Office Supplies Market Research, 2034

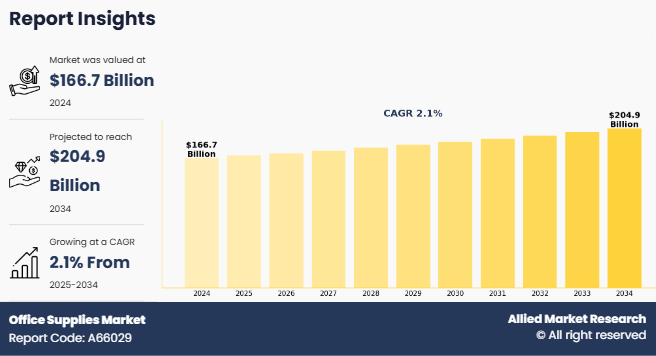

The global office supplies market size was valued at $166.7 billion in 2024, and is projected to reach $204.9 billion by 2034, growing at a CAGR of 2.1% from 2025 to 2034. Office supplies refer to the range of consumable products and tools used in workplaces to support daily administrative tasks and improve productivity. These supplies include items such as paper, pens, notebooks, staplers, folders, and filing systems that are essential for documentation, communication, and organization. Office supplies are utilized by corporate offices, educational institutions, healthcare facilities, and various other organizations to maintain efficient operations. They play a vital role in ensuring smooth workflow by facilitating writing, printing, record-keeping, and filing activities. With the rise of digital transformation, modern office supplies also include smart stationery and digital tools designed to enhance efficiency.

Market Dynamics

Educational institutions are major consumers of office supplies, contributing substantially to office supplies market growth. Schools, colleges, and universities require consistent supplies of products such as notebooks, pens, binders, and paper. The global education sector’s expansion has intensified this demand, especially in developing regions where governments are investing heavily in education infrastructure. According to UNESCO, global enrollment rates in primary and secondary education have risen steadily, prompting increased demand for stationery, filing products, and academic resources. Additionally, institutions increasingly adopt blended learning models, which require supplementary supplies such as digital writing tools and USB drives. Administrative tasks in educational institutions also contribute to demand for filing systems, documentation products, and organizational supplies. Moreover, as the adoption of STEM education continues to grow, the need for specialized notebooks, graph papers, and scientific stationery has expanded. University research departments require additional filing products, label markers, and specialized equipment for data management. Educational publishers, printing companies, and bookstores further sustain this demand. Consequently, the education sector’s sustained growth, combined with evolving learning methods and digitization, continues to drive steady office supplies market size.

The rising adoption of remote and hybrid work models has significantly influenced office supply demand. With employees increasingly working from home, essential products such as ergonomic desk accessories, paper supplies, and filing systems have gained traction. The increase in remote jobs has prompted consumers to invest in productivity-enhancing products such as desk organizers, wireless printers, and office furniture. Remote employees frequently purchase supplies that improve organization, comfort, and efficiency at home. Furthermore, the growing freelance economy has contributed to additional demand, particularly for notebooks, planners, and document storage solutions. Many remote workers also prioritize ergonomic chairs, laptop stands, and wrist support pads to promote posture and productivity. Companies adopting hybrid work models often provide employees with reimbursement programs for essential supplies, further stimulating demand. Additionally, businesses implementing flexible workspaces require portable supplies such as mobile whiteboards, document carriers, and compact storage systems. As remote and hybrid work arrangements continue to expand, this segment will remain a strong driver for the office supplies market, encouraging product innovation tailored to flexible work environments.

The integration of smart technologies presents a significant opportunity for the office supplies market. Products such as digital planners, smart pens, and app-connected writing tools have gained popularity, especially in corporate environments where productivity-enhancing tools are valued. Digital notebooks that sync with cloud platforms provide professionals with seamless access to notes and documents, streamlining collaboration. Smart labels and digital filing systems offer improved organization for both corporate offices and educational institutions. Additionally, interactive whiteboards with connectivity features are increasingly adopted in classrooms and conference rooms, enhancing engagement and knowledge sharing. Businesses that incorporate digital solutions benefit from improved document security, faster data retrieval, and reduced paper dependency. As organizations continue to prioritize digital transformation, the integration of smart office solutions will create lucrative growth opportunities for office supplies manufacturers. Investing in digital innovations that simplify workplace organization and improve efficiency is vital for companies seeking to remain competitive in the evolving market. The emergence of smart stationery integrated with cloud storage and mobile applications is gaining traction, enhancing workflow management and ensuring document security. Manufacturers offer innovative solutions such as reusable digital notebooks, smart pens with transcription capabilities, and wireless presentation tools can appeal to businesses seeking enhanced productivity. Furthermore, educational institutions are increasingly investing in smart boards and interactive displays to improve teaching experiences, driving demand for tech-enabled office supplies. By developing solutions that seamlessly integrate with digital ecosystems, office supply providers can expand their customer base, cater to evolving workplace demands, and strengthen their presence in the growing digital office supplies segment.

The increasing shift towards digitalization presents a significant challenge for the office supplies market. Organizations worldwide are transitioning to paperless practices, reducing the demand for traditional stationery and paper-based products. Businesses are adopting cloud storage solutions, digital document management systems, and electronic communication tools to streamline operations and minimize paper consumption. Educational institutions are also shifting to e-learning platforms, reducing reliance on printed textbooks, notebooks, and other paper supplies. Government agencies and large enterprises are implementing digital documentation policies to enhance efficiency, further diminishing the need for physical filing systems. As companies adopt eco-conscious practices to reduce their carbon footprint, paper-based records, files, and correspondence are increasingly replaced with digital alternatives. Additionally, advancements in tablet technology, e-readers, and touchscreen devices have accelerated this trend, enabling convenient notetaking and documentation. This shift threatens traditional office supplies sales, compelling manufacturers to adapt by offering digital-integrated solutions or multifunctional stationery products. To counterbalance this decline, suppliers are investing in hybrid solutions such as reusable notebooks that sync with digital platforms and smart pens that digitize handwritten notes. While the paperless movement poses a significant challenge, manufacturers focusing on innovative solutions that bridge the gap between digital and physical documentation can effectively sustain growth in the evolving market.

Segmental Overview

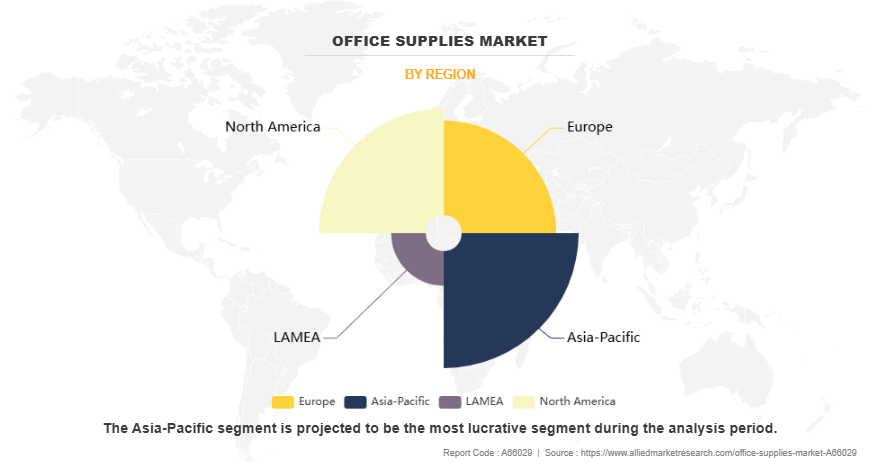

The office supplies market is segmented into product, end user, distribution channel, and region. By product, the market is fragmented into paper supplies, writing supplies, filing supplies, desk supplies, binding supplies, and others. By end use, the market is fragmented into corporates, educational institutes, hospitals, and others. On the basis of distribution channel, it is divided into online and offline. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, and rest of LAMEA).

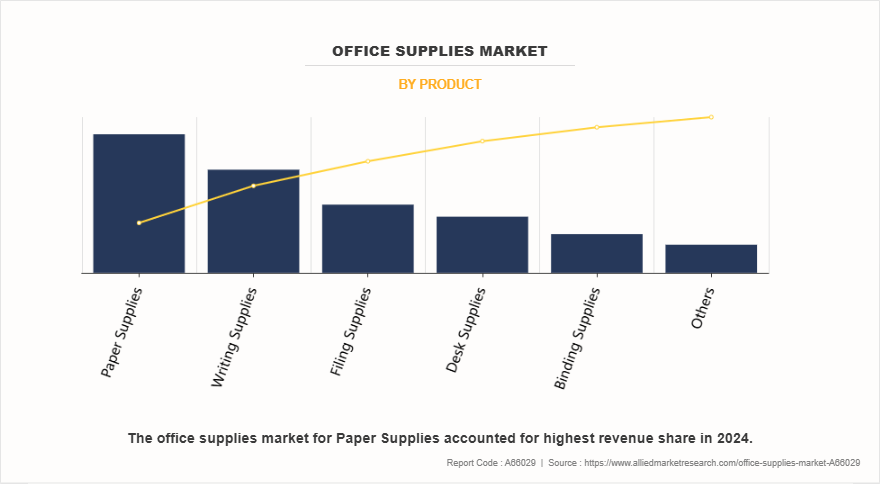

By Product

By product, the paper supplies segment dominated the global office supplies market in 2024 and is anticipated to maintain its dominance during the forecast period. The paper supplies market is witnessing notable trends driven by environmental concerns and sustainable practices. Demand for eco-friendly paper products such as recycled paper, bamboo-based notebooks, and FSC-certified paper is increasing as organizations prioritize green initiatives. Additionally, digital printing advancements have spurred the need for high-quality printing paper designed for improved ink absorption and durability. Educational institutions and corporate offices continue to rely on premium-grade paper for presentations, training materials, and official documentation.

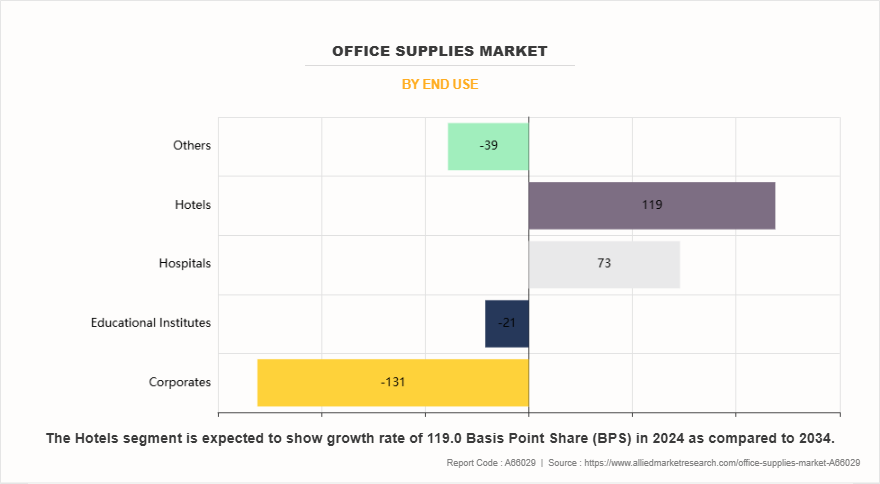

By End Use

By end use, the corporates segment dominated the global office supplies market in 2024 and is anticipated to maintain its dominance during the forecast period. In the corporate sector, evolving workplace trends are driving significant changes in office supplies demand. One major trend is the increasing adoption of ergonomic and productivity-enhancing products. Corporations are investing heavily in ergonomic chairs, adjustable desks, and posture-improving accessories to promote employee well-being. This trend aligns with growing awareness of workplace health issues such as musculoskeletal disorders and fatigue. Additionally, digital transformation in corporate environments has accelerated the demand for smart office supplies.

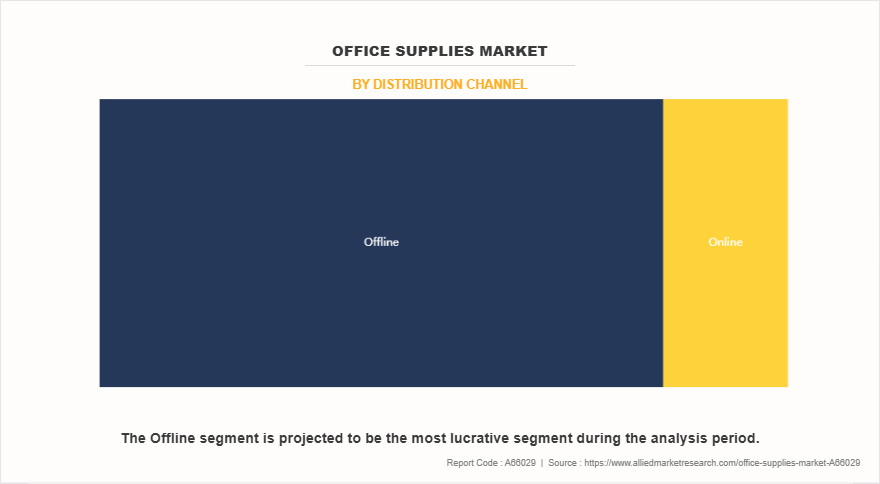

By Distribution Channel

By distribution channel, the offline segment dominated the global office supplies market in 2024 and is anticipated to maintain its dominance during the forecast period. One major trend is the increasing adoption of experiential retail strategies by office supply stores. Retailers are creating interactive spaces where customers can test ergonomic chairs, digital pens, or filing systems before purchasing. This approach enhances customer confidence, especially for high-value products. Additionally, many offline stores are integrating technology within their physical outlets to improve shopping experience. For example, digital kiosks and in-store tablets allow customers to browse expanded product catalogs, check inventory availability, or access online reviews in real time. Another key driver is the rising demand for specialized office supplies in industries such as healthcare and hospitality, prompting stores to create dedicated sections for customized products.

By Region

Region-wise, Asia-Pacific dominated the office supplies market share in 2024. The Asia Pacific office supplies market is witnessing rapid growth driven by expanding educational sectors, urbanization, and the increasing adoption of digital learning tools. Countries such as China, India, and Japan are investing heavily in educational infrastructure, creating substantial demand for classroom supplies, writing instruments, and filing solutions. The region's thriving start-up ecosystem is also fueling demand for cost-effective yet high-quality office supplies that cater to flexible and dynamic workspaces. Another key trend in Asia Pacific is the growing popularity of multifunctional office supplies that combine traditional stationery with digital features. For instance, smart pens with integrated transcription capabilities and cloud-synced notebooks are gaining traction among corporate employees and students asuch as.

Competition Analysis

The key players profiled in the global office supplies market report include KOKUYO Co.,Ltd., BIC USA Inc. (BIC), Newell Brands Inc., Crayola, LLC, ACCO Brands Corporation, Office Depot, LLC, Pentel Co. Ltd., FABER-CASTELL, HAMELIN, and Jam Paper & Envelope.

Several well-known and upcoming brands are vying for market dominance in the expanding office supplies industry. Smaller, niche firms are more well-known for catering to consumer demands and preferences. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the office supplies market forecast analysis from 2024 to 2034 to identify the prevailing office supplies market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the office supplies market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global office supplies market trends, key players, market segments, application areas, and market growth strategies.

Office Supplies Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 204.9 billion |

| Growth Rate | CAGR of 2.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 391 |

| By Product |

|

| By Distribution Channel |

|

| By End Use |

|

| By Region |

|

| Key Market Players | HAMELIN, ACCO Brands Corporation., FABER-CASTELL, Jam Paper & Envelope, Newell Brands Inc., Crayola, LLC, Pentel Co. Ltd., BIC USA Inc. (BIC), KOKUYO Co.,Ltd., Office Depot, LLC |

Analyst Review

The demand for office supplies continues to witness sustained momentum across global markets, primarily influenced by the evolution of work environments that blend in-office presence with remote capabilities. Senior executives acknowledge the imperative to innovate within this transitioning space by embracing sustainable materials, responsive supply chains, and digitally compatible products. Major players are investing in the development of ergonomic desk accessories, smart stationery, and environmentally certified paper and writing tools. This strategic shift is aimed at supporting productivity and well-being for employees working from diverse locations. Furthermore, personalized offerings and bundled remote work kits are gaining traction among corporate clients, reinforcing a consumer-driven approach.

The hybrid work model has also elevated the significance of multi-functional and adaptive office products that align with both corporate and home-based settings. From a CXO standpoint, market differentiation hinges on integrating technology, enhancing user experience, and fulfilling ESG commitments. There is a growing inclination toward product lines that reflect organizational values around sustainability, efficiency, and health. Urbanization, especially in rapidly growing economies, continues to fuel the adoption of high-quality supplies in coworking spaces, startups, and SMBs. As such, top executives are focusing on strategic partnerships with e-commerce giants, regional distribution expansion, and digital transformation of procurement channels to capture emerging opportunities and maintain a competitive edge in an increasingly fragmented market landscape.

The office supplies market was valued at $166,711.1 million in 2024 and is estimated to reach $204,898.1 million by 2034, exhibiting a CAGR of 2.1% from 2025 to 2034.?

The office supplies market is segmented into product, end user, distribution channel, and region. By product, the market is fragmented into paper supplies, writing supplies, filing supplies, desk supplies, binding supplies, and others. By end use, the market is fragmented into corporates, educational institutes, hospitals, and others. On the basis of distribution channel, it is divided into online and offline. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, and rest of LAMEA).

Asia-Pacific is the largest regional market for office supplies

The key players profiled in the global office supplies market report include KOKUYO Co.,Ltd., BIC USA Inc. (BIC), Newell Brands Inc., Crayola, LLC, ACCO Brands Corporation, Office Depot, LLC, Pentel Co. Ltd., FABER-CASTELL, HAMELIN, and Jam Paper & Envelope

The global office supplies market report is available on request on the website of Allied Market Research.

Loading Table Of Content...

Loading Research Methodology...