Offshore Oil & Gas Paints And Coatings Market Research, 2030

The global offshore oil & gas paints and coatings market was valued at $537.6 million in 2020, and is projected to reach $764.9 million by 2030, growing at a CAGR of 3.7% from 2021 to 2030.

Offshore oil & gas exploration activities frequently result in the buildup of corrosion and foul layers on vessel equipment, which is then coated to give further protection. Coatings for offshore oil & gas deployment must withstand high levels of dissolved oxygen, seawater abrasion, UV exposure, meteorological extremes, and marine life harm. As a result, offshore paints and coatings have properties that allow them to endure the rigors of underwater cleaning. Furthermore, stationary vessels collect significant fouling quickly, necessitating the use of thicker systems with 12–20 mils of coal tar epoxy coatings to safeguard the vessels. Furthermore, organic, zinc-rich primers, higher-build epoxies, and coatings are applied to a vinyl ester or polyester basis.

Increase in urbanization and economic development result in a significant rise in global energy demand, which is likely to drive demand for onshore oil & gas resources. Demand for offshore oil & gas paints and coatings is predicted to expand in tandem with rising consumption of onshore oil & gas resources because onshore oil & gas resources are limited and offshore oil & gas are suitable cost-effective alternatives. Painting and coatings are also advantageous in drilling equipment, where they increase heat resistance in offshore or subsea operations by utilizing coatings to withstand harsh pressures and salt water, which drives the offshore oil & gas paints and coatings industry. However, raw material costs and environmental concerns related with the release of volatile organic compounds by chemical organic coatings are limiting the market growth to some extent.

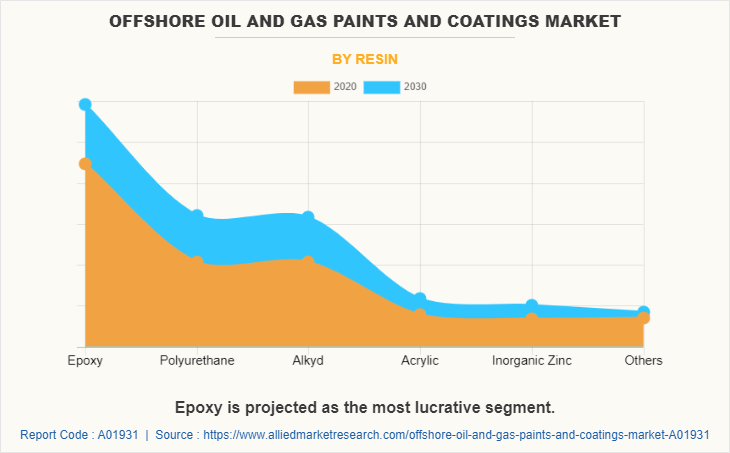

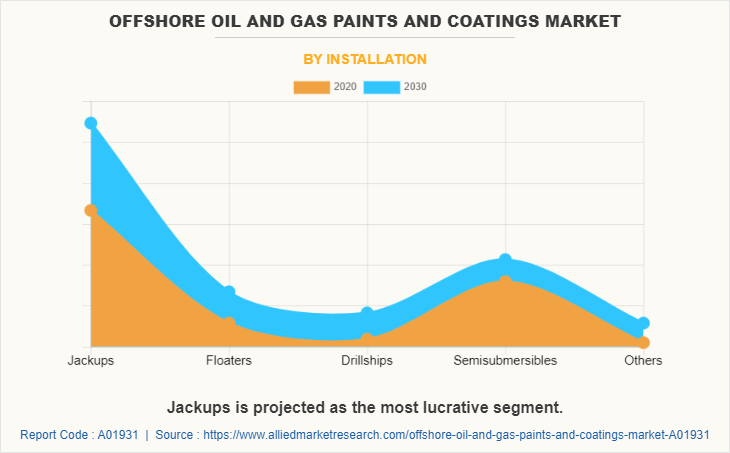

The offshore oil & gas paints & coatings market is segmented on the basis of type, installation, and region. By type, the market is segregated into epoxy, polyurethane alkyd, acrylic, inorganic zinc, and others. On the basis of installation, it is fragmented into jackups, floaters, drillships, semisubmersibles, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include, Hempel, 3M, Nippon Paints Co., AkzoNobel N.V., PPG Industries, Inc., Wacker Chemie AG, The Sherwin-Williams Company, Jotun, Kansai Paints Co., and A&A Coatings.

The global offshore oil & gas paints & coatings market report provides in-depth competitive analysis as well as profiles of these major players.

By type, the epoxy segment held a significant share in the offshore oil & gas paints and coatings market in 2020, growing at a CAGR of 3.0% during the forecast period. Offshore oil & gas installations require coatings to withstand extreme weather conditions, dissolved oxygen, saltwater abrasion, and mechanical impact from debris, ultraviolet exposure, and damage by marine life. Therefore, offshore paints and coatings possess characteristics to withstand the rigors of underwater cleaning.

On the basis of installation, the drillships segment held a significant share in offshore oil & gas paints and coatings market in 2020. A drillship is a commercial vessel designed for use in offshore exploration drilling, assisting in purposes such as scientific drilling and obtaining new oil & gas wells.

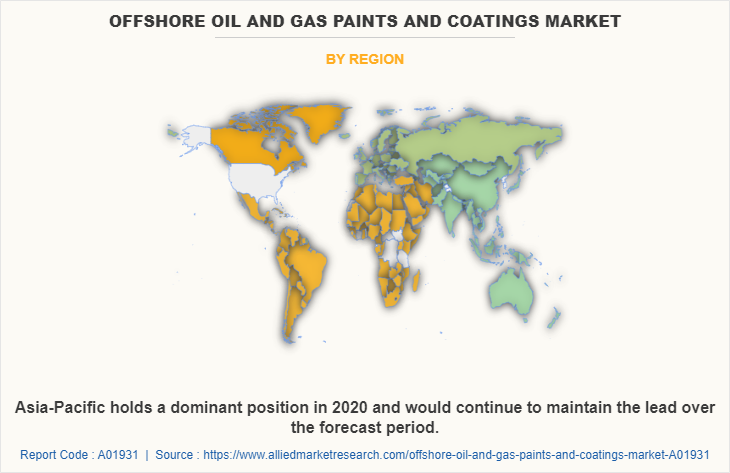

Region-wise, Asia-Pacific dominated the offshore oil & gas paints and coatings market with a share of more than 37.2%, followed by North America and Europe. Increase in urbanization and economic development have led to the rapid rise in energy demand across the globe, which in turn is expected to fuel the consumption of onshore oil & gas resources.

Impact of COVID-19 on Global Offshore Oil & Gas Paints and Coatings Market

- The outbreak of COVID-19 led to partial or complete shutdown of production facilities that do not come under essential goods, owing to prolonged lockdown in major countries, including the U.S., China, Japan, India, and Germany. It led to either closure or suspension of their production activities in most of the industrial units across the globe.

- Sudden outbreak of the COVID-19 pandemic led to the implementation of stringent lockdown regulations across several nations resulting in disruptions in import and export activities of offshore oil & gas paints and coatings.

- The impact of COVID-19 and fluctuations in oil prices are proving to be a two-pronged crisis for oil, gas, and chemicals companies. The Organization of the Petroleum Exporting Countries (OPEC) agreed to cut 1.5 million barrels per day from production. The COVID-19 pandemic shattered oil demand, sunk prices, and is posing a significant risk for those involved in oil extraction and processing.

KEY BENEFITS FOR STAKEHOLDERS

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, & offshore oil & gas paints & coatings market opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Offshore Oil & Gas Paints and Coatings Market Report Highlights

| Aspects | Details |

| By Resin |

|

| By Installation |

|

| By Region |

|

| Key Market Players | PPG INDUSTRIES, INC., HEMPLEL A/S, NIPPON PAINTS CO. LTD., AKZONOBEL N.V., Jotun, WACKER CHEMIE AG, 3M CO., THE SHERWIN-WILLIAMS COMPANY, KANSAI PAINTS CO., LTD., A&A Coatings |

Analyst Review

Oil & gas are extracted by the process of well drilling and transported through ships and pipelines to refineries. Paints coatings are effectively deployed among oil & gas equipment to effectively provide corrosion prevention, providing a nonslip-surface, and bright paint colors improve visibility. The global offshore oil & gas paints and coatings market provides various opportunities to the market players, as the process of drilling involves the trend of shifting towards ultra-deepwater, which enhances the equipment capability to perform in the corrosive and harsh environment. Therefore, the aforementioned reasons have effectively driven the market growth. In addition, ongoing advances in drilling techniques, the development and higher rate of extraction from reserves, and development of well stimulation models are expected to further surge the market growth.

Increase in urbanization and economic development result in a significant rise in global energy demand, which is likely to drive demand for onshore oil & gas resources.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Asia-Pacific region will provide more business opportunities for offshore oil & gas paints and coatings market in coming years

Hempel, 3M, Nippon Paints Co., AkzoNobel N.V., PPG Industries, Inc., Wacker Chemie AG, The Sherwin-Williams Company are the top players in offshore oil & gas paints and coatings market.

By installation segment holds the maximum share of the offshore oil & gas paints and coatings market

jackups, floaters, drillships, semisubmersibles installation are the potential customers of offshore oil & gas paints and coatings industry

Offshore oil & gas paints and coatings have gained popularity in recent years, owing to increase in application of epoxy resin-based coats, which possess more abrasion and chemical-resistant properties, that topcoat the marine vessels, providing anticorrosive protection against atmospheric exposure.

The global offshore oil & gas paints and coatings market provide various opportunities to the market players, as the process of drilling involves the trend of shifting towards ultra-deepwater which enhances the equipment capability to perform in the corrosive and harsh environment.

Loading Table Of Content...