless management of billing, customer data, and service delivery, enhancing operational efficiency and improving customer satisfaction.

Moreover, proliferation of IoT devices further drives the market growth, as managing the data and connectivity of these devices requires sophisticated OSS and BSS solutions. For instance, in February 2024, Ericsson and MTN Group renewed their partnership to continue delivering two key products from the Ericsson Business and Operations Support Systems portfolio, namely Ericsson Charging and Ericsson Mediation. These solutions are integrated with Ericsson Dynamic Activation (EDA) from the Ericsson Network Management portfolio. The renewed collaboration focuses on modernizing MTN Group’s Business Support Systems (BSS) ecosystem, enhancing it with advanced features and capabilities that support new monetization opportunities and business models, including those related to 5G and the Internet of Things (IoT). In addition, rise in emphasis on regulatory compliance and data security is driving telecom operators to adopt advanced cloud-based systems that can meet stringent industry standards. Rise in concerns over data privacy, government regulations, and cybersecurity threats, telecom companies are investing in secure, scalable cloud platforms to ensure compliance and protect sensitive customer information. These cloud-based solutions not only provide enhanced security measures but also offer greater flexibility, allowing operators to efficiently manage data and maintain regulatory adherence while meeting the evolving demands of the digital landscape.

The North America cloud OSS and BSS market is segmented into component, solution type, organization size, industry vertical, type, and country. On the basis of component, the market is divided into solution and service. By solution type, the market is segmented into network planning and design, service delivery, service fulfillment, service assurance, customer and product management, billing and revenue management, network performance management, and others. On the basis of organization size, the market is divided into small and medium-sized enterprises, and large enterprises. By industry vertical, the market is segmented into telecom, and media and entertainment. On the basis of type, the market is divided into OSS and BSS. Country-wise, the North America cloud OSS and BSS market is analyzed across the U.S. and Canada.

Loading Table Of Content...