Online Dating Services Market Research, 2033

Market Introduction and Definition

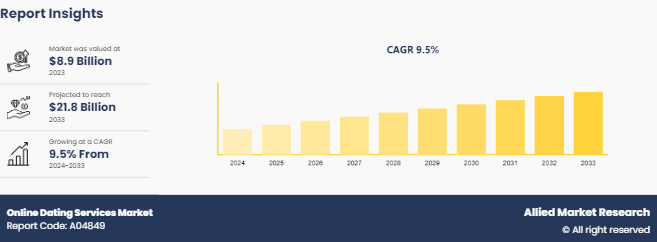

The global online dating services market was valued at $8.9 billion in 2023, and is projected to reach $21.8 billion by 2033, growing at a CAGR of 9.5% from 2024 to 2033. Online dating services are platforms that facilitate the process of finding and establishing romantic or personal relationships over the internet. These services typically provide various tools and features to help users create profiles, search for potential matches, communicate, and interact with each other. Users create profiles with personal information, photos, and preferences to showcase themselves to potential matches. Many services use algorithms to suggest matches based on compatibility factors such as interests, location, age, and other criteria. Communication tools such as messaging, chat, and video calls allow users to get to know each other, while safety measures like profile verification, privacy settings, and reporting mechanisms ensure a secure user experience. Some services offer free basic features with the option to upgrade to premium memberships for additional benefits.

Key Takeaways

The online dating services market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of online dating services industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The continuous innovations in technology, particularly the proliferation of smartphones and the integration of artificial intelligence (AI) and machine learning, have significantly enhanced the user experience. These advancements allow for more accurate matching algorithms and user-friendly interfaces, making it easier for people to connect and interact, increasing the Online Dating Services Market size.

The increasing social acceptance of online dating as a mainstream method for finding romantic partners has driven market growth. As more people become comfortable with the idea of meeting potential partners online, the user base for Online Dating Services Market size expanding, .

Despite advancements in safety measures, concerns about data privacy, identity theft, and fraudulent activities remain significant barriers. Users are often wary of sharing personal information online, which can deter them from using online dating platforms.

The high level of competition among numerous online dating platforms can lead to market saturation. This makes it challenging for new entrants to gain a foothold and for existing players to maintain their market share without continuous innovation and differentiation.

Expanding internet penetration and increasing smartphone adoption in emerging markets present significant growth opportunities. These regions such as Asia-Pacific and Latin America, with their large populations and growing middle class, offer a vast untapped user base for online dating services.

Value Chain of Online Dating Services Market

The value chain of the online dating services market begins with platform development and software engineering, where dating apps and websites are designed with user-friendly interfaces and advanced features such as matchmaking algorithms, messaging systems, and safety protocols. Data analytics and AI-driven matchmaking play a crucial role, ensuring users are matched based on preferences and behaviors. Marketing and user acquisition strategies, including digital advertising, influencer partnerships, and content marketing, help attract new users. Monetization models, such as subscriptions, freemium options, and in-app purchases, are used to generate revenue, while customer support and safety measures ensure users have a secure experience, increasing the Online Dating Services Market share. User engagement is driven through notifications, personalized suggestions, and continuous updates to enhance retention. Consumer feedback is collected to refine the platform and introduce innovations.

Market Segmentation

The online dating services market is segmented into service, subscription, demography, and region. On the basis of service, it is fragmented into matchmaking, social dating, adult dating, and niche dating. On the basis of subscription, it is divided into annually, quarterly, monthly, and weekly. On the basis demography, it is categorized into adult and baby boomer. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

Regional/Country Market Outlook

The online dating services market in the U.S. is one of the largest and most developed globally, characterized by high user engagement and a diverse array of platforms catering to various demographics and relationship goals. Major players in this market include Tinder, Bumble, Match.com, and eHarmony. The U.S. market was valued at $3 billion in 2020, with projections indicating it can reach $5 billion by 2025. According to a Pew Research Center study in 2020, approximately 30% of U.S. adults have used an online dating site or app, supported by a significant number of single adults—around 124 million as reported by the U.S. Census Bureau. The market is experiencing trends such as increased adoption of mobile dating apps and a growing emphasis on integrating AI and machine learning to enhance matchmaking, increasing the Online Dating Services Market growth.

China is witnessing rapid growth in the online dating services market, driven by factors such as increasing internet penetration, urbanization, and a large population of young adults. The number of online dating users in China was around 240 million in 2022, reflecting the country's burgeoning middle class and evolving social norms. Popular platforms include Momo, Tantan, and Baihe, with a notable shift towards integrating AI technologies to improve user experiences and matchmaking. According to the National Bureau of Statistics of China, internet users in the country surpassed 1 billion by the end of 2022, further fueling the growth of the online dating market.

Industry Trends

The online dating services market has experienced significant growth over the past decade, driven by technological advancements, changing social norms, and increased internet penetration. This market is composed of various platforms that cater to diverse demographics, interests, and relationship goals, including casual dating, serious relationships, and niche communities. Key players such as Tinder, Bumble, Match.com, and eHarmony continually innovate to attract and retain users in this highly competitive industry. Two notable industry trends are the rise of mobile dating apps and the increase in use of artificial intelligence (AI) and machine learning. The proliferation of smartphones has led to a surge in mobile dating apps, making it easier for users to connect on the go. Moreover, apps such as Tinder, Bumble, and Hinge dominate this space, offering user-friendly interfaces and innovative features such as swipe-based matching. Additionally, many platforms now utilize AI and machine learning to enhance matching algorithms, providing more accurate and compatible matches by analyzing user behavior and preferences, increasing the Online Dating Services industry.

Several macro factors contribute to the expanding online dating services market. Increasing urbanization, higher disposable incomes, and a growing number of single individuals drive the demand for online dating services. Changing societal attitudes towards online dating have made it a mainstream method for finding romantic partners. Greater access to the internet, particularly in emerging markets, has expanded the user base for online dating platforms. The COVID-19 pandemic has also led to an increase in online dating as people turned to virtual means to connect during lockdowns and social distancing measures. Statistics from government sources further highlight the market's growth potential. According to the International Telecommunication Union (ITU) , global internet penetration reached 63% in 2021, up from 53.6% in 2019, facilitating the growth of online services, including dating platforms. Data from the U.S. Census Bureau indicates that there were approximately 124 million single adults in the U.S. in 2020, representing a substantial market for online dating services.

Competitive Landscape

The key players profiled in the online dating services market include Badoo, Bumble, Grindr LLC, Love Group Global Ltd., Match Group, Inc., Spark Networks SE, The Meet Group Inc., Spice of Life, Zoosk Inc., and Tinder.

Recent Key Strategies and Developments

In February 2022, Tinder is expanding its portfolio of features by introducing blind dates as it features a popular suite of Fast Chat designed to help members connect faster through fun, innovative prompts, and games.

In December 2021, Bumble has introduced a new profile design and revamped the matchmaking algorithm, where users on the dating app can have access to view a person's bio, including interests below their first picture, to get an idea about the potential match right from the beginning.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the online dating services market analysis from 2024 to 2033 to identify the prevailing online dating services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the online dating services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global online dating services market trends, key players, market segments, application areas, and market growth strategies.

Online Dating Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 21.8 Billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 255 |

| By Service |

|

| By Subscription |

|

| By Demography |

|

| By Region |

|

| Key Market Players | Badoo, Zoosk Inc., Spark Networks SE, Match Group, Inc., Tinder, Bumble, Love Group Global Ltd., Grindr LLC, The Meet Group Inc., Spice of Life |

Analyst Review

Online dating services has been growing at a significant rate in terms of sales value. Upsurge in internet penetration has facilitated easy access to online dating services. Moreover, over the past two decades, the number of singles has been to increase at a considerable rate. Millennials account for a large share of the total single population. This kind of population prefers being in a nonmonogamous relationship rather than being in a long-term relationship. For them, online dating services sights as an ideal platform.

Thus, the online dating services market is turning out to be highly competitive. The players in the market strategize on continuous improvement in their services that cater to the varying needs and requirements of their target customers. Most of major players in the market have adopted artificial intelligence technology to facilitate convenient use of their services.

The key players profiled in the online dating services market include Badoo, Bumble, Grindr LLC, Love Group Global Ltd., Match Group, Inc., Spark Networks SE, The Meet Group Inc., Spice of Life, Zoosk Inc., and Tinder.

North America is the largest regional market for online dating services.

The online dating services market is continuously evolving, with several emerging trends shaping its future.

The leading application of the online dating services market is matchmaking for romantic relationships.

The global online dating services market was valued at $8.9 billion in 2023, and is projected to reach $21.8 billion by 2033, growing at a CAGR of 9.5% from 2024 to 2033.

Loading Table Of Content...