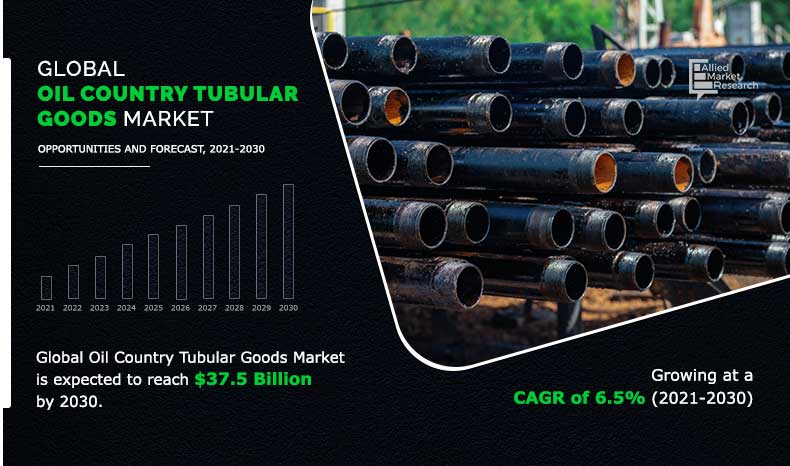

Oil Country Tubular Goods Market Outlook - 2021-2030

The global Oil Country Tubular Goods market size was valued at $20.9 billion in 2020, and projected to reach $37.5 billion by 2030, with a CAGR of 6.5% from 2021 to 2030. Oil Country Tubular Goods is consolidation of group of tubular products such as drill pipe, casing, line pipe, and tubing that are subjected to loading conditions according to their specific application. American Petroleum Institute grade is widely used all over the world due to its versatility and safety. The main function of API is to define and draft standards for the oil and petroleum industry to ensure the safety and reliability of the industrial equipment. Premium grade products are those which follow the specification of the International Organization for Standardization. Oil country tubular goods have applications in the onshore & offshore exploration and extraction facilities. Well casing is generally held in position with the help of cement or other materials between casings and wellbore. It also prevents unwanted fluids & gases from entering the well.

Oil and gas play a vital role in the development of an economy and development of a civilization. The increase in the rig count of oil & gas fields in the offshore areas and the recent development of application of shale gas in the U.S. have fueled the keen interest of government and private investment in the oil & gas sector. The surge in the offshore explorations in the North sea’s exploration activity has now moved in to deeper waters that require more sophisticated equipment, which have led to the growth of the oil country tubular goods market.

The government policies and restriction over the development of the oil country tubular goods by manufacturers from other countries in order to support the development of local manufacturers and increase the GDP of the country have hampered the development of the market. The uncertainties with regard to the international crude oil prices have certain impact on the development of the oil country tubular goods market.

The Oil Country Tubular Goods market is segmented on the basis of manufacturing process, product, application, grade, and region.

On the basis of manufacturing process, the global market is segmented into electric resistance welded and seamless. On the basis of product, the market is fragmented into well casing, product tubing, drill pipe, and others. On the basis of application, the global market is bifurcated into onshore and offshore. On the basis of grade, it is classified into API grade and Premium grade.

Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, North America accounts for the largest share of the market, followed by Asia-Pacific and Europe.

The major companies profiled in this report include ArcelorMittal SA, EVRAZ North America, ILJIN Steel Corporation, JFE Steel Corporation. National-Oilwell Varco Inc, Oil Country Tubular Limited, Sumitomo Corporation, Tenaris, TMK Ipsco Enterprises Inc., and U.S. Steel Corporation. Rapid industrialization, modernization has led to the increase in the demand for energy resources and chemical raw materials, which in-turn has fueled the demand for Oil Country Tubular Goods. Additional growth strategies such as expansion of production capacities, acquisition, partnership, and joint venture in the development of the high quality OCTG products from manufacturers have helped to attain key developments in the global Oil Country Tubular Goods market trends.

In addition to the above mentioned companies, TPCO Inc., Vallourec SA, Continental Alloys, Anhui Tianda Oil Pipe Company, and others also compete for the share of the market through partnership, acquisition, and expansion of the production capabilities to meet the future demand for the Oil Country Tubular Goods during the forecast period.

Oil Country Tubular Goods Market, By Region

North America has the largest share of the Oil Country Tubular Goods market and consists of countries such as U.S., Canada, and Mexico. The U.S. was the largest crude oil producer in the world, as of 2019. During the past decade, the shale drilling regions of the U.S. have expanded the use of horizontal and directional drilling activities. Liberation of the oil & gas industry in Canada and Mexico led to increase in the foreign investment thereby helping the growth oil & gas industry. The rise in deep-water exploration in remote areas with harsh environments has resulted in an increase in the use of premium quality products, which drives the growth of the market. Mexico is one of the major offshore deep-water reserves, which is likely to witness an upsurge in the production during the forecast period.

By Region

North America holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Oil Country Tubular Goods Market, By Manufacturing Process

The seamless segment dominates the global Oil Country Tubular Goods market. The surge in the usage of seamless tube in oil & natural gas industry is mostly as it is extruded and drawn from a billet. It also offers a higher range of safety measures compared to welded tube. A seamless tube is relatively short in length and generally does not show any sign of corrosion until and unless it is subjected to a highly corrosive environment. The increase in exploration activities in the off shore fields and redevelopment of many oil fields are expected to provide ample opportunities for the growth of the seamless process of Oil Country Tubular Goods market.

By Manufacturing Process

Electric Resistance Welded segment is projected as the most lucrative segment.

Oil Country Tubular Goods Market, By Product

The well casing segment dominates the global Oil Country Tubular Goods market. Well casing refers to large diameter pipe inserted into the drilled section of a borehole. This casing is generally held in the position with the help of cement or other materials between the casings and wellbore. It is considered as a significant part of the well completion activity. The increase in demand for the well casing in this market is mostly due to the reason that it provides aid in the drilling process in several ways and provides a strong foundation to allow use of high density drilling fluid to continue drilling deeper and provide a smooth internal bore for installing production equipment, which are expected to provide ample opportunities for the growth of the well casing product in Oil Country Tubular Goods market.

By Product

Well Casing is projected as the most lucrative segment.

Oil Country Tubular Goods Market, By Application

The onshore segment dominates the global Oil Country Tubular Goods market. Onshore refers to process that takes place on land that are associated with oil, gas or condensate production that has taken place offshore. Onshore oil terminal includes large crude oil tanks for the initial storage of oil prior to processing. Tanks provide a buffer volume where oil is delivered by tanker. The increase in the demand for oil & gas to develop wide variety of chemical products and fuel in the automotive sector have led to the exploration of the onshore oil fields that have driven the need for oil country tubular goods for the transportation of the crude oil, which is expected to provide ample opportunities for the growth of the onshore segment of Oil Country Tubular Goods market.

By Application

Onshore is projected as the most lucrative segment.

Oil Country Tubular Goods Market, By Grade

The premium grade segment dominates the global Oil Country Tubular Goods market. The development and exploration of oil & natural gas fields in offshore region and the need for high grade transportation tubes, which can resist corrosion, have guarantee leak proof performance and sealing integrity of the connections even when subjected to a combinations of loads, bending, and high internal pressure. The demand for premium tubing to transport oil and gas from onshore and offshore fields to the consumer’s site is expected to provide ample opportunities for the Oil Country Tubular Goods market growth.

By Grade

Premium Grade is projected as the most lucrative segment.

COVID-19 analysis:

The COVID-19 pandemic has negatively impacted the global Oil Country Tubular Goods market drastically. The pandemic has affected various industries and has caused global economic slowdown. It has major impact on energy systems across the world due to lockdown and improper transportation among the countries. The outbreak of pandemic led to partial or complete shutdown of production facilities, which are not related to essential goods, owing to prolonged lockdown in major countries such as the U.S., China, Japan, India, and Germany. The oil & gas industry has been negatively affected by pandemic as most countries worldwide imposed lockdown restriction, which have impacted the import & export of goods and services, leading to a decline in the sales of oil & gas. The linear increase in the development of global production of oil and natural gas from 2017 to 2018 was considerably disrupted due to pandemic outbreak.

Key benefits for stakeholders

- This report provides a detailed quantitative analysis of the current market trends and estimations from 2020 to 2030, which assists to identify the prevailing opportunities.

- An in-depth Oil Country Tubular Goods market analysis across the globe is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the global Oil Country Tubular Goods industry is provided.

- Region-wise and country-wise market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2020 to 2030 in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global Oil Country Tubular Goods market.

Oil Country Tubular Goods Market Report Highlights

| Aspects | Details |

| By Manufacturing Process |

|

| By Product |

|

| By Application |

|

| By Grade |

|

| By Region |

|

| Key Market Players | TENARIS, NOV INC., EVRAZ NORTH AMERICA PLC, ARCELORMITTAL SA, SUMITOMO CORPORATION, JFE STEEL CORPORATION, ILJIN STEEL CORPORATION, U.S. STEEL CORPORATION, OIL COUNTRY TUBULAR LIMITED, TMK INC. |

Analyst Review

The global Oil Country Tubular Goods market is expected to witness increased demand during the forecast period due to rapidly growing offshore rig counts and the government initiatives to reduce the import of hydrocarbons while investing in the development of conventional and unconventional resources in the territory.

Oil and gas are important part of the economic growth of any nation and the world. The derivatives of the crude oil are immensely used in varied industries such as transportation, power generation, production of chemicals, and other processes. The increase in the consumption of oil and gas has resulted in increased exploration and production activities. The major firms and governments across the globe are consistently investing in the extraction of oil and gas. Drilling and transportation of the extracted oil and gas have led to the innovation and development of the oil country tubular goods manufacturers, which is a consolidation of different steel tubular products such as well casing, production tubing, drill pipe of various sizes and grades.

Appropriate oil country tubular goods selection during drilling activities save cost and reduces the risk of generating various accidents. The increase in innovation in regards with the efficiency and developments in well-drilling technology to improve the recoverability of the oil and gas resources is another factor boosting the market growth. The increase in the rig count in recent years have created significant trend for the growth of the oil country tubular goods market.

The increase in environmental awareness among the people regarding the effect of oil and gas has led to decline in the application of fossil fuels in automotive industry. The international political and economic stability with technology sanctions from the developed countries to the developing countries have limited the market expansion.

Onshore and Offshore oil and natural gas industries are the potential customers of Oil Country Tubular Goods industry.

Acquisition and Joint Venture are the key growth strategy for Oil Country Tubular Goods market players in order to attract the end users.

To get latest version of Oil Country Tubular Goods market report can be obtained on demand from the website.

Increase in the drilling & exploration activities, innovation of new technologically advanced pipes and growing global offshore rig count with the depletion of onshore resources is a major driving factor and opportunity for the growth of Oil Country Tubular Goods market.

North America will provide more business opportunities for Oil Country Tubular Goods in future.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

ArcelorMittal SA, EVRAZ North America, ILJIN Steel Corporation, JFE Steel Corporation. National-Oilwell Varco Inc, Oil Country Tubular Limited, Sumitomo Corporation, Tenaris, TMK Ipsco Enterprises Inc., and U.S. Steel Corporation.

Electric Resistance Welded segment holds the maximum share of the Oil Country Tubular Goods market.

Onshore and Offshore exploration and extraction facilities are key applications expected to drive the adoption of Oil Country Tubular Goods.

The report includes the detailed study of the market with respective to the growth prospects and restrains based on the regional analysis. In addition to this, the market report is analysed and estimated in accordance with the impacts of the driving factors, restraints and opportunities.

Loading Table Of Content...