Oilseeds Market Research, 2031

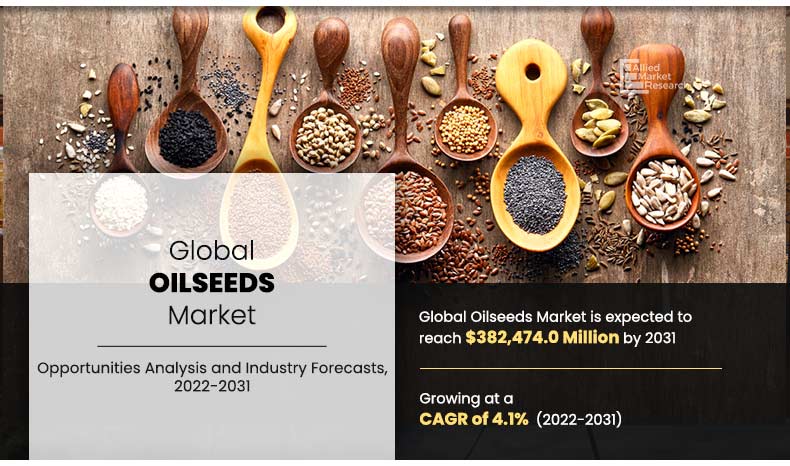

The global oilseeds market size was valued at $244,115.9 million in 2020, and is estimated to reach $382,474.0 million by 2031, registering a CAGR of 4.1% from 2022 to 2031.

Copra, cottonseed, palm kernel, peanut, rapeseed, soybean, and sunflower seeds are primarily cultivated for obtaining oil. The oil extracted from oilseeds is used in food products for human consumption, whereas the residue is used as animal feed. The edible oil extracted from oilseeds is used as a feedstock for biodiesel production. The major factors driving the market growth are increased consumption of soybean and its high production in the developing countries such as, Brazil, Argentina, and others. In addition, increased acceptance and large area under cultivation of genetically modified (GM) oilseeds are anticipated to supplement the oilseeds market growth. Biotech traits are being widely utilized by commercial oilseed producers to develop higher yielding seeds for the most widely grown global crops, which include soybean, cottonseed, rapeseed, and others. Advancement in agricultural biotechnology is the key driver for improving farm economics by introducing genetically modified (GM) seeds with traits that reduce the cost of managing crop biotic stresses such as weeds, insects, and microbial pests. Biotech traits such as herbicide tolerance and insect resistance have considerably been commercialized, which has led to significant crop protection, leading to an increase in seed value and growth of the market.

Oilseed crop productivity is highly dependent on climatic changes and variability, which needs to be addressed to meet the future food demands of increasing population. Change or variability in temperature, radiation, rainfall, carbon dioxide, and other climatic condition may affect the yields of oilseed crops. This, in turn, limits the growth of the global oilseeds market during the forecast period.

Segment Overview

According to the oilseeds market analysis, the market is segmented into oilseed types, product, breeding type, biotech trait and region. On the basis of oilseed type, the market is categorized into copra, cottonseed, palm kernel, peanut, rapeseed, soybean and sunflower seed. By product, it is bifurcated into animal feed and edible oil. Depending on breeding type, it is segregated into genetically modified and conventional. On the basis of biotech trait, market is bifurcated into herbicide tolerant, insecticide resistant and other stacked trait. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, Netherlands, Spain, France, Italy, UK, Russia, Ukraine and Rest of Europe), Asia-Pacific (China, India, Japan, Indonesia, South Korea and Rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Paraguay, South Africa and Rest of LAMEA).

By Oilseed Type

Soybean segment helds the major share of 49.2% in 2020

According to the oilseeds market trends, on the basis of oilseeds type, the soybean segment was the highest contributor to the market, with $120,159.9 million in 2020, and is estimated to reach $171,267.8 million by 2031, at a CAGR of 3.2% during the forecast period.

Global soybean production has increased, and is expected to continue to grow, owing to strong demand for animal feed, especially in emerging economies such as China, Brazil, India, Korea, and others, where the rapid increase in standard of living allows the average consumer to eat more meat. In addition, substantial demand for soybean-based vegetable oil as a biodiesel feedstock is anticipated to boost the production of soybean, thereby driving the growth of oilseeds market.

By Product

Animal Feed segment helds the major share of 57.0% in 2020

According to the product, the animal feed segment was the highest contributor to the market, and is estimated to reach $212,054.6 million by 2031, at a CAGR of 3.8% during the forecast period. Meat, seafood, poultry, and milk continue to make vital contributions to global food supply and, as a result, animal feeds have become a significant component of the integrated food chain. Oilseed meal, which is a by-product of processed oilseeds after extraction of oil, is used extensively in animal feeds, and is therefore a vital economic aspect of oilseed production. Animal feed is produced from large varieties of oilseeds, which include copra, cottonseed, palm kernel, peanut, rapeseed, soybean, and sunflower seed. Thus, animal feed segment gained the highest traction in the oilseeds market.

On the basis of breeding type, the conventional segment was accounted for the highest share in the global market and is expected to sustain its share throughout the oilseeds market forecast period. Conventional oilseeds are seeds that are cheaply available and are produced through natural pollination of plants. These oilseeds utilize significant amount of energy inputs and chemicals to produce highest possible yields of crops. Though conventional agriculture was adopted to maximize the production, owing to increase in food demand, the use of this method deteriorates the soil quality, thereby altering the natural environment. Product innovation and modernization of conventional farming techniques are major factors, which are expected to drive the demand for conventional oilseeds across the globe.

By Breeding Type

Genetically Modified segment helds the major share of 53.4% in 2020

On the basis of biotech trait, the herbicide tolerant segment was the highest contributor to the oilseeds market, with $98,683.5 million in 2020, and is estimated to reach $154,853.7 million by 2031, at a CAGR of 4.1% during the forecast period.

Herbicide-tolerant oilseeds or crops are engineered to endure specific or a wide range of herbicides, which destroy harmful weeds surrounding them. The cultivation of herbicide-tolerant crops provides farmers with the flexibility to apply herbicides to their crops whenever the number of weeds increases significantly, protecting the crops from the effects of the herbicide. Furthermore, heavy investment on R&D activities are underway to include more seeds or crops in the herbicide-tolerant list, making them suitable for utilization in all regions. Thus, above factors are likely to garner the growth of the market through herbicide tolerant segment.

By Biotech Trait

Herbicide Tolerant segment helds the major share of 40.4% in 2020

By region wise, Asia-Pacific gained highest oilseeds market share and is expected to sustain its share during the forecast period. In 2020, Asia-Pacific accounted for the highest market, in terms of value and volume, registering a significant CAGR from 2022 to 2031. China is the largest consumer of oilseeds, accounting for approximately two-sevenths share of the global market in terms of volume, and is expected to maintain its dominance during the forecast period. India is anticipated to grow at the highest rate in the Asia-Pacific region.

Competition Analysis

The players operating in the global oilseeds industry have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Archer Daniels Midland Company, BASF SE, Bayer AG, Burrus Seed Farms, Inc, Cargill Incorporated, Corteva Agriscience, Gansu Dunhuang Seed Industry Group Co., Ltd., KWS SAAT SE & Co., Mahyco Seeds Ltd and Syngenta Crop Protection AG.

By Region

Asia Pacific region helds the major share of 45.8% in 2020

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current trends, estimations, and dynamics of the market size from 2020-2031 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assist to determine the prevailing oilseeds market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the market.

Oilseeds Market Report Highlights

| Aspects | Details |

| By Oilseed Type |

|

| By Product |

|

| By Breeding Type |

|

| By Biotech Trait |

|

| By Region |

|

Analyst Review

Soybean is the principal source of edible oil and the key source of protein in animal feed. The other oilseeds comprise copra, cottonseed, palm kernel, peanut, rapeseed, and sunflower seeds. The edible oil extracted from oilseeds is used for household as well as industrial applications. Increased applications of oilseeds in the production of edible oil, fatty acids, soaps & personal care products, biodiesels, and animal feed are expected to drive the market growth. Further, farmers have adapted biotech trait in the oilseeds for improving the yield of agricultural produce.

In 2020, the soybean segment dominated the global oil seed market, and is expected to maintain this trend during the forecast period. In 2020, this segment accounted for approximately 60.0% share of the global market in terms of volume. The U.S. and some countries in Latin America, including Brazil and Argentina, are the largest producers of soybean.

Asia-Pacific was the largest consumer of oilseeds worldwide accounting for approximately two-fifths share of the market, in terms of volume, in 2020. China is expected to import large quantity of soybean, to meet the domestic demand for animal feed. Increase in consumption of vegetable oil/edible oil to produce biodiesel is anticipated to have a positive impact on the market growth.

The global oilseeds market size was valued at $244,115.9 million in 2020, and is estimated to reach $382,474.0 million by 2031

The global Oilseeds market is projected to grow at a compound annual growth rate of 4.1% from 2022 to 2031 $382,474.0 million by 2031

The key players profiled in this report include Archer Daniels Midland Company, BASF SE, Bayer AG, Burrus Seed Farms, Inc, Cargill Incorporated, Corteva Agriscience, Gansu Dunhuang Seed Industry Group Co., Ltd., KWS SAAT SE & Co., Mahyco Seeds Ltd and Syngenta Crop Protection AG.

By region wise, Asia-Pacific gained highest oilseeds market share

The edible oil extracted from oilseeds is used for household as well as industrial applications. Increased applications of oilseeds in the production of edible oil, fatty acids, soaps & personal care products, biodiesels, and animal feed are expected to drive the market growth.

Loading Table Of Content...