North America Electric Vehicle Battery Market Statistics 2028 -

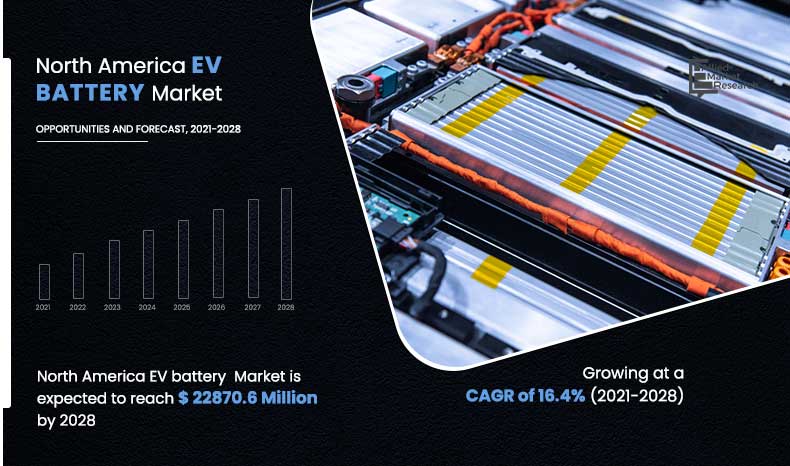

The North America Electric Vehicle Battery valued at USD 7,700.6 million in 2020 and is projected to reach USD 22,870.6 million in 2028, registering a CAGR of 16.4% for the forecast period 2021-2028.

Factors such as rising global pollution levels and depleting fossil fuels have created a demand for the development of sustainable transportation systems. The automotive manufacturers have implemented innovative technologies to tackle the growing concern for environmental sustainability. The electrification of passenger and commercial transport conveyance infrastructure presents a viable eco-friendly opportunity for the automotive industry. The electrification of a vehicle involves replacing conventional power sources namely gasoline and diesel power with an electric energy power source such as batteries. The electric vehicle emits zero emissions and also delivers a highly efficient driving experience.

The rise in innovations and development of advanced battery systems with large power delivery capabilities are the factors attributed to the growth of the North America electric vehicle battery market. The automotive manufacturers have increased the adoption of electric vehicle battery solutions & advancements for reducing greenhouse gas emissions and combating climate change. For instance, General Motors announced plans for investing $1 billion in the installation of electric vehicle manufacturing units in Mexico. The investment comes under the plans of General Motors for making all its vehicle offering electrically powered by 2035. The rising electric vehicle sales throughout North America owing to the presence of market leaders such as Tesla, General Motors, and other electric vehicle manufacturers. The growing electrification for multiple transportation applications also significantly boosts the demand for battery packs in the North American region. For instance, the U.S. government unveiled plans for electrification of the mail trucks of the U.S. Postal Service in May 2021. The electrification will lower the expenses of the U.S. Postal Service department. The factors such as lower operating costs and less pollution associated with electric vehicles supplement the growth of the North America electric vehicle battery market.

The North America electric vehicle battery market is segmented based on battery type, propulsion type, vehicle type, and country. By battery type, it is divided into Lead-Acid battery, Lithium-ion battery, and others. Depending on propulsion type it is fragmented into battery electric vehicles, hybrid electric vehicles, and plug-in hybrid electric vehicles. On the basis of vehicle type, it is classified into passenger cars, light commercial vehicles, heavy commercial vehicles, and two-wheelers. Country-wise, the market is analyzed across the U.S., Canada, and Mexico.

Key players operating in the North America electric vehicle battery market include A123 Systems LLC, ACDelco, American Battery Solutions, Clarios, Emerson Electric Co., EnerSys, Envision AESC Group Ltd., Exide Technologies, Gridtential Energy, Inc., IAI America, Inc., Malema Engineering Corporation, Mitsubishi Electric Corporation, Omron Electronics LLC, Panasonic Corporation, PARKER-HANNIFIN CORPORATION, PARKER-HANNIFIN Corporation Fluid System Connectors Division, PARKER-HANNIFIN Corporation Instrumentation Products Division, PARKER-HANNIFIN Corporation Veriflo Division, Romeo Power, Inc., Samsung Electronics Co., Ltd., and Watlow Electric Company.

Development of low cost and high-performance electric vehicle batteries

The major component of an electric vehicle is a battery which significantly affects the performance and cost of the vehicle. Battery and electric vehicle manufacturers around the world have begun testing and developing low-cost batteries to lower the overall cost of the electric vehicle. The cost per kilowatt-hour is gradually lowering throughout North America owing to the development of new low-cost battery technologies and are arriving at a point where they can match the price of comparable gasoline or diesel-powered vehicles. The identification of cost-effective materials and innovations such as low-cobalt and cobalt-free battery chemistries aids in cutting down the costs of electric vehicle batteries. The research and development activities conducted by the industry leaders have led to the evolution of low-cost and high-performance electric vehicle batteries. For instance, Tesla, the market leader of electric vehicles has developed lithium-iron-phosphate battery solutions. The lithium-iron-phosphate battery solution is projected to lower the cost, extend the vehicle range up to 400 miles and increase the capacity of the batteries to last for as long as 1 million miles. The automotive manufacturers are partnering with battery producers for developing advanced battery technologies. For instance, in March 2020, General Motors launched a modular platform and battery system, Ultium in partnership with LG Energy Solution. The Ultium Batteries and Propulsion System enables a range of up to 400 miles on a full charge and 0 to 60 mph acceleration in 3 seconds. The advanced battery technologies developed by the battery manufacturers are anticipated to increase the industry-wide deployment of the electric vehicle battery. The development of cost-effective solutions and high-performance battery solutions throughout the North American automotive industry is a key driving factor for the growth of the North America electric vehicle battery market.

By Battery Type

Lithium Ion Battery is projected as the most lucrative segment

Increase in public charging infrastructure

The electric vehicle operates for a range varying from 100 miles to 350 miles approximately on a single charge and varies with different driving styles and operating conditions. Electric vehicles require charging stations at workplaces and public destinations for covering long-distance journeys and bolstering the market acceptance. The private automotive fleet companies are installing electric vehicle supply equipment (EVSE) at various. locations for medium and heavy-duty vehicles throughout the North American region. For instance, in May 2021, Nuuve and Stonepeak Infrastructure Partners have announced a joint venture Levo Mobility LLC for accelerating fleet electrification in the United States. The joint venture will focus. on electrifying school buses and installing charging infrastructure across the nation. Government organizations across North America have increased the installation of charging infrastructure in the region. For instance, in October 2020, the National Renewable Energy Laboratory(NREL), operating under the U.S. Department of Energy (DOE) released a report citing that the number of charging stations doubled from December 2015 to December 2019. The report also mentioned that the charging stations per 100,000 people in Vermont and California were 105.3 and 64.0 in December 2015 and December 2019 respectively. The electric vehicle offers a sustainable alternative to IC engine vehicles which motivates the governments in accelerating the deployment of public charging infrastructure. The grants and incentives released by the nations situated in North America, mainly the U.S., support the growth in the installation of electric vehicle charging facilities. For instance, in March 2021, the Alternative Fuel Data Center of the Department of Energy announced that The U.S. passed the milestone of 100,000 public chargers for electric vehicles. In addition, the U.S. government announced a $15 billion investment for building 500,000 charging stations for electric vehicles across the nation. The installation of an extensive network of electric vehicle charging infrastructure across the region is expected to fuel the growth of the North America electric vehicle battery market over the forecast timeframe.

By Propulsion Type

Battery Electric Vehicles is projected as the most lucrative segment

Unstable supply of raw material

The battery manufacturers have to procure multiple raw materials for building a battery. The major raw materials essential for manufacturing automotive batteries are cobalt, lithium, and manganese. The availability of cobalt and lithium is negligible in the North American region as the majority of Cobalt is mined in the Democratic Republic of Congo (DRC) and China. For instance, according to the data published by Cobalt Institute in 2018, 47% of global refining of cobalt took place in China. Besides cobalt, raw materials such as lithium and manganese are also scarce in North America and are largely available in Argentina, Australia, Bolivia, Chile, China, and South Africa which creates an obstacle for acquiring these raw materials for the battery manufacturers located in North American region. For instance, globally, Australia, Chile, and China were responsible for 52.9%, 21.5%, and 9.7% of the production of lithium respectively. The battery manufacturers also face challenges in the procurement of these raw materials owing to the volatility and price variations of the market of electric vehicle battery raw materials caused by the high concentration, metal oversupply, and economic slowdowns in emerging countries such as China. In addition, the trade war between the U.S. and China has also created additional barriers for procuring these raw materials by the U.S. battery manufacturers, as China is one of the largest exporters of these raw materials. The fluctuation in supply of the raw materials required for manufacturing electric vehicle batteries is a major factor expected to restrain the growth of the North America electric vehicle battery market.

By Vehicle Type

Heavy commercial vehicle is projected as the most lucrative segment

Development of battery-as-a-service model

Electric vehicle manufacturers have developed a novel battery-as-a-service business model for increasing the convenience of owning electric vehicles. The manufacturers offer battery asset management services in which the service providers rent battery services to the customer periodically. The rental plan for the battery removes a large amount of cost associated with owning an electric vehicle and facilitates the sales of electric vehicles. Several companies are setting up battery-as-a-service platforms in the region owing to the growing demands for a battery service provider in the North American electric vehicle market. For instance, in March 2021, Ample announced the commencement of testing activities of electric vehicle battery swapping stations in California. The battery swapping stations will recharge the electric vehicle in 10 minutes through its modular battery-swapping system. In addition, battery-as-a-service providers also offer battery maintenance, repair, and logistics services for electric vehicle batteries. For instance, in May 2021, Daimler Trucks North America (DTNA) launched Detroit eConsulting service for planning the customers in navigating the transition towards the electric truck. The service also includes providing assistance for installing energy storage projects, charging infrastructure, solar panels, and other services. Factors such as an increase in the number of both commercial and private electric vehicles have promoted the growth in the adoption of the battery services business model by multiple companies operating in the North American region. The growing battery-as-a-service business model is forecasted to offer an opportunity for the growth of the North America electric vehicle battery market.

By Country

Canada would exhibit the highest CAGR of 19.7% during 2021-2028.

COVID-19 Impact Analysis

- The COVID impact on the North America electric vehicle battery market is unpredictable and it is expected to remain under stress till the second quarter of 2021.

- The COVID-19 outbreak forced governments across the North American region to implement strict lockdowns and made social distancing mandatory to contain the spread of the virus. This led to a sudden downfall in the demand for electric vehicle batteries across the North America.

- Moreover, nationwide lockdowns forced North American electric vehicle battery manufacturing facilities to partially or completely shut their operations.

- Adverse impacts of the COVID-19 pandemic have resulted in delays in activities and initiatives regarding development of innovative electric vehicle battery solutions in the North American region.

Key Benefits For Stakeholders

- This study presents analytical depiction of the North America electric vehicle battery market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall North America electric vehicle battery market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the North America electric vehicle battery market with a detailed impact analysis.

- The current North America electric vehicle battery market is quantitatively analyzed from 2020 to 2028 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Key Market Segments

By Battery Type

- Lead-Acid Battery

- Lithium-Ion Battery

- Others

By Propulsion Type

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicle

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two Wheelers

By Country

- U.S.

- Canada

- Mexico

KEY PLAYERS

- A123 Systems LLC

- ACDelco

- American Battery Solutions

- Clarios

- Emerson Electric Co.

- EnerSys

- Envision AESC Group Ltd.

- Exide Technologies

- Gridtential Energy, Inc.

- IAI America, Inc.

- Malema Engineering Corporation

- Mitsubishi Electric Corporation

- Omron Electronics LLC

- Panasonic Corporation

- PARKER-HANNIFIN CORPORATION

- PARKER-HANNIFIN Corporation Fluid System Connectors Division

- PARKER-HANNIFIN Corporation Instrumentation Products Division

- PARKER-HANNIFIN Corporation Veriflo Division

- Romeo Power, Inc.

- Samsung Electronics Co., Ltd.

- Watlow Electric Company

North America Electric Vehicle Battery Market Report Highlights

| Aspects | Details |

| By BATTERY TYPE |

|

| By PROPULSION TYPE |

|

| By VEHICLE TYPE |

|

| By COUNTRY |

|

| Key Market Players | A123 SYSTEMS LLC, CLARIOS, AMERICAN BATTERY SOLUTIONS, EMERSON ELECTRIC CO., ENVISION AESC Group Ltd., PARKER-HANNIFIN CORPORATION, ENERSYS, Gridtential Energy, Inc., ACDELCO (SUBSIDIARY OF GENERAL MOTORS), .PARKER-HANNIFIN CORPORATION VERIFLO DIVISION, Mitsubishi Electric Corporation, Malema Engineering Corporation, Panasonic Corporation, PARKER-HANNIFIN CORPORATION INSTRUMENTATION PRODUCTS DIVISION, PARKER-HANNIFIN CORPORATION FLUID SYSTEM CONNECTORS DIVISION, .ROMEO POWER, INC., OMRON ELECTRONICS LLC, SAMSUNG ELECTRONICS CO., LTD., WATLOW ELECTRIC COMPANY, IAI AMERICA, INC., EXIDE TECHNOLOGIES |

Analyst Review

The North America electric vehicle battery market is expected to witness significant growth, owing to the development of advanced battery systems and an increase in sales of the electric vehicle.

Development of low-cost and high-performance electric vehicle batteries and increase in public charging infrastructure are expected to drive the North America electric vehicle battery market growth during the forecast period. However, an unstable supply of raw material and safety concerns associated with the battery are anticipated to hamper the growth of the North America electric vehicle battery market during the forecast period. Moreover, the development of the battery-as-a-service model and the rise in adoption of zero-emission electric vehicles are expected to offer lucrative opportunities for the market in the future.

Electric vehicle battery offers a green power supply to propel commercial and passenger vehicles. The electric vehicle battery is a rechargeable power pack and eliminates the need for combustion engines for powering the vehicle. The electric vehicle batteries can be utilized as both primary and secondary power sources in an automobile depending upon the type of vehicle.

The alarming levels of pollution and increase in concerns for climate change are the factors driving the growth of the electric vehicle battery market. The evolution of advanced battery technologies has increased the driving range and decreased the required time to charge a vehicle which further aids in propelling the adoption of an electric vehicle battery in North America. The declining battery prices in the region also is a key factor for increased sales of electric vehicle batteries in North America.

Among the analyzed countries, the U.S. is the highest revenue contributor, followed by Canada. Based on forecast analysis, the U.S. is expected to maintain its lead during the forecast period, owing to an increase in funding for electric vehicle infrastructure development in the country and the presence of big market players such as ACDelco, IAI America, Inc., and PARKER-HANNIFIN CORPORATION, which have a global presence.

The North America Electric Vehicle Battery Market was valued at USD 7,700.6 million in 2020 and is projected to reach USD 22,870.6 million in 2028,

The global north america electric vehicle battery market is projected to grow at a compound annual growth rate of 16.4% for the forecast period 2021-2028.

the U.S. is the highest revenue contributor.

The key players that operate in the north america electric vehicle battery market such as IAI AMERICA, INC., ENERSYS, Malema Engineering Corporation, WATLOW ELECTRIC COMPANY, SAMSUNG ELECTRONICS CO., LTD., ENVISION AESC Group Ltd., PARKER-HANNIFIN CORPORATION, .PARKER-HANNIFIN CORPORATION VERIFLO DIVISION, PARKER-HANNIFIN CORPORATION INSTRUMENTATION PRODUCTS DIVISION, OMRON ELECTRONICS LLC, Mitsubishi Electric Corporation, EMERSON ELECTRIC CO., A123 SYSTEMS LLC, ACDELCO (SUBSIDIARY OF GENERAL MOTORS), PARKER-HANNIFIN CORPORATION FLUID SYSTEM CONNECTORS DIVISION, CLARIOS, AMERICAN BATTERY SOLUTIONS, EXIDE TECHNOLOGIES, .ROMEO POWER, INC., Gridtential Energy, Inc., Panasonic Corporation.

Factors such as rising global pollution levels and depleting fossil fuels have created a demand for the development of sustainable transportation systems. The automotive manufacturers have implemented innovative technologies to tackle the growing concern for environmental sustainability. The electrification of passenger and commercial transport conveyance infrastructure presents a viable eco-friendly opportunity for the automotive industry. The electrification of a vehicle involves replacing conventional power sources namely gasoline and diesel power with an electric energy power source such as batteries. The electric vehicle emits zero emissions and also delivers a highly efficient driving experience.

Loading Table Of Content...