Obesity Intervention Devices Market Research, 2031

The global obesity intervention devices market size was valued at $243.2 million in 2021, and is projected to reach $407.6 million by 2031, growing at a CAGR of 5.3% from 2022 to 2031. Medical devices used to manage obesity are called obesity intervention devices. These tools are intended to lower caloric intake or alter how the body breaks down food, resulting in weight reduction. Weight reduction that improves or remits type 2 diabetes results in approval of an obesity intervention device. Gastric bands, gastric balloons, and the gastric stimulator system are examples of obesity intervention technologies.

The methods used to treat obesity are minimally invasive and include laparoscopy and endoscopy. Gastric bands are adjustable silicone bands used for weight loss. Gastric balloons are silicone balloons that are inserted into the stomach to help with weight loss. The balloons are filled with a sterile saline solution and are designed to take up space in the stomach, reducing the amount of food that can be consumed in one sitting. A gastric stimulator system is a medical device that is used to treat obesity by stimulating the stomach muscles to contract.

Market Dynamics

Growth of the global obesity intervention devices market share is majorly driven by increase in the prevalence of obesity, increase in number of market players who manufactures obesity intervention devices and increase in number product launches for obesity intervention devices drugs. Obesity is an excess of body fat that has accumulated to the point where it has an adverse effect on health. It is usually defined by body mass index (BMI), which is calculated using a person's weight and height. A person with a BMI of 30 or more is obese. Obesity intervention devices reduce weight by limiting the amount of food a person can comfortably consume. Thus, rise in prevalence of obesity is anticipated to boost the growth of obesity intervention devices market.

For instance, in 2020, The World Obesity Federation, the International Association for the Study of Obesity and the International Obesity Task Force, estimated that one billion population is suffering from obesity globally. In addition, as per the same source, it was estimated that 1 in 5 women and 1 in 7 men, will be living with obesity by 2030. In addition, according to the States of Obesity, in 2021, it was reported that, there is rise in the prevalence of obesity from 36% (in 2020) to 41% (in 2021) in U.S. In addition, as per the same source, between 2020 and 2021, 17 states had statistically significant increases in their obesity rate. Thus, this factor is expected to fuel the demand for obesity intervention devices and boost the obesity intervention devices market share.

Increase in the prevalence of type 2 diabetes is anticipated to boost the obesity intervention devices market size. Type 2 diabetes is the most common type of diabetes, accounting for around 90% of all diabetes. It is generally characterized by insulin resistance, where the body does not fully respond to insulin. Because insulin cannot work properly, blood glucose levels keep rising, releasing more insulin. Obesity is a major risk factor for type 2 diabetes. People who are obese are more likely to develop insulin resistance, which is a major contributor to type 2 diabetes. Obesity is also associated with chronic inflammation, which can lead to insulin resistance. In addition, people who are obese have higher levels of certain hormones, including leptin, that are linked to an increased risk of type 2 diabetes.

Obesity intervention devices are used in diabetes patients because they can help to reduce the risk of complications associated with diabetes. These devices can also help to reduce obesity, which is a risk factor for type 2 diabetes. By reducing obesity, patients can reduce their risk of developing type 2 diabetes and its associated complications. Moreover, obesity intervention devices such as LAP-BAND AP Adjustable Gastric Banding System, provided by Allergan, a medical device company, shown improvement or remission of type 2 diabetes in patients with BMI greater than or equal to 35. Thus, rise in prevalence of diabetes is expected to witnessed obesity intervention devices market Growth during forecast period.

For instance, in 2021, according to International Diabetes Federation, it was reported that, 537 million adults (20-79 years) are living with diabetes over the globe. This number is predicted to rise to 643 million by 2030 and 783 million by 2045. In addition, as per the same source, in 2021, globally 541 million adults have Impaired Glucose Tolerance (IGT), which places them at high risk of type 2 diabetes.

Increase in awareness among the people regarding adverse effects of obesity is anticipated to fuel the demand for obesity intervention devices and drives the obesity intervention devices market opportunity. For instance, the adverse effects of obesity include an increased risk of type 2 diabetes, heart disease, stroke, certain types of cancer, and other chronic health issues. Obesity is also associated with an increased risk of depression, anxiety, and other mental health issues. In addition, people who are obese are more likely to experience mobility issues, joint pain, and other physical impairments.

In addition, in November 2020, according to Practo, India’s leading integrated healthcare company, witnessed a staggering increase of 550% in the number of obesity-related queries. This indicates growing awareness about the obesity among people and an increase in the knowledge of treatments for obesity such as bariatric surgeries, minimally invasive obesity intervention procedures related to obesity. The top searched queries give an understanding of how people are aware and concerned of problems like body mass index (BMI) levels, and the various diets. Thus, rise in awareness among the people regarding adverse effects of obesity is attributed to boost the demand for obesity intervention devices and drives the growth of market.

On the other hand, Side effects associated with obesity interventional devices like gastric bands and gastric balloons includes nausea, vomiting, abdominal pain, and constipation are anticipated to restrain the growth of obesity intervention devices industry. Other side effects may include reflux, erosions of the stomach lining, infection, and blockage of the intestines. Additionally, some people may experience an increase in heart rate or blood pressure, or an allergic reaction to the balloon material. Thus, this factor is anticipated to avoid the adoption of gastric balloons and hamper the growth of market.

COVID-19 has had a significant impact on the obesity intervention devices market. Several clinical trials have been disrupted due to the pandemic and social distancing regulations. The shortage of healthcare workers, financial constraints, and lockdowns have led to an increase in the number of patients who are unable to access timely treatments. Additionally, the number of patients seeking treatment for obesity has decreased, due to a decrease in the disposable income.

Moreover, the Covid-19 pandemic negative impact on the obesity intervention devices market because many of elective surgeries such as gastric band implantation, gastric balloon implantation is cancelled or postponed during pandemic. For instance, in July 2020, according to the Journal of Karger, it was reported that, the European Association for the Study of Obesity (EASO) promptly recognized the impact of COVID-19 outbreak on people with obesity. To have a clearer picture about the situation of obesity care in Europe during the COVID-19 epidemic, EASO launched an electronic survey exploring the topic across the EASO Collaborating Centers for Obesity Management (COMs) network. According to the survey, obesity surgery was cancelled or postponed in 96.5% of the responding COMs due to the COVID-19 outbreak in Europe.

Segmental Overview

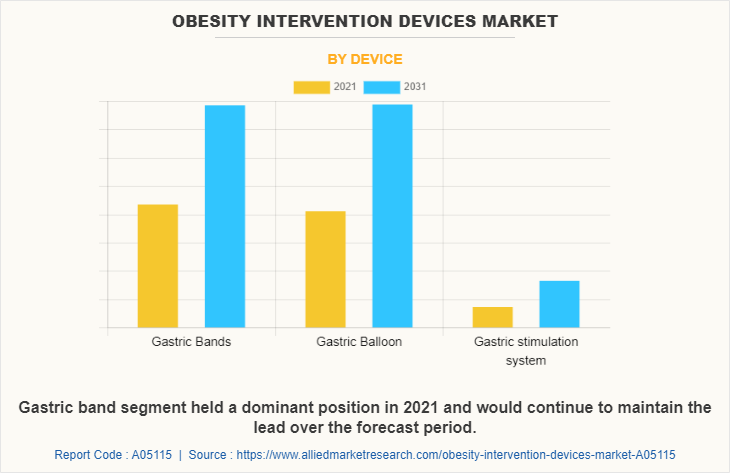

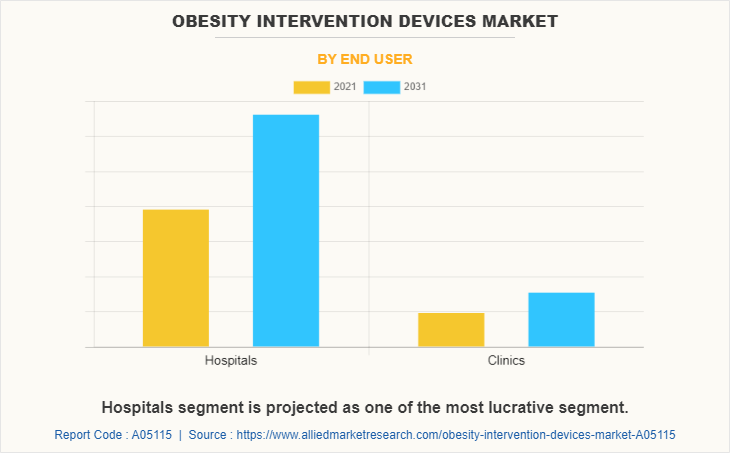

The obesity intervention devices market is segmented based on devices, end users and region. Based on devices the market is segmented into gastric band, gastric balloons, and gastric stimulator system. Based on end user the market is classified into hospitals and others. Others include gastroenterology clinics and ambulatory surgical centers. Region wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Device

Based on device, the market is classified into gastric bands, gastric balloon, and gastric stimulator system. The gastric balloon segment dominated the market in 2021 and is expected to grow with a faster CAGR during the forecast period owing to rise in the number of product launch and product approvals for gastric balloons in obesity intervention devices and increase in number of market players who manufactures gastric balloons.

By End User

Based on end user, the market is classified into hospitals and others. Others include gastroenterology clinics and ambulatory surgical centers. The hospitals segment is dominated the market in 2021 and is expected to grow with a faster CAGR during the forecast period owing to the availability of trained medical staff in hospitals that helps to provide better services to patients, increase in patient admission in hospital, and surge in the prevalence of obesity.

By Region

North America obesity intervention devices market is expected to grow during the forecast period owing to rise in number of market players who manufactures obesity intervention devices and increase in number of product launch and product approvals for obesity intervention devices. For instance, Apollo Endosurgery, Reshape Lifesciences, GI Dynamics, Johnson & Johnson, Asensus Surgical and Allurion Technologies, Inc. are some market players who manufactures obesity intervention devices. In addition, in August 2022, according to ReShape Lifesciences, a developer of minimally invasive medical devices to treat obesity and metabolic diseases, received 510(k) approval from Food and Drug Administration (FDA) for the disposable, gastrointestinal balloon indicator (GIBI HD) calibration tube for use in gastric and bariatric surgical procedure.

Asia-pacific obesity intervention devices market forecast is expected to witness growth during the forecast period owing to, rise in the prevalence of obesity in Asia-Pacific and increase in prevalence of diabetes is expected to witnessed growth during the forecast period. For instance, according to Statista, it was reported that, in India, the share of overweight or obese women increased from 20.6% in 2016 to 24% in 2021. On the other hand, the prevalence among men increased from 18.6% to 22.9% in 2021. Moreover, obesity intervention devices are used for improvement in type 2 diabetes condition. Thus, rise in prevalence of diabetes in anticipated to fuel the market growth.

For instance, in 2021, according to International Diabetes Federation, it was reported that, 1 in 11 adults (90 million) are living with diabetes in southeast Asia. As per the same source, the number of adults with diabetes is expected to reach 113 million by 2030 and 151 million by 2045 in southeast Asia. Thus, rise in prevalence of obesity and diabetes is anticipated to fuel the demand for obesity intervention devices and boost the growth of market.

Competition Analysis

Some of the major companies that operate in the global obesity intervention devices industry include Major key players that operate in the global obesity intervention devices market are Apollo Endosurgery, Reshape Lifesciences, GI Dynamics, Allergan, Cousin Biotech, Johnson & Johnson, Asensus Surgical, A.M. I GmbH, Allurion Technologies, Inc., and Endalis.

Recent product approvals in obesity intervention devices market globally

In August 2022, according to ReShape Lifesciences, a developer of minimally invasive medical devices to treat obesity and metabolic diseases, received 510(k) approval from Food and Drug Administration (FDA) for the disposable, gastrointestinal balloon indicator (GIBI HD) calibration tube for use in gastric and bariatric surgical procedures.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the obesity intervention devices market analysis from 2021 to 2031 to identify the prevailing obesity intervention devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the obesity intervention devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global obesity intervention devices market trends, key players, market segments, application areas, and market growth strategies.

Obesity Intervention Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 407.6 million |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 297 |

| By Device |

|

| By End User |

|

| By Region |

|

| Key Market Players | A.M.I. GmbH, Endalis Laboratoire, Johnson & Johnson, Spatz FGIA Inc, Allurion Technologies, Inc., Abbvie Inc (Allergan), Cousin Surgery, GI Dynamics, ReShape Lifesciences Inc, Apollo Endosurgery |

Analyst Review

Obesity intervention devices are medical devices used to treat obesity and leads to improvement or remission of type 2 diabetes. Rise in the prevalence of obesity and increase in number of market players who manufacture obesity intervention devices is expected to augment market growth during the forecast period. Moreover, increase in number of product provision of obesity intervention devices and rise in awareness among people regarding obesity intervention devices are anticipated to fuel the growth of market in forecast period. For instance, in December 2021, Spatz FGIA, Inc., medical equipment manufacturing company, announced that the U.S. Food and Drug Administration (FDA) has approved the Spatz3 Gastric Balloon, the first adjustable gastric balloon system to aid in weight loss for adult patients struggling with obesity.

In addition, technological advancement in the development of obesity intervention devices is expected to witnessed growth during the forecast period. For instance, Reshape LifeSciences, a medical device company, provides Obalon Balloon System, swallowable, gas-filled, Food and Drug Administration (FDA)-approved balloon system for weight-loss. The Obalon Balloon System is intended for adults with a body mass index (BMI) of 30 to 40 kg/m2 willing to follow a diet and exercise program.

The top companies that hold the market share in obesity intervention device market are Apollo Endosurgery, Reshape Lifesciences, GI Dynamics, Allergan and Johnson & Johnson.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to rise in expenditure by government organization to develop the healthcare sector, increase in the prevalence of obesity and increase in the awareness among the population regarding adverse effects of obesity.

The key trends in the obesity intervention device market are rise in number of product launches and product approvals for obesity intervention device and increase in the number of market players who manufactures obesity intervention device.

The base year for the report is 2021.

10 obesity intervention device companies are profiled in the report

The total market value of obesity intervention device market is $243.23 million in 2021.

The forecast period in the report is from 2022 to 2031.

High cost of obesity intervention surgeries and side effects associated with procedures are restraining factor for obesity intervention device market.

Loading Table Of Content...

Loading Research Methodology...