North America Protective Clothing Market Research - 2027

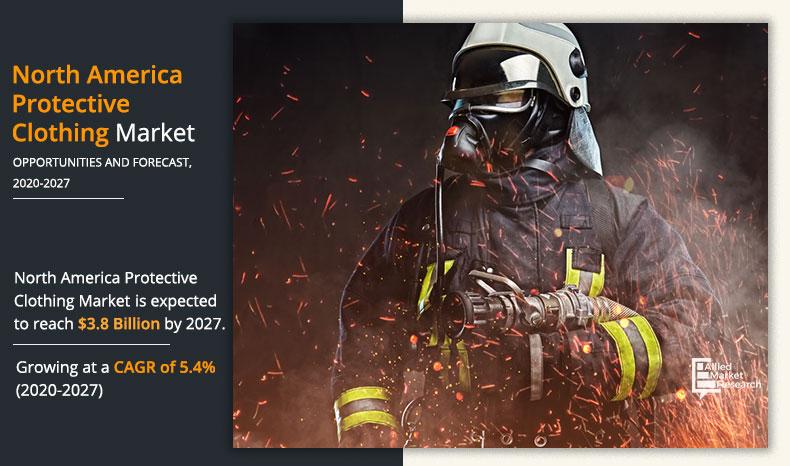

The North America protective clothing market was valued at $2.9 billion in 2019, and is projected to reach $3.8 billion by 2027, growing at a CAGR of 5.4% from 2020 to 2027.

Protective clothing protects from hazardous or risky conditions that can be life frightening. They are developed to safeguard the worker from coming in contact with unfavorable elements of the working environment. Based on industry, the industrial protective wear can be heat repellent, chemical resistant, cold resistant, mechanical resistant, and others.

The North America protective clothing market is expected to witness growth, owing to rise in concerns regarding the safety of workers around various sectors. The presence of a well-established manufacturing sector and skilled workforce is also one of the factors propelling the market growth. However, factors such as high investment in R&D activities and high prices of protective clothing are anticipated to hinder the North America protective clothing market growth. On the contrary some of the positives of COVID-19 outbreak on the market are upsurge in demand from pharmaceutical sectors, owing to rise in R&D activities for vaccine development.

The North America protective clothing market is segmented on the basis of material type, application, and region. By material type, the market is divided into aramid & blends, polyolefin & blends, polybenzimidaloe (PBI), cotton fibers, laminated polyesters, and others. On the basis of application, it is divided into thermal, mechanical, chemical, biological/radiation, and others. On the basis of end-use industry, the market is studied across oil & gas, construction &manufacturing, pharmaceuticals/medical military & defense, firefighting, and others. Based on the country, the market is analyzed across U.S., Canada, and Mexico. North America protective clothing market share is analyzed for all segments and countries.

The North America protective clothing market analysis covers in-depth information of the major industry participants. Some of the major players in the protective clothing market include Ansell Limited, DuPont, Glen Raven Inc., Kimberly Clark Corp, Koninklijke Ten Cate NV, Lakeland Industries, Inc., Teijin Ltd., VF Corporation, W.L. Gore & Associates, and 3M Company.

Other players in the value chain of the North America protective clothing market include FallTech, Moldex-Metric, Inc., NASCO Industries, Inc., OccuNomix International LLC, HexArmor, and Ironwear.

The key players are adopting numerous strategies such as product launch, business expansion, acquisition, partnership, collaboration, and agreement to stay competitive in the North America protective clothing market.

For instance, Lakeland industries launched a new line of apparel named Linemen. It offers exceptional athletic fit with high-performance fire resistance (FR) attributes, breathability & moisture-wicking technology, multi-weight fabrics for optimal layering effectiveness, and others. This product launch enhanced its current product layering system specifically designed for electrical utility linemen.

Furthermore, DuPont launched a personal protection garment named Nomex. It is used in numerous end-user industries such as oil & gas, utilities, and manufacturing industries. This product provides workers with flame-resistant (FR) and arc-rated (AR) protection. This product launch reinforced its product portfolio.

By Material Type

Aramid & Blends is projected as the most lucrative segment.

North America Protective Clothing Market, by Material Type

By material type, the aramid & blends segment garnered the highest share in the market in 2019. Aramids are widely used in protective clothing as they have excellent mechanical properties as compared to steel or glass fiber of the same weight, and are also resistant to heat and flame.

By Application

Thermal is projected as the most lucrative segment.

North America Protective Clothing Market, by Application

By application, the thermal segment garnered the highest share in the market in 2019, owing to increase in demand for durable and breathable flame-resistant clothing from various sectors such as oil and gas, firefighting, and others. For instance, the U.S. is one of the major countries that face annual forest fires in its places such as California, Colorado, Washington, Arizona, Idaho, and Oregon among others, which surges the adoption of thermal protective clothing from the firefighting sector. In addition, stringent fire safety regulations and guidelines for minimizing fire hazard in the industrial space also boost the demand for the North America thermal protective clothing market.

By End-use Industry

Pharmaceutical/Medical is projected as the most lucrative segment.

North America Protective Clothing Market, by End-Use Industry

By end-use industry, the pharmaceutical/medical segment is expected to witness the fastest growth for protective clothing. Increase in standards of medical hygiene has triggered the need for protective clothing in the U.S. and Canada.

By Country

U.S. holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

North America Protective Clothing Market, by Country

Region wise, the U.S. witnessed rapid growth in the North America protective clothing market in 2019, owing to rise in stringent regulation for safety of workers across sectors such as oil & gas, construction, and others. In addition, the usage of protective clothing in the North America region is increasing owing to the rising trends toward multi-functional clothing with high mechanical and chemical resistivity.

Key Benefits For Stakeholders

- The North America protective clothing market forecast is studied from 2020 to 2027.

- The report provides an in-depth analysis of the market along with the current and future market trends.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building

- The qualitative data in this report aims on market dynamics, North America protective clothing market trends, and developments.

- A comprehensive analysis of the factors that drive and restrain the North America protective clothing market growth is provided.

- The North America protective clothing market size is provided in terms of revenue.

North America Protective Clothing Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Application |

|

| By End Use Industry |

|

| By Country |

|

| Key Market Players | GLEN RAVEN INC., 3M COMPANY, VF CORPORATION, DUPONT, ANSELL LIMITED, KONINKLIJKE TEN CATE NV, KIMBERLY CLARK CORP, LAKELAND INDUSTRIES, INC., W. L. GORE & ASSOCIATES INC., TEIJIN LTD. |

Analyst Review

According to the perspective of the CXOs of leading companies, the factors that drive the demand for protective clothing in North America in various end-use industries include increase in concern toward safety of workers coupled with stringent governmental regulations, and others. In addition, extensive investments in R&D is leading to development of new products and makes way for new applications; thereby, boosting the market growth. The U.S. is the dominant country in the usage of protective clothing in the North America region owing to the growing trends toward multi-functional clothing with high mechanical and chemical resistivity. Moreover, growing concern for safety of patients, doctors, and other healthcare professionals augmented the demand for protective clothing even in the medical and healthcare sector. However, factors such as high price of protective clothing and a constant threat of substitution are expected to hamper the market growth during the forecast period.

Factors contributing towards North America protective clothing market growth are stringent governmental regulations in the U.S. regarding the safety of workers across numerous sectors, industrial growth in Mexico, and others.

The market value of North America protective clothing market in 2019 was $2.9 billion in 2019, and is projected to reach $3.8 billion by 2027, growing at a CAGR of 5.4% from 2020 to 2027.

Ansell Limited, Du Pont, Glen Raven Inc., VF Corporation, and 3M Company are some of the top companies in North America protective clothing industry.

Increase in demand for phase change materials and multifunctional clothing is expected to create lucrative opportunities in the North America protective clothing market

Firefighting and Pharmaceutical/Medical industries are expected to increase the demand for protective clothing in boost the North America protective clothing market.

On the basis of application thermal and on the basis of end-use industry pharmaceutical/medical is the most influencing segment growing in the North America protective clothing market.

Stringent Government Regulation for safety across several end-use industries is the main driver of North America protective clothing market.

Thermal and biological applications are expected to drive the adoption of protective clothing in North America protective clothing market.

The COVID-19 has impacted numerous sectors such as construction; oil and gas and others which expected to impact the demand for protective clothing in North America and hinder the North America protective clothing market in 2020.

Loading Table Of Content...