North America Data Center Cooling Market Statistics, 2025

Data center operators use cooling solutions to maintain temperature in data centers within a permissible limit. Data centers are required to work efficiently 24/7 to process huge chunks of data. In data processing, the equipment dissipates heat energy, which generates the need for cooling to prevent the equipment from damage due to overheating. Air-based and water-based are two types of cooling systems. Through air-based cooling, air is circulated in the data center to maintain the temperature. On the other hand, water-based cooling is further bifurcated into immersion cooling and water-cooled racks where liquid coolants flow across hot components to maintain the temperature. The North America data center cooling market size was valued at $4,020 million in 2017, and is projected to reach $9,177 million by 2025, growing at a CAGR of 11.0% from 2018 to 2025.

Data center cooling is adopted by data center operators due to its eco-friendly, energy-efficiency, and cost-effective nature. There is an increase in the number of data centers due to rise in the use of 4G LTE networks. Therefore, with surge in number of data centers, there is a growing demand for data center cooling solutions to reduce the overall IT cost for data centers.

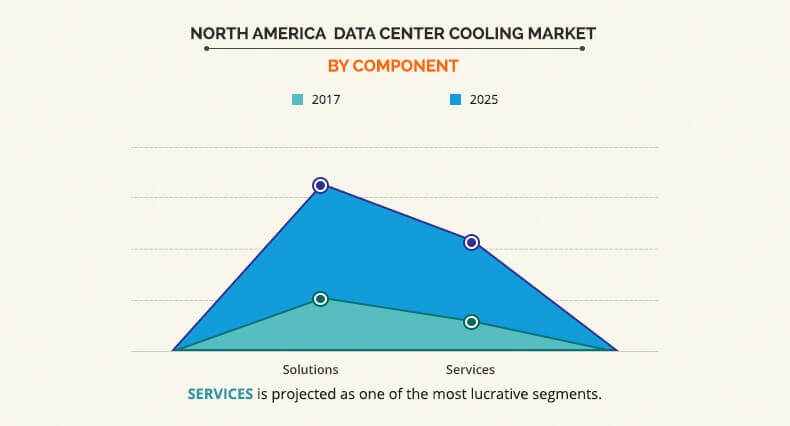

The solution segment dominated the North America data center cooling market share in 2017 due to rise in adoption of energy-efficient, environment-friendly, and cost-effective cooling solutions because of the stringent environmental safety rules imposed by various governments. Air conditioners under solution sub-segment had the largest data center cooling market share due to its energy-efficiency and cost-effectiveness. Therefore, there is a need for efficient cooling with increase in number of data centers and higher density in data centers. Air conditioners with the help of air ducts circulate air in the high-density racks to maintain the temperature within permissible limit. However, services in the component segment witnessed high CAGR in the North America data center cooling market due to increase in number of service providers for installation & deployment, support & maintenance, and consulting for data center cooling solutions. Data center cooling solutions are required to be installed properly as leakages in cooling will lead to damage of equipment.

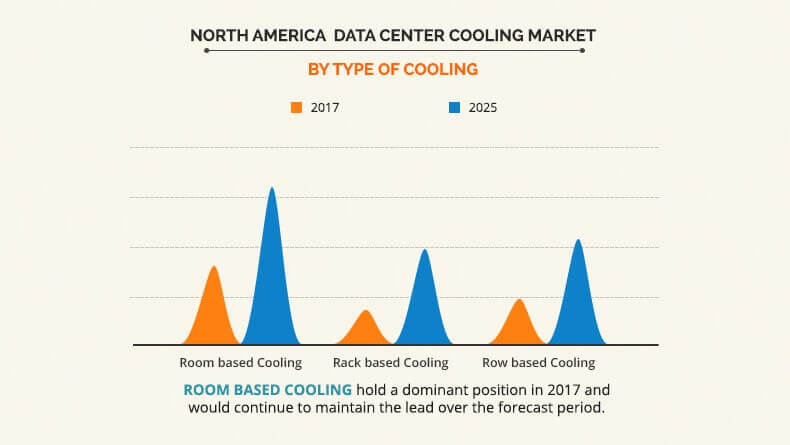

Room-based cooling had the largest North America data center cooling market share in type of cooling segment due to effective cooling at less cost. This type of cooling is anticipated to maintain a large market share due to least use of pipes and ducts compared to other cooling types. Air-conditioners and other air-based cooling circulate air in data centers to maintain temperature within permissible limit. Room-based cooling is gaining ground due to its energy-efficient cooling. However, rack-based cooling is expected to grow at the highest CAGR in the upcoming years due to the extreme density capability. In addition, rack-based cooling reduces the airflow path length of CRAH fan resulting in increased operational efficiency along with being energy efficient. Rack-based cooling is highly recommendable to high-density rack data centers.

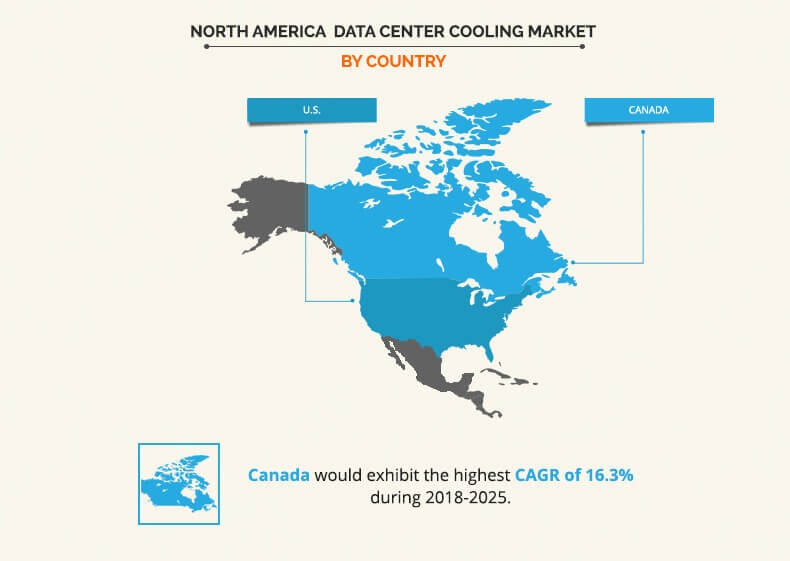

U.S. dominated the overall North America data center cooling market size in 2017 due to the growth in development of hyperscale and colocation facilities with a power capacity of more than 100 MW. Moreover, the larger number of development projects in South-Eastern and South-Western regions, particularly in Virginia & Texas in the U.S. are the largest revenue contributors of the market. Also, introduction of high-performance infrastructure and launch of rack as well as row-based cooling solutions are expected to revolutionize the market over the next few years. However, Canada is expected to witness the highest growth rate during the North America data center cooling market forecast period due to increase in number of datacenters in Canada due to numerous factors which includes low energy costs, political stability, bandwidth and ease of doing business and others are expected to positively affect the market.

The report focuses on the growth prospects, restraints, and North America data center cooling market trends. The study provides Porters five forces analysis of the North America data center cooling industry to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the North America data center cooling market.

Segment Review

The North America data center cooling market is segmented based on component, type of cooling, type of data centers, industry verticals, and regions. In terms of component, the market is bifurcated into solution and service. Based on type of cooling, it is classified into room-based cooling, rack-based cooling, and row-based cooling. Based on type of data centers, it is categorized into enterprise data centers, colocation data centers, wholesale data centers, and hyperscale data centers. In terms of industry vertical, the market is classified into BFSI, manufacturing, IT & telecom, media & entertainment, retail, government & defense, healthcare, energy, and others. Based on the country, it is analyzed across U.S. and Canada.

The report provides North America data center cooling market analysis of key players operating in the market including Schneider Electric Se; Black Box Corporation; Nortek Air Solutions, LLC; Emerson Electric Co.; Hitachi, Ltd.; Rittal GmbH & Co. Kg; Fujitsu Ltd.; Stulz GmbH; Vertiv; and Asetek.

Top Impacting Factors

Increase in the demand for efficient and cost-effective data centers, green initiatives for eco-friendly data center solutions, substantial growth with data center, and power density drive the market growth. However, requirement of specialized infrastructure and higher investment cost and cooling challenges during power outage are expected to hamper the growth during the North America data center cooling market forecast period.

Furthermore, emergence of liquid-based cooling and portable cooling technologies and growth in requirement for modular data center cooling approach are anticipated to provide lucrative opportunities for the North America data center cooling market.

Substantial growth with data center and power density

In recent past, there is an increase in the number of data centers. To increase the performance of the data centers, more processors are being used in a given space which results in increasing density. The requirement of power and cooling has increased along with increase in density. Furthermore, the power density of data centers experiences growth by an average of 1.5 kW per rack, which results in limited air distribution and increased heat generation. In general, the IT equipment typically require between 100 and 160 cfm of air per kW, but in a dense environment it reduces to less than 100, which results in higher heat generation.

Emergence of liquid-based cooling and portable cooling technology

Emergence of liquid-based cooling and portable cooling technology in North America data center cooling market is providing lucrative opportunities for the growth of the data center cooling market. The current trend in IT is to increase server density, which means increasing the power of the chips, placing more chips per rack unit, and filling up the racks as much as possible. Therefore, the rack power has transitioned from a normal 3.5-4 kW to support 60-70 kW per rack, which will generate an enormous amount of heat. Furthermore, it is difficult to move the amount of heat generated with forced air as the fan power and compressor power is unmanageable, which in turn is expected to increase the demand for liquid-based cooling techniques in the enterprise IT data centers.

Cooling challenges during power outage

Power outages are critical in data centers as data centers are required to work efficiently 24/7. Power outage shuts down the cooling systems, which results in shutdown of data center to prevent equipment from any damage. This shutdown results in reduced overall performance and financial risk to the business. It also results in damage of equipment and affect their lifecycle. Therefore, power outage is a key restraint which impedes North America data center cooling market growth. To avoid aforementioned restraint, the data centers should be constructed in areas with almost zero power outage and preferably using renewable source of energy for uninterrupted energy. Secondly, the data centers and its cooling systems should be provided with power backup to avoid the losses.

Key Benefits for North America Data Center Cooling Market:

- This study includes the North America data center cooling market analysis along with the North America data center cooling market forecast, trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities.

- The current market is quantitatively analyzed from 2018 to 2025 to highlight the financial competency of the industry.

- Porters five forces analysis illustrates the potency of buyers & suppliers in the North America data center cooling industry.

North America Data Center Cooling Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Type |

|

| By Type |

|

| By Industry Vertical |

|

| By Country |

|

| Key Market Players | RITTAL GMBH & CO. KG, VERTIV CO., FUJITSU LIMITED, ASETEK, STULZ GMBH, HITACHI, LTD., EMERSON ELECTRIC CO., NORTEK AIR SOLUTIONS, BLACK BOX CORPORATION, SCHNEIDER ELECTRIC |

Analyst Review

Owing to the increase in green initiatives and amid stringent environment regulations from government, data center operators are adopting cooling systems that emit least carbon footprints, thereby driving the growth of the global market. Moreover, data center cooling system manufacturers are introducing innovative products, which use less water while cooling the data centers. For instance, in June 2018, Microsoft has announced an eco-friendly data center that has been lowered into the sea waters near Orkney Island, Scotland, as a part of Phase 2 of Project Natick, which is expected to check the feasibility of systems on the seabed. Moreover, the data center operators are also focusing on using renewable source of energy such as geo-thermal energy to make data center cooling systems energy efficient and eco-friendly. Furthermore, data center operators are focusing to provide modular cooling and portable cooling to data centers present in mild temperature at reasonable pricing. The market is getting competitive with the rise in number of data centers.

Moreover, Canada has become an appealing data center location for number of companies, due to which large, global co-locators with customers based in Europe and Asia, who want to bring operations to North America but need regulations that protect the customer's privacy, are expanding their data center facilities in this region. For instance, according to “Data Centre Risk Index”, Canada is ranked second out of 20 countries, owing to numerous factors that are projected to affect successful data center operations. The North America data center cooling market is highly competitive due to the strong presence of the existing vendors. However, the data center cooling system vendors who have access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the global market requirements. Furthermore, the competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by the key vendors. Some of the major key players profiled in the report include Schneider Electric Se; Black Box Corporation; Nortek Air Solutions, LLC; Emerson Electric Co.; Hitachi, Ltd.; Rittal Gmbh & Co. Kg; Fujitsu Ltd.; Stulz Gmbh; Vertiv; and Asetek.

Loading Table Of Content...