North America Fire Protection Systems Market Overview:

Advanced technologies, such as smart building, building automation, Internet of Things (IoT), wireless sensory networks, nanotechnology, and human machine interface solutions are being introduced in the fire protection system market. Intelligent sensors with networking capabilities, and sensors and detectors can communicate easily through control units leading to increased efficiency in the fire protection systems.

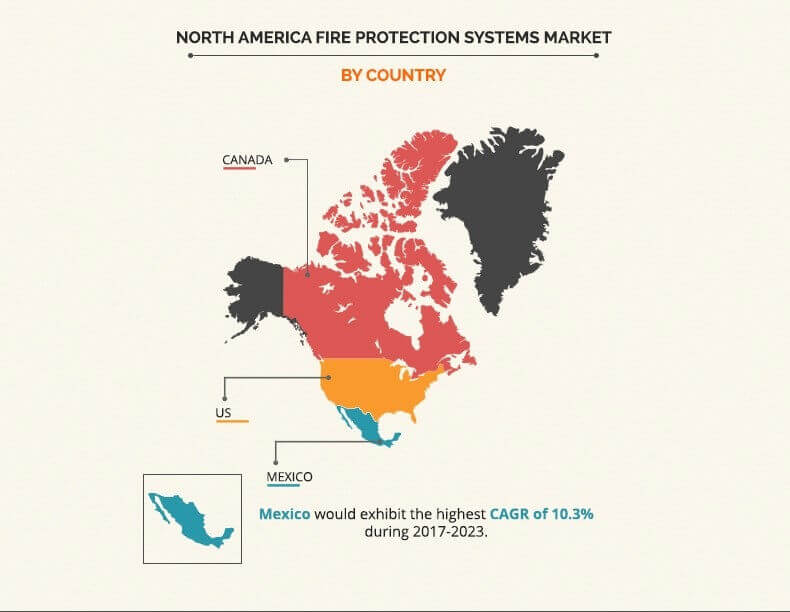

Strict government regulations and infrastructural developments drive the market for North American fire protection systems. As multistory, high rise buildings are in need for fire protection systems, strict fire and safety codes are being implemented to minimize the risks and losses that would be caused by fire. The U.S. and Canada have witnessed major infrastructural developments owing to the high population growth rates in these regions.

Prominent players profiled in the study are Honeywell International Inc., Johnson Controls, Inc., Siemens AG, Orcus Fire & Risk, Inc., Halma PLC, Robert Bosch GmbH, United Technologies Corporation, Amerex Corporation, Gentex Corporation, and HOCHIKI Corporation. Company overview, business performance, strategic moves and developments, and other key points are provided for the aforementioned companies. These players have expanded their market presence by adopting various business strategies such a s acquisition, geographical expansion, product development, strategic alliance, and collaboration.

Segment Review: North America Fire Protection Systems Market

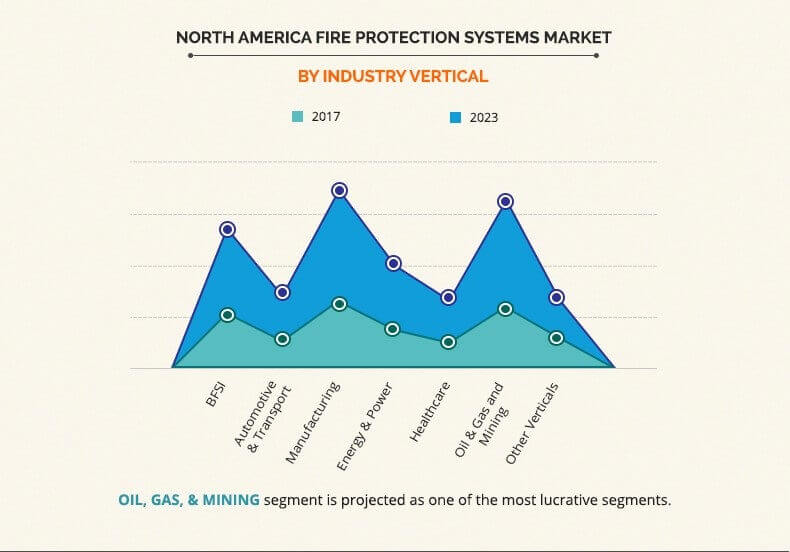

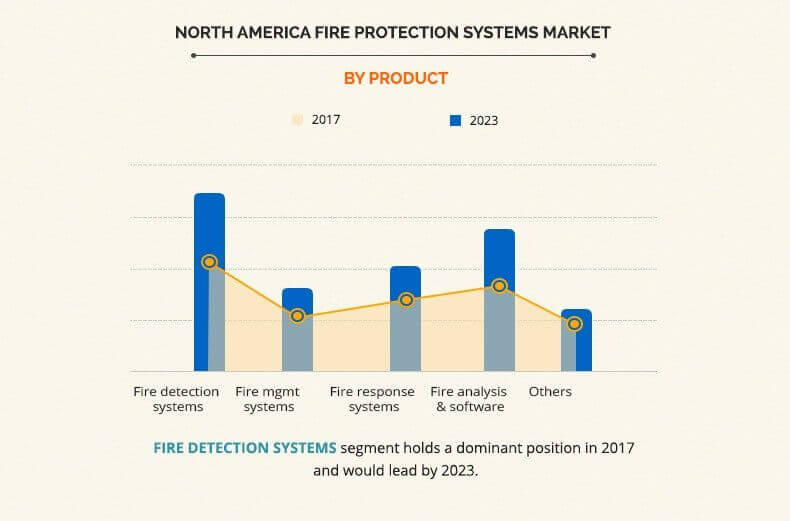

The North American fire protection system market report is segmented based on product, services, industry vertical, and country. The product segment is further sub-segmented into fire detection systems, fire management systems, fire response systems, fire analysis & software, and others. By services, the market is bifurcated into consulting & design services and installation & maintenance services. The fire protection systems are implemented in various industry verticals that include BFSI, automotive & transport, manufacturing, energy & power, healthcare, oil & gas and mining, and other vertical. The North American market is further analyzed across countries such as the U.S., Canada, and Mexico.

The North American fire protection system market is categorized based on product into fire detection systems, fire management systems, fire response systems, fire analysis & software, and others. The fire detection systems segment includes sensors, detectors, and RFID systems. The fire management systems segment includes fire sprinklers and extinguishers. The fire response systems segment covers voice evacuation system, fire alarm devices, and emergency lighting systems. The fire analysis & software segment includes fire mapping, analysis, and simulation software. The other product segment covers control systems and notification systems.

Top Winning Strategies: North America Fire Protection Systems Market

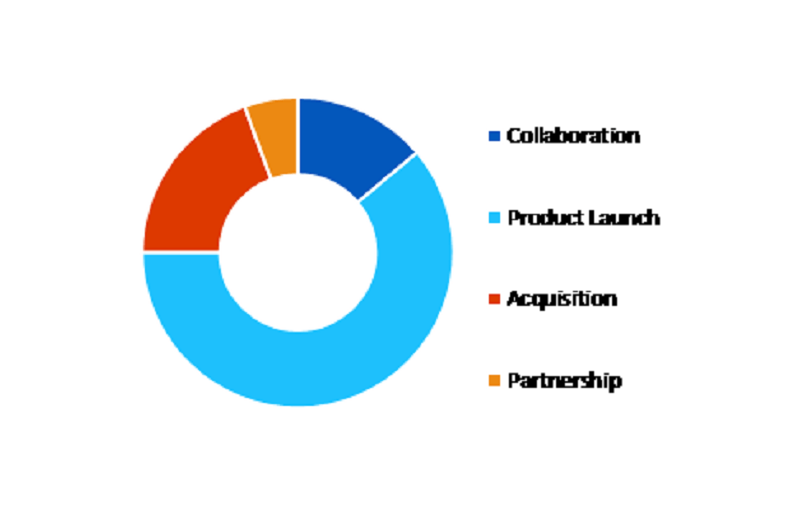

Top winning strategies are analyzed by performing a thorough study of the leading players in the North America fire protection systems market. Comprehensive analysis of recent developments and growth curves of various companies have helped understand the growth strategies adopted by them and their potential effect on the market. The companies are evaluated based on annual reports, SEC filings, and press releases. The key strategies traced from the analysis of recent developments of the key players in the fire protection system market are as follows:

- Agreement: This strategy enhances market players’ capabilities and improves market outreach

- Acquisition: This move is adopted by companies to take ownership stakes of other companies and control it. It also expands owners' geographical presence and cater to new customers as well as them.

- Product Launch: This includes introduction of new and unique rental plans in the market

- Partnership: This strategy is adopted when two or more companies agree to cooperate to advance their mutual interests

- Expansion: These strategies are adopted to enhance product portfolios, effective operations, expand geographical reach, and increase customer base

- Collaboration: This includes two or more companies agree to cooperate each other for a specific purpose or achieving a common goal

Top Winning Strategies, by Development 2015-2017 (%)

Drivers, Restraints, & Opportunities: Fire Protection Systems Market

Need for fire Protection Systems Across Various Industry Domains

Various sectors have witnessed the requirement for fire protection systems, especially industrial, as there is a greater risk of fire hazard in this sector due to the presence of various flammables such as oil and gas, and operations such as mining, fuel, manufacturing, and others. Fire protection systems offer safety and reduce damage and loss that can be caused by fire hazard. Increase in incident of fire and government mandates for workplace safety drive the market for fire protection systems in this region.

Increase in Automation in rEsidential and Commercial Buildings

Integration of fire and safety systems with the automated buildings is critical to save or reduce loss during fire hazard. A fire safety system provides high level of coordination, which is required between the active fire system, building wide communications, and interactive smoke control systems in case of a fire. This system minimizes the loss caused during fire. North America recorded a fire loss of ~14.3 billion in 2015; thus, fire safety is an important and one of the mandatory feature in the upcoming commercial & residential buildings.

Higher Installation & Maintenance Costs

Fire protection systems are more complex as they comprise several additional components, especially the fire detection system. This adds to the system cost and increases the overall cost for the safety system. Owing to such complexity, experienced and skilled professionals are required for installation of the system. Moreover, the maintenance cost is also a concern for these systems. These systems require regular maintenance checks to ensure the functionality of the system and reliability.

Key Benefits for Stakeholders

- In-depth analysis of the North America fire protection systems market along with its dynamics is provided to understand the market scenario.

- Quantitative analysis of the current trends and future estimations from 2017 to 2023 is provided to assist strategists and stakeholders to capitalize on prevailing opportunities.

- Porter’s Five Forces analysis examines the competitive structure of the Fire protection systems market and provides a clear understanding of the factors that influence the market entry and expansion.

- A detailed analysis of the geographical segments enables identification of profitable segments for market players.

- Comprehensive analysis of the trends, sub-segments, and key revenue pockets are provided in the report.

- Detailed analysis of the key players and their business strategies are anticipated to assist stakeholders to take informed business decisions.

- Profile analysis of leading players that operate in the fire protection systems market are provided in the report, which highlight the major developmental strategies such as mergers & acquisitions, expansions, and new product launches adopted by these companies.

North America Fire Protection Systems Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By SERVICES |

|

| By INDUSTRY VERTICAL |

|

| By COUNTRY |

|

| Key Market Players | AMEREX CORPORATION (MCWANE, INC.), JOHNSON CONTROLS INTERNATIONAL PLC, HOCHIKI CORPORATION, HALMA PLC, GENTEX CORPORATION, ROBERT BOSCH GMBH (BOSCH), HONEYWELL INTERNATIONAL INC., ORCUS FIRE & RISK, INC (ORCUS), UNITED TECHNOLOGIES CORPORATION (UTC), SIEMENS AG |

Analyst Review

As per the perspective of CXOs of leading companies, the North American fire protection system market is expected to grow at a promising rate during the forecast period. The government regulations, need for safe and protected commercial and residential spaces, and the reduced infrastructural and monetary loss supplement the market growth across various industry domains. Fire protection systems protect infrastructure from fire losses and help in saving lives. In various industries, organizations need devices such as sensors & detectors, fire alarm systems, control panels, interfaces, and communication devices to install fire protection systems in their premises. The need for real-time data and the advanced analytics for early and reliable fire detection is expected to drive the market growth.

According to the insights of CXOs of leading companies in the fire protection system market, the market is driven by the increase in building automation in commercial and residential structures, technological advancements, and innovations in equipment & networking, increased fire incidents in the region, and strict government regulations for upcoming buildings. However, this growth is restrained due to high monetary expenses for the retrofitting and maintenance of the system.

Manufacturing segment is the dominant one throughout the analysis period, while oil, gas, & mining segment is forecasted to grow at the highest CAGR from 2017 to 2023. Furthermore, fire detection systems segment generated largest share of revenue in 2016 and fire analysis & software segment is projected to dominate the North America fire protection systems market in 2023.

The key market players in the North America fire protection systems market have adopted various strategies, such as product launches, partnerships, business expansions, promotional activities, and strategic alliances, to increase awareness about newer technologies and increase their adoption across various verticals.

Loading Table Of Content...