Online Entertainment Market Research, 2035

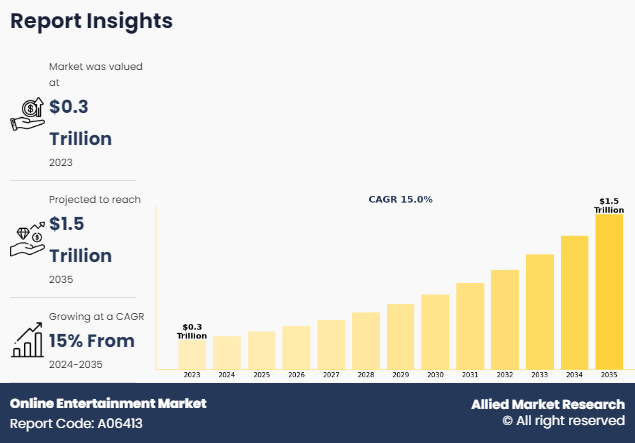

The global online entertainment market was valued at $284.8 billion in 2023, and is projected to reach $1500.6 billion by 2035, growing at a CAGR of 15% from 2024 to 2035. Online Entertainment Industry involves accessing entertainment material, including music, videos, books, and games over internet. Surge in internet penetration and increase in adoption of smart devices such as smartphones, smart TVs, and laptops boost the number of netizens who have shifted their preference toward online entertainment.

Key Takeaways

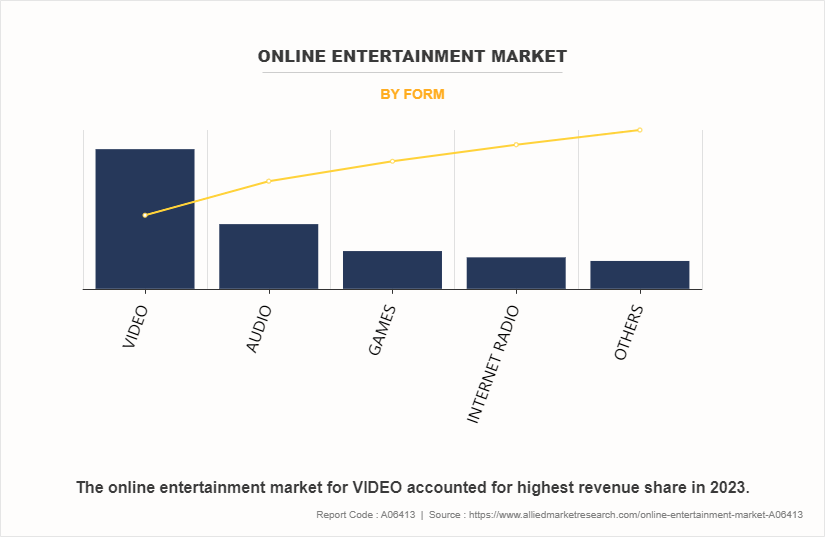

On the basis of form, the video segment dominated the market in 2023.

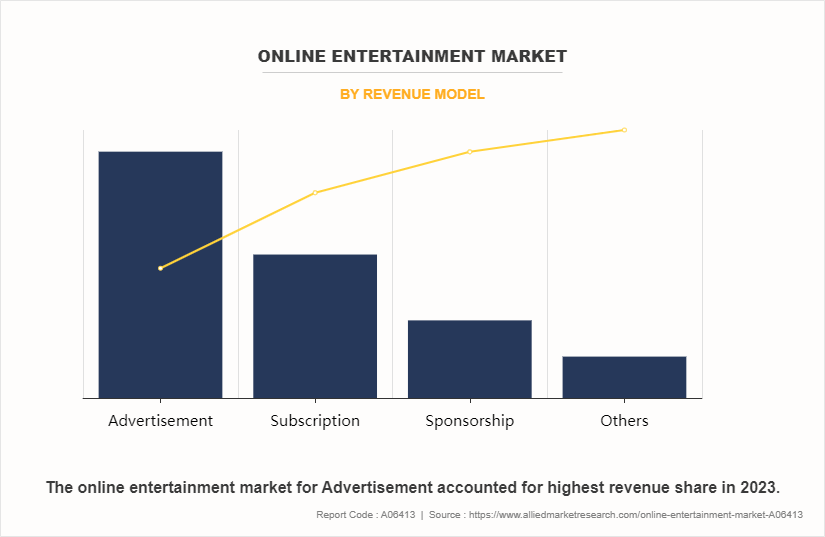

On the basis of revenue model, the advertisement segment dominated the market in 2023.

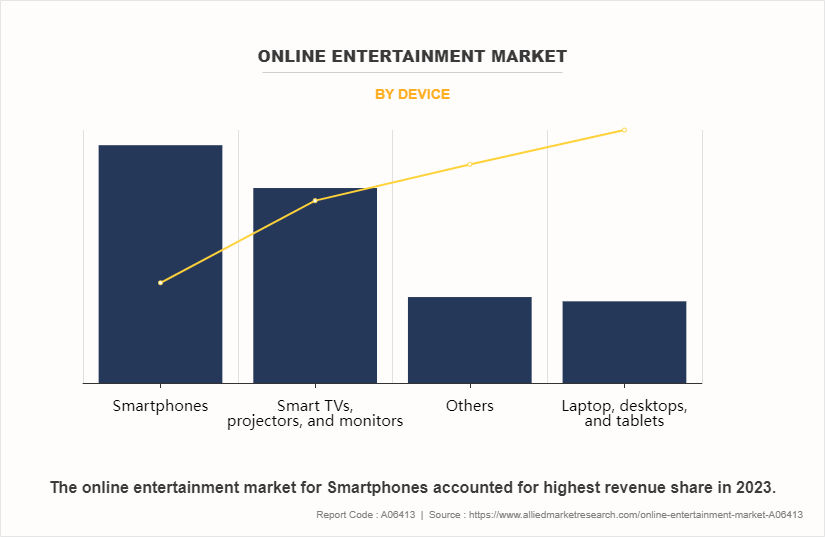

On the basis of device, the smartphone segment dominated the market in 2023.

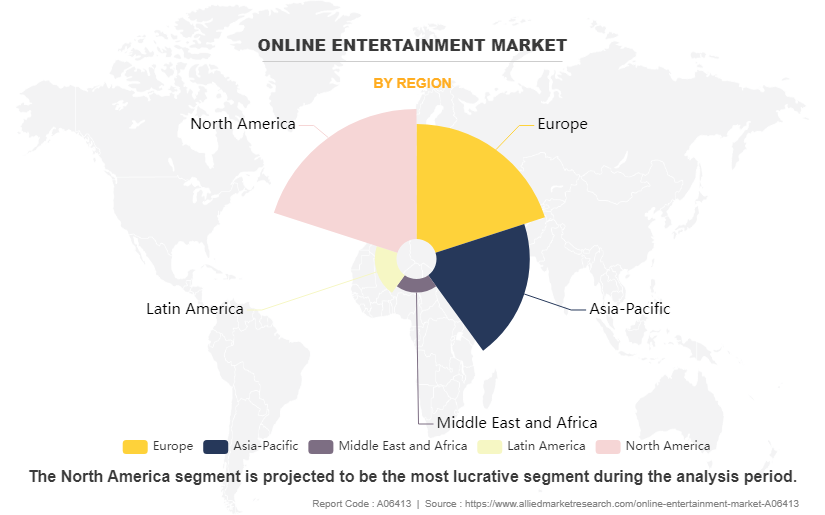

On the basis of region, North America dominated the market in 2023.

Market Dynamics

Rise in technological advancement

The rise of high-speed internet and advancements in streaming technology have transformed how people consume entertainment. Platforms such as Netflix, Hulu, and Disney+ have made on-demand streaming mainstream. This has allowed users to watch content from any device at any time. Moreover, the proliferation of smartphones and tablets has made entertainment more accessible, which contributes to the growth of mobile apps for games, movies, and music. These devices enable users to enjoy entertainment on the go, boosting Online Entertainment Market Size. In addition, VR and AR technologies offer immersive entertainment experiences. drives innovation in gaming, virtual concerts, and interactive storytelling, providing users with new ways to engage with content.

Change in consumer behavior

The shifts in consumer behavior is another significant factor that drives the growth of the online entertainment market, influenced by demographic changes, lifestyle trends, and evolving preferences. Moreover, consumers seek personalized entertainment experiences. Platforms use data analytics and AI algorithms to recommend content based on user preferences. This has created a more customized experience, increasing the Online Entertainment Market Size. In addition, subscription-based models, such as those offered by streaming services and gaming platforms, have gained popularity. Consumers appreciate the convenience of all-you-can-watch or play access for a fixed monthly fee, reducing the need for individual purchases or rentals.

Data Privacy and Security Concerns

As online entertainment platforms collect and use personal data to provide personalized content and targeted advertising, consumers become more concerned about data privacy and security. High-profile data breaches and misuse of personal information erode consumer trust. Regulatory frameworks such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. have established strict guidelines for data handling, increasing compliance costs for companies. Moreover, online entertainment platforms are vulnerable to cyberattacks, including hacking, ransomware, and data breaches. These risks are expected to disrupt Online Entertainment Market Share, compromise sensitive information, and damage brand reputation.

Content Licensing and Intellectual Property (IP) Issues

Online entertainment platforms basically rely on licensed content, such as movies, TV shows, music, and games, which come with licensing fees and restrictions. The cost of obtaining licenses is substantial, affecting profitability. In addition, restrictive licensing agreements limit the variety of content that platforms offer. Moreover, with the rise of user-generated content and content sharing, intellectual property infringement has become a concern. Unauthorized use of copyrighted material has led to legal disputes and financial penalties. This has hindered the growth of the market and have affected Online Entertainment Market Demands.

Diversification of Content and Monetization Models

The diversification of content and monetization models presents significant opportunities in the online entertainment market. By exploring various content formats, such as interactive storytelling, virtual reality (VR), augmented reality (AR), live streaming, and user-generated content, platforms create unique experiences that appeal to a wider audience. This diversification enables companies to attract different user segments and stay ahead in a competitive landscape. Moreover, innovative monetization strategies boost revenue generation. Beyond traditional subscription and advertising models, companies offer freemium services, where basic content is free, and premium features are accessible for a fee, contributing to Online Entertainment Market Opportunity. Microtransactions and in-app purchases provide additional content or virtual goods within games or apps, while partnerships and sponsorships with brands and influencers create sponsored content. Furthermore, platforms such as Patreon allow content creators to receive direct support from fans through monthly subscriptions or one-time contributions. This model fosters a closer connection between creators and their audience. These diversified approaches help companies maintain flexibility, attract varied audiences, and adapt to the ever-evolving demands of the online entertainment market and will contribute to Online Entertainment Market Growth.

SEGMENTAL OVERVIEW

The online entertainment market is segmented into form, revenue model, device, and region. On the basis of form, the market is categorized into video, audio, games, internet radio, and others. By revenue model, it is segregated into subscription, advertisement, sponsorship, and others. Depending on device, it is divided into smartphones; smart TVs, projectors, & monitors; laptop, desktops, & tablets; and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Russia, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Form

By form, the video segment dominated the global online entertainment market, registering a CAGR of 5.3% in 2023 and is anticipated to maintain its dominance during the forecast period. The video segment dominates the global online entertainment market due to a combination of factors that make video content highly engaging and accessible. The visual appeal and immersive storytelling inherent in videos attract audiences, while advancements in streaming technology and high-speed internet make video content readily available across multiple devices, from smartphones to smart TVs. Moreover, according to Online Entertainment Market Outlook video streaming platforms such as Netflix, Hulu, and Disney+ offer extensive libraries of on-demand content, providing a convenient and cost-effective way for consumers to access movies, TV shows, and original programming. In addition, the rise in usage of user-generated content platforms, such as YouTube and TikTok, has given birth to a new generation of content creators, adding diversity and cultural impact to the video segment. Monetization opportunities in video, including advertising, subscriptions, and merchandising, create sustainable business models for companies. Overall, the ability of videos to go viral on social media further amplifies their reach and cultural significance, solidifying the video segment's position as the dominant force in the online entertainment market.

By Revenue Model

By revenue model, the advertisement segment dominated the global online entertainment market, registering a CAGR of 5.3% in 2023 and is anticipated to maintain its dominance during the forecast period. The advertisement segment dominates the global online entertainment market's revenue model due to its wide reach, targeted marketing capabilities, and ability to offer free or low-cost content to consumers. Platforms such as social media and video streaming services have extensive user bases, enabling advertisers to target specific demographics with precision, leading to higher return on investment (ROI). This approach appeals to consumers who enjoy free content in exchange for viewing ads, creating a large and engaged user base. The flexibility of ad formats, ranging from display ads to interactive ads and sponsored content, provides advertisers with diverse options to reach audiences. In addition, user-generated content platforms such as YouTube and TikTok monetize content through advertising while sharing revenue with creators, fostering a vibrant ecosystem. High user engagement on these platforms generates substantial ad impressions, enhancing revenue potential. Data-driven analytics further optimize ad campaigns, ensuring that advertisers are able to track performance and improve outcomes.

By Device

By device, the smartphones segment dominated the global online entertainment market, registering a CAGR of 5.3% in 2023 and is anticipated to maintain its dominance during the forecast period. The smartphones segment dominates the global online entertainment market due to its ubiquity, versatility, and high-speed connectivity. With billions of smartphones in use worldwide, these portable devices offer consumers a convenient way to access entertainment anywhere, anytime. Smartphones' multifunctionality allows users to stream videos & music, play games, engage with social media, and create user-generated content (UGC), fostering a vibrant ecosystem. The rapid adoption of 4G and 5G networks ensures smooth streaming and online gaming, enhancing user experiences.

The extensive app ecosystem provides personalized entertainment choices, with apps catering to various interests, from video streaming to interactive games. Integration with social media platforms further drives smartphone usage, allowing users to create, share, and participate in viral trends. Constant innovation in smartphone technology, such as advanced cameras and augmented reality (AR), keeps this segment at the forefront of the online entertainment market. These factors collectively establish smartphones as the dominant platform for a wide range of online entertainment activities.

By Region

By region, North America dominated the online entertainment market, registering a CAGR of 5.3% in 2023 and is anticipated to maintain its dominance during the forecast period. North America dominates the global online entertainment market due to a combination of advanced technological infrastructure, a large & affluent consumer base, leading entertainment companies, and a diverse cultural output. With widespread high-speed internet and robust 4G & 5G networks, the region provides a seamless environment for streaming, online gaming, and other data-intensive activities. This strong infrastructure is complemented by a consumer base with high disposable income, supporting premium content and in-app purchases. North America is home to major entertainment platforms such as Netflix, Disney, and YouTube, which drive innovation and set industry trends. The region's diverse cultural content, from Hollywood movies to music and television shows, has a significant global influence, attracting audiences worldwide. Strong investment in technology and entertainment startups, backed by venture capital and private equity, has fueled the online entertainment industry growth. Meanwhile, the robust legal framework for intellectual property protection in the region has encouraged innovation. These factors collectively make North America a dominant force in the online entertainment market.

Competitive Analysis

The major players operating in the online entertainment market are Amazon Web Services (AWS), Netflix, Inc., Google LLC, Facebook, Tencent Holdings Ltd., Sony Corp, King Digital Entertainment Ltd., Spotify Technology S.A., Rakuten, Inc., and CBS Corporation.

Players in the market have adopted business expansion and product launch as their key developmental strategies to expand their market share, increase profitability, and remain competitive in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the online entertainment market analysis from 2023 to 2035 to identify the prevailing online entertainment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the online entertainment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global online entertainment market trends, key players, market segments, application areas, and market growth strategies.

Online Entertainment Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 1500.6 billion |

| Growth Rate | CAGR of 15% |

| Forecast period | 2023 - 2035 |

| Report Pages | 328 |

| By FORM |

|

| By REVENUE MODEL |

|

| By DEVICE |

|

| By Region |

|

| Key Market Players | Sony Corporation (Sony Corp.), Google, Inc., Rakuten, Inc., AMAZON PRIME, Spotify Technology S.A., KING.COM LTD, Facebook, Inc., Tencent Holdings Ltd., Netflix, Inc., Ubisoft Entertainment SA |

Analyst Review

As per the perspective of top-level CXOs, the global online entertainment market is expected to offer remunerative business opportunities in the developing economies such as India and China. This is attributed to increase in digitalization of the entertainment & media industry, expansion of the internet user base, and surge in disposable income. Increase in penetration of smart devices and decrease in cost of internet boost the demand for online entertainment content such as videos, audios, e-books, and online games over smartphones. Furthermore, surge in popularity of social media platform has promoted the online video content creators to design unique products for social media. For instance, recently introduced online music streaming services include Spotify, Amazon Music, Tidal, YouTube Music, and Apple Music that have significantly influenced the online entertainment market, altering how people consume, share, and interact with music. The CXOs further added that surge in popularity of online gaming and increase in readership of e-books are expected to significantly contribute toward the growth of the online entertainment market. In developing countries such as India and China, online fantasy sports gaming (OFSG) has gained significant traction among the audience owing to increase in trend of sports such as cricket, football, and kabaddi. Furthermore, money making features, intelligent backend/admins, and live game feeds augment the growth of the online games industry, which, in turn, boosts the growth of the online entertainment market

North America the largest regional market for Online Entertainment

The popularity of live streaming platforms continues to rise, fueled by the demand for real-time interaction and engagement.

Video has leading application of Online Entertainment Market.

The players operating in the online entertainment market have adopted product launch and business expansion as their key developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Amazon Web Services (AWS), Netflix, Inc., Google LLC, Facebook, Tencent Holdings Ltd, Sony Corp, King Digital Entertainment Ltd, Spotify Technology S.A., Rakuten, Inc., and CBS Corporation.

The global online entertainment market was valued at $284.8 billion in 2023, and is projected to reach $1500.6 billion by 2035, growing at a CAGR of 15% from 2024 to 2035.

Loading Table Of Content...

Loading Research Methodology...