The global on-orbit satellite servicing market size was valued at $3.4 billion in 2022, and is projected to reach $9.0 billion by 2032, growing at a CAGR of 10.59% from 2023 to 2032.

The demand for on-orbit satellite services, such as life extension, maintenance, and repair, is on the rise due to the aging satellite population. These services aim to prolong the lifespan of existing satellites, thereby lessening the necessity for costly launches of new satellites from Earth. For instance, instead of replacing satellites that are nearing the end of their operational lives, they can be refueled or repaired while in orbit.

The maintenance, repair, refuelling, upgrading, or relocation of satellites while they are in orbit around the Earth, or another celestial body is referred to as on-orbit satellite servicing. This feature eliminates the need for expensive and dangerous satellite replacements or the production of new space trash, allowing for the extension of satellite operating lifespans, the correction of defects, improved performance, or adaptation to changing mission requirements.

Key Takeaways

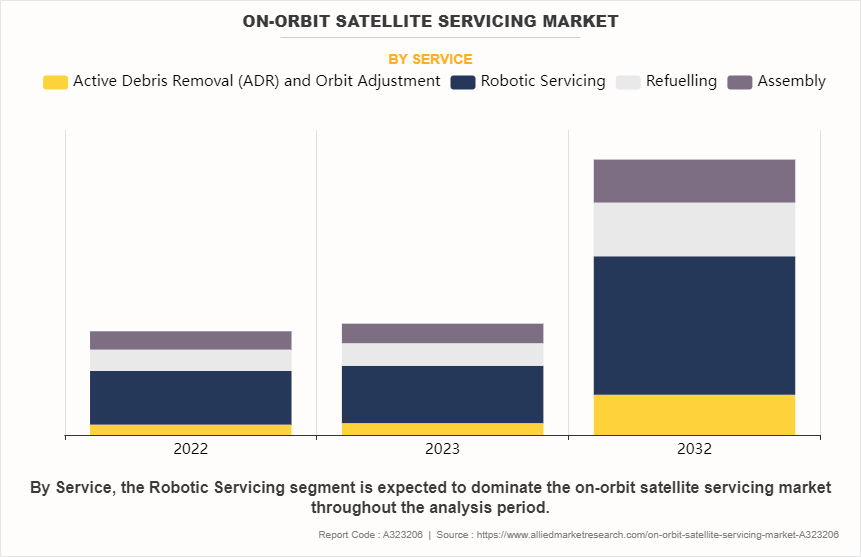

- The robotic servicing segment held the largest on-orbit satellite servicing market share in 2022.

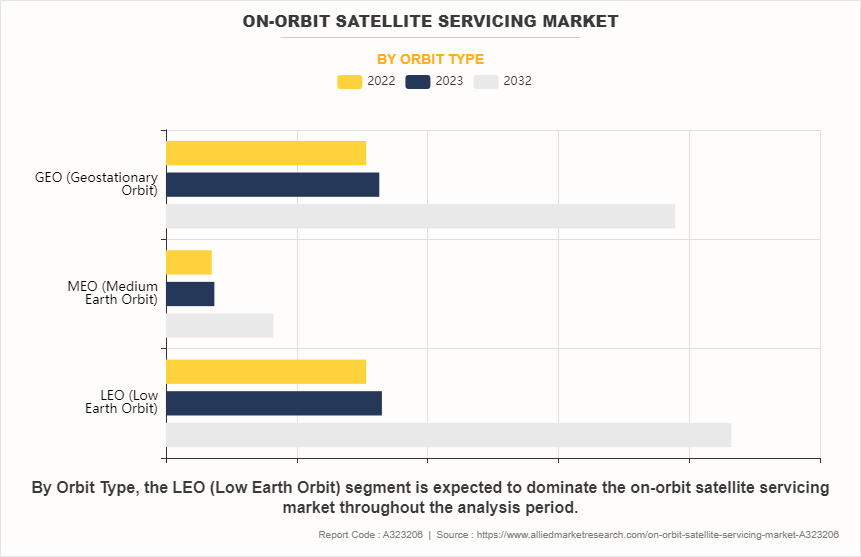

- The LEO (low earth orbit) segment was the highest revenue contributor to the market during the forecast period of 2022-2032.

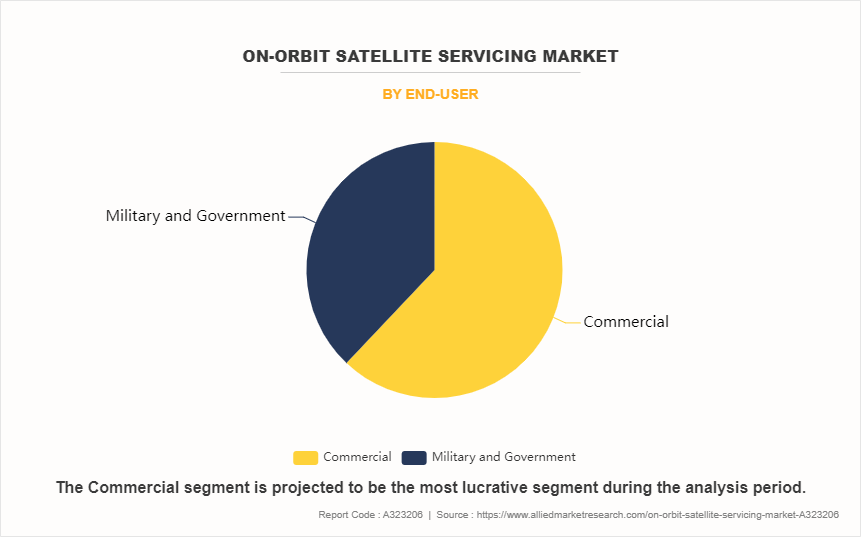

- The commercial segment generated the largest revenue in 2022.

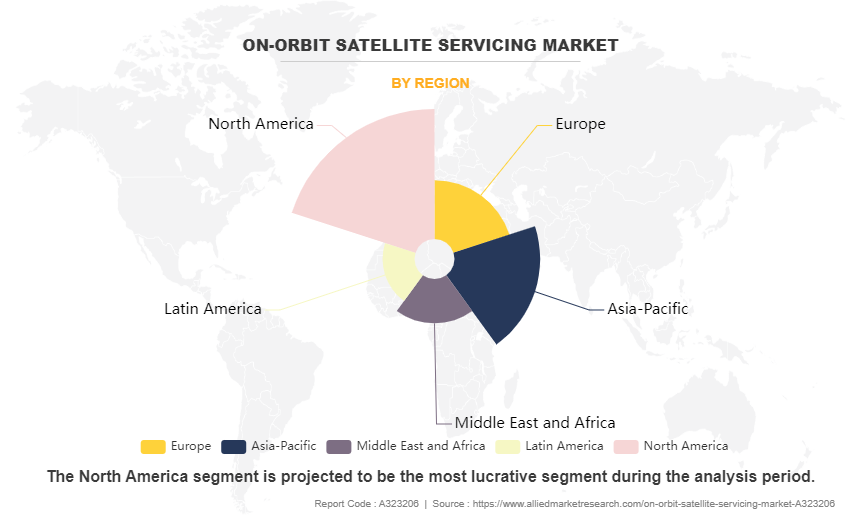

- North America accounted for the largest share in 2022, and is expected to follow the same trend during the forecast period of 2022-2032.

The on-orbit satellite servicing market report is segmented into Service, Orbit Type and End-User.

On the basis of service, the on-orbit satellite servicing market analysis is bifurcated into active debris removal (ADR) and orbit adjustment, robotic servicing, refueling, and assembly.

Proliferation of Aging Satellite Population is Boosting the Market Growth

The aging satellite population is one of the key drivers of the on-orbit satellite servicing market. For instance, in September 2022, SpaceX launched 3,399 Star link satellites into orbit, including prototypes and spacecraft. Numerous satellite enterprises are experiencing growth in the U.S., driven by the increasing need for communication and space-based internet services.

Several satellites in orbit near the end of their operational lifespans often require maintenance or replacement to sustain functionality. Typically, satellites are engineered to operate for a specific duration, beyond which they may encounter technical issues or diminished performance.

The provision of on-orbit satellite servicing also serves to tackle technical challenges that emerge throughout a satellite's active tenure. Exposure to rigorous space conditions can lead to failures or declines in performance, and on-orbit servicing offers a means to detect and rectify these issues. Consequently, this aids in maintaining the operational integrity and dependability of satellite-dependent services like communication, navigation, and remote sensing. With an increasing number of satellites nearing the conclusion of their operational life, there is an anticipated surge in demand for on-orbit satellite services, which is poised to stimulate innovation and investment within this sector.

On the basis of orbit type, the market is divided into LEO (low earth orbit), MEO (medium earth orbit), and GEO (geostationary earth orbit).The provision of on-orbit satellite servicing also serves to tackle technical challenges that emerge throughout a satellite's active tenure. Exposure to rigorous space conditions can lead to failures or declines in performance, and on-orbit servicing offers a means to detect and rectify these issues.

Rise in Deployment of Small Satellites will Create Lucrative Growth Opportunities in United States and China

In recent years, several number of space exploration missions increased as launch costs reduced, technologies advanced, and public interest in space exploration increased. The missions of space expeditions are mostly focused on human Low-Earth-Orbit missions and unmanned scientific research. Moreover, various countries plan to collaborate with other countries for space exploration. For instance, in September 2022, China disclosed its intentions to establish collaborations with other nations for its forthcoming lunar and solar system exploration missions.

Furthermore, as a component of the National Defense Authorization Act for 2020, the U.S. government established the U.S. Space Command, which comprises a Space Operations Force and a Space Development Agency. This advancement is poised to have a significant positive impact on the U.S. Department of Defense, as well as the aerospace and defense industries. It will enable a more targeted and expeditious allocation of resources towards pioneering technologies and enhanced capabilities.

There is an increase in the launches of satellites to augment space exploration missions. For instance, in July 2021, Virgin Orbit launched seven satellites using a 747 airliner for three different customers namely the U.S. Defense Department, the Royal Netherlands Air Force, and Poland’s Sat Revolution company. The increase in private investments in space exploration missions is projected to be a major driver for the growth of the on-orbit satellite servicing market forecast.

As per end-user, the market is classified into commercial, government and military.There is an increase in the launches of satellites to augment space exploration missions. For instance, in July 2021, Virgin Orbit launched seven satellites using a 747 airliner for three different customers namely the U.S. Defense Department, the Royal Netherlands Air Force, and Poland’s Sat Revolution company.

Complications in Technology are Restricting the Market Growth

The on-orbit satellite servicing industry, encompassing tasks such as salvage operations, life extension and satellite repair and modification, encounters significant technological intricacies. Delivering such services demands cutting-edge technology and specialized expertise, which can involve substantial development and maintenance costs. Frequently, these services necessitate highly skilled workforce, specialized equipment, and software. For instance, conducting repairs or modifications on satellites in orbit mandates precise control of robotic arms, specialized tools, and communication systems.

Furthermore, the technology essential for providing on-orbit satellite services is in a perpetual state of evolution, requiring companies to make substantial investments in research and development to remain competitive. This poses a formidable barrier to entry for new entrants into the market. Moreover, on-orbit satellite services are confronted with unique technical hurdles, including operating in zero-gravity environments, mitigating the effects of radiation and extreme temperatures, and navigating the logistics of servicing satellites positioned in diverse orbits and locations.

To create and sustain cutting-edge technology, companies must possess the funding, workforce, and know-how to change with current trends and meet emerging challenges in technology.

The on-orbit satellite servicing market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina and Rest of Latin America) and Middle East and Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East and Africa), North America was the highest revenue contributor, accounting for $1.26 billion in 2022, and is estimated to reach $3.08 billion by 2032, with a CAGR of 9.72%.

Competitive Analysis

Competitive analysis and profiles of the major global on-orbit satellite servicing market players that have been provided in the report include Maxar Technologies; Astroscales Holdings Inc.; Thales Alenia Space; Airbus SE; Altius Space Machines; Tethers Unlimited; Orbit Fab, Inc.; Momentus Space; Nanoracks (Voyager Space); and Space Logistics LLC. The key strategies adopted by the major players of the global market are product launch and mergers & acquisitions.

Top Impacting Factors

The global on-orbit satellite servicing market is expected to witness notable growth registering a CAGR of 9.72%, owing to proliferation of aging satellite population. Rise in deployment of small satellites create lucrative growth opportunities. On the other hand, complications in technology are projected to hinder market growth.

Historical Data & Information

The global on-orbit satellite servicing market is highly competitive, owing to the strong presence of existing vendors. Vendors of the global market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in On-Orbit Satellite Servicing

- In February 2023, Gilmour Space Technologies and Atomos Space announced the signing of an MOU to explore a multi-year contract for Gilmour and Atomos to mutually purchase the services for launching and in-space transportation.

- In March 2022, Altius Space Machines, Inc., and U.S. Department of Defense signed a contract. The contract enabled Altius to assist Maxar in developing two flight-ready robotic arms, each 2 meters in length. Each arm will be underactuated, with a single motor running a tensioned cable system to transmit torque to any number of joints, reducing the weight and cost. Altius will supply novel and capable interfaces for each robotic arm, a key technology for the success of the project.

- In September 2022, Orbit Fab jointly announced the partnership with Clear Space, joining their USD 2.2 million contract awarded by the United Kingdom Space Agency (UKSA) to equip the Clear Space debris-removing satellites with refueling capabilities. To refuel in orbit, Clear Space will integrate Orbit Fabs RAFTI refueling valve in their Active Debris Removal (ADR) satellite design.

- In April 2022, Orbit Fab and Neutron Star Systems (NSS) established a cooperative agreement for the co-development of satellite refueling solutions with green propellants by combining NSS propellant-agnostic electric propulsion technology with orbit fabs refueling interfaces and tankers.

- In September 2022, Thales Alenia Space and its partners have been chosen by the European Commission to lead EROSS IOD, a program dedicated to On-Orbit Servicing.

Key Benefits of Stakeholders

- This study comprises analytical depiction of the global on-orbit satellite servicing market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the market.

On-Orbit Satellite Servicing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9 billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 321 |

| By Service |

|

| By Orbit Type |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Airbus SE, Orbit Fab, Inc., Nanoracks (Voyager Space), Altius Space Machines, Aerospace Corporation, Momentus Space, Maxar Technologies, Thales Alenia Space SAS, Astroscales Holdings Inc., Tethers Unlimited |

The global on-orbit satellite servicing market was valued at $3.4 billion in 2022.

Maxar Technologies,Astroscales Holdings Inc., Thales Alenia Space, Airbus SE, Altius Space Machines are the top companies to hold the market share in On-Orbit Satellite Servicing.

North America is the largest regional market for on-orbit satellite servicing market.

The commercial is the leading end-user of On-Orbit Satellite Servicing Market.

The upcoming trends of On-Orbit Satellite Servicing Market include proliferation of aging satellite population and rise in deployment of small satellites..

Loading Table Of Content...

Loading Research Methodology...