Online Accounting Software Market Research, 2034

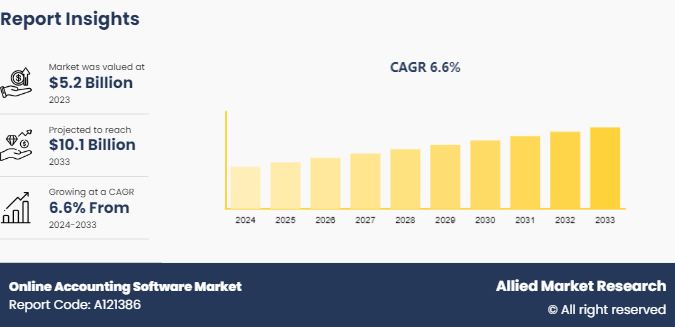

The global online accounting software market was valued at $5.2 billion in 2023, and is projected to reach $10.1 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033. The online accounting software market is experiencing rapid growth driven by the shift towards cloud-based solutions, scalability for businesses of all sizes, and increased demand for real-time financial insights and automation capabilities. This market expansion is also fueled by the integration of AI and machine learning technologies to enhance data analytics and streamline accounting processes.

Online accounting software is a cloud-based tool designed to help businesses and individuals manage their financial transactions, records, and reporting with ease and accuracy. Unlike traditional accounting software that requires installation on a local computer, online accounting software is accessible through the internet, allowing users to access their financial data from anywhere, at any time, using any device with internet connectivity. This type of software typically offers features such as invoicing, expense tracking, payroll processing, tax preparation, and financial reporting. It automates many accounting tasks, reducing the risk of human error and saving time. In addition, online accounting software often integrates with other business tools and financial institutions, enhancing efficiency and providing real-time financial insights. Security is also a key feature, with data encryption and regular backups ensuring that sensitive financial information is protected.

Key Takeaways

The online accounting software market forecast covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major online accounting software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The online accounting software market growth is influenced by several key factors including technological advancements, rise of cloud computing, increase in demand for automation, and the growing emphasis on data security. As businesses increasingly move towards digital solutions, the need for efficient and accessible financial management tools has surged. The scalability and cost-effectiveness of online accounting software makes it particularly attractive to small and medium-sized enterprises (SMEs) that may lack the resources for traditional accounting systems. In addition, the integration capabilities of online accounting software with other business applications streamline operations, further driving its adoption. The competitive landscape is marked by numerous players offering diverse features and pricing models, fostering innovation and continuous improvement in the sector. Furthermore, regulatory changes and the need for compliance with financial reporting standards are pushing businesses to adopt more sophisticated accounting solutions.

Public Policies of Global Online Accounting Software Market

Public policies on online accounting software are primarily focused on ensuring data security, privacy, and compliance with financial regulations. Governments and regulatory bodies enforce stringent data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the U.S., which mandate how personal and financial data should be handled, stored, and shared. These policies require online accounting software providers to implement robust security measures, including encryption and regular security audits, to protect sensitive financial information from breaches and cyberattacks. In addition, accounting standards and regulations, such as the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) , influence how financial transactions and reports are managed and generated by these software systems. Compliance with these standards ensures accuracy, transparency, and consistency in financial reporting. Public policies also encourage the use of digital solutions to improve efficiency and reduce the risk of errors in financial management.

Market Segmentation

The online accounting software market is segmented into enterprise size, deployment mode, end user, and region. On the basis of enterprise size, the market is divided into large enterprises and small and medium-sized enterprises. On the basis of deployment mode, the market is divided into on-premises and cloud. As per end user, the market is segregated into BFSI, IT and telecom, government, automotive, retail and consumer goods, manufacturing, healthcare, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The regional outlook on online accounting software varies significantly across different parts of the world, influenced by economic development, technological adoption, regulatory environments, and business practices. In North America, particularly the U.S. and Canada, the market for online accounting software is mature and highly competitive, driven by widespread adoption of cloud technologies and a strong emphasis on automation and efficiency in business operations. Europe also shows robust growth, especially in countries such as the UK, Germany, and France, where stringent data protection regulations including GDPR have heightened the focus on secure and compliant financial solutions. In the Asia-Pacific region, the market is rapidly expanding, propelled by the growing digital transformation in countries such as China, India, and Australia. These countries are witnessing rise in adoption of online accounting software by SMEs looking to streamline their financial processes and comply with evolving regulatory standards. Latin America and Africa, while still in earlier stages of adoption, are experiencing increase in demand for online accounting software due to improving internet infrastructure and rise in awareness of the benefits of digital accounting solutions. The shift towards remote work and the need for real-time financial insights are common drivers pushing businesses towards online accounting software in all regions.

In April 2023, the Princess Alexandra Hospital NHS Trust opted to implement MRI Software's lease and capital accounting solution, which is compliant with International Financial Reporting Standards (IFRS) to enhance the hospital's asset management and control processes while ensuring adherence to the updated lease accounting requirements under IFRS 16.

In April 2023, a report by the Asia Pacific Economic Corporation revealed that SMEs constitute approximately 97% of businesses and contribute about 50% of the workforce. Moreover, SMEs account for approximately 40-60% of the GDP share in most economies. These findings highlight the significant growth potential for SMEs in the Asia Pacific region, which is expected to drive the demand for accounting software, leading to growth in the accounting software market in the region.

Industry Trends

In March 2023, Focus Softnet announced the launch of its new accounting software, namely, FocusLyte, which is a cloud-based system that assists in handling company's invoices and payments. The software is mainly designed for medium and small enterprises.

In January 2023, ezAccounting software from Halfpricesoft.com was updated. The company updated its software and made it available for customers at no additional cost. The software is expected to allow customers to process payroll and business tasks all in one easy and affordable software application.

In August 2022, Intuit Accountants launched Intuit Tax Advisor Integrating Tax Prep and Advisory, a new, convenient insights tool for tax professionals to deliver tax advisory services. Intuit Tax Advisor seamlessly integrates with Intuit Accountant software, Lacerte, and ProConnect Tax, to provide insights and strategies for the tax professional's clients. ITA helps in all recommended tax strategies and estimated tax savings automatically populated in a personalized, client-friendly report for tax professionals to share with their clients and can be customized with specific firm logos and colors.

Competitive Landscape

The major players operating in the online accounting software market include Intuit Inc., Xero Limited, Freshbooks Inc., Zoho Corporation Pvt. Ltd., Sage Group plc, Oracle Corporation, Wave Financial Inc., KashFlow Software Ltd, MYOB Australia Pty Ltd, and FreeAgent Central Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the online accounting software industry.

Recent Key Strategies and Developments

In February 2020, Intuit, the maker of TurboTax, QuickBooks, and Mint, announced that it has agreed to acquire Credit Karma, which is a consumer technology platform with more than 100 million members in the U.S., Canada, and the U.K., for approximately $7.1 billion in cash and stock. The acquisition is expected to bring together both the technology leaders with a shared goal to help solve the personal finance problems that the consumers face today, regardless of their financial situation.

In July 2022, Xero unveiled Xero Go, a new app to help sole traders access entry-level accounting that will support the self-employed to get ready for one of the most significant changes to the UK tax system.

Key Sources Referred

Intuit Inc.

Xero Limited

Focus Softnet

ezAccounting Software

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the online accounting software market analysis from 2024 to 2034 to identify the prevailing online accounting software market share.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the online accounting software market size to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global online accounting software market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global online accounting software market trends, key players, market segments, application areas, and market growth strategies.

Online Accounting Software Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 10.1 Billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 245 |

| By Enterprise Size |

|

| By Deployment Mode |

|

| By End User |

|

| By Region |

|

| Key Market Players | Wave Financial Inc., Sage Group plc, KashFlow Software Ltd, Freshbooks Inc., Intuit Inc., MYOB Australia Pty Ltd, Oracle Corporation, Zoho Corporation Pvt. Ltd., Xero Limited, FreeAgent Central Limited |

The global online accounting software market was valued at $5.2 billion in 2023, and is projected to reach $10.1 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

The major players operating in the online accounting software market include Intuit Inc., Xero Limited, Freshbooks Inc., Zoho Corporation Pvt. Ltd., Sage Group plc, Oracle Corporation, Wave Financial Inc., KashFlow Software Ltd, MYOB Australia Pty Ltd, and FreeAgent Central Limited.

North America is the largest regional market for Online Accounting Software.

Increase adoption of mobile and app-based accounting software is the leading application of Online Accounting Software Market.

Increase in adoption of innovative enterprise size and increase in trend of automation in accounting process are the upcoming trends of Online Accounting Software Market in the globe.

Loading Table Of Content...