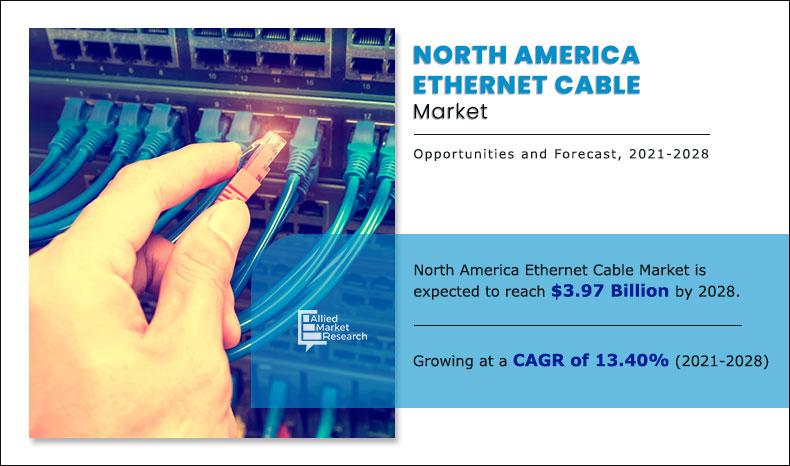

The North America Ethernet cable market size was valued at $1.32 billion in 2019, and is projected to reach $3.97 billion by 2028, registering a CAGR of 13.4% from 2021 to 2028.

Ethernet cable system is an innovative technology used to connect devices through wired local area networks (LANs) or wide area networks (WAN). It is designed to format and transfer data to other devices onto the same local and campus area network to recognize, receive, and process transferred information. Further, Ethernet can evolve and deliver high-level performance while maintaining backward compatibility.

Moreover, new generation Ethernet technology can support operations up to 100 to 400 gigabits per second (Gbps).

Ethernet cable is designed to define two units of transmission: pocket and frame. The frame includes physical media access control (MAC) addresses to both receiver and sender. Further, Ethernet connects routers and modems with different cables with different speeds and standards. For instance, the category CAT 5E cable can handle GbE and Category CAT 6 can support 10 GbE.

The North America Ethernet cable industry is expected to witness growth during the forecast period, owing to rise in adoption of high reliable networks with low-security threats. The North America Ethernet cable market is expected to be driven by surge in demand for Internet of Things (IoT) systems in this region.

Surge in demand for high data transfer technology in commercial and industrial sectors is one of the prime drivers of the North America Ethernet cable market growth. However, growth in wireless technology in North America acts as a key challenge for this market. Further, rise in demand for power over Ethernet technology in the industrial sector is significant for the market growth. Considering these factors, the demand Ethernet cable is expected to provide lucrative opportunities for the market in this region.

The global outbreak of COVID-19 has declined growth rate of various markets in 2020, and the market is expected to witness relatively slow growth till the end of 2021. However, data center has witnessed a massive surge in growth, owing to rise in demand for e-learning, binge television, and high data transfer devices. For other verticals, the market was primarily hit by several obstacles created amid the COVID-19 pandemic in the restriction of import and export of raw material and industrial equipment for manufacturing Ethernet cables. Further, rise in demand for high-speed internet in the residential sector has resulted in rise in demand for the North America Ethernet cable industry.

The North America Ethernet cable market is analysed on the basis of cable category, type, application, and cable structure. On the basis of cable category, it is fragmented into CAT 3, CAT 5, CAT 5E, CAT 6, CAT 6A, CAT 7, CAT 8, and others. The CAT 6A segment dominated the market, in terms of revenue in 2020, and is expected to follow the same trend during the forecast period. On the basis of type, the market is segregated into copper cable and fiber optic cable.

By Cable Category

CAT 7 segment is projected as one of the most lucrative segments.

The copper cable segment dominated the market, in terms of revenue in 2019, however, the fiber optic cable segment is projected to witness significant market share during the forecast period. By application, the market is divided into residential, industrial (transportation, IT & telecom, oil & gas, and energy & power), and commercial (office building, healthcare, and retail). The commercial segment dominated the market, in terms of revenue in 2019, however, the industrial segment is projected to witness significant market share during the forecast period. By cable structure, the market is divided into unshielded twisted pair and shielded twisted pair. The North America Ethernet cable market share of shielded twisted pair accounted for the highest market share in 2020, and is expected to grow at a high CAGR from 2021 to 2028.

Country wise, the North America Ethernet cable market trends are analyzed across the U.S., Canada, and Mexico. U.S is expected to grow at the highest rate during the forecast period. Canada, remains a significant participant in the global supply chain market as organizations in the country are intensely putting resources into the technology, for example, surge in adoption of fiber optic cable technology in residential and commercial sectors.

By Application

Industrial segment is expected to secure leading position during forecast period.

Top Impacting Factors

Significant factors that impact growth of the North America Ethernet cable market include surge in demand for highly reliable network with low security threat, growth in data centers and AI-based technologies, and surge in demand for (PoE) power over Ethernet in the industrial sector. However, high installation cost and growth of wireless technologies acts as a major barrier for adoption of Ethernet cables, which hampers growth of the market. On the contrary, growth in demand for high data transfer technology is anticipated to provide lucrative opportunities for the North America Ethernet cable market during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major North America Ethernet cable market players such as Anixter International, Inc., Belden Inc., Prysmian Group., Nexans SA, Cables-to-Go (CGC), Black Box Corporation, Siemon, Schneider Electric, Siemens AG, and Hitachi are provided in this report.

By Country

Canada would exhibit the highest CAGR of 17.2% during 2021-2028

Key Benefits For Stakeholders

- This study comprises analytical depiction of the North America Ethernet cable market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall North America Ethernet cable market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current North America Ethernet cable market forecast is quantitatively analyzed from 2019 to 2028 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the North America Ethernet cable market.

- The report includes the North America Ethernet cable market share of key vendors and market trends.

North America Ethernet Cable Market Report Highlights

| Aspects | Details |

| By Cable Category |

|

| By Type |

|

| By Application |

|

| By Cable Structure |

|

| By Country |

|

| Key Market Players | SIEMENS AG, SIEMON COMPANY, SCHNEIDER ELECTRIC SE, BELDEN INC., C2G, NEXANS S.A., HITACHI, LTD., ANIXTER INTERNATIONAL INC., PRYSMIAN GROUP, BLACK BOX CORPORATION |

Analyst Review

Ethernet cable technology is a standard system to connect multiple computer applications to a network over a wired connection. Ethernet cable solution offers a simple interface by connecting numerous devices to create a local area network (LAN) or a wide area network (WAN) to transfer data and information. Further, Ethernet cable system is designed to use various protocols to control data transmission by avoiding instant data transmission.

Market players are striving to gain maximum opportunities from growing North America Ethernet cable market by planning their strategies meticulously. Strategic partnership, collaboration, and product launches are some of the prominent strategies adopted by key market players in the North America Ethernet cable market. For instance, Siemens AG, a leading manufacturer of Ethernet cable solutions joined hands with Aruba subsidiary of Hewlett Packard to offer highly reliable, secure, and insightful data network system to end-users.

Market players are expanding their business to new industry verticals by developing new Ethernet cable techniques to reach a new customer base. For instance, French Ethernet cable supplier, Nexans S.A, expanded its business to next-generation innovative FLAMEX Ethernet cable solutions to offer fire-resistant communication cable with the ability to transfer data transmission performance for category CAT 5.

The key players profiled in the report include Anixter International, Inc., Belden Inc., Prysmian Group., Nexans SA, Cables-to-Go (CGC), Black Box Corporation, Siemon, Schneider Electric, Siemens AG, and Hitachi.

Loading Table Of Content...