North America Wood Plastic Composites Market Overview:

The North America Wood Plastic Composites Market was valued at $736 million in 2016, and is projected to reach $1,876 million by 2023, registering a CAGR of 12.4% from 2017 to 2023. Wood plastic composites (WPCs) are made up of recycled plastic and wood wastes with beneficial features such as low melting temperature that results in lower energy costs for producers. This also reduces the impact of the product on the environment. These composites are growing at the highest rate among the plastic additives. These hybrid materials provide sustainability, longevity, and cost savings in a wide range of applications such as car speakers, interiors, home furniture, and kitchen accessories.

Ease of handling non-utilized plastic is the major driving factor of the North American wood plastic composites market. Moreover, upsurge in demand from building & construction sector boosts the market in the North American region. Moreover, stringent government regulations on the usage of chemicals in construction materials drive the North America wood plastic composites market. However, the high prices of raw materials coupled with issues regarding mechanical strength and/or weight are the major restraints for the market growth. Nevertheless, the increase in usage of biodegradable raw materials is expected to create growth opportunities for the market.

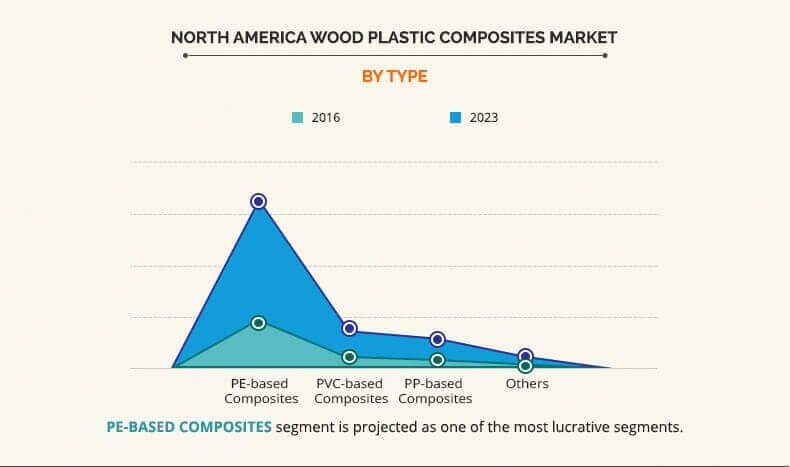

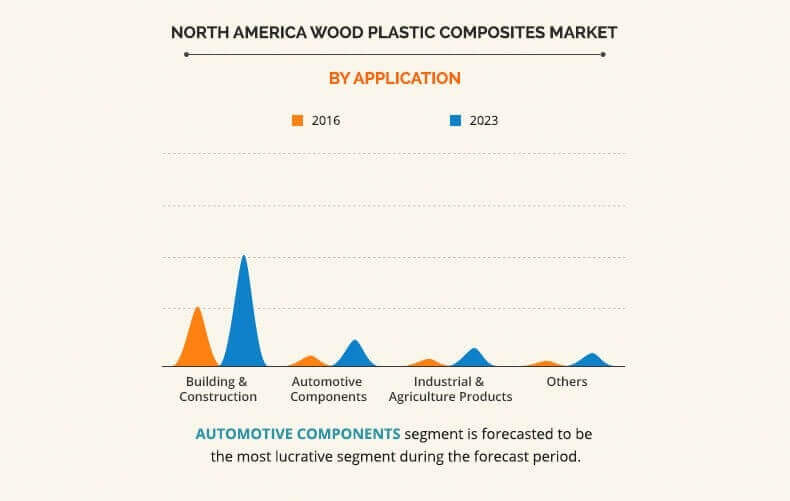

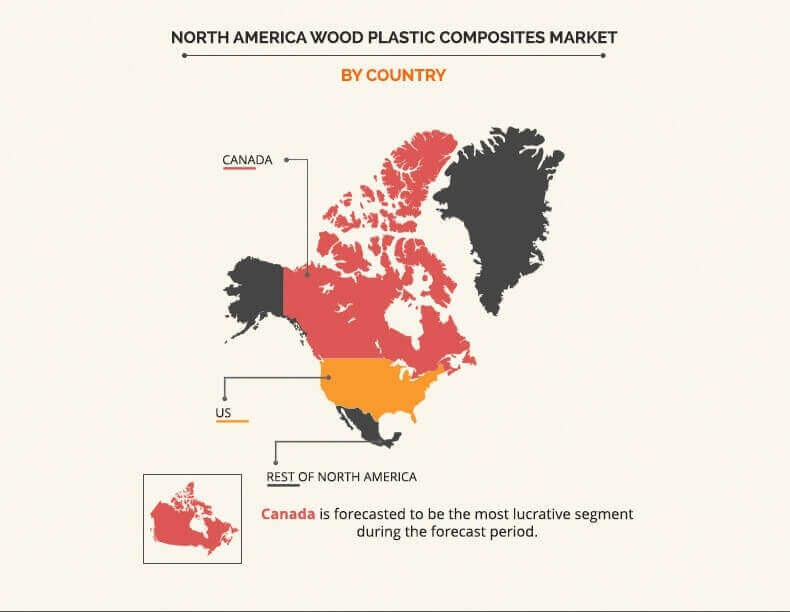

The North America wood plastic composites market is segmented into type, application, and country. Based on type, it is categorized into PE-based composites, PVC-based composites, PP-based composites, and others. Based on application, it is divided into building & construction, automotive components, industrial & consumer products, and others. By country, it is analyzed across the U.S., Canada, and rest of North America.

North America Wood Plastic Composites Market Segmentation

The PE-based Composites was the highest revenue contributor, accounting for approximately 70% share in 2016, PE is the most widely used WPCs in the U.S. for WPC decking applications. PE-based wood plastic composites consist of wood sawdust, and hence, are suitable for building and structural components applications. PE-based wood composites are extensively used as they improve the wood dispersion and compatibility between PE and wood fiber. However, poor compatibility between a hydrophilic wood and hydrophobic PE persists. This restricts the application scope of PE/wood composite.

Top Investment Pockets

In 2016, the automotive components segment, in terms of revenue, accounted for around one-eighth of the North America market share. This is the most lucrative segment for investment, owing to high demand for recyclable, dimensionally stable, and lightweight materials for interior automotive parts during the recent years. Thus, this segment is anticipated to exhibit growth along with significant return on investment for the stakeholders, owing to its notable revenue contribution.

The U.S. Review

The U.S. market for wood plastic composites was the largest market in the region owing to the increased automobile production and reemergence of chemical synthesis industry after the recession in North America. Environmental concerns regarding emissions have induced improved manufacturing methods and development of sustainable materials.

The U.S. wood plastic composites market witnessed a comparatively protracted growth in the last few years, due to the economic slowdown. The level of economic activity directly influences the construction and automotive markets. Owing to the large share of these end-use industries in the U.S. wood plastic composites market, the growth is anticipated to fuel the end-use applications.

Higher safety regulations, disposable incomes, and demand for lightweight materials among OEMs are expected to help the market players to maintain its share throughout the forecast period.

The prominent players profiled in this report include Advanced Environmental Recycling Technologies Inc., Axion International Inc., Certainteed Corporation., Polymera Inc., Tamko Building Products Inc., TimberTech Ltd., Trex Company Inc., Green Matters Mexico, Wellington Polymer Technology Inc., and Shantex.

Key Benefits

- The report provides an in-depth analysis of the current trends, drivers, and dynamics of the North America wood plastic composites market to elucidate the prevailing opportunities and tap the investment pockets.

- It offers qualitative trends and quantitative analyses of the industry from 2016 to 2023 to assist stakeholders to understand the market scenario.

- In-depth analysis of the key segments demonstrates the market potential of the North America wood plastic composites industry.

- Competitive intelligence of the industry highlights the business practices followed by key players across the region and prevailing market opportunities.

- Key market players and their strategies & developments are profiled to understand the competitive outlook of the market.

North America Wood Plastic Composites Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Country |

|

| Key Market Players | Shantex, Headwaters Incorporated (Wellington Polymer Technology, Inc), American Wood Fibers Inc., The AZEK Company LLC (TimberTech Limited), Trex Company, Inc., Green Matters Mexico, CRH plc (Advanced Environmental Recycling Technologies Inc.), Compagnie de Saint-Gobain S.A. (CertainTeed Corporation), TAMKO Building Products, Inc., Polymera, Inc. |

Analyst Review

The North America wood plastic composites market is perceived to be an area of potential growth, owing to various potential benefits, such as dimensional stability, recyclability, design flexibility, and others. These composites are identified as sustainable materials due to the use of wood particles, which is a byproduct of sawmill and other wood-processing waste streams, and most of the plastic is derived from consumer and industrial recycling efforts. This further increases the demand for WPCs in North America.

U.S. is expected to gain a significant market share in the North America market by 2023, owing to the coverage of wood plastic composites infrastructure and supply. In addition, the U.S. market share is projected to increase due to surge in inclination toward biodegradable building materials. Further, WPC exhibits high flexibility, and therefore, can be used in the automotive and consumer product segments, which further boost the growth of the market in the U.S.

Loading Table Of Content...