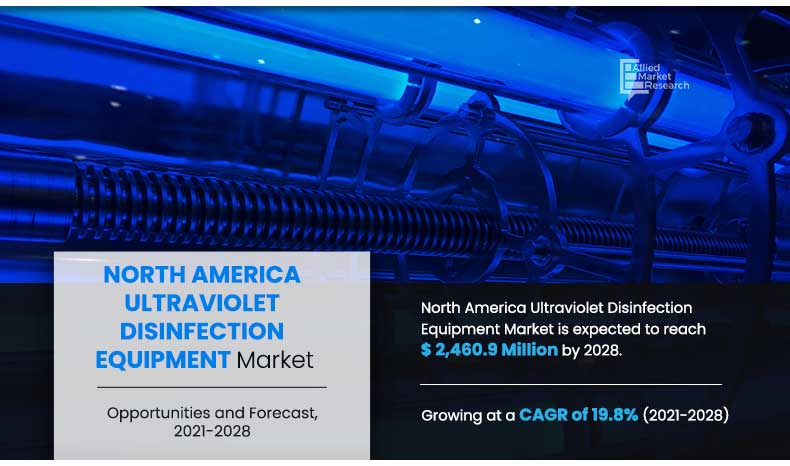

The North America ultraviolet disinfection equipment market size was valued at $565.4 million in 2020, and is projected to reach $2,460.9 million by 2028, growing at a CAGR of 19.8% from 2021 to 2028.

UV disinfection equipment is the collection of instruments and components that make up the UV disinfection system. The equipment in this category is utilized in a variety of applications, including water treatment, industrial equipment cleaning, device cleansing, and others. It is a chemical-free disinfectant process that involves exposure to ultraviolet rays helping in the removal of any unwanted bacteria or infections.

Ultraviolet disinfection uses short-wavelength ultraviolet light to kill bacteria by destroying their nucleic acids and disrupting their DNA. Microorganisms are rendered inactive as a result of the process, and are unable to conduct essential biological tasks. Ultraviolet disinfection equipment disinfects water by putting LEDs, lamps, or bulbs in close proximity to it. The COVID-19 pandemic has impacted the UV disinfection equipment market, resulting in higher shipments of UV disinfection equipment and related components, as well as higher revenues. This is projected to expand in the coming years as the demand for surface disinfection rises due to rising health concerns. In addition, the extensive usage of UV disinfection equipment for disinfecting hospitals and medical institutions is one of the primary factors influencing the growth of the UV disinfection equipment market.

The North America ultraviolet disinfection equipment market is segmented on the basis of end-use industry, application, component, and marketing channel. Depending on end-use industry, it is classified into residential, commercial, and industrial. As per application, it is segregated into air treatment (healthcare facilities, residential & commercial, and bio terror agents), food & beverage disinfection, surface disinfection, and others. By component, it is classified into UV lamp, quartz sleeve, controller unit, reactor chamber, and others. Depending on marketing channel, it is divided into direct marketing and indirect marketing.

Major ultraviolet disinfection equipment players operating in North America include American Ultraviolet, Atlantic Ultraviolet Corporation, Bulbtronics, Inc., Danaher Corporation, UV Pure, Integrated Aqua Systems, Inc., Ozonia, Advanced UV, Inc., Evoqua Water Technologies Llc., and Xylem Inc.

These companies have expanded their production capabilities by acquiring other businesses and launching new products by collaborating with end user.

North America Ultraviolet Disinfection Equipment Market, By End-use Industry

The residential segment accounted for the largest share in 2020, as well as the fastest growing segment with a CAGR of 19.9%, increase in demand for clean and safe drinking water, owing to rise in population and decline in freshwater resources is expected to boost the growth of the UV disinfection equipment market.

By End-use

Residential is projected as the most lucrative segment.

North America Ultraviolet Disinfection Equipment Market, By Application

The others segment accounted for the largest market share in 2020. Increase in demand for clean and safe drinking water due to rise in population and decline in freshwater resources is expected to have a positive impact on the UV disinfection equipment market.

By Application

Others is projected as the most lucrative segment.

North America Ultraviolet Disinfection Equipment Market, By Component

The others segment accounted for the largest market share in 2020. Controller unit manages the overall electrical output of a UV lamp and powers the lamp to produce UV-C light to disinfect water.

By Component

Controller Unit is projected as the most lucrative segment.

North America Ultraviolet Disinfection Equipment Market, By Marketing Channel

The direct marketing segment accounted for the highest market share in 2020. Direct marketing channel helps sellers reach potential customers, who are a good target for product such as UV disinfection equipment.

By Marketing Channel

Direct Marketing is projected as the most lucrative segment.

North America Ultraviolet Disinfection Equipment Market, By Country

U.S. is the fastest growing region during the forecast period. North America is hub for the UV disinfection equipment market due to hygiene and safety concerns, especially in food and healthcare industries.

By Country

U.S. would exhibit a CAGR of 19.9% during 2019-2027.

Key Benefits For Stakeholders

- The North America ultraviolet disinfection equipment market report covers in-depth information of the major industry participants.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides an in-depth analysis of the North America ultraviolet disinfection equipment market forecast for the period 2020–2028.

- The report outlines the current North America ultraviolet disinfection equipment market trends and future estimations from 2020 to 2028 to understand the prevailing opportunities and potential investment pockets.

- The key drivers, restraints, and regional market opportunity and their detailed impact analysis is elucidated in the study.

Impact Of Covid-19 On The North America Ultraviolet Disinfection Equipment Market

The demand for UV disinfection equipment for air treatment is anticipated to increase during the COVID-19 pandemic. Air-conditioning systems used in offices can be breeding grounds for corona virus and can distribute the virus throughout the room particularly if they are not cleaned regularly. To effectively deal with COVID-19, UV-C germicidal lamps can be installed in ventilation ducts to clean the air passing through them. As the air flows through the air conditioning system, UV-C can suppress the formation of mold in the air conditioning system and help reduce viruses and bacteria, preventing them from multiplying.

Offices and commercial institutions are the important part of economy and cannot be under lockdown forever. Post-COVID-19 working at offices may not remain the same and there will be implementation of hygienic practices. This is expected to increase the demand for UV-C lamps for disinfection of surfaces. The demand for UV-C lamps from educational institutes is expected to increase post COVID-19 to provide healthy and fresh air to the students by installing UV-C lamps in their AC system.

Key market segments

By End-use Industry

- Residential

- Commercial

- Industrial

By Application

- Air Treatment

- Healthcare Facilities

- Residential & Commercial

- Bio Terror Agents

- Food & Beverage Disinfection

- Surface Disinfection

- Others

By Component

- UV Lamp

- Controller Unit

- Quartz Sleeve

- Reactor Chamber

- Others

By Marketing Channel

- Direct Marketing

- Indirect Marketing

By Region

- North America

- U.S.

- Canada

- Mexico

North America Ultraviolet Disinfection Equipment Market Report Highlights

| Aspects | Details |

| By End-use Industry |

|

| By Application |

|

| By Component |

|

| By Marketing Channel |

|

| By Region |

|

| Key Market Players | EVOQUA WATER TECHNOLOGIES LLC, .XYLEM INC., DANAHER CORPORATION, BULBTRONICS, INC., ADVANCED UV, INC., UV PURE TECHNOLOGIES INC., .AMERICAN ULTRAVIOLET, INTEGRATED AQUA SYSTEMS, INC., ATLANTIC ULTRAVIOLET CORPORATION, OZONIA |

Analyst Review

According to the insights of CXOs of leading companies, UV disinfection is a process of treating air, surface, food & beverages or water by making use of ultraviolet lamps instead of the usual chemical treatment. When UV lights are used at a wavelength of 254 nm, it destroys molecular bonds of DNA of microorganism, which kills or inactivates the microorganism. Surge in emphasis on the use of chemical free disinfection methods has given an impetus to the North America UV disinfection equipment market. The key applications of the UV disinfection equipment market are air treatment, process water treatment, food & beverages, and surface treatment. According to the insights of CXOs of leading companies, UV disinfection is a process of treating air, surface, food & beverages or water by making use of ultraviolet lamps instead of the usual chemical treatment. When UV lights are used at a wavelength of 254 nm, it destroys molecular bonds of DNA of microorganism, which kills or inactivates the microorganism. Surge in emphasis on the use of chemical free disinfection methods has given an impetus to the North America UV disinfection equipment market. The key applications of the UV disinfection equipment market are air treatment, process water treatment, food & beverages, and surface treatment.

The increase in urge to provide safe drinking water in emerging nations is one the major driving factors for the North America UV disinfection equipment market, as UV disinfection is considered as the safest water treatment method in developing economies. Moreover, chemical disinfectants leave behind chemical by-products in water, whereas UV does not leave behind any residues. In addition, it is an environmentally friendly and cost-effective treatment method compared to other disinfection methods such as ozonation and ultrasonic treatment. The increase in urge to provide safe drinking water in emerging nations is one the major driving factors for the North America UV disinfection equipment market, as UV disinfection is considered as the safest water treatment method in developing economies. Moreover, chemical disinfectants leave behind chemical by-products in water, whereas UV does not leave behind any residues. In addition, it is an environmentally friendly and cost-effective treatment method compared to other disinfection methods such as ozonation and ultrasonic treatment.

Furthermore, COVID-19 pandemic outbreak across the North America has led to increase in demand for UV-C lamp to be used in UV disinfection equipment used for surface disinfection and air treatment across the commercial and Industrial sector. Moreover, in 2020 the demand for UV disinfection equipment was observed to increase for surface disinfection application as compared to air treatment application owing to COVID -19 pandemic outbreak. Furthermore, COVID-19 pandemic outbreak across the North America has led to increase in demand for UV-C lamp to be used in UV disinfection equipment used for surface disinfection and air treatment across the commercial and Industrial sector. Moreover, in 2020 the demand for UV disinfection equipment was observed to increase for surface disinfection application as compared to air treatment application owing to COVID -19 pandemic outbreak.

Growth in the levels of concern amongst the world regarding the availability of drinking water; this factor is expected to augment the market growth

The NA ultraviolet disinfection equipment market is projected to reach $2,460.9 million by 2028, registering a CAGR of 19.8% from 2020 to 2028

Major players operating in NA ultraviolet disinfection equipment are American Ultraviolet, Atlantic Ultraviolet Corporation, Bulbtronics, Inc., Danaher Corporation, UV Pure, Integrated Aqua Systems, Inc.

Rising concerns for surface disinfection are the opportunities for the growth of the NA ultraviolet disinfection equipment Market

The residential industry is projected to be the fastest growing segment, hence increase the demand for liquid packaging

Extensive use of UV disinfection equipment for disinfecting hospitals and medical facilities are some of the emerging trends in NA ultraviolet disinfection equipment market

The residential segment is projected to be the fastest growing segment, hence increase the demand for liquid packaging

The need for air treatment products drive the adoption of NA ultraviolet disinfection equipment

The COVID-19 pandemic has led to an increase in demand for ultraviolet disinfection equipment in food & beverage disinfection, surface disinfection, water treatment and air treatment products.

Loading Table Of Content...