Online Car Buying Market Insights & Trend 2021-2030

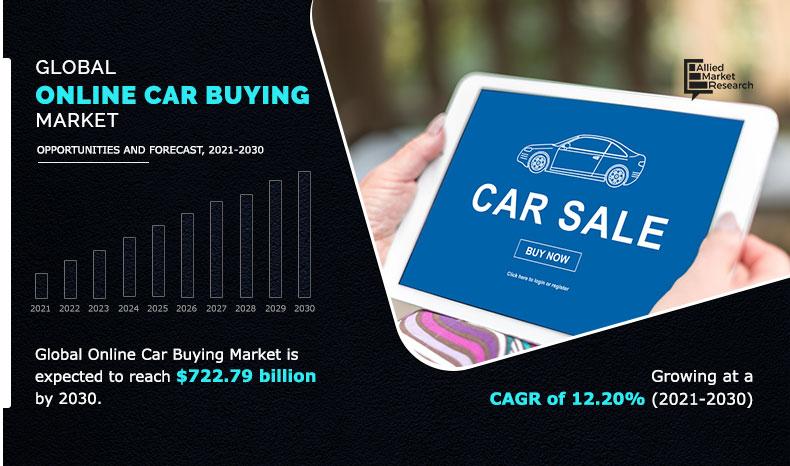

The global online car buying market was valued at $237.93 billion in 2020, and is projected to reach $722.79 billion by 2030, registering a CAGR of 12.2% from 2021 to 2030.

Online car buying market refers to the end-to-end buying of car through online platforms. Online car buying allows customer to have better price transparency, the ease of shopping from home, and a digital payment process. Customers can easily go through the available offerings and have quick access to product related information, prices and can instantly access to a wide array of available vehicles along with custom suggestion and recommendations with easy benchmarking and price comparisons with less or even no paperwork that too with home deliveries of vehicles. The online car buying market can be categorized as pre-owned vehicle also called used vehicle and new vehicles.

Then the COVID-19 outbreak resulted in closing showrooms, sending sales teams home and driving consumers to purchase vehicles online. The COVID-19 pandemic has accelerated the trend toward online purchases, increasing online penetration and changing consumer behavior. The outbreak has forced the consumer to purchase the vehicle online. The shift to digital retail appeared to be fruitful for many automotive dealers across the globe. Furthermore, most of the consumers also prefer the online channels to buy new and pre-owned cars, which in turn is expected to fuel the growth of the online sector in the online car buying market. There are some automotive companies that are struggling due to the pandemic, while the online car buying market for pre-owned cars is projected to bolster the sales in some regions owing to decrease in income, shortage of money, and rise in preference for private cars to maintain social distancing, which is anticipated to positively impact the industry amid the COVID-19 pandemic.

The global online car buying market is segmented on the basis of vehicle type, propulsion type and category. By vehicle type, the market has been categorized into hatchback, sedan, SUV and other. On the basis of propulsion type, it is categorized into petrol, diesel and others. On the basis of category, it is categorized into pre-owned vehicle and new vehicle. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA. Rise in number of active internet users, increase in vehicle demand, digitization of the automotive retail sector in countries, such as the U.S., Canada, the UK, Germany and China, and surge in third party online marketplaces are anticipated to propel the growth of online car buying market between 2021 and 2030.

By Vehicle Type

Sedan segment is projected as the most lucrative segment

The key players analyzed in the online car buying market include Asbury Automotive Group, Inc. AutoNation, Inc., Cargurus, Inc., CarsDirect, Cars.com, Inc., Cox Automotive Inc, Group1 Automotive Inc., Hendrick automotive group, Lithia motors, Inc. and TrueCar, Inc.

By Propulsion Type

Petrol segment projected as the most lucrative segment

OEMs focusing on making a shift to end-to-end online sales

Several OEMs have started experimenting with online sales to deliver a better online experience for their clients, including better price transparency, the ease of shopping from home, and a digital payment process. For instance, Volkswagen is uniting the launch of its new IT infrastructure with a new range of electric vehicles that is expected to enable online vehicle sales at a considerably large extent. In February 2019, PSA Group CEO Carlos Tavares stated aims to push online sales by more than 1,500% from 6,000 units in 2018 to 100,000 by the end of 2021. In addition, in June 2019, the responsible members of the board for marketing and sales at Daimler, Britta Seeger, announced that the OEM is expected to sell 25% of its vehicles online by 2025. In Europe, automakers such as Dacia, Volvo, Hyundai, Jaguar, Alpine, Mitsubishi, BMW, Land Rover, and Mini are directing online sales in selected markets. However, still the adoption of these online platforms and stores remains low and the customer experience they offer need to be improved. for example, Hyundai and Audi only make a small series of models, which are available online. Many others either do not provide a trade-in option or limit purchase options to new cars. Furthermore, for most OEMs, the online sales share still remains low, which is expected to witness growth in the near future.

By Category

Pre-Owned Vehicle is projected as the most lucrative segment

Rapid adoption of E-commerce and online technologies expected to reinforce the growth

The advancements in technology such as the development of the internet, use of e-commerce sites/applications to boost the demand for business, and introduction of hybrid and electric vehicle has changed the buyer position in the market. With the help of online technologies, consumers are becoming knowledgeable about the vehicle, on road price of new cars and residual value, third party profit margin and others for pre-owned vehicles. Moreover, rapid urbanization, surge in internet connectivity, and developments in the telecom sector have allowed for a much-better information flow for people. These factors are being rapidly used by online car sellers to advertise their vehicles and spread the details about them. This online platform has smoothly increased the sales process and enables more stakeholders to sell and buy cars. The supply side of this online car buying market has more weightage than the demand side and transparency through knowledge has changed the dynamics and managed to turn customer intelligence to their advantage, thereby foreseen to increase the online car sales in the future.

By Region

LAMEA would exhibit the highest CAGR of 15.4% during 2021-2030.

Key Benefits For Stakeholders

- This study presents analytical depiction of the online car buying market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current online car buying market size is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the online car buying industry.

Key Market Segments

By Vehicle Type

- Hatchback

- Sedan

- SUV

- Others

By Propulsion Type

- Petrol

- Diesel

- Others

By Category

- Pre-Owned Vehicle

- New Vehicle

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

KEY PLAYERS

- Asbury Automotive Group, Inc.

- AutoNation, Inc.

- Cargurus, Inc.

- CarsDirect

- Cars.com, Inc.

- Cox Automotive Inc

- Group1 Automotive Inc.

- Hendrick automotive group

- Lithia motors, Inc.

- TrueCar, Inc.

Online Car Buying Market Report Highlights

| Aspects | Details |

| By VEHICLE TYPE |

|

| By PROPULSION TYPE |

|

| By CATEGORY |

|

| By Region |

|

| Key Market Players | ASBURY AUTOMOTIVE GROUP, INC., LITHIA MOTORS, INC., CARSDIRECT.COM, COX AUTOMOTIVE INC., GROUP1 AUTOMOTIVE INC., CARGURUS, INC., CARS.COM, Inc., TrueCar, Inc., HENDRICK AUTOMOTIVE GROUP, AUTONATION, Inc. |

Analyst Review

According to the insights of CXOs of the leading companies, the online car market holds high potential for the automotive industry. The global online car buying market is projected to witness considerable growth, especially in North America and Europe, owing to adoption of advanced technology, digitization of automotive retail along with increase in globalization and rise in purchasing power.

Currently, the online car buying market is expected to witness a steady growth. With OEMs focusing on shifting to end-to-end online sales, growing third-party online marketplaces offer a platform for professional dealers and private sellers and growing active internet users are the key factors expected to reinforce the growth prospects of online car buying in developed as well as developing economies.

The advancements in technology such as the development of the internet, use of e-commerce sites/applications boost the demand for business. The market in developed countries, such as the U.S., Canada, Mexico, and Germany, is projected to report a significant growth rate as compared to developing regions, such as Asia-Pacific and the Middle East. Prominent OEMs have started experimenting with online sales to deliver a better online experience for their customers, including better price transparency and ease of purchasing from home. For instance, Volkswagen is uniting the launch of its new range of electric vehicles with the release of a new IT infrastructure that will enable online vehicle sales on a considerably larger extent. However, for OEMs, still the adoption of online platforms remains low and the customer experience they offer needs to be improved. Furthermore, North America leads the online car buying market and is expected to maintain its dominance during the forecast duration.

The global online car buying market was valued at $237.93 billion in 2020, and is projected to reach $722.79 billion by 2030, registering a CAGR of12.2% from 2021 to 2030

The COVID-19 pandemic has accelerated the trend towards online purchases, increasing online penetration and changing consumer behavior. The outbreak has forced the consumer to purchase the vehicle online. The shift to digital retail appeared to be fruitful for many automotive dealers across the globe.

The sample for global online car buying market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

There are certain upcoming trends such as advancements in technology such as the development of the internet, use of e-commerce sites/applications and digital shift of auto retail sector to boost the market

By category, new vehicle segment is expected to gain traction over the forecast period. However, at present Pre-owned vehicle segment is the major constributor in the global online car buying market

The company profiles of the top market players of online car buying market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the online car buying market

At present, below 5% cars are sold online. However, the outbreak has forced the consumer to purchase the vehicle online which is foreseen to drive the demand

North America region is leading the market presently in terms of revenue. However, Asia-Pacific region is expected to provide more business opportunities for the key players operating in the global online car buying market.

Shifting of OEMs to end-to-end online sales, growing number of third-party online marketplaces and Rapid adoption of E-commerce and online technologies have strong impact on the global online car buying market

The key growth strategies adopted by the online car buying industry players includes product launch, business expansion, collaboration. These strategies opted by various industry players is leading to the growth of the online car buying market as well as the players.

Loading Table Of Content...