Online Payment API Market Research, 2032

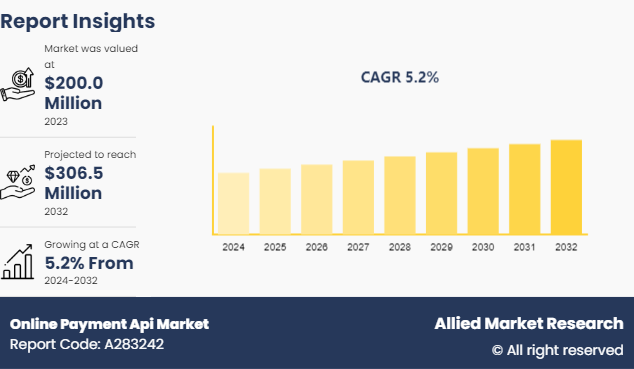

The global online payment API market was valued at $200.0 million in 2023 and is projected to reach $306.5 million by 2032, growing at a CAGR of 5.2% from 2024 to 2032.

Market Introduction and Definition :

The online payment API market is a subset of the digital payment business that focuses on the development and usage of application programming interface (API) to enable secure and efficient online transactions. APIs are the software programs that facilitate the sharing of payment information among various parties engaged in online transactions, including payment processors, merchants, and customers. These APIs are essential for ensuring a smooth checkout process for customers and merchants alike since they link different payment methods such as digital wallets, bank transfers, and credit cards to the payment processing infrastructure. The technologies, services, and solutions that help companies securely process online payments, manage transactions, and improve the entire payment experience for clients are the essential components of the market. By utilizing payment APIs, businesses increase their productivity, simplify payment procedures, and provide a variety of payment choices which cater to the diverse requirements demands of customers in the digital age.

Key Takeaways :

The online payment API market study covers 20 countries. The research includes a segment analysis of each country in terms of value.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major online payment API industry participants; along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrates high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Key Market Dynamics :

The online payment API solution is a crucial component for the smooth purchasing experience of consumers due to the rise in the e-commerce industry. Customers benefit from the ease and security of online payments, while retailers receive payments without incurring high startup fees. As a large base of individuals and businesses are switching toward digital payments, there is anticipated to be a rise in demand for online payment API solutions. Considering the expansion of the e-commerce industry, companies are striving to take advantage of novel opportunities by using online payment APIs to expedite payment procedures.

Despite the growth opportunities, one of the major challenges restraining the development of the global online payment API market is rise in cyberattacks. Since the online payment API market holds sensitive client data, including credit card numbers and other personal information, it is highly susceptible to hackers. Various customers remain deterrent from using these services owing to concerns regarding privacy and data breaches. In addition, the process of integrating a payment gateway with existing systems is multifaceted and requires high accuracy. Ensuring synchronization between the payment gateway and the system remains a significant challenge for the market players. These factors limit the expansion of the online payment API market globally.

On the contrary, the implementation of numerous payment service-related legislations is expected to open new avenues for the online payment API market. The online payment API market is anticipated to rise owing to surge in deployment of enhanced attributes such as fraud detection, authentication, and authorization. In addition, increase in need for sophisticated payment services such as EMV chip cards and digital wallets is expected to present lucrative opportunities for the market growth. Moreover, upsurge in partnerships between banks and payment service providers is projected to expand the online payment API market globally. Furthermore, surge in the trend for practical payment methods such as contactless payments is anticipated to propel the growth of the market.

Parent Market Overview: API Management Market

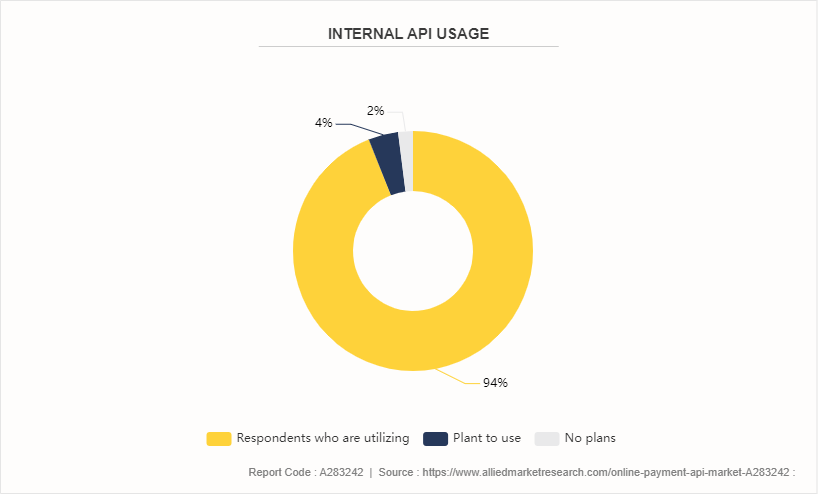

API stands for application programming interface, which is a specialized software with distinct functions. APIs enable organizations to share application data and functionality to internal departments, external business partners, and third-party developers within an organization. Through defined interfaces, they facilitate the interaction between different departments and make use of one another's management & data. Rise in the use of API-based solutions by businesses to enhance customer interaction and corporate processes is one of the major trends in the online API management market. In response to the changing needs of businesses, suppliers are developing novel solutions including API gateways, API analytics, and API security solutions. The API management market is projected to develop significantly in upcoming years due to rise in acceptance of digital transformation projects and the requirement for businesses to increase their flexibility & response to fluctuating market conditions. Internal APIs exhibit substantial current usage, with 94% of respondents already utilizing them, only 4% having plans to use them, and a mere 2% having no plans.

Regional/Country Market Outlook :

The online payment API market in North America, Europe, Asia, and Middle East is experiencing rapid growth due to rise in demand for digital payment solutions, the presence of big technology companies, fintech startups, and regulatory implementation. The European market is experiencing a notable growth due to increase in the number of fintech startups providing innovative payment solutions, the adoption of mobile payments, and rise in the number of e-commerce businesses. Asia-Pacific is experiencing rapid growth due to its large population, high mobile penetration, and growing e-commerce industry. The emergence of new technologies such as blockchain and AI is providing new opportunities for businesses to develop innovative payment solutions. In Middle East, the exponentially growing population, high mobile penetration rate, and introduction of innovative payment solutions such as mobile wallets, digital banking, and cryptocurrency are driving the market, however the online payment API market size is growing in middle east.

Industry Trends:

In December 2023, Cashfree Payments, a leading payment and API banking solutions Indian company, launched 'FlowWise'— a secure, cutting-edge payment orchestration platform. This innovative, cloud-native platform allows Indian businesses to use multiple payment aggregators with one integration, efficiently routing payments to partners in real-time. The platform aims to improve success rates and reduce processing costs.

In April 2024, Chilean fintech startup, Fintoc, raised $7 million to expand its presence in Mexico and Chile. The company's product is an API that allows online businesses to accept instant payments directly from customers' bank accounts, known as accounts to accounts (A2A) . A2A offers an alternative to credit card transactions with fewer intermediaries, making it frictionless for end users.

Competitive Landscape :

The major players operating in the online payment API market include PayPal, Stripe, Amazon Payments, Authorize.net, WorldPay, Adyen, CCBill, 2Checkout, FirstData, and SecurePay. Other players operating in the market include WorldPay by FIS, ?CCBILL, LLC., ?Fiserv, Inc., ?and Infibeam Avenues.

Recent Key Strategies and Developments :

In 2020, PayPal acquired Honey Science for $4 billion, marking its biggest acquisition in two decades. Honey, a service that helps consumers find deals while shopping online, works with 30, 000 retailers and claims 17 million monthly users. PayPal plans to use Honey's technology to reach consumers with personalized offers. The deal was closed in Q1 2020, post which Honey retained its brand and Los Angeles headquarters.

In 2023, Mastercard partnered with Google to launch Google Pay in Kuwait, enhancing digital payment capabilities in the country. Cardholders are able to use Google Pay to make payments in stores, online, and through apps. The platform offers a secure and privacy-conscious transaction experience, avoiding the need for physical cards or cash exchange. Transactions are made using a virtual card number, ensuring data protection.

Key Sources Referred :

Mastercard

Google pay

PayPal

FinTech

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing market opportunities.

- The report offers information related to key drivers, restraints, online payment API market size, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers & suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the online payment API market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market during the online payment API market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional & global online payment API market trends, key players, market segments, application areas, market growth strategies, and online payment API market forecast.

Online Payment Api Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 306.5 Million |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2024 - 2032 |

| Report Pages | 455 |

| By Product |

|

| By Application |

|

| By Payment Method |

|

| By Integration Type |

|

| By Region |

|

| Key Market Players | Adyen, Authorize.net, Stripe, Amazon Payments, CCBill, First Data, SecurePay, PayPal, 2Checkout, WorldPay |

The increase in demand for online payment services, the growing e-commerce industry, and the rise in adoption of mobile payment options are the growth factors for the Online Payment API market.

North America is the largest regional market for Online Payment API market.

PayPal, Stripe, Amazon Payments, Authorize.net, WorldPay, and Adyen are the top companies to hold the market share in Online Payment API market.

The increase in demand for online payment services, the growing e-commerce industry, and the increase in adoption of mobile payment options are the current drivers in the online payment API market.

The increasing presence of online merchants and the demand for secured payment options are the current opportunities in the online payment API market.

Loading Table Of Content...