North America Industrial Brakes Market Overview:

The North America industrial brakes market was valued at $146 million in 2017, and is projected to reach $189.48 million by 2025, growing at a CAGR of 3.4%.

Industrial brakes play a crucial role in mechanical power transmission to deliver mechanical energy to shafts. This aids in facilitating motion in the industrial equipment. The speed of the motion can be controlled and subsequently used to deliver the desired action or processing required in respective application. The brakes help in holding machinery, deploy emergency or dynamic brakes, and maintain tension in pulleys of the equipment. Furthermore, the smooth motion and halt improves the efficiency, accuracy, and safety of the workplace. Thus, the industrial brakes are crucial to industrial requirement and boost the market growth during the forecast period. Moreover, rise in adoption of industrial automation to improve the production capabilities of the manufacturing plant fuel the growth of the market.

Increase in construction and manufacturing activities due to rise in population and growth in industries, such as metals & mining, power generation, construction, entertainment, marine & shipping, and others boost the industry. Furthermore, the brakes deliver a robust performance, which is also expected to fuel the market growth during the forecast period.

Moreover, rise in inclination toward enhanced efficiency and safety of the industrial machineries among the market players is anticipated to drive the North America industrial brakes industry in the coming years. Technology driven motion control solutions involving sensors enabled in brakes can provide lucrative opportunities to the manufacturers.

Segment Overview

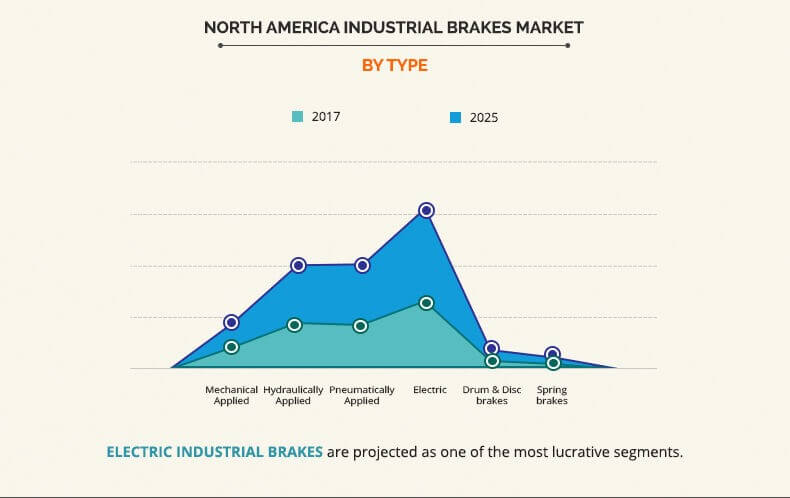

The North America industrial brakes market is segmented based on type, application, end-user industry, and country. Based on type, the market is fragmented into mechanically-applied, hydraulically-applied, pneumatically-applied, electrically-applied, drum & disk brake, and spring brakes. The electric segment is anticipated to dominate the North America industrial brakes market throughout the study period. Based on application, the market is categorized into holding brakes, dynamic & emergency brakes, and tension brakes. The holding brakes segment is projected to dominate the market in future. Based on end-user industry, the market is segmented into manufacturing, metal & mining, construction, entertainment, marine & shipping, and others.

The market is analyzed across North America in countries such as the U.S., Canada, and Mexico. Among these, U.S. the holds a significant share in the North America market, and Mexico is projected to register the highest CAGR.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the North America industrial brakes market with its current & future trends to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the market is provided.

- Porters five forces analysis illustrates the potency of buyers and suppliers operating in the industry.

- The quantitative analysis of the North America market from 2017 to 2025 is provided to determine the market potential.

North America Industrial Brakes Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By END-USER |

|

| By COUNTRY |

|

| Key Market Players | INDUSTRIAL BRAKE MARS, INC., ALTRA INDUSTRIAL MOTION CORP., THE CARLYLE JOHNSON MACHINE COMPANY, LLC., EATON CORPORATION, AKEBONO BRAKE CORPORATION, CHASSIS BRAKES INTERNATIONAL GROUP, DRIVE-LINE INC., OGURA INDUSTRIAL CORP., CARLISLE BRAKE & FRICTION (SUBSIDIARY OF CARLISLE COMPANIES INCORPORATED), MACH III CLUTCH, INC. |

Analyst Review

The industrial brakes play a vital role in manufacturing and processing activities in various industrial verticals. They assist in delivering the desired motion to the machineries and equipment and have applications in holding platforms, applying dynamic brakes, and maintaining tensions in the pulley and other machineries. In 2017, the electrically-applied brake segment held 34.9% market share of the North America industrial brakes market and is expected to dominate the market with highest CAGR during the forecast period owing to its large scope of application and efficient performance. In addition, the increase in mining and construction activities are anticipated to drive the growth of the industrial brakes market during the forecast period.

Industrial brakes in the manufacturing industry accounted for a major share in the North America industrial brakes market in 2017, owing to the widespread adoption and cost-effectiveness of these brakes. By country, Mexico is expected to exhibit the highest growth rate of 4.9% during the forecast period, owing to rise in demand for construction and manufacturing activities driven by the increase in need for consumer goods.

Loading Table Of Content...