The North America Polyurea Coatings Market is expected to reach a value of $270.6 million by 2032.

Polyurea coatings are a class of protective coating materials produced when amines and isocyanates are combined. This chemical process produces a flexible and long-lasting elastomeric coating with various uses. In addition, these coatings are extensively employed in various industries, such as construction, transportation, oil & gas, and automotive applications, for waterproofing, corrosion protection, industrial flooring, and other protective coating needs. Polyurea coatings have distinct properties such as high tensile strength, flexibility, resilience to chemicals and environmental conditions, fast cure times, and great abrasion resistance.

The surge in the building and construction activities is poised to drive significant expansion in the North America polyurea coatings market.

The expansion of the polyurea coating market in North America is majorly driven by the expansion of the building and construction industry. New residential, commercial, and infrastructure developments are in higher demand as urbanization and population growth increase. In January 2023, the Federal Highway Administration (FHWA) announced that bridge infrastructure renovations in the U.S. will cost $2.1 billion. The $2.1 billion program is a portion of the national government's significant commitment to funding the nation's highway bridge repairs.

Polyurea coatings have become essential, protecting and extending the lifespan of many types of structures. Concrete surface protection is one of the main uses of polyurea coatings in the construction industry. These coatings are used to protect structures from environmental deterioration and extend their lifespan owing to their remarkable qualities, including fast curing, high tensile strength, and resistance to water, chemicals, and abrasion.

According to the Associated General Contractors (AGC) of America, Inc., in the first quarter of 2023, there were more than 919,000 construction establishments in the U.S. The business generates structures valued at around $2.1 trillion annually and employs 8.0 million people. Polyurea coatings are widely used in many different applications, including waterproofing, bridge decks, parking structures, flooring, and roofing. The coatings reduce the possibility of structural damage by serving as a strong barrier against moisture, corrosion, and severe weather.

In addition, as building projects are frequently time-sensitive, the expedited cure time of polyurea coatings helps to ensure efficient project timetables. The adaptability of polyurea formulations allows for smooth application on a variety of surfaces and configurations, providing architects and builders with a flexible solution for a wide range of construction-related problems. Thus, surge in the building and construction activities is expected to drive the growth of North America polyurea coating market.

The surge in the application of lining systems for environmental preservation is poised to drive significant expansion in the North America polyurea coatings market.

The increased application of lining systems for environmental preservation, especially in industries such as landfill management, is projected to propel the need for polyurea coatings in North America. Landfills present serious environmental problems due to the possibility of hazardous waste leaching into the groundwater and soil. Strict guidelines enforced by regulatory bodies to combat this environmental concern require the installation of strong lining systems for containment.

Polyurea coatings are ideal material for environmental protection owing to their exceptional chemical resistance and impermeability. These coatings function as an effective barrier to stop pollutants from seeping into the surrounding environment. The quick-curing property of polyurea accelerates the application process even further, in keeping with the immediate need for environmental control measures. It is projected that polyurea coatings will become much more necessary as regulators focus on establishing complete waste containment systems in place.

Furthermore, polyurea coatings are versatile for use in various environmental protection applications outside of landfills, including wastewater treatment facilities, industrial spill containment, and secondary containment for chemical storage. Thus, rise in the use of lining systems is expected to boost the North America polyurea coating market during the forecast period.

However, high cost of polyurea coating restrains the growth of the North America polyurea coating market. Polyurea coatings are an effective choice for many applications, especially in demanding industrial and infrastructure projects, due to their excellent durability, chemical resistance, and short cure times. The cost of producing polyurea coatings is significantly higher, mostly because isocyanates and other essential raw materials are expensive.

An important part of polyurea formulations, isocyanates have an important function in the total cost structure. The price volatility of these materials may be attributed to various sources, including fluctuations in the market demand, disruptions in the supply chain, and changes in regulations. Polyurea coatings have a higher initial cost, which may discourage certain end users from using the technology and reduce its market share relative to less expensive options. Thus, high cost of polyurea coating is expected to hinder the market growth in North America.

The production of polyurea coatings has seen significant technological developments in North America. The main objectives of manufacturing process advancements have been to improve polyurea coating performance, environmental sustainability, and efficiency. North American manufacturers have made R&D investments to produce new polyurea precursors with higher chemical characteristics that enable increased resistance to abrasive environments, flexibility, and adhesion. As a result, coatings have been developed that suit the demanding needs of a wide range of industrial applications and offer better protection against corrosion, wear, and chemical exposure.

Moreover, developments in formulation chemistry have produced hybrid polyurea coatings, which combine the benefits of polyurea with those of other polymers or additives to produce coatings with specific characteristics. These hybrids are appropriate for certain uses where traditional polyurea coatings might not be sufficient since they can provide special combinations of flexibility, hardness, and chemical resistance. Thus, technological advancements present lucrative opportunities for the expansion of North America polyurea coating market.

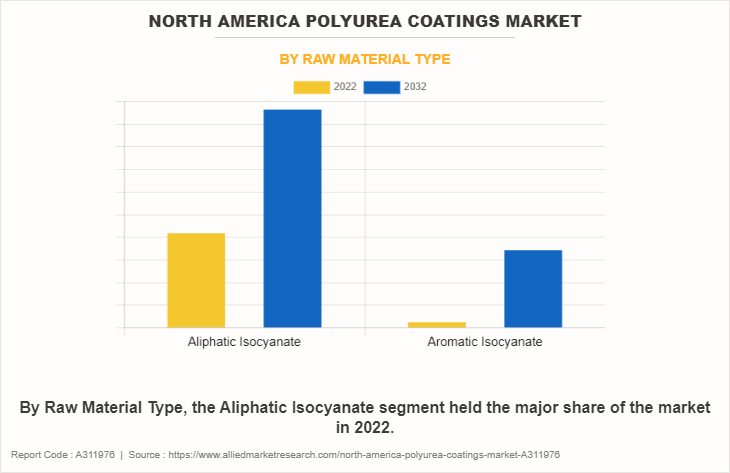

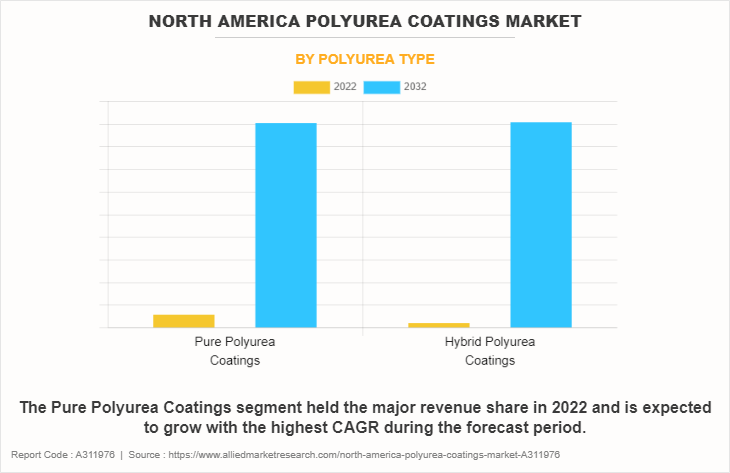

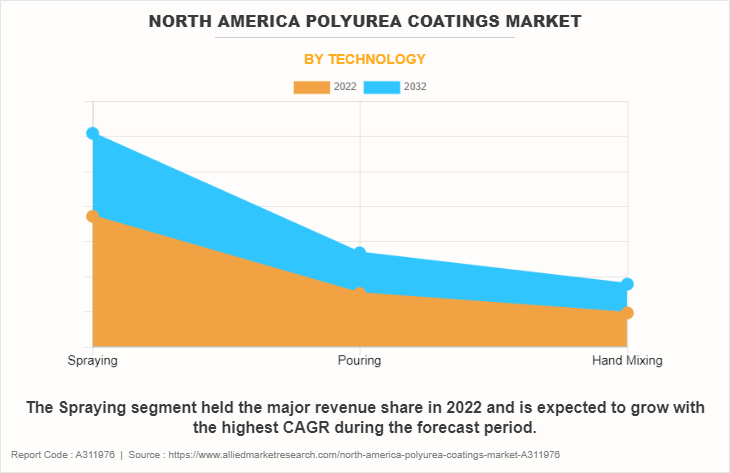

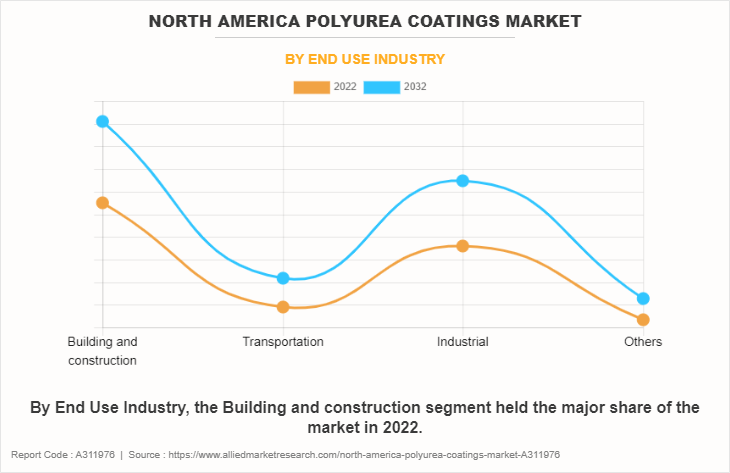

The North America polyurea coating market is segmented into raw material type, polyurea type, technology, end-use industry, and country. By raw material type, the market is divided into aliphatic isocyanate and aromatic isocyanate. On the basis of polyurea type, it is bifurcated into pure polyurea coatings and hybrid polyurea coatings. Depending on technology, the market is categorized into spraying, pouring, and hand mixing. By end-use industry, it is classified into building and construction, transportation, industrial, and others. Country wise, the market is studied across U.S., Mexico, and Canada.

The aliphatic isocyanate segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 4.1%. This can be attributed to its excellent UV stability, weather resistance, and color retention properties. These characteristics make it a preferred choice for outdoor applications, providing durable protection against environmental factors. Industries such as construction, automotive, and infrastructure benefit from their versatile and reliable performance.

The pure polyurea coatings segment accounted for the largest share in 2022 owing to its unmatched versatility, rapid curing, and seamless application. Offering a durable, elastic, and chemical-resistant protective layer, it is extensively employed across industries. Its effectiveness in providing long-lasting protection against diverse environmental factors contributes to its dominance in the market.

The hybrid polyurea coatings segment is expected to register the highest CAGR of 4.1% due to its unique combination of polyurea and polyurethane properties. This results in enhanced flexibility, abrasion resistance, and prolonged durability, making it a preferred choice for various applications, contributing to its dominance in the market

The spraying segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 4.2%. This can be attributed to its efficiency and versatility. The method allows for quick and uniform application over various surfaces, facilitating seamless protection. Its ease of use supports large-scale projects, making it the preferred choice in industries such as construction, infrastructure, and manufacturing for its cost-effective and time-saving benefits.

The building and construction segment accounted for the largest share in 2022 due to the polyurea coatings' exceptional protective properties. Offering durability, chemical resistance, and waterproofing, they are vital for applications like roofing, flooring, and infrastructure. The construction industry relies on polyurea coatings for long-lasting and reliable protection against environmental factors.

The industrial segment is expected to register the highest CAGR of 4.2% due to the increasing demand for robust protective solutions. Polyurea coatings exhibit superior resistance to chemicals, abrasion, and corrosion, making them essential for industrial applications like pipelines, tanks, and machinery. This drives their widespread adoption and growth within the industrial sector.

U.S. garnered the largest share in 2022. This can be attributed to its robust industrial base, extensive infrastructure development, and high demand across various sectors. The country's advanced automotive, construction, and manufacturing industries contribute to the dominant position, driving the widespread use of polyurea coatings for diverse applications.

The major players operating in the North America polyurea coating market are ArmorThane, Canadian Polyurea, Huntsman International LLC, Iron Man Coatings. Inc., MARVEL COATINGS, Nukote Coating Systems, PPG Industries, Inc., Rhino Linings Corporation, Specialty Products Inc., and The Sherwin-Williams Company.

Strategic Developments Undertaken By Key Players

In January 2021, PPG Industries, Inc. acquired VersaFlex, a manufacturer of epoxy, polyurea, and polyurethane coatings for industrial applications, transportation infrastructure, water and wastewater infrastructure, and flooring. PPG's current product portfolio will be enhanced and complemented by VersaFlex's appealing industry mix, robust growth outlook, distinctive product offering, extensive experience, and manufacturing capabilities in polyurea and flooring coatings.

In October 2020, PPG Industries, Inc. launched the SANISHIELD 3000/5000 two-part polyurea coatings system for walls and ceilings in industrial settings, including food and beverage facilities, where easy maintenance and fast installation are essential. The PPG SaniShield coating technique improves surface integrity and longevity by filling small breaches in the substrate material, offering an alternative to fiberglass and stainless-steel wall and ceiling systems. It provides outstanding gloss retention on a clean, white surface. This product launch will boost the demand for polyurea coatings, leading to market growth.

Historic Trends

- Over the years, there has been a consistent increase in the demand for polyurea coatings in North America. This demand is driven by various industries, including construction, automotive, industrial, and infrastructure.

- Ongoing research and development have led to technological advancements in polyurea coating formulations. Manufacturers have been focusing on improving the performance characteristics of polyurea coatings, such as durability, flexibility, and chemical resistance.

- Polyurea coatings have found diverse applications across different sectors, including protective coatings for concrete structures, waterproofing, tank linings, and bed liners for trucks.

- Growth in infrastructure projects, such as bridges, highways, and commercial buildings, has contributed to the demand for protective coatings like polyurea.

- The industry has seen an increasing emphasis on environmentally friendly formulations, leading to the development of low-VOC and eco-friendly polyurea coatings.

- The market has witnessed some consolidation with mergers and acquisitions among key players, aiming to strengthen their market presence and expand their product portfolios.

- Competition among manufacturers has intensified, with companies striving to differentiate themselves through product innovation, quality, and strategic partnerships.

- Adherence to environmental regulations and standards has become a significant factor influencing product development and market strategies.

- Fluctuations in raw material prices, particularly those of isocyanates, a key component in polyurea formulations, have impacted the market dynamics.

- Economic conditions, both globally and regionally, have influenced the construction and industrial sectors, thereby affecting the demand for polyurea coatings.

Key Benefits For Stakeholders

- The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities.

- Major countries are mapped according to their revenue contribution to the north america polyurea coatings market.

- In-depth analysis of the north america polyurea coatings market segmentation assists to determine the prevailing market opportunities.

- Identify key players and their strategic moves in north america polyurea coatings market.

- Assess and rank the top factors that are expected to affect the growth of north america polyurea coatings market.

- Analyze the market factors in various countries and understand business opportunities.

- Player positioning provides a clear understanding of the present position of key market players.

North America Polyurea Coatings Market, by Raw Material Type Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 270.6 million |

| Growth Rate | CAGR of 4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 120 |

| By Raw Material Type |

|

| By Polyurea Type |

|

| By Technology |

|

| By End Use Industry |

|

| By Country |

|

| Key Market Players | Dow Chemical Company, The Sherwin-Williams Company, Akzo Nobel N.V., BASF SE, PPG Industries, Inc., Covestro AG, Rhino Linings Corporation, Specialty Products, Inc., VersaFlex Incorporated, Huntsman Corporation |

The North America Polyurea Coatings Market is estimated to reach $270.6 million by 2032

BASF SE, The Sherwin-Williams Company, PPG Industries, Inc., Huntsman Corporation, Dow Chemical Company, Akzo Nobel N.V., Covestro AG, Rhino Linings Corporation, Specialty Products, Inc., VersaFlex Incorporated are the leading players in North America Polyurea Coatings Market

1. The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities. 2. Major countries are mapped according to their revenue contribution to the north america polyurea coatings market. 3. In-depth analysis of the north america polyurea coatings market segmentation assists to determine the prevailing market opportunities. 4. Identify key players and their strategic moves in north america polyurea coatings market. 5. Assess and rank the top factors that are expected to affect the growth of north america polyurea coatings market. 6. Analyze the market factors in various countries and understand business opportunities. 7. Player positioning provides a clear understanding of the present position of key market players.

North America Polyurea Coatings Market is classified as by raw material type, by polyurea type, by technology, by end use industry

Loading Table Of Content...

Loading Research Methodology...