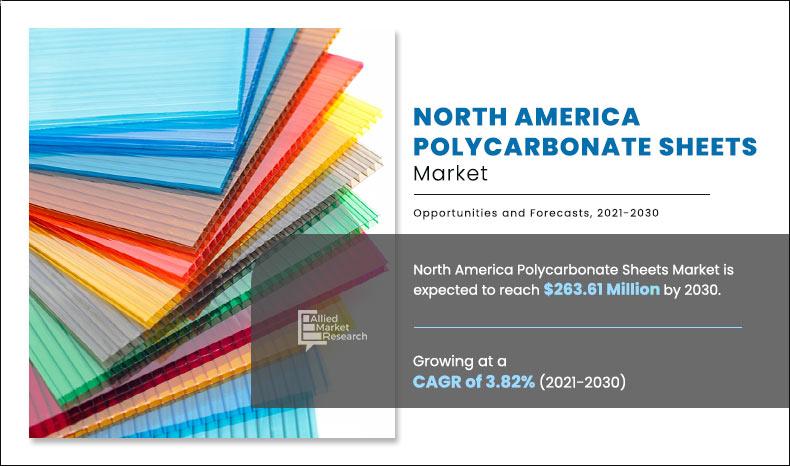

The North America polycarbonate sheets market was valued at $185.98 million in 2020, and is projected to reach $263.61 million by 2030, registering a CAGR of 3.82% from 2021 to 2030.

Polycarbonate sheets are lighter than glass sheets. Their transparency and durability make them an ideal substitute to glasses. Polycarbonate sheets are used in numerous applications such as roofs, eyeglasses, DVDs, CDs, and others. Further, these sheets are used in various industries such as automotive, building & construction, and electrical & electronics. Their properties such as high strength, optical clarity, thermal stability, and exceptional dimensional stability make these sheets the material of choice in the production of electric components, riot shields, headlamp lenses, vandal-proof glazing, baby-feeding bottles, and safety helmets.

The growth of the North America polycarbonate sheets market is driven by growth in automotive industry along with increased demand from the construction sector for roofing application, modern building wall, decoration of commercial building, and others. However, polycarbonate sheets contain bisphenol A, which is not ideal for use in the food industry. In addition, these sheets are not biodegradable, owing to which they are potential threat to the environment. Thus, the negative environmental impact of polycarbonate sheets is predicted to hamper the North America polycarbonate sheets market growth during the forecast period. On the contrary, increase in demand for polycarbonate sheets for building green house is expected to offer lucrative opportunities during the forecast period.

The North America polycarbonate sheets market is segmented on the basis of type, end-use industry, and region. By type, the market is classified into solid, multiwall, corrugated, and others. By end use-industry, the market is categorized into building & construction, electrical & electronics, automotive & transportation, aerospace & defense, packaging, and others. Country wise, the market is analyzed across U.S., Canada, and Mexico. Among the North American countries, the U.S. holds the highest North America polycarbonate sheets market share owing to rise in demand for electric vehicles coupled with the growth in construction and electronics industries.

The key players profiled in the report include COVESTRO AG; Emco Industrial Plastics; Gallina USA; H&F Manufacturing Corp.; PALRAM INDUSTRIES LTD.; SABIC; Sirius Plastics LLC; Spartech; TEIJIN LIMITED; and Ug Plast, Inc. These companies compete for the share of the market through product launch, joint venture, partnership, and expansion of the production capabilities to meet the future demand for the polycarbonate sheets market during the forecast period. For instance, in 2021, SABIC announced ISCC certified LEXAN polycarbonate film & sheet products based on certified renewable feedstock. The new film and sheet product offering connects with the company’s existing TRUCIRCLE initiative and responds to the increase in demand for further sustainable material solutions in an increasingly more circular plastics economy. These products are available worldwide and target demanding applications in different markets, including building & construction, automotive, mass transportation, electrical & electronics, and specialty glazing.

By Country

The U.S. holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

POLYCARBONATE SHEETS MARKET, BY COUNTRY

The U.S. occupies the largest part of the polycarbonate sheets market. The market growth in the country is driven by surge in demand for electric vehicles. In addition, rise in demand from the construction and electronics industries is anticipated to propel the market growth in the coming years.

By Type

Multiwall is projected to be the dominating segment.

NORTH AMERICA POLYCARBONATE SHEETS MARKET, BY TYPE

The multiwall segment dominated the North America polycarbonate sheets market in terms of revenue, in 2020, owing to its properties such as high impact strength, high clarity, and lightweight. Besides, it is widely used in applications such as canopies, displays, conservatories, roof lights, signage, vertical glazing, swimming pool roofs, insulation, walkways, and others.

By End Use Industry

Electrical & Electronics is projected to be the dominating segment.

NORTH AMERICA POLYCARBONATE SHEETS MARKET, BY END-USE INDUSTRY

The electrical & electronics segment hold the highest North America polycarbonate sheets market size, in 2020, owing to growth of electronics industry along with growth in inclination toward smart homes and smart offices environment in the region. Polycarbonate sheet is a promising material for building sensor components, LCD pieces, switching relays, laptops, mobile phones, cables, CDs, and DVDs, owing to its lightweight and high impact properties.

COVID-19 Analysis:

The polycarbonate sheets market witnessed value chain disruption owing to spread of COVID-19 and lockdown in North America. COVID-19 pandemic has led to a decline in demand from myriad of end-use industries such as electrical & electronics, building & construction, automotive & transportation, and other industries, which negatively impacted the polycarbonate sheets market in North America. Further, with the shutdowns of a large part of the automotive industry, the polycarbonate sheets market in the region were negatively impacted during the pandemic. For instance, in America, the 2020 automotive production of about 15 million units represented a 20% share of the global production. The North American region witnessed production declining by over 20%, with U.S. production plunging by 19%. However, with the COVID-19 vaccination campaign across the region and as the economies are getting stable, there is growth in the demand from end-use industries, which in turn is anticipated to augment the demand for polycarbonate sheets in the region.

Key benefits for stakeholders

- This report provides a detailed quantitative analysis of the current North America polycarbonate sheets market trends and estimations from 2020 to 2030, which assists to identify the prevailing opportunities.

- An in-depth analysis of polycarbonate sheets market across North America is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the market is provided.

- Country-wise market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2021 to 2030 in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the North America polycarbonate sheets market.

North America Polycarbonate Sheets Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End-use industry |

|

| By Country |

|

| Key Market Players | Ug Plast, Inc., Sirius Plastics LLC, H&F Manufacturing Corp., Gallina USA, PALRAM INDUSTRIES LTD., Emco Industrial Plastics, TEIJIN LIMITED, SABIC, COVESTRO AG, Spartech |

Analyst Review

Increased demand for the product roofing system and growth in automotive industry are some of the key factors that drive the growth of the North America polycarbonate sheets market. Their properties such as high strength, optical clarity, thermal stability, and exceptional dimensional stability make these sheets material of choice in the production of electric components, riot shields, headlamp lenses, vandal-proof glazing, baby-feeding bottles, and safety helmets. However, negative environmental impacts of polycarbonate sheets are anticipated to hamper the market growth.

The U.S. is the dominating country in the North America polycarbonate sheets market. The primary factor that propels the development of the polycarbonate sheets market is the rise in demand for electric vehicles. Further, the heightened demand from the construction industry is anticipated to drive the market. In the construction sector, polycarbonate sheets find broad applications. Hurricane shutters employing multiwall sheets as well as corrugated sheets offer solution for translucent, building envelope protection in the country. Besides, security and safety window glazing utilizing polycarbonate monolithic solid sheets deliver excellent protection.

The increased demand for the product roofing system and the growth in automotive industry are the key factors boosting the north america polycarbonate sheets market growth.

The North America polycarbonate sheets market was valued at $ 185.98 million in 2020, and is projected to reach $ 263.61 million by 2030, registering a CAGR of 3.82% from 2021 to 2030.

The most established players of the North America polycarbonate sheets market include COVESTRO AG; Emco Industrial Plastics; Gallina USA; H&F Manufacturing Corp.; PALRAM INDUSTRIES LTD.; SABIC; Sirius Plastics LLC; Spartech; TEIJIN LIMITED; and Ug Plast, Inc.

Electrical & electronics is projected to increase the demand for north america polycarbonate sheets

Type and end-use industry segments are covered in north america polycarbonate sheets market report

Growth in automotive industry along with increased demand from the construction sector for roofing application, modern building wall, decoration of commercial building, and others is the main driver of north america polycarbonate sheets market

Electrical & electronics applications are expected to drive the adoption of north america polycarbonate sheets market

The polycarbonate sheets market witnessed value chain disruption owing to spread of COVID-19 and lockdown in major manufacturing countries. COVID-19 pandemic has led to a decline in demand from myriad end-use industries such as electrical & electronics, building & construction, automotive & transportation, and other industries, which negatively impacted the polycarbonate sheets market in North America. However, with the COVID-19 vaccination campaign across the region and as the economies are getting stable, there is growth in the demand from end-use industries, which in turn is anticipated to augment the demand for polycarbonate sheets in the region.

Loading Table Of Content...