Oncology/Cancer Drugs Market Research, 2033

The global oncology/cancer drugs market size was valued at $167.0 billion in 2023, and is projected to reach $335.2 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033. Major factors driving the oncology/cancer drugs market growth include increasing prevalence of cancer globally and advancements in targeted therapies and immunotherapies, which offer more precise and effective treatment options.

Market Introduction and Definition

The oncology/cancer drugs encompass pharmaceuticals specifically designed to diagnose, treat, and manage various types of cancer. These drugs target cancerous cells or interfere with processes involved in cancer growth and spread. It includes a wide array of therapeutic approaches, ranging from traditional chemotherapy to more targeted therapies like immunotherapy and precision medicine. Cancer, characterized by the uncontrolled growth and spread of abnormal cells, poses significant challenges to healthcare systems globally, necessitating the continuous evolution of therapeutic interventions. Traditional chemotherapy drugs, such as alkylating agents, antimetabolites, and mitotic inhibitors, work by interfering with the cell division process. They target rapidly dividing cells, a characteristic feature of cancer cells, and disrupt their DNA synthesis or mitosis, leading to cell death.

Key Takeaways

The oncology/cancer drugs market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major oncology/cancer drugs industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The global oncology drugs market is driven by rising incidence of cancer globally due to aging population, lifestyle changes, and environmental exposures, which drives the demand for innovative therapies. This growing patient population underscores the need for continuous research and development efforts to address diverse cancer types and unmet medical needs. In addition, advancements in science and technology, particularly in areas such as molecular biology, genomics, and immunotherapy, are driving significant innovation in cancer drug development. Precision medicine approaches, which target specific molecular aberrations driving cancer growth, are gaining prominence, leading to the development of more effective and less toxic therapies which drives the oncology drugs market.

However, high development costs of oncology drugs are extensive and costly, often requiring significant investments in preclinical studies, clinical trials, and regulatory approvals which may limit the adoption of cancer drugs. The high cost involved in new drug development coupled with threat of failure & adverse effects associated with cancer drugs therapies is expected to restrain the growth of the market.

On the other hand, increase in adoption of precision medicine approaches, fueled by advancements in genomics, molecular biology, and biomarker identification provide lucrative oncology/cancer drugs market opportunity. Precision medicine enables the development of targeted therapies that are tailored to individual patients based on their genetic makeup, tumor characteristics, and other molecular markers. Moreover, developing countries in Asia-Pacific and LAMEA are expected to witness considerable growth in the near future, owing to surge in healthcare infrastructure, increase in affordability, and rise in awareness related to early diagnosis of cancers such as oral cancer and others. Therefore, these factors are expected to drive the growth during the oncology/cancer drugs market forecast period.

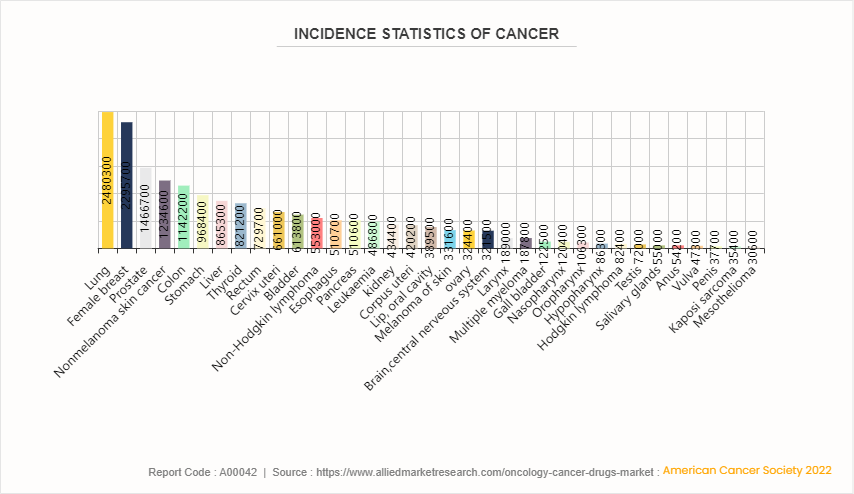

Incidence Statistics of Cancer

According to report of American Cancer Society 2022, estimated of cancer incidence for various types of cancer, with lung cancer having the highest estimated incidence at 2, 480, 300 cases, followed closely by female breast cancer at 2, 295, 700 cases, and prostate cancer at 1, 466, 700 cases. Other common types include nonmelanoma skin cancer (1, 234, 600 cases) , colon cancer (1, 142, 200 cases) , and stomach cancer (968, 400 cases) . Less common but significant types include liver cancer (865, 300 cases) , thyroid cancer (821, 200 cases) , and rectal cancer (729, 700 cases) . Cervical uterine cancer is estimated at 661, 000 cases, bladder cancer at 613, 800 cases, and non-Hodgkin lymphoma at 553, 000 cases. Further down the list are esophageal cancer (510, 700 cases) , pancreatic cancer (510, 600 cases) , and leukemia (486, 800 cases) . Kidney cancer is estimated at 434, 400 cases. Less common cancers include laryngeal cancer (189, 000 cases) , multiple myeloma (187, 800 cases) , and gallbladder cancer (122, 500 cases) . Nasopharyngeal cancer is estimated to be 120, 400 cases, oropharyngeal cancer at 106, 300 cases, and hypopharyngeal cancer at 86, 300 cases. Rarer cancers include Kaposi sarcoma (35, 400 cases) , mesothelioma (30, 600 cases) , and vaginal cancer (30, 600 cases) .

Market Segmentation

The oncology/cancer drugs market size is segmented into drug class type, indication, and region. On the basis of drug class type, the market is categorized chemotherapy, targeted therapy, immunotherapy (biologic therapy) , hormonal therapy. On the basis of indication, the market is divided into lung cancer, stomach cancer, colorectal cancer, breast cancer, prostate cancer, liver cancer, esophagus cancer, cervical cancer, kidney cancer, bladder cancer, and other cancers. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Developed regions such as North America dominated the oncology/cancer drugs market share in 2023. This is attributed to advanced healthcare systems and higher R&D investments, fostering early adoption of innovative cancer treatments such as targeted therapies and immunotherapies. Regulatory agencies like the FDA and EMA play pivotal roles in these regions, ensuring rigorous drug approval processes and shaping market trends accordingly.

Conversely, emerging markets in Asia-Pacific, Latin America, and parts of Eastern Europe exhibit rapid urbanization and improving healthcare infrastructure, driving demand for oncology drugs. However, challenges like affordability and access to advanced treatments persist, necessitating tailored strategies from pharmaceutical companies to navigate these markets effectively. Differential pricing and strategic partnerships are increasingly common approaches to address these challenges and enhance market access. Therapeutic trends such as precision medicine and immunotherapy are reshaping the oncology drugs landscape globally. Precision medicine emphasizes targeted treatments based on genetic profiles, offering personalized approaches to cancer care. Meanwhile, immunotherapy has gained prominence for its ability to harness the body's immune system to fight cancer, revolutionizing treatment options across various cancer types.

In April 2024, the Food and Drug Administration granted traditional approval to tisotumab vedotin-tftv for recurrent or metastatic cervical cancer with disease progression on or after chemotherapy. Tisotumab vedotin-tftv previously received accelerated approval for this indication.

In April, 2024, the Food and Drug Administration approved alectinib for adjuvant treatment following tumor resection in patients with anaplastic lymphoma kinase (ALK) -positive non-small cell lung cancer (NSCLC) , as detected by an FDA-approved test.

Industry Trends

- An article published by American Association for Cancer Research in 2023, the U.S. Food and Drug Administration (FDA) issued 40 drug approvals for oncology indications, 12 of which were new, first-in-human molecules.

- In October 2023, the U.S. Food and Drug Administration (FDA) approved several new treatments for a range of cancers over the summer. In July, the FDA approved a new indication for Jemperli (dostarlimab) in endometrial cancer.

- An article published by National Center for Biotechnology Information (NCBI) in 2022, a total of 48 new oncology drugs and biologics (comprising 215 pivotal clinical trials) with initial marketing approval in the U.S., European Union, Japan, and China were included.

Competitive Landscape

The major players operating in the oncology/cancer drugs market include AbbVie Inc., Amgen, Astellas Pharma Inc., AstraZeneca PLC, Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Merck & Co., Inc., Novartis AG, and Pfizer Inc. Other players in oncology/cancer drugs market includes Bayer AG, Regeneron Pharmaceuticals Inc., Eli Lilly and Company, and so on.

Recent Key Strategies and Developments in Oncology/Cancer Drugs Industry

- In March 2024, Bristol Myers Squibb announced that the U.S. Food and Drug Administration (FDA) approved Opdivo (nivolumab) , in combination with cisplatin and gemcitabine, for the first-line treatment of adult patients with unresectable or metastatic urothelial carcinoma the most common type of bladder cancer.

- In November 2023, Astellas Pharma Inc. and Pfizer Inc. announced that the companies received an approval by the U.S. Food and Drug Administration (FDA) of a supplemental New Drug Application for XTANDI (enzalutamide) , following FDA expedited development and review programs (Priority Review designation, Fast Track designation, Real-time Oncology Review) , based on results from the Phase 3 EMBARK trial.

- In October 2021, Amgen announced that it has successfully completed its previously announced acquisition of Teneobio, Inc. (Teneobio) .

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the oncology/cancer drugs market analysis from 2023 to 2033 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the oncology/cancer drugs market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the Global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global oncology/cancer drugs market trends, key players, market segments, application areas, and market growth strategies.

Oncology-Cancer Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 335.2 Billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Drug Class |

|

| By Indication |

|

| By Region |

|

| Key Market Players | Astellas Pharma Inc., AstraZeneca plc, Merck & Co., Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson, Amgen, Bristol-Myers Squibb Company, Pfizer Inc., AbbVie Inc., Novartis AG |

Analyst Review

The total market value of Oncology/Cancer Drugs market is $335.2 billion in 2033.

Top companies such as AstraZeneca Plc, F. Hoffmann-La Roche Ltd., Bristol Mayers Squibb Company, Merck & Co., Inc., and Novartis held a high market position in 2023. These key players held a high market postion owing to the strong geographical foothold in different regions.

Targeted therapy segment is the most influencing segment owing to identification of molecular targets of cancer cells, fewer adverse effects, and availability of number of targeted therapeutics.

The forcast period for Oncology/Cancer Drugs market is 2024 to 2033

The market value of Oncology/Cancer Drugs market in 2023 is $167.0 billion

The upcoming trends in the global oncology-cancer drugs market include the increasing adoption of personalized and precision medicine driven by genomic profiling, the rise of immunotherapy and CAR-T cell therapies as key treatment modalities, and the expansion of targeted therapies alongside advancements in biomarker identification and utilization

The base year is 2023 in Oncology/Cancer Drugs market.

North America is the largest regional market for oncology-cancer drugs, primarily driven by the rise in prevalence of cancer, significant healthcare expenditure, advanced healthcare infrastructure, and strong presence of leading pharmaceutical companies.

Oncology/cancer drugs are medications specifically designed to treat various types of cancer. They include chemotherapy agents that target and destroy cancer cells, immunotherapy drugs that boost the immune system's ability to fight cancer, targeted therapies that interfere with specific molecules involved in cancer growth, and hormone therapies that alter hormone levels to slow or stop cancer cell growth.

Loading Table Of Content...